How To File Form 9465 Online

How To File Form 9465 Online - If you are filing form. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. Form 9465 is used by taxpayers to. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If you do not qualify for. See option 1below for details. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your.

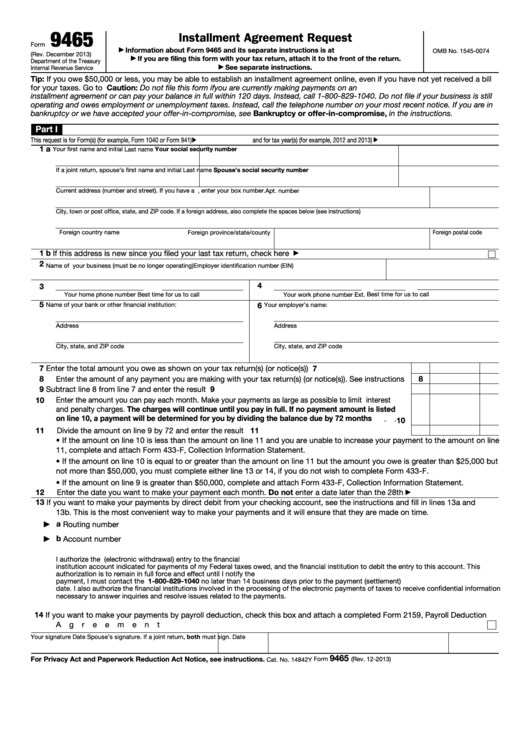

Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your. Get ready for tax season deadlines by completing any required tax forms today. Web department of if you are filing this form with your tax return, attach it to the the treasury internal revenue service front of the return. See option 1below for details. If you do not qualify for. If you are filing form. On smaller devices, click in the upper left. Ad get ready for tax season deadlines by completing any required tax forms today. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay.

Double check all the fillable fields to ensure full precision. Get ready for tax season deadlines by completing any required tax forms today. Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your. Web tax form filed or examined (if applicable) can you file form 9465 online? Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. Ad upload, modify or create forms. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. If certain conditions are met and your account is eligible. Web easy online amend: If you do not qualify for.

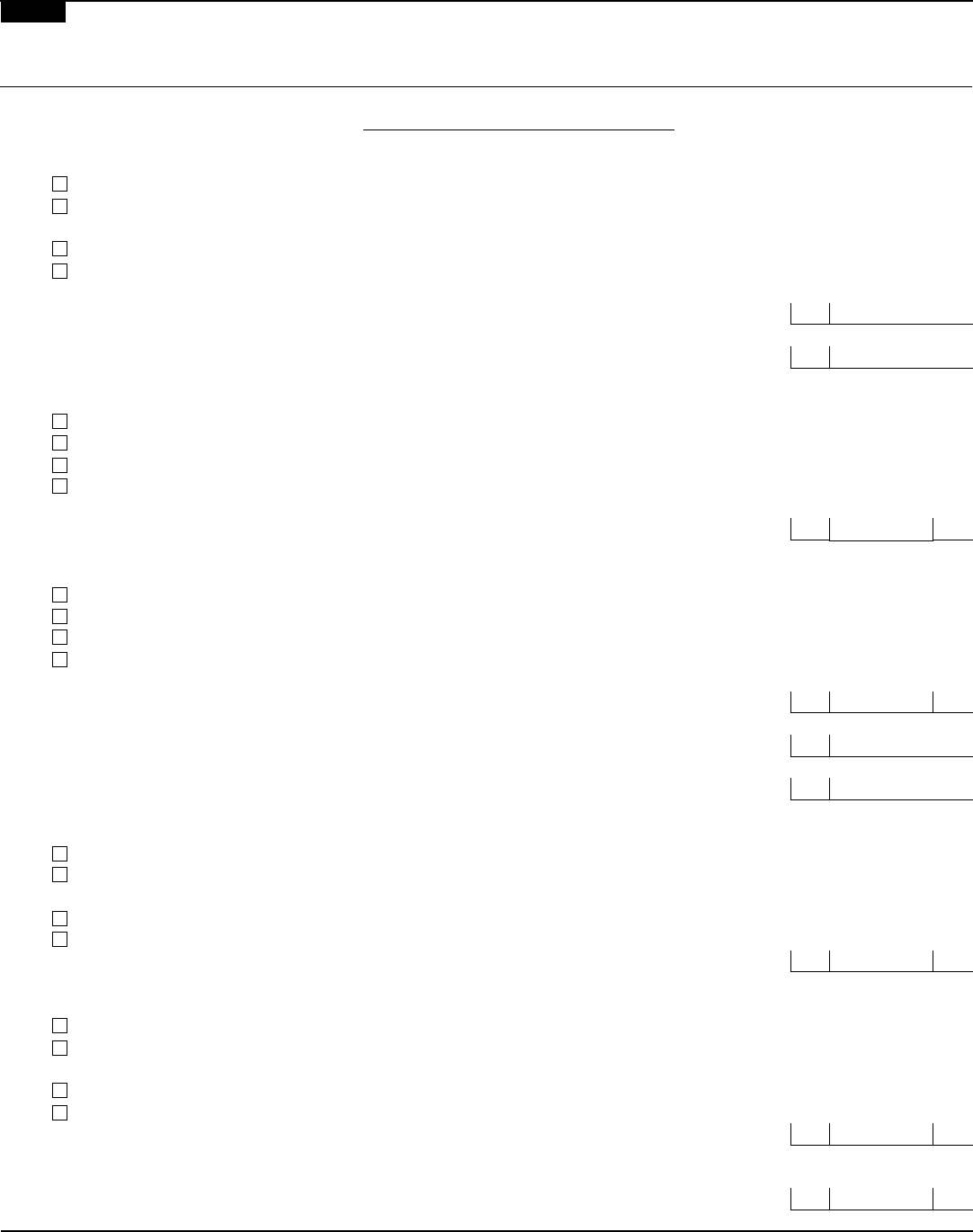

Form 9465 Edit, Fill, Sign Online Handypdf

Web easy online amend: Can i apply for an installment plan. Try it for free now! Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your. Web enter your official identification and contact details.

Irs Form 9465 File Online Universal Network

Web federal communications commission 45 l street ne. Complete, edit or print tax forms instantly. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Double check all the fillable fields to ensure full precision. If you.

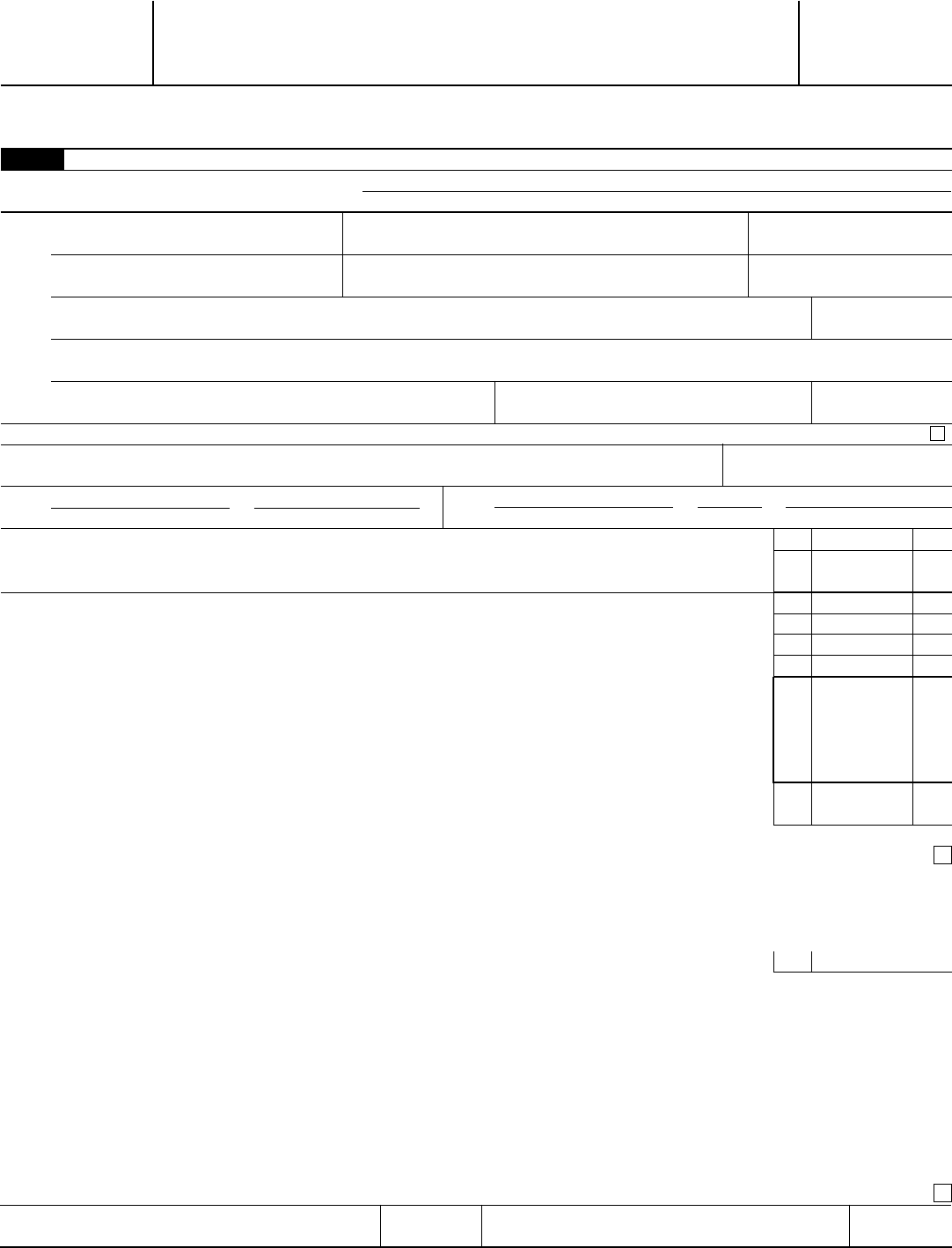

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

On smaller devices, click in the upper left. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Form 9465 is used by taxpayers to. Ad upload, modify or create forms. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement.

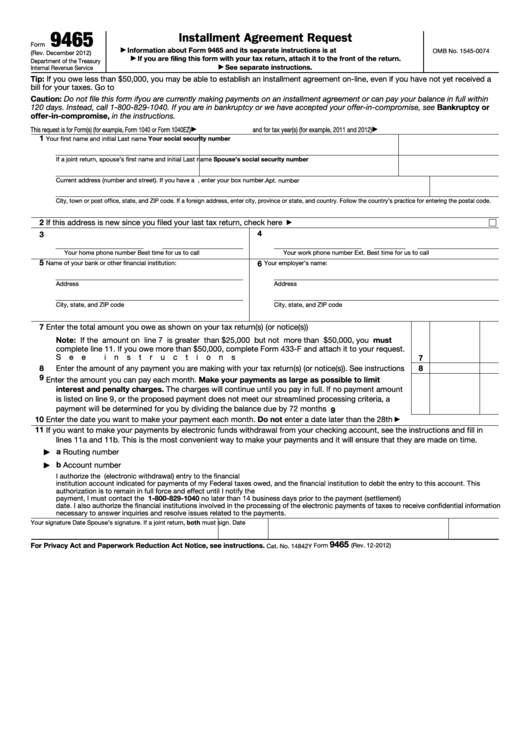

Fillable Form 9465 Installment Agreement Request printable pdf download

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web easy online amend: Web irs definition use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If you do not qualify for.

Applying for a tax payment plan Don't Mess With Taxes

Web tax form filed or examined (if applicable) can you file form 9465 online? Web easy online amend: Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. From within your taxact return ( online or desktop), click on the federal tab..

Irs Payment Form 9465 Form Resume Examples EvkBqoxO2d

Can i apply for an installment plan. If you do not qualify for. Form 9465 is available in all versions of taxact ®. Utilize a check mark to point the answer wherever expected. Web easy online amend:

IRS 9465 2018 Fill and Sign Printable Template Online US Legal Forms

If certain conditions are met and your account is eligible. From within your taxact return ( online or desktop), click on the federal tab. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web internal revenue service see separate instructions.

Stay on Top of your Tax Installments by Filing Form 9465

Web internal revenue service see separate instructions. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. If certain conditions are met and.

Fillable Form 9465 Installment Agreement Request printable pdf download

Web department of if you are filing this form with your tax return, attach it to the the treasury internal revenue service front of the return. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan.

Form 9465 Installment Agreement Request Definition

From within your taxact return ( online or desktop), click on the federal tab. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Web department of if you are filing this form with your tax return, attach it to the the.

Web Information About Form 9465, Installment Agreement Request, Including Recent Updates, Related Forms And Instructions On How To File.

Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Complete, edit or print tax forms instantly. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Form 9465 is used by taxpayers to.

Web To Complete Form 9465 In Taxact, Please Do The Following:

Try it for free now! Complete, edit or print tax forms instantly. If you are filing form. Ad upload, modify or create forms.

If You Owe $50,000 Or Less, You May Be Able To Avoid Filing Form 9465 And Establish An Installment Agreement Online,.

Can i apply for an installment plan. Complete, edit or print tax forms instantly. Below is the setup fee for. Web federal communications commission 45 l street ne.

If You Are Filing Form 9465 With Your Return, Attach It To The Front Of Your Return When You File.

Web internal revenue service see separate instructions. Web please consult the form 9465 instructions (under the where to file heading) to find the irs service center mailing address for your location. Ad access irs tax forms. Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your.

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)