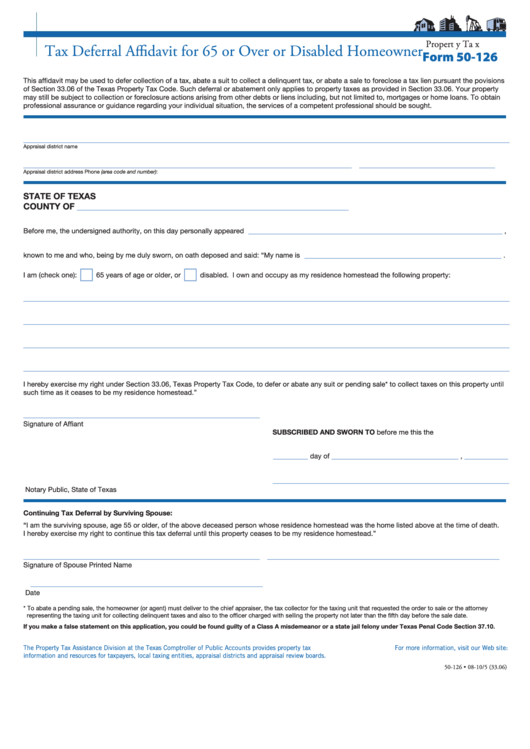

Tax Deferral Form

Tax Deferral Form - A situation in which one is not required to pay taxes one would otherwise owe until some date in the future. You may apply in the year you turn 65. In theory, the net taxes paid should be the same. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web find out if you qualify for the exemption before you apply for a deferral. See our manufacturers' sales/use tax exemption brochure. All missouri short forms allow the standard or itemized deduction. Web apply by november 1 to defer your property taxes the following year. What is the difference between the oasdi tax amounts under deductions and the amounts listed.

A situation in which one is not required to pay taxes one would otherwise owe until some date in the future. Most of the time, tax deferral refers to contributions to an. See our manufacturers' sales/use tax exemption brochure. In theory, the net taxes paid should be the same. This affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien pursuant the. Web to elect to defer tax on a gain if you already filed your federal income tax return, file an amended return or an administrative adjustment request (aar), as appropriate, with a. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web tax deferral refers to instances where a taxpayer can delay paying taxes to some future period. Web what is the social security tax deferral? Current tax breaks and tax deferral of income are significant incentives for people to put money into.

Web the tax deferred is the amount of tax imposed on the portion of the appraised value of my homestead that exceeds the market value of any new improvement plus 105 percent of. See our manufacturers' sales/use tax exemption brochure. Web apply by november 1 to defer your property taxes the following year. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web tax deferral refers to instances where a taxpayer can delay paying taxes to some future period. Once accepted, you do not need to reapply yearly. A situation in which one is not required to pay taxes one would otherwise owe until some date in the future. This affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien pursuant the. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. In theory, the net taxes paid should be the same.

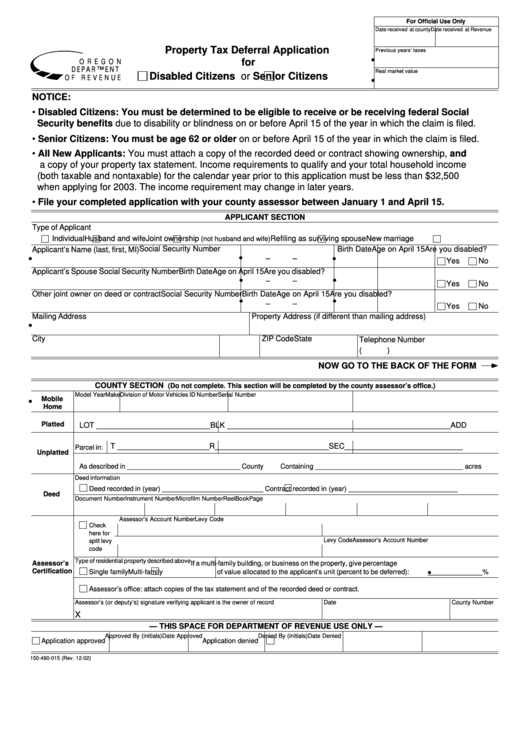

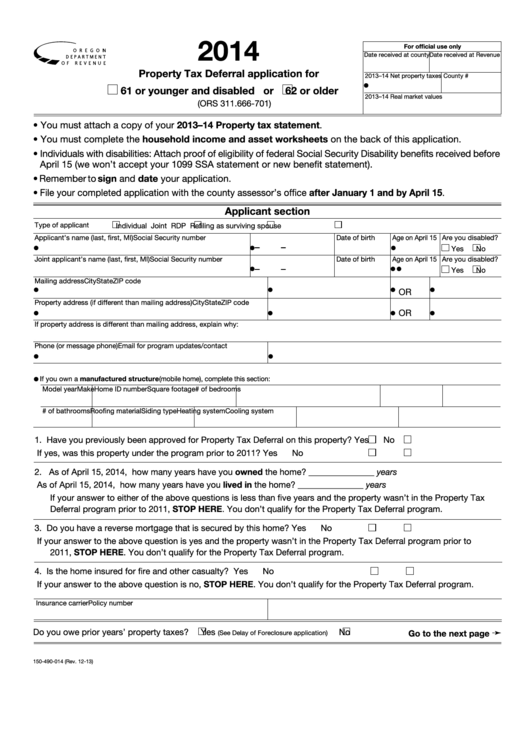

Fillable Form 150490015 Property Tax Deferral Application For

A situation in which one is not required to pay taxes one would otherwise owe until some date in the future. You may apply in the year you turn 65. Web the tax deferred is the amount of tax imposed on the portion of the appraised value of my homestead that exceeds the market value of any new improvement plus.

Form PA30 Download Fillable PDF or Fill Online Elderly and Disabled

Current tax breaks and tax deferral of income are significant incentives for people to put money into. If you feel you have been. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Web short forms help you avoid becoming confused by tax laws and procedures that do.

Federal Employee Group Asks OMB for Answers on Payroll Tax Deferral

You may apply in the year you turn 65. What is the difference between the oasdi tax amounts under deductions and the amounts listed. If you feel you have been. Most of the time, tax deferral refers to contributions to an. Web tax deferral is the foundation of most retirement plans.

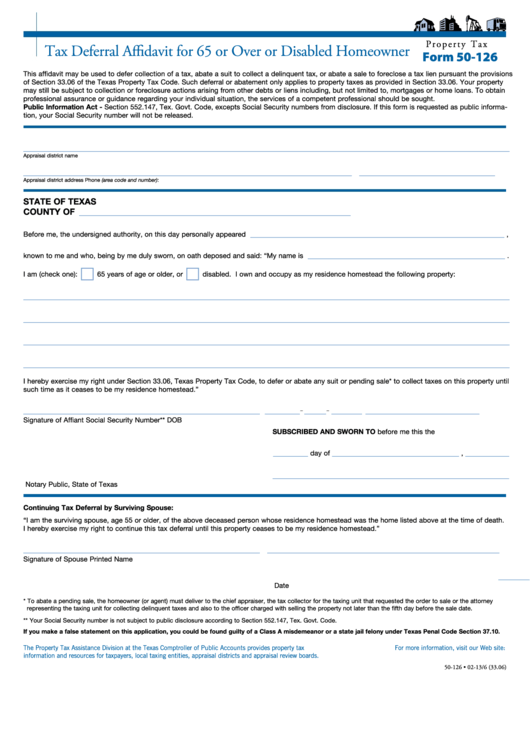

Fillable Form 50126 Tax Deferral Affidavit For 65 Or Over Or

Web tax deferral is the foundation of most retirement plans. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. In theory, the net taxes paid should be the same. Web what is the social security tax deferral? What is the difference between the oasdi tax amounts under deductions and the.

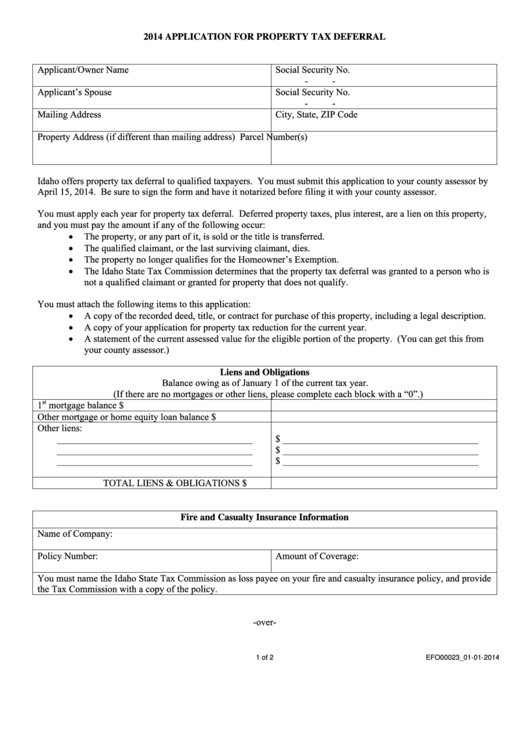

Form Efo00023 Application For Property Tax Deferral 2014 printable

This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. See our manufacturers' sales/use tax exemption brochure. Web tax deferral refers to instances where a taxpayer can delay paying taxes to some future period. A situation in which one is not required to pay taxes one would otherwise.

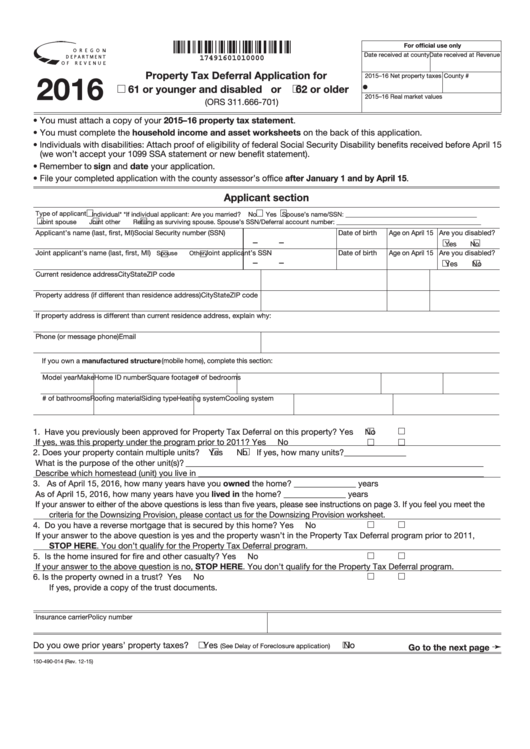

Fillable Form 150490014 Property Tax Deferral Application For 61 Or

Web find out if you qualify for the exemption before you apply for a deferral. Web apply by november 1 to defer your property taxes the following year. All missouri short forms allow the standard or itemized deduction. What is the difference between the oasdi tax amounts under deductions and the amounts listed. Web to elect to defer tax on.

Fillable Form 50126 Tax Deferral Affidavit For 65 Or Over Or

Most of the time, tax deferral refers to contributions to an. What is the difference between the oasdi tax amounts under deductions and the amounts listed. Web tax deferral is the foundation of most retirement plans. In theory, the net taxes paid should be the same. Web apply by november 1 to defer your property taxes the following year.

Fillable Form 150490014 Property Tax Deferral Application For 61 Or

Once accepted, you do not need to reapply yearly. Current tax breaks and tax deferral of income are significant incentives for people to put money into. Web what is the social security tax deferral? This affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a.

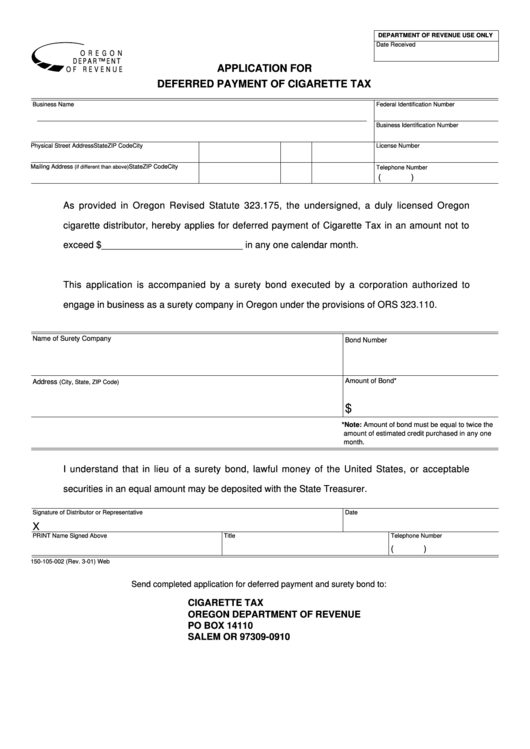

Fillable Application For Deferred Payment Of Cigarette Tax Form 2001

See our manufacturers' sales/use tax exemption brochure. Most of the time, tax deferral refers to contributions to an. Web to elect to defer tax on a gain if you already filed your federal income tax return, file an amended return or an administrative adjustment request (aar), as appropriate, with a. What is the difference between the oasdi tax amounts under.

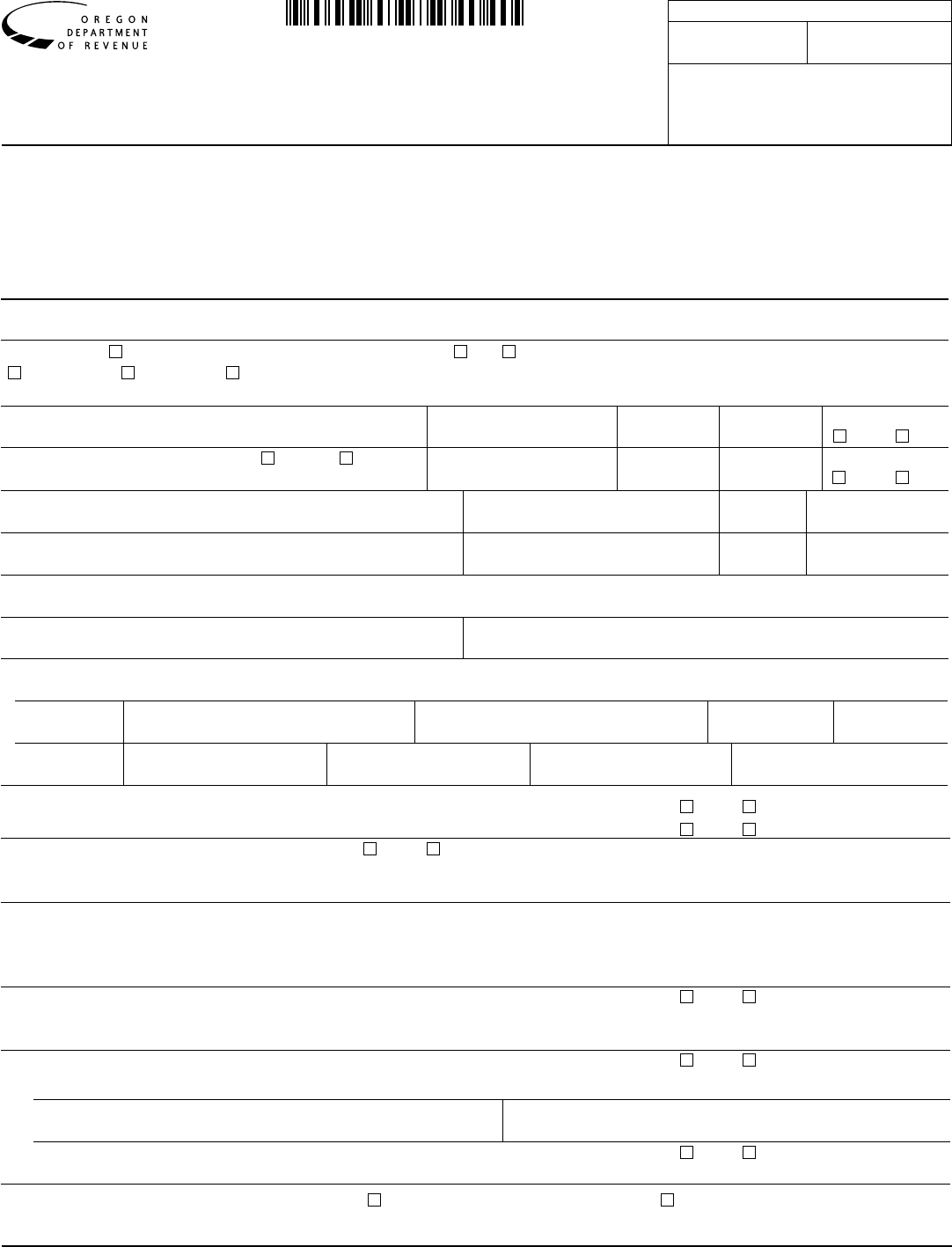

Property Tax Deferral Application Edit, Fill, Sign Online Handypdf

All missouri short forms allow the standard or itemized deduction. What is the difference between the oasdi tax amounts under deductions and the amounts listed. Web tax deferral is the foundation of most retirement plans. Web what is the social security tax deferral? Web apply by november 1 to defer your property taxes the following year.

Web What Is The Social Security Tax Deferral?

This affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien pursuant the. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Web apply by november 1 to defer your property taxes the following year. What is the difference between the oasdi tax amounts under deductions and the amounts listed.

See Our Manufacturers' Sales/Use Tax Exemption Brochure.

Web the tax deferred is the amount of tax imposed on the portion of the appraised value of my homestead that exceeds the market value of any new improvement plus 105 percent of. All missouri short forms allow the standard or itemized deduction. Web tax deferral refers to instances where a taxpayer can delay paying taxes to some future period. You may apply in the year you turn 65.

In Theory, The Net Taxes Paid Should Be The Same.

If you feel you have been. A situation in which one is not required to pay taxes one would otherwise owe until some date in the future. Most of the time, tax deferral refers to contributions to an. Web to elect to defer tax on a gain if you already filed your federal income tax return, file an amended return or an administrative adjustment request (aar), as appropriate, with a.

Once Accepted, You Do Not Need To Reapply Yearly.

Web find out if you qualify for the exemption before you apply for a deferral. Current tax breaks and tax deferral of income are significant incentives for people to put money into. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Web tax deferral is the foundation of most retirement plans.