Where To Report Form 2439 On Tax Return

Where To Report Form 2439 On Tax Return - Advantages and disadvantages of form 2439: A mutual fund usually distributes all its capital gains to its shareholders. Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). Click on jump to 2439. Go to the payments/penalties > payments worksheet. Web or for reporting the tax paid only from form 2439. Go to screen 22.1 dispositions (schedule d, 4797, etc.). From the dispositions section select form 2439. However, a mutual fund might keep some. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section.

Go to screen 22.1 dispositions (schedule d, 4797, etc.). This is true even if your investment is held in your ira. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. In turbotax enter 2439 in the search box located in the upper right of the program screen. March 27, 2023 11:14 am. Go to the payments/penalties > payments worksheet. When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Web form 2439 is available on the irs website. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. If your mutual fund sends you a form 2439:

When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. If your mutual fund sends you a form 2439: A mutual fund usually distributes all its capital gains to its shareholders. From the dispositions section select form 2439. Go to the payments/penalties > payments worksheet. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. However, a mutual fund might keep some. Click on jump to 2439. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Web form 2439 is available on the irs website.

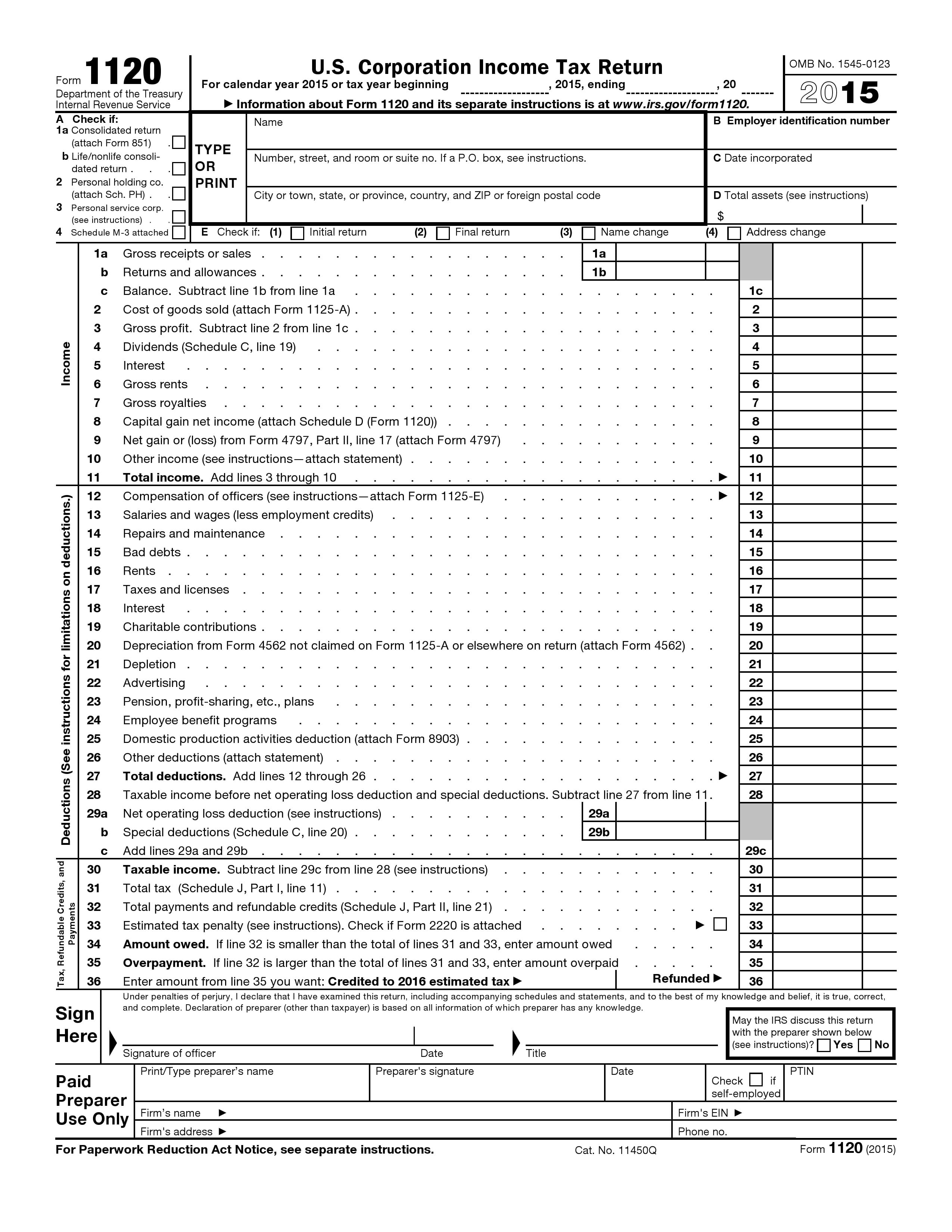

Solved 6 Walt is a new tax preparer. A potential client

Individuals who have already filed their tax returns can file. In turbotax enter 2439 in the search box located in the upper right of the program screen. Advantages and disadvantages of form 2439: A mutual fund usually distributes all its capital gains to its shareholders. When these fields have an amount, the box is marked, indicating that the other payment.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web or for reporting the tax paid only from form 2439. This is true even if your investment is held in your ira. Individuals who have already filed their tax returns can file. When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Web tax paid by the ric and reit.

Publication 17 Your Federal Tax; Refundable Credits

This is true even if your investment is held in your ira. However, a mutual fund might keep some. A mutual fund usually distributes all its capital gains to its shareholders. Go to screen 22.1 dispositions (schedule d, 4797, etc.). When these fields have an amount, the box is marked, indicating that the other payment was from form 2439.

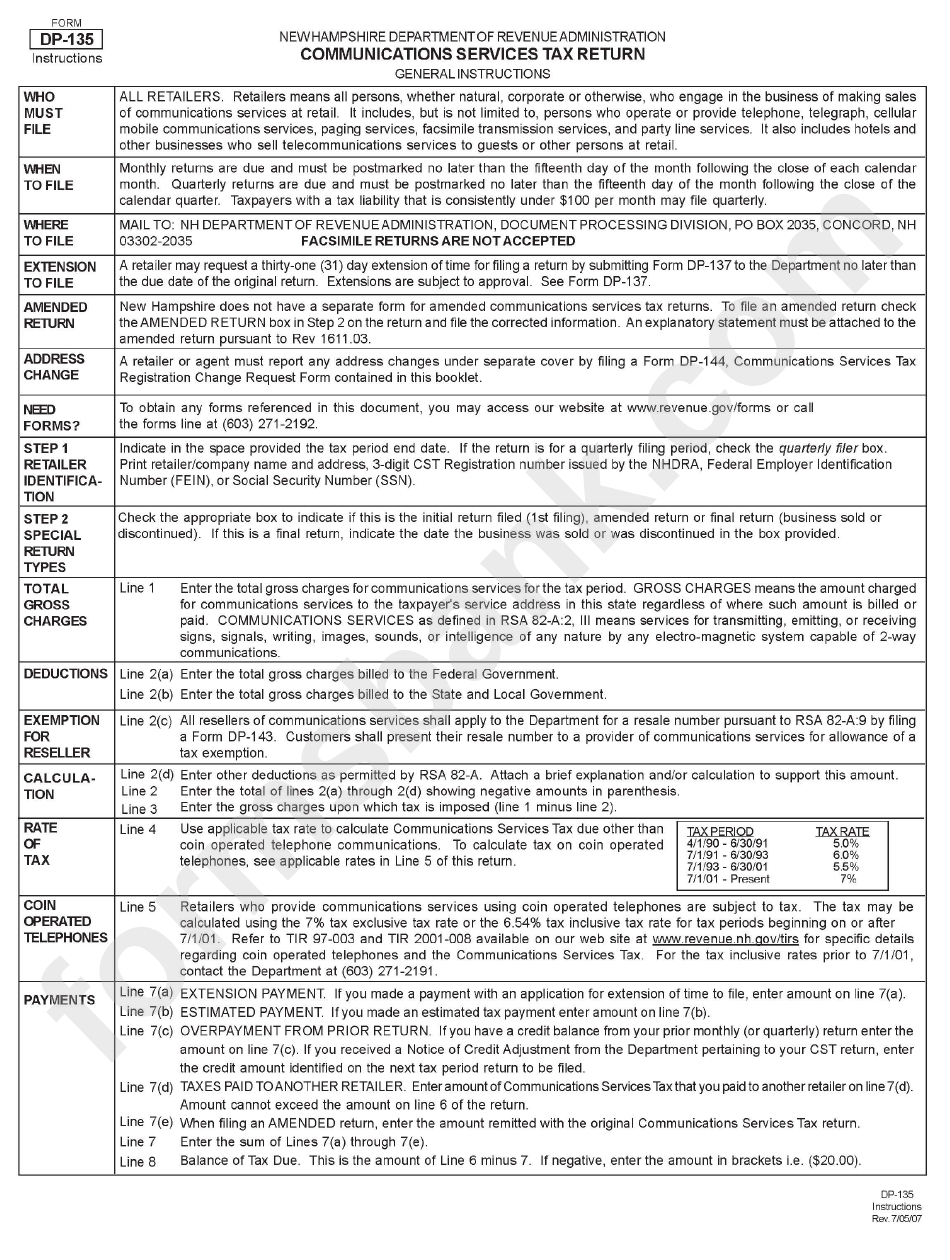

Form Dp135 Instructions Communications Services Tax Return printable

In turbotax enter 2439 in the search box located in the upper right of the program screen. Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). From the dispositions section select form 2439. A mutual fund usually distributes all its capital gains to its shareholders. Web.

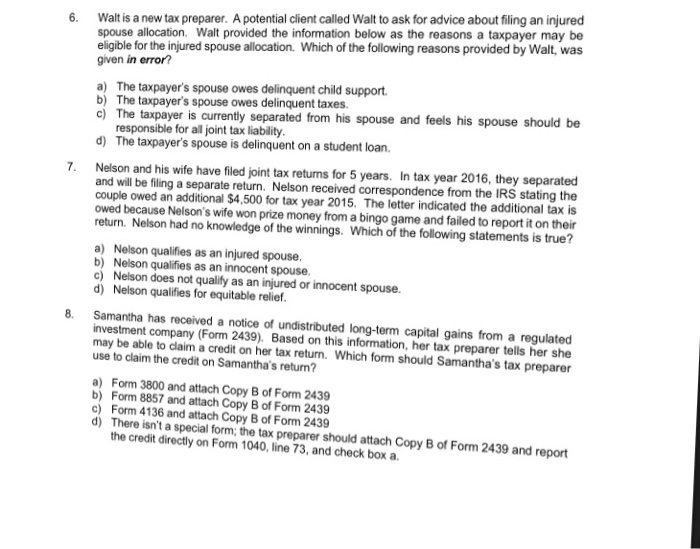

Fill Free fillable IRS PDF forms

Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). Individuals who have already filed their tax returns can file. However, a mutual fund might keep some. Go to screen 22.1 dispositions (schedule d, 4797, etc.). From the dispositions section select form 2439.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). Go to the payments/penalties > payments worksheet. Advantages and disadvantages of form 2439: When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Web or for reporting the.

Fill Free fillable IRS PDF forms

Web to enter the 2439 in the fiduciary module: Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. March 27, 2023 11:14 am. A mutual fund usually distributes all its capital gains to its shareholders. Web or for reporting the tax.

Fill Free fillable IRS PDF forms

In turbotax enter 2439 in the search box located in the upper right of the program screen. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Advantages and disadvantages of form 2439: However, a.

Certified Quality Auditor Training Acceclass

When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. Web tax paid by the ric and reit on the box 1a gains.

Free Tax Forms PDF Template Form Download

Go to screen 22.1 dispositions (schedule d, 4797, etc.). A mutual fund usually distributes all its capital gains to its shareholders. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. Advantages and disadvantages of form 2439: Go to the payments/penalties >.

Go To Screen 22.1 Dispositions (Schedule D, 4797, Etc.).

This is true even if your investment is held in your ira. When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. From the dispositions section select form 2439. Web form 2439 is available on the irs website.

Web To Enter Form 2439 Go To Investment Income And Select Undistributed Capital Gains Or You Can Search For Form 2439 In The Top Right Corner Of Your Screen And Select Jump To That Section.

Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). If your mutual fund sends you a form 2439: However, a mutual fund might keep some. Web or for reporting the tax paid only from form 2439.

Go To The Payments/Penalties > Payments Worksheet.

Click on jump to 2439. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. March 27, 2023 11:14 am. Web to enter the 2439 in the fiduciary module:

A Mutual Fund Usually Distributes All Its Capital Gains To Its Shareholders.

Advantages and disadvantages of form 2439: Individuals who have already filed their tax returns can file. In turbotax enter 2439 in the search box located in the upper right of the program screen.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)