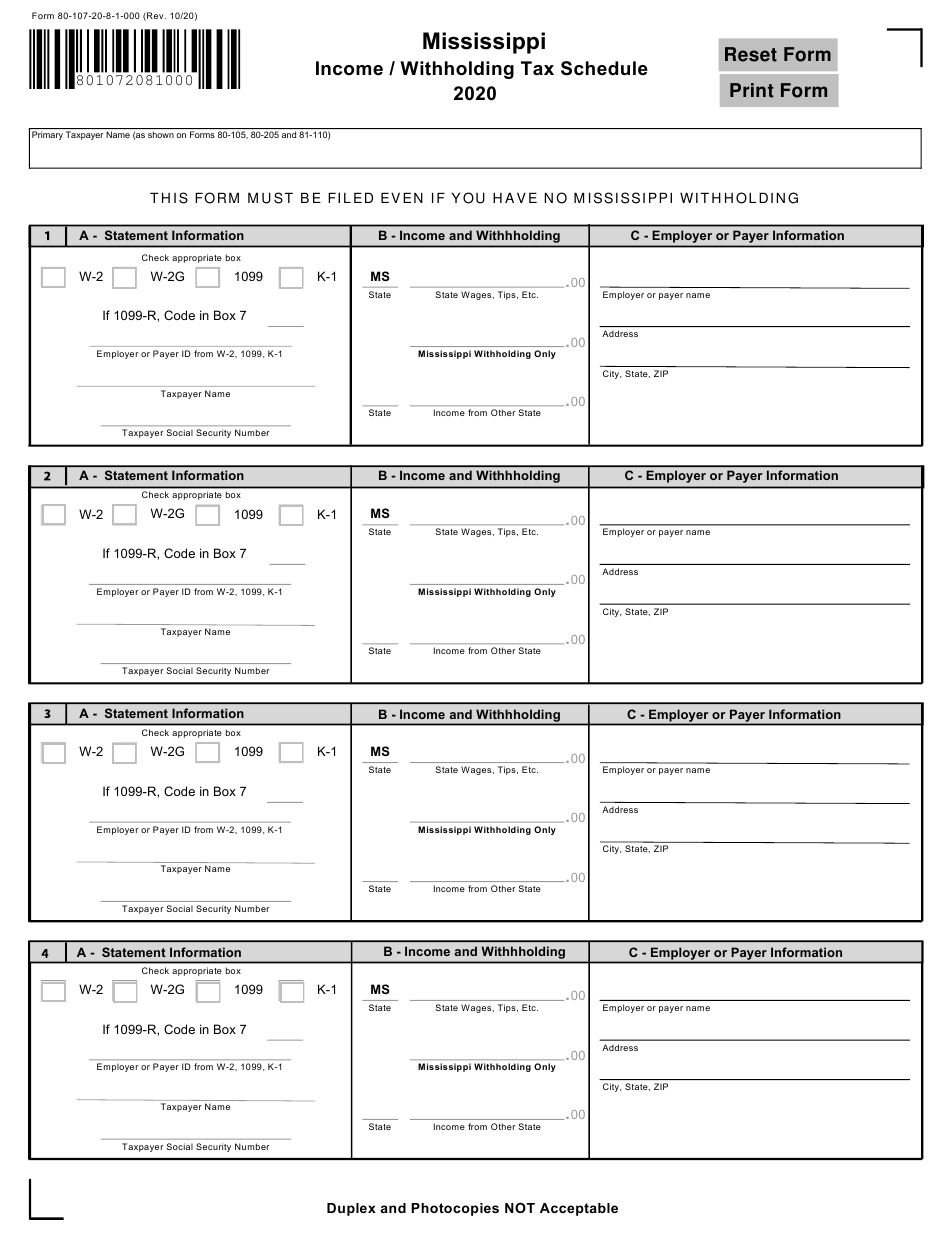

How To Fill Out Mississippi Withholding Form

How To Fill Out Mississippi Withholding Form - This form must be filed even if you have no. You can download or print. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status. Complete the form the way it should have been filed. Enjoy smart fillable fields and. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web declaration of estimated tax. Web file this form with your employer. Get your online template and fill it in using progressive features. Web file this form with your employer.

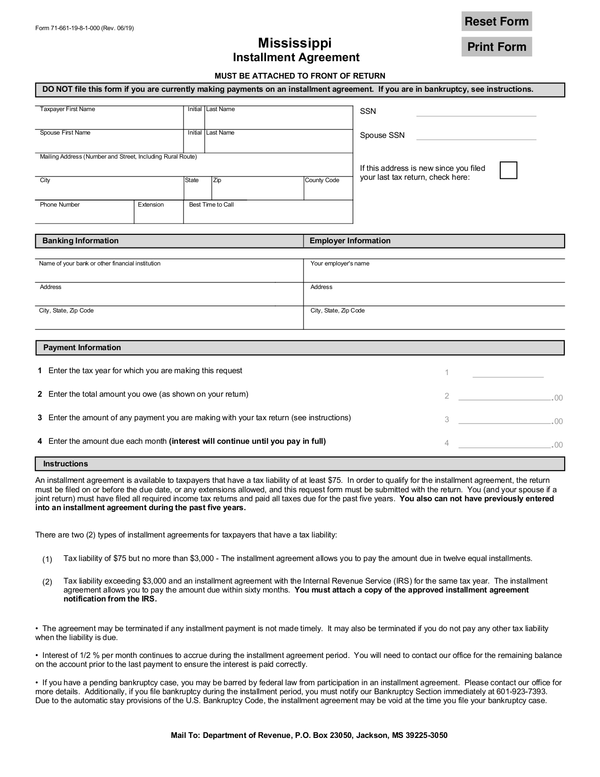

Marital status (check one)spous (a) spouse not. Web declaration of estimated tax. Web there are several ways to submit form 4868. Complete the form the way it should have been filed. Web the mississippi employer’s withholding tax return is a simple enough form, but you need payroll software for data management and recordkeeping purposes. Engaged parties names, places of residence and phone numbers etc. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Edit your mississippi employee's withholding exemption certificate online type text, add images, blackout confidential details, add comments, highlights and more. Web fill in the blank areas; Web file this form with your employer.

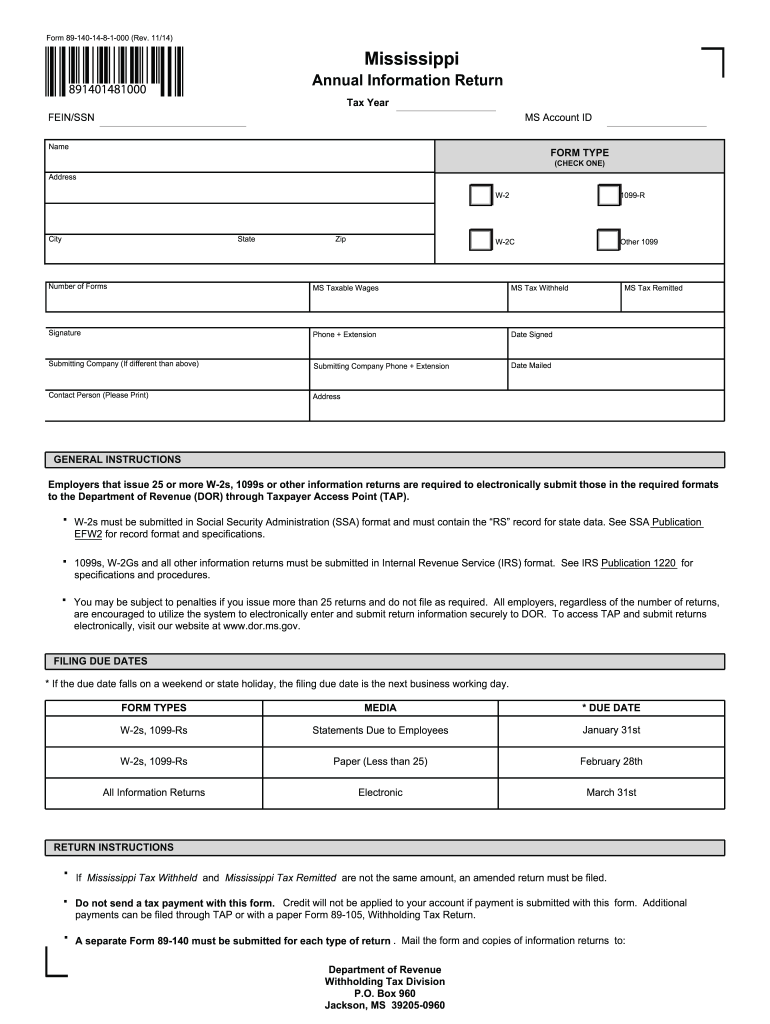

Amended return check this box if you need to make a change to a return already filed. Engaged parties names, places of residence and phone numbers etc. Get ready for tax season deadlines by completing any required tax forms today. This form must be filed even if you have no. Put the day/time and place your e. Edit your mississippi employee's withholding exemption certificate online type text, add images, blackout confidential details, add comments, highlights and more. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status. You can download or print. Web withholding taxpayers use tap (taxpayer access point) for online filing. Keep this certificate with your records.

Fill Free fillable forms for the state of Mississippi

Web withholding taxpayers use tap (taxpayer access point) for online filing. Web start on editing, signing and sharing your how to fill out mississippi employee's withholding exemption certificate online following these easy steps: Otherwise, he must withhold mississippi income t ax from the full amo unt of your wages. Marital status (check one)spous (a) spouse not. Complete the form the.

How To Fill Out Mississippi State Tax Withholding Form

Web fill in the blank areas; Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Marital status (check one)spous (a) spouse not. Go to tap to register. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status.

Fill Free fillable forms for the state of Mississippi

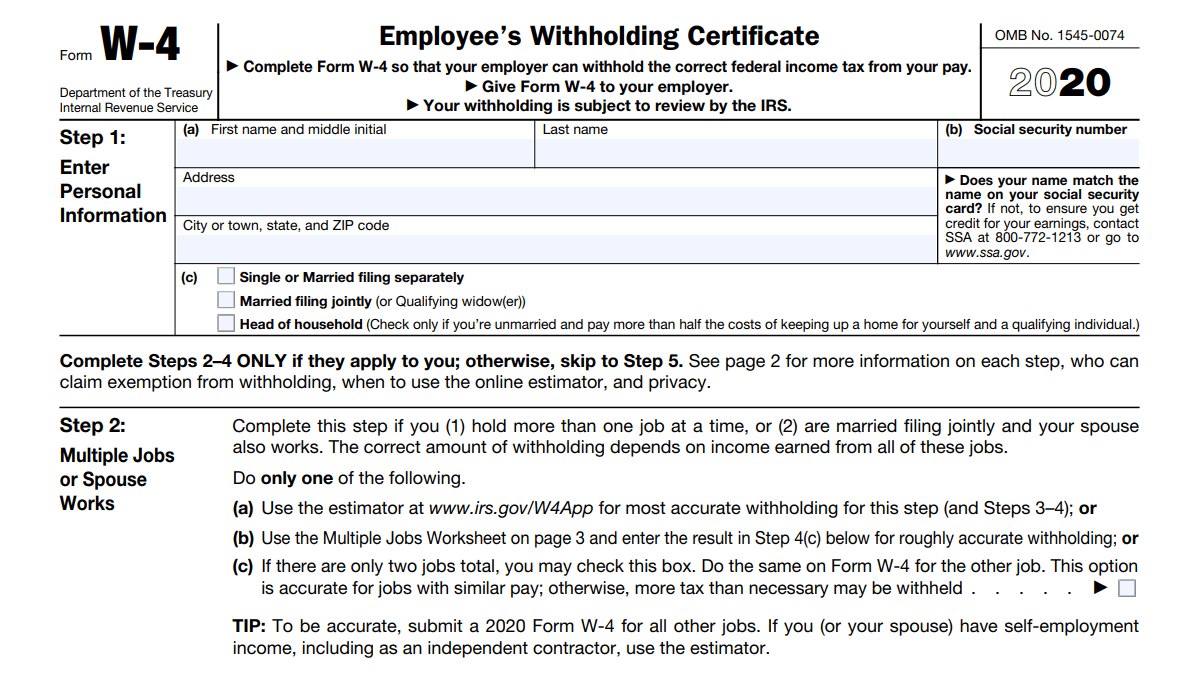

Complete the form the way it should have been filed. Get your online template and fill it in using progressive features. Web how to fill out mississippi order for withholding? Employee's withholding certificate form 941; Web there are several ways to submit form 4868.

Ms Printable W4 Forms 2021 2022 W4 Form

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Get ready for tax season deadlines by completing any required tax forms today. Gather this information before beginning the registration. Put the day/time and place your e. Web declaration of estimated tax.

how to fill out new york state withholding form Fill Online

This form must be filed even if you have no. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status. Web there are several ways to submit form 4868. Change the template with exclusive fillable areas. Otherwise, he must withhold mississippi income t ax from the full amo unt of your wages.

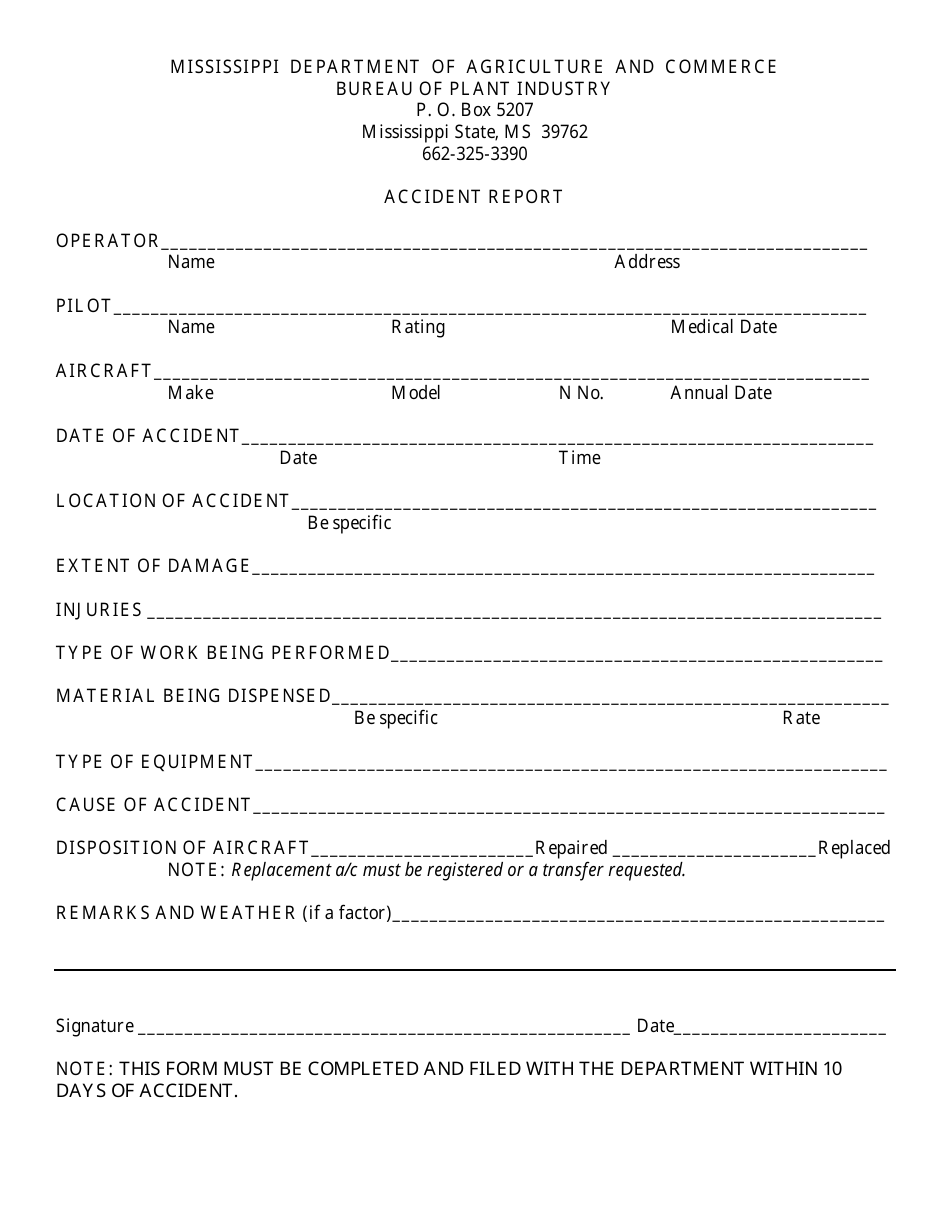

Mississippi Accident Report Form Download Printable PDF Templateroller

Go to tap to register. Web fill in the blank areas; Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Keep this certificate with your records. Web the mississippi employer’s withholding tax return is a simple enough form, but you need payroll software for data management and recordkeeping purposes.

Mississippi State Withholding Form 2021 2022 W4 Form

Get your online template and fill it in using progressive features. Web multiply number ofblockschecked online 5 by $1,500 and enter amount of exemptionclaimed. Enjoy smart fillable fields and. Web file this form with your employer. Web file this form with your employer.

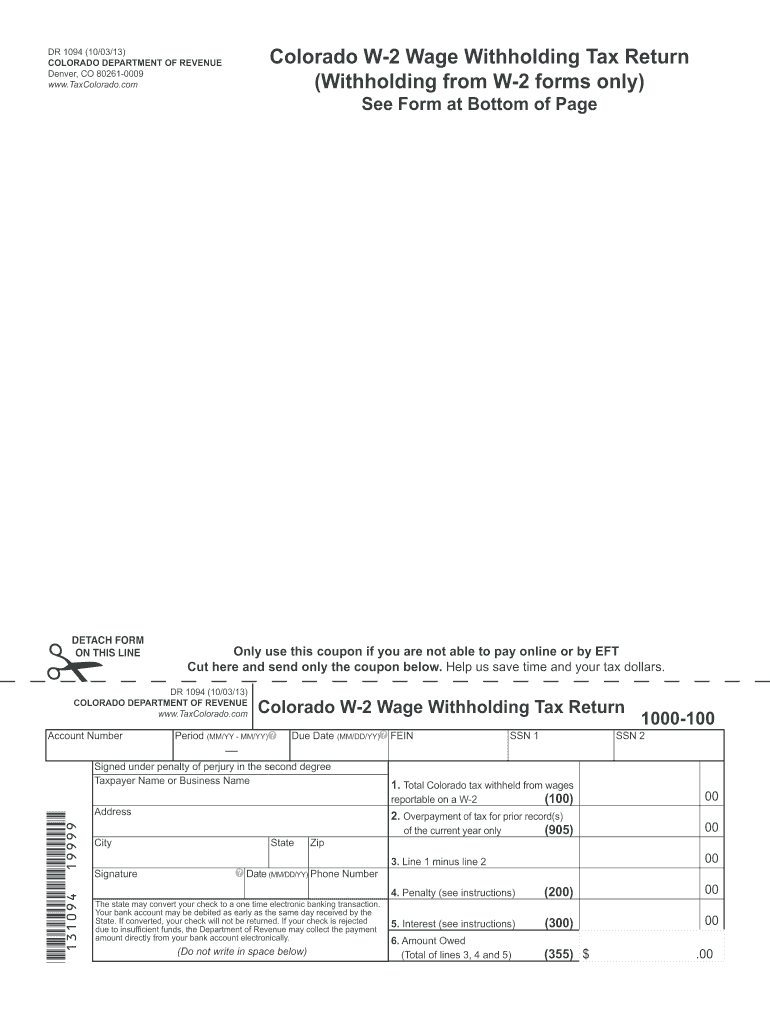

Colorado W 2 Wage Withholding Tax Return Colorado Gov Colorado Fill

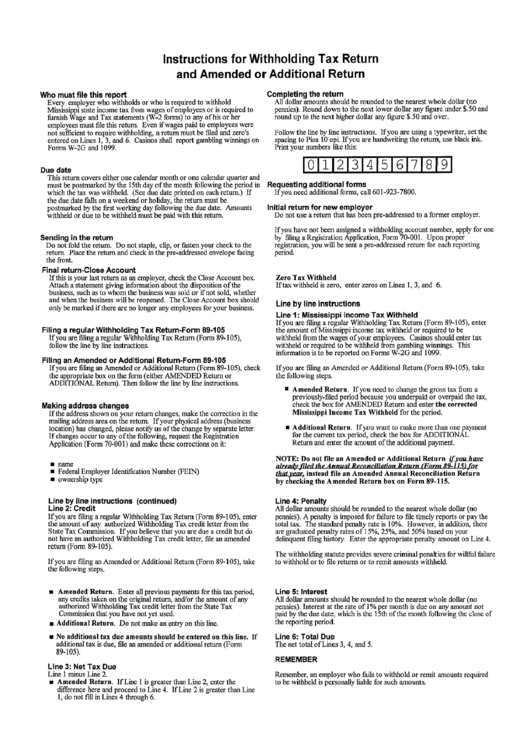

Web the mississippi employer’s withholding tax return is a simple enough form, but you need payroll software for data management and recordkeeping purposes. Get your online template and fill it in using progressive features. Gather this information before beginning the registration. Otherwise, he must withhold mississippi income t ax from the full amo unt of your wages. Web withholding taxpayers.

Top 8 Mississippi Withholding Form Templates free to download in PDF format

8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status. Web start on editing, signing and sharing your how to fill out mississippi employee's withholding exemption certificate online following these easy steps: Web withholding taxpayers use tap (taxpayer access point) for online filing. Go to tap to register. Put the day/time and place your e.

Iowa State Withholding Form 2022

Amended return check this box if you need to make a change to a return already filed. Enjoy smart fillable fields and. Engaged parties names, places of residence and phone numbers etc. Web fill in the blank areas; Web start on editing, signing and sharing your how to fill out mississippi employee's withholding exemption certificate online following these easy steps:

Web There Are Several Ways To Submit Form 4868.

Go to tap to register. Web fill in the blank areas; Enjoy smart fillable fields and. This form must be filed even if you have no.

8/19 Mississippi Employee's Withholding Exemption Certificate Employee's Name Ssn Employee's Residence Address Marital Status.

Otherwise, you must withhold mississippi income tax from the full amount of your wages. Emergency services health & social services new residents guide e11 directory. Change the template with exclusive fillable areas. Web the mississippi employer’s withholding tax return is a simple enough form, but you need payroll software for data management and recordkeeping purposes.

Edit Your Mississippi Employee's Withholding Exemption Certificate Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Amended return check this box if you need to make a change to a return already filed. Engaged parties names, places of residence and phone numbers etc. Marital status (check one)spous (a) spouse not. Web withholding taxpayers use tap (taxpayer access point) for online filing.

Web File This Form With Your Employer.

Web declaration of estimated tax. Web multiply number ofblockschecked online 5 by $1,500 and enter amount of exemptionclaimed. Get ready for tax season deadlines by completing any required tax forms today. Keep this certificate with your records.