Waiver Of Subrogation Form

Waiver Of Subrogation Form - A subrogation provision is used to relieve a party of liability for damages if they are even partially responsible for a loss. Web what is a waiver of subrogation? Web waiver of transfer of rights of recovery against others to us (waiver of subrogation) this endorsement modifies insurance provided under the following: Web a waiver of subrogation means your insurer cannot try to recover damages from a liable third party. Web a waiver of subrogation is a provision that prohibits an insurer from pursuing a third party to recover damages for covered losses. This clause can protect contractors and shift the risk for damages to owners and their insurance policies. Waivers of subrogation are commonly used in commercial automobile, property, and general liability as well as in workers’ compensation insurance. Web waivers of subrogation typically are agreed to by insurers as a response to the insured's having waived its own right of recovery against a third party. An agreement between two parties in which one party agrees to waive subrogation rights against another in the event of a loss. Having a waiver in place can simplify legal matters when there’s an incident or help preserve business relationships.

Web subrogation clause waivers in construction contracts help avoid construction delays caused by disputes and litigation over losses. A subrogation provision is used to relieve a party of liability for damages if they are even partially responsible for a loss. When these provisions are not in place, investigations determine liability, and this process can be lengthy and jeopardize construction projects. Your insurance premiums typically increase with a waiver of subrogation. Web a waiver of subrogation clause, common in construction contracts, removes this right. Waivers of subrogation are found in various contracts,. Restrictions on amending or terminating the r&w insurance policy. The intent of the waiver is to prevent one party's insurer from pursuing subrogation against the other party. Web a waiver of subrogation means your insurer cannot try to recover damages from a liable third party. Generally, insurance policies do not bar coverage if an insured waives its right of recovery against a third party before a loss.

A subrogation provision is used to relieve a party of liability for damages if they are even partially responsible for a loss. Web a waiver of subrogation in the r&w insurance policy. Web waiver of transfer of rights of recovery against others to us (waiver of subrogation) this endorsement modifies insurance provided under the following: Generally, insurance policies do not bar coverage if an insured waives its right of recovery against a third party before a loss. An agreement between two parties in which one party agrees to waive subrogation rights against another in the event of a loss. When these provisions are not in place, investigations determine liability, and this process can be lengthy and jeopardize construction projects. It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. Web subrogation clause waivers in construction contracts help avoid construction delays caused by disputes and litigation over losses. A project owner or general contractor may require you to add this endorsement to your business insurance policy. Web a waiver of subrogation is a provision that prohibits an insurer from pursuing a third party to recover damages for covered losses.

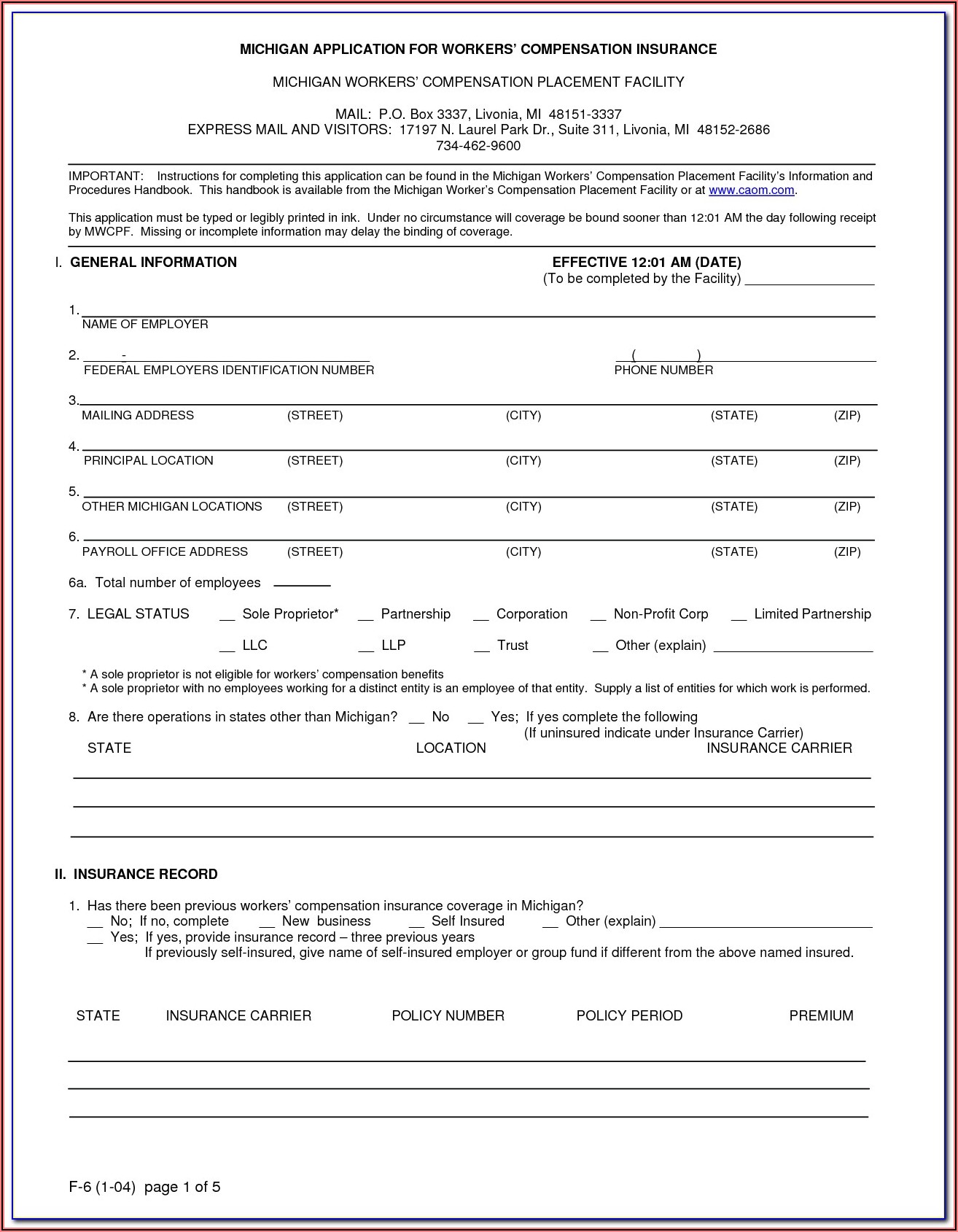

Waiver Of Subrogation Form For Workers Compensation Form Resume

It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. Having a waiver in place can simplify legal matters when there’s an incident or help preserve business relationships. Web a waiver of subrogation means your insurer cannot try to recover damages from a liable third party. Web a.

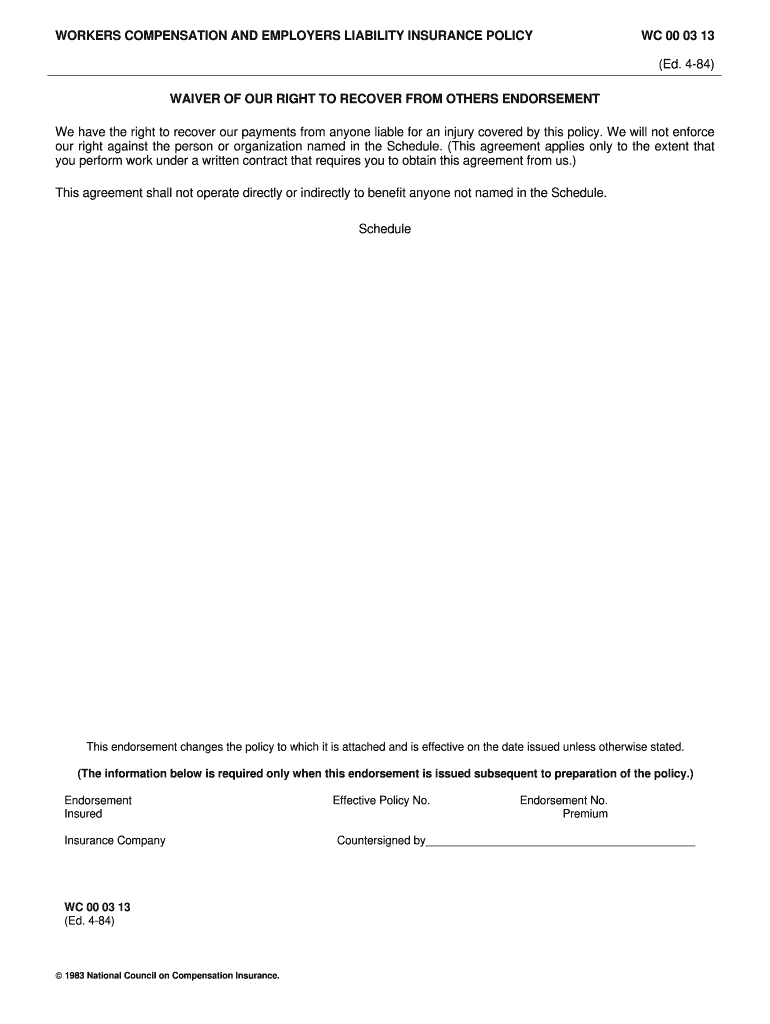

General Liability Waiver Of Subrogation Endorsement Form Form

It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. The intent of the waiver is to prevent one party's insurer from pursuing subrogation against the other party. Web a waiver of subrogation clause, common in construction contracts, removes this right. A project owner or general contractor may.

Waiver of Subrogation Form PDF Fill Out and Sign Printable PDF

This clause can protect contractors and shift the risk for damages to owners and their insurance policies. The intent of the waiver is to prevent one party's insurer from pursuing subrogation against the other party. Web a waiver of subrogation is a provision that prohibits an insurer from pursuing a third party to recover damages for covered losses. Web waivers.

Avn 102 waiver of subrogation endorsement

Web a waiver of subrogation means your insurer cannot try to recover damages from a liable third party. Waivers of subrogation are found in various contracts,. When these provisions are not in place, investigations determine liability, and this process can be lengthy and jeopardize construction projects. An agreement between two parties in which one party agrees to waive subrogation rights.

Waiver Of Subrogation in Workers Compensation Exhaustive Guide in 2021

Web a waiver of subrogation in the r&w insurance policy. Having a waiver in place can simplify legal matters when there’s an incident or help preserve business relationships. It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. The intent of the waiver is to prevent one party's.

Waiver Of Subrogation Form For Workers Comp Form Resume Examples

It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. The intent of the waiver is to prevent one party's insurer from pursuing subrogation against the other party. Web a waiver of subrogation is used in the insurance industry. Web a waiver of subrogation in the r&w insurance.

Iso Blanket Waiver Of Subrogation Kitchens Design, Ideas And Renovation

Web waivers of subrogation typically are agreed to by insurers as a response to the insured's having waived its own right of recovery against a third party. A subrogation provision is used to relieve a party of liability for damages if they are even partially responsible for a loss. When these provisions are not in place, investigations determine liability, and.

General Liability Waiver Of Subrogation Endorsement Form Form

Web a waiver of subrogation clause, common in construction contracts, removes this right. It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. Web a waiver of subrogation is a provision that prohibits an insurer from pursuing a third party to recover damages for covered losses. A subrogation.

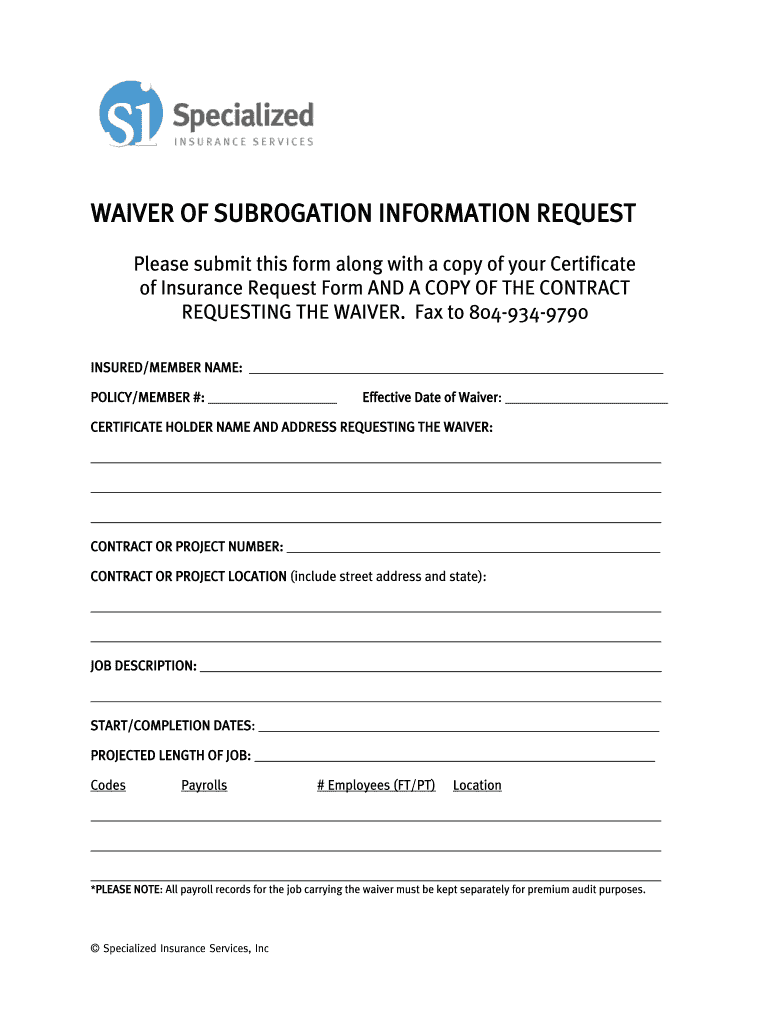

Waiver Of Subrogation Form Pdf Fill Online, Printable, Fillable

Web a waiver of subrogation in the r&w insurance policy. A project owner or general contractor may require you to add this endorsement to your business insurance policy. Web subrogation clause waivers in construction contracts help avoid construction delays caused by disputes and litigation over losses. Web a waiver of subrogation is a provision that prohibits an insurer from pursuing.

Waiver Of Subrogation Endorsement For Workers Comp Form Resume

A project owner or general contractor may require you to add this endorsement to your business insurance policy. Web a waiver of subrogation clause, common in construction contracts, removes this right. It is a clause in a contract, but it can only be used once you have the right kind of insurance coverage. Waivers of subrogation are found in various.

Restrictions On Amending Or Terminating The R&W Insurance Policy.

Your insurance premiums typically increase with a waiver of subrogation. Web a waiver of subrogation clause, common in construction contracts, removes this right. Web waivers of subrogation typically are agreed to by insurers as a response to the insured's having waived its own right of recovery against a third party. Waivers of subrogation are found in various contracts,.

Web A Waiver Of Subrogation Is A Provision That Prohibits An Insurer From Pursuing A Third Party To Recover Damages For Covered Losses.

Web what is a waiver of subrogation? Web a waiver of subrogation is used in the insurance industry. Web waiver of transfer of rights of recovery against others to us (waiver of subrogation) this endorsement modifies insurance provided under the following: Web a waiver of subrogation in the r&w insurance policy.

Auto Dealers Coverage Form Business Auto Coverage Form Motor Carrier Coverage Form With Respect To Coverage Provided By This.

Having a waiver in place can simplify legal matters when there’s an incident or help preserve business relationships. The intent of the waiver is to prevent one party's insurer from pursuing subrogation against the other party. Waivers of subrogation are commonly used in commercial automobile, property, and general liability as well as in workers’ compensation insurance. This clause can protect contractors and shift the risk for damages to owners and their insurance policies.

A Subrogation Provision Is Used To Relieve A Party Of Liability For Damages If They Are Even Partially Responsible For A Loss.

Generally, insurance policies do not bar coverage if an insured waives its right of recovery against a third party before a loss. An agreement between two parties in which one party agrees to waive subrogation rights against another in the event of a loss. A project owner or general contractor may require you to add this endorsement to your business insurance policy. When these provisions are not in place, investigations determine liability, and this process can be lengthy and jeopardize construction projects.