Fincen 105 Form Cost

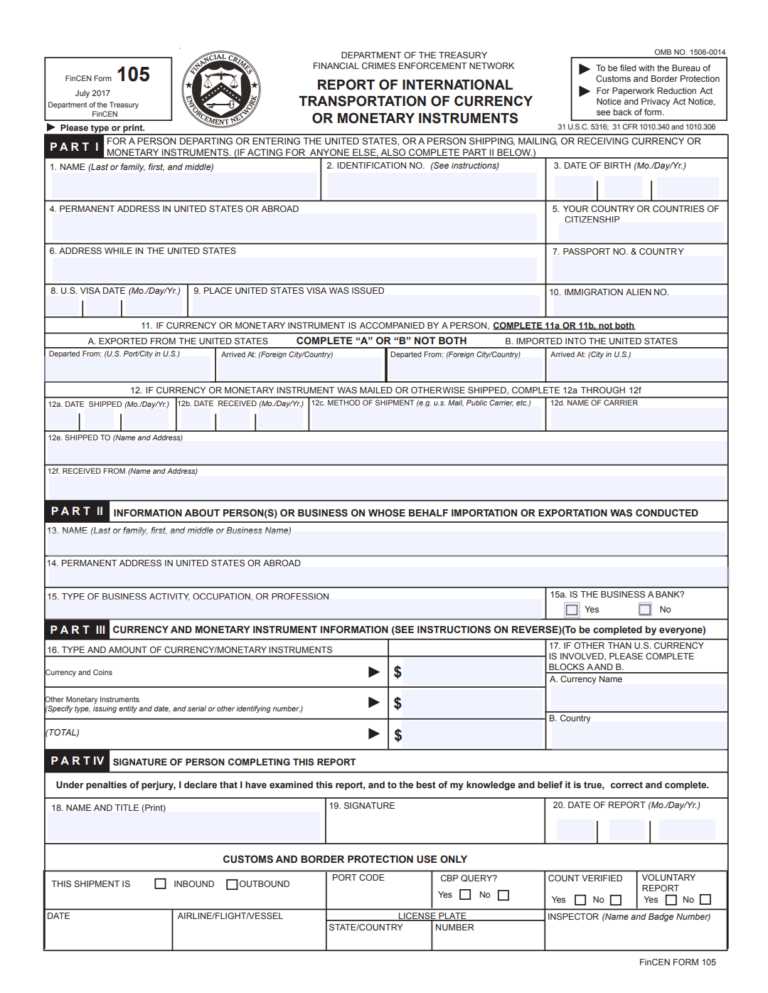

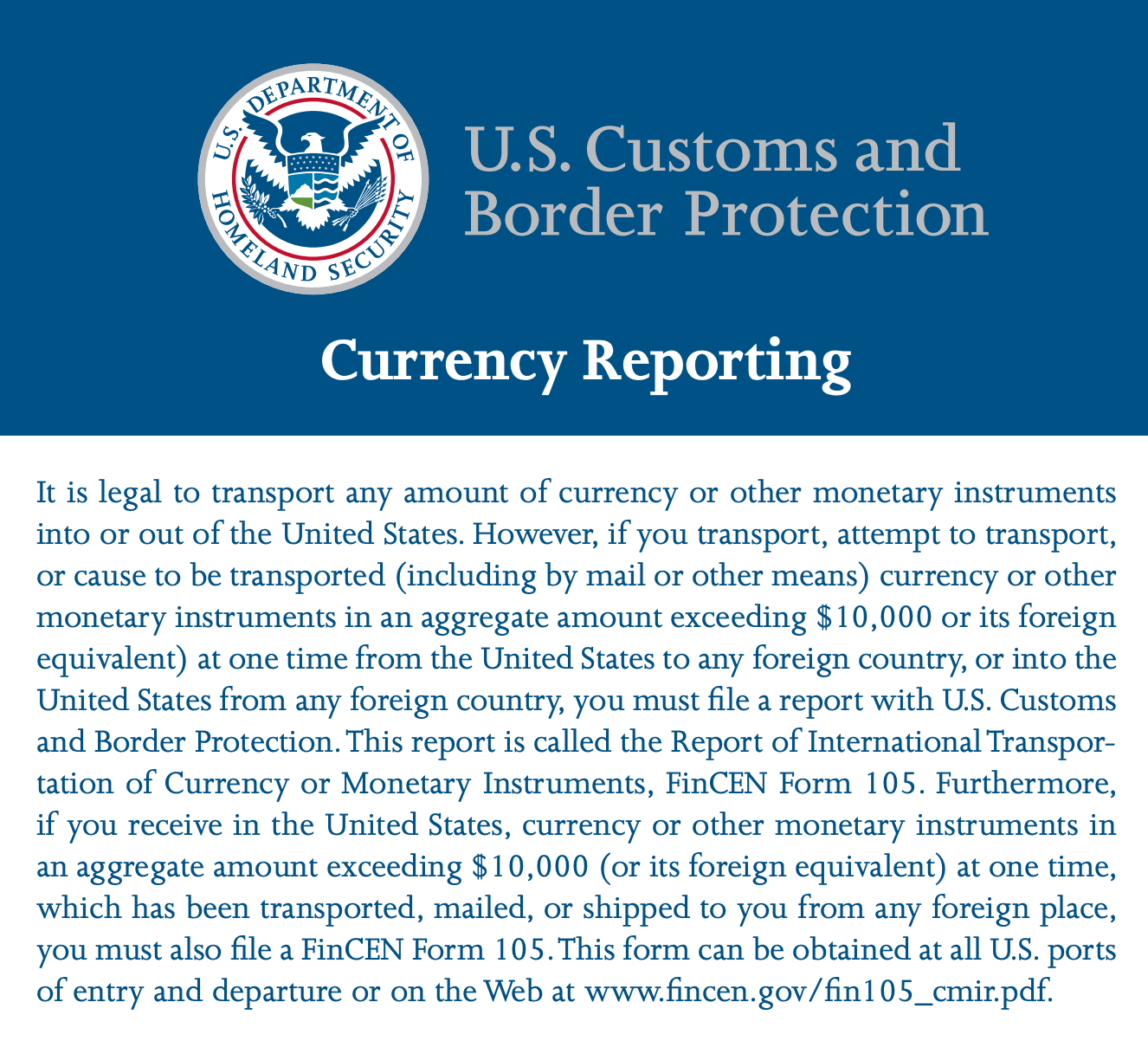

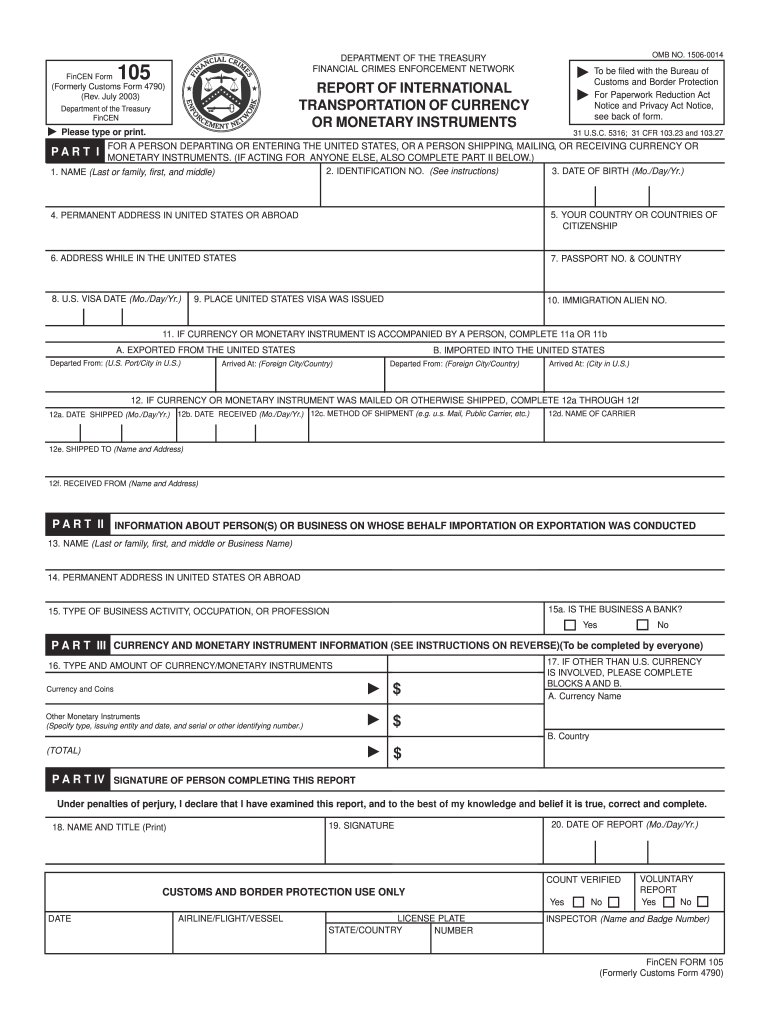

Fincen 105 Form Cost - Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Web please note a fincen 105 form must be completed at the time of entry for monetary instruments over $10,000. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. What happens when you file a fincen 105?. Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or via electronic fund transfer, can be. Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers.

What happens when you file a fincen 105?. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Traveling on airplanes in or into the united statesdetails international. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Web fees fincen does not charge for time spent locating and reviewing privacy act requests; However, the same charges assessed for copying records under the foia will be. Web here is all you need to know! Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an.

Web please note a fincen 105 form must be completed at the time of entry for monetary instruments over $10,000. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. Web up to $40 cash back comments and help with fincen form 105 pdf. If you are traveling out of the country with more than $10,000 cash on your person or in your. Web here is all you need to know! Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web fees fincen does not charge for time spent locating and reviewing privacy act requests; Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

What happens when you file a fincen 105?. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. However, the same charges assessed for copying records under the foia will be. Web international travelers entering the united states must declare if they.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Web bsa regulations stipulate that a cmir.

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Web here is all you need to know! However, the same charges assessed for copying records under the foia will be. Web finding an attorney for seizures of unreported cash at the airport. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Web (1)each person who physically transports, mails, or ships, or causes.

Formulario Fincen 105 En Español Fill Online, Printable, Fillable

Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. What happens when you file a fincen 105?. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Fincen form 105 august 20, 2022.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web up to $40 cash back comments and help with fincen form 105 pdf. Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers. What happens when you file a fincen 105?. Web please note a fincen 105 form must be completed at the time of entry for monetary.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an. Web finding an attorney for seizures of unreported cash at the airport. Web up to $40 cash back comments and help with fincen form 105 pdf. Web please note a fincen 105 form must be.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

If you are traveling out of the country with more than $10,000 cash on your person or in your. Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or.

Fincen Form 105 ≡ Fill Out Printable PDF Forms Online

Web up to $40 cash back comments and help with fincen form 105 pdf. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Web up to $40 cash back comments and help with fincen form 105 pdf. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). What happens when you file a fincen 105?. Traveling on airplanes in or into the united statesdetails international. Fincen form 105.

Web The Financial Crimes Enforcement Network (“Fincen”) Is Issuing This Guidance To Correct Observed Deficiencies And Enhance Compliance By Common Carriers.

Fincen form 105 august 20, 2022 money transfers, whether accompanied by someone or via electronic fund transfer, can be. Traveling on airplanes in or into the united statesdetails international. Web finding an attorney for seizures of unreported cash at the airport. What happens when you file a fincen 105?.

However, The Same Charges Assessed For Copying Records Under The Foia Will Be.

Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Web fees fincen does not charge for time spent locating and reviewing privacy act requests; Web up to $40 cash back comments and help with fincen form 105 pdf.

If You Are Traveling Out Of The Country With More Than $10,000 Cash On Your Person Or In Your.

Web here is all you need to know! Web to use this status, you must pay more than half the cost of maintaining a household for certain dependents or relatives other than your nonresident alien spouse. Web please note a fincen 105 form must be completed at the time of entry for monetary instruments over $10,000. Web (1)each person who physically transports, mails, or ships, or causes to be physically transported, mailed, or shipped currency or other monetary instruments in an.

Web Bsa Regulations Stipulate That A Cmir Must Be Used To Report The Physical Transportation Of Currency Or Other Monetary Instruments In An Aggregate Amount.

Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105).