941 Form 2020 Pdf

941 Form 2020 Pdf - Web the social security wage base limit is $137,700. Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: See the instructions for line 42. Type or print within the boxes. April, may, june enter the calendar year of the quarter you’re correcting. Web changes to form 941 (rev. Social security and medicare taxes apply to the wages of household workers you pay $2,200 or more in cash wages in 2020. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on The medicare tax rate is 1.45% each for the employee and employer, unchanged from 2019. Pay the employer's portion of social security or medicare tax.

Write your daily tax liability on the numbered space that corresponds to the date wages were paid. (yyyy) read the separate instructions before completing this form. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Social security and medicare taxes apply to the wages of household workers you pay $2,200 or more in cash wages in 2020. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. The medicare tax rate is 1.45% each for the employee and employer, unchanged from 2019. There is no wage base limit for medicare tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Type or print within the boxes. Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to:

Web the social security wage base limit is $137,700. April, may, june enter the calendar year of the quarter you’re correcting. Employer s quarterly federal tax return keywords: Write your daily tax liability on the numbered space that corresponds to the date wages were paid. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). There is no wage base limit for medicare tax. Instructions for form 941 (2021) pdf. Web changes to form 941 (rev. See section 11 in pub.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web changes to form 941 (rev. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Write your daily tax liability on the numbered space that.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web employer's quarterly federal tax return for 2021. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. See section 11 in pub. Pay the employer's portion of social security or medicare tax.

941 Schedule B Fill Out and Sign Printable PDF Template signNow

Web changes to form 941 (rev. See section 11 in pub. Pay the employer's portion of social security or medicare tax. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. Instructions for form 941 (2021) pdf.

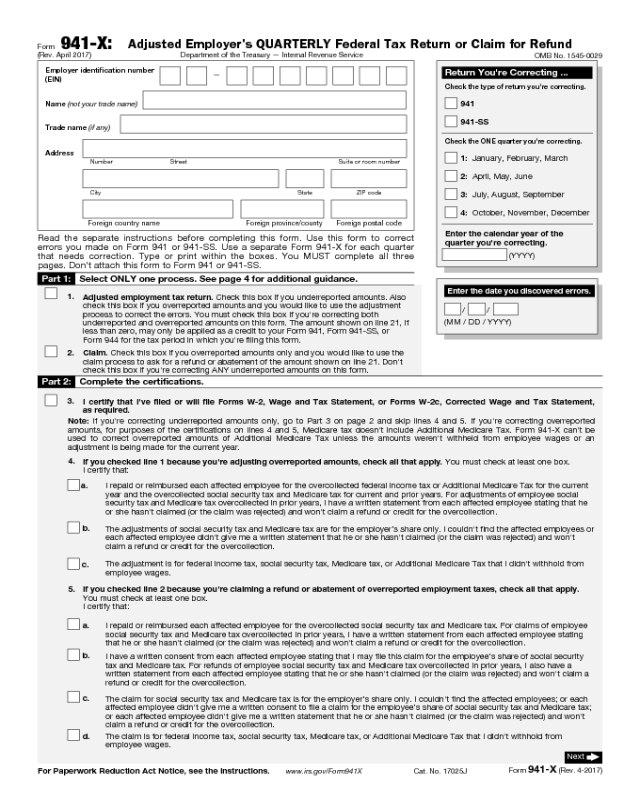

941 X Form Fill Out and Sign Printable PDF Template signNow

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Pay the employer's.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: See section 11 in pub. Type or print within the boxes.

2022 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Pay the employer's portion of social security or medicare tax. Web employer's quarterly federal tax return for 2021. Instructions for form 941 (2021) pdf. You must complete all five pages. Type or print within the boxes.

form 941 instructions 2020 Fill Online, Printable, Fillable Blank

You must complete all five pages. Type or print within the boxes. Current revision form 941 pdf instructions for form 941 ( print version. Web the social security wage base limit is $137,700. Web employer's quarterly federal tax return for 2021.

Update Form 941 Changes Regulatory Compliance

Type or print within the boxes. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on See section 11 in pub. Write your daily tax liability on the numbered space that.

ezAccounting Business and Payroll Software Has Been Updated to Include

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on The july 2020 revision of form 941 will be used to report employment taxes beginning with.

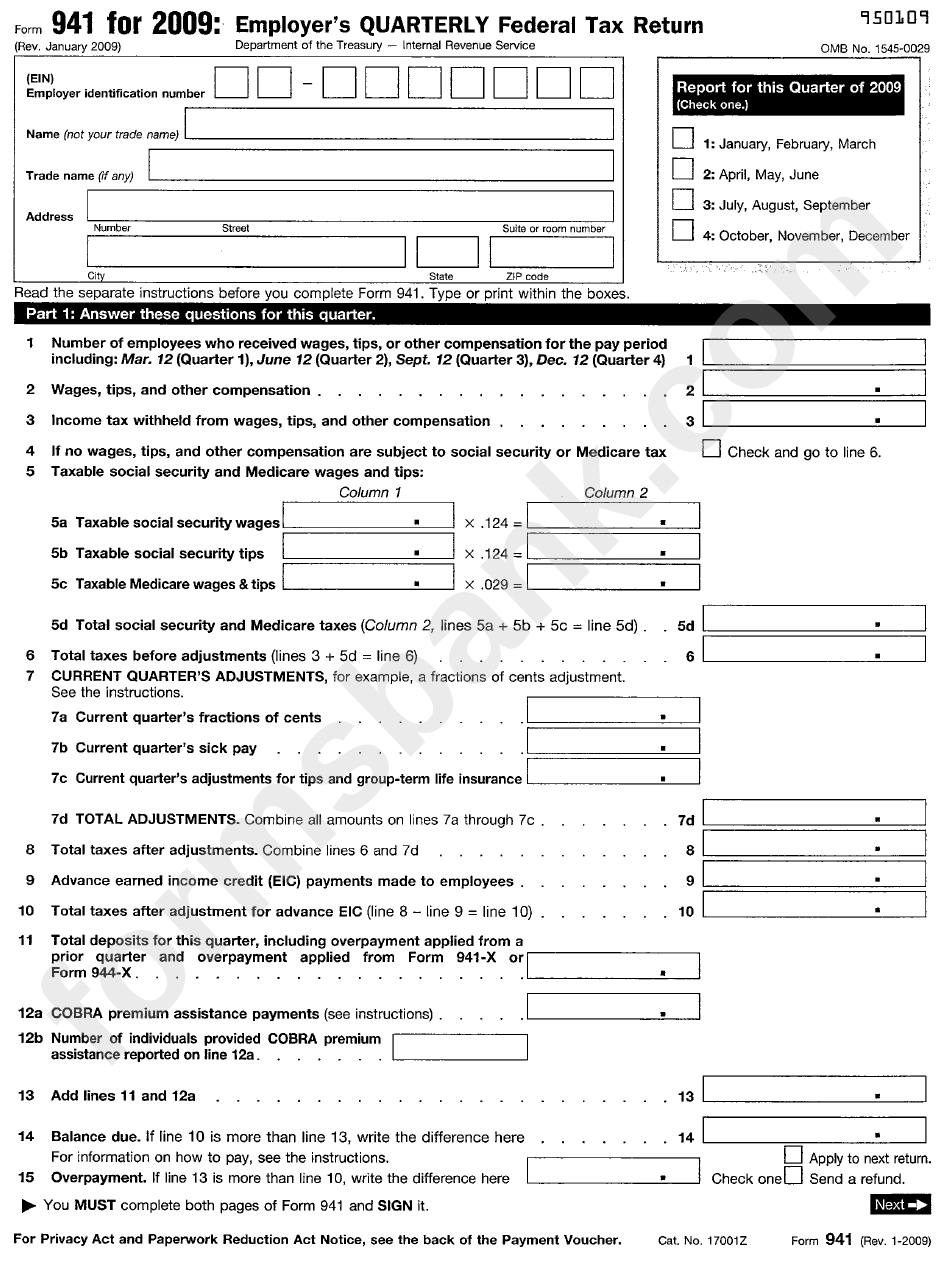

Form 941 Employer'S Quarterly Federal Tax Return 2009 printable pdf

Web changes to form 941 (rev. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. You must complete all five pages. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on The medicare tax rate is.

The Medicare Tax Rate Is 1.45% Each For The Employee And Employer, Unchanged From 2019.

Web the social security wage base limit is $137,700. Instructions for form 941 (2021) pdf. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on There is no wage base limit for medicare tax.

For Employers Who Withhold Taxes From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax (Also Known As Schedule B).

You must complete all five pages. Social security and medicare taxes apply to the wages of household workers you pay $2,200 or more in cash wages in 2020. Type or print within the boxes. Current revision form 941 pdf instructions for form 941 ( print version.

(Yyyy) Read The Separate Instructions Before Completing This Form.

Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web employer's quarterly federal tax return for 2021. April, may, june enter the calendar year of the quarter you’re correcting. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks.

The July 2020 Revision Of Form 941 Will Be Used To Report Employment Taxes Beginning With The Third Quarter Of 2020.

See the instructions for line 42. Employer s quarterly federal tax return keywords: Pay the employer's portion of social security or medicare tax. Web changes to form 941 (rev.