St 12 Form Ma

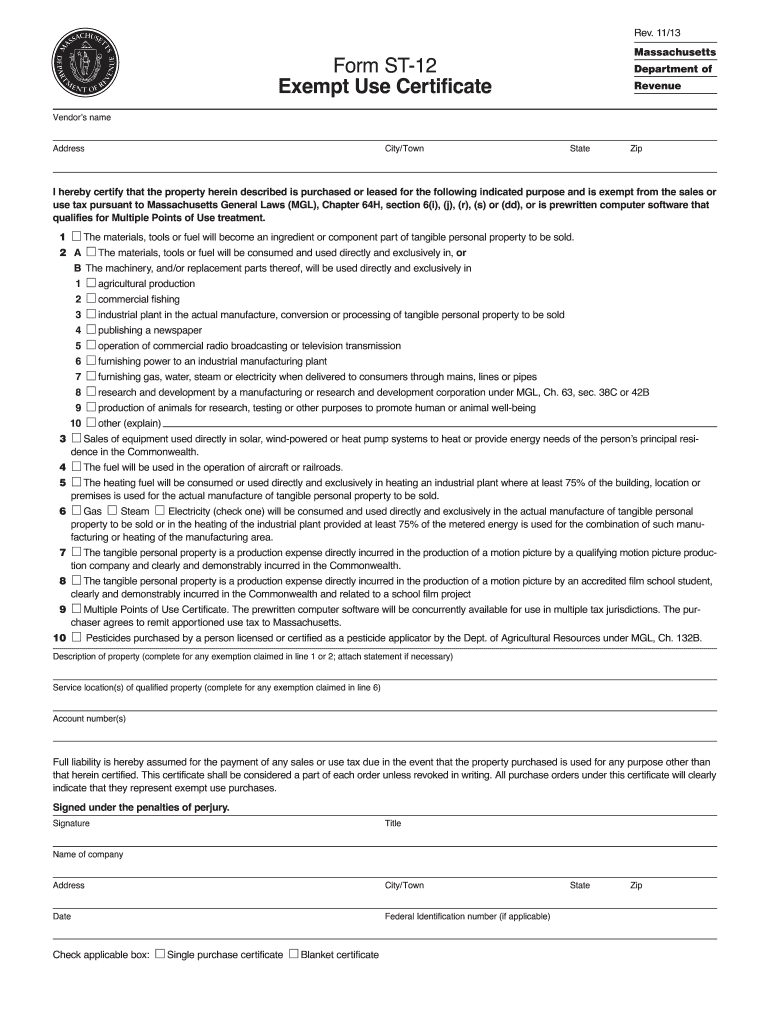

St 12 Form Ma - For further information regarding the acceptance or use of exempt use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web you need to enable javascript to run this app. For further information regarding the acceptance or use of exempt use. Web operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered. Sign online button or tick the preview image of the document. Web ma form exempt st 12 pdf details. I hereby certify that the property herein. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Complete, edit or print tax forms instantly.

Sign online button or tick the preview image of the document. To get started on the form, use the fill camp; Ma form exempt st 12 is a form that you can use to apply for an exemption from the massachusetts sales and use tax. You can also download it, export it or print it out. For further information regarding the acceptance or use of exempt use. Edit your ma st 12 fillable online. You need to enable javascript to run this app. I hereby certify that the property herein. Get the st12 form you require. Chapter 64h, section 6 (r) or (s),.

For further information regarding the acceptance or use of exempt use. Edit your ma st 12 fillable online. You can also download it, export it or print it out. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. For further information regarding the acceptance or use of exempt use. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Ma form exempt st 12 is a form that you can use to apply for an exemption from the massachusetts sales and use tax. Try it for free now! Complete, edit or print tax forms instantly. Chapter 64h, section 6 (r) or (s),.

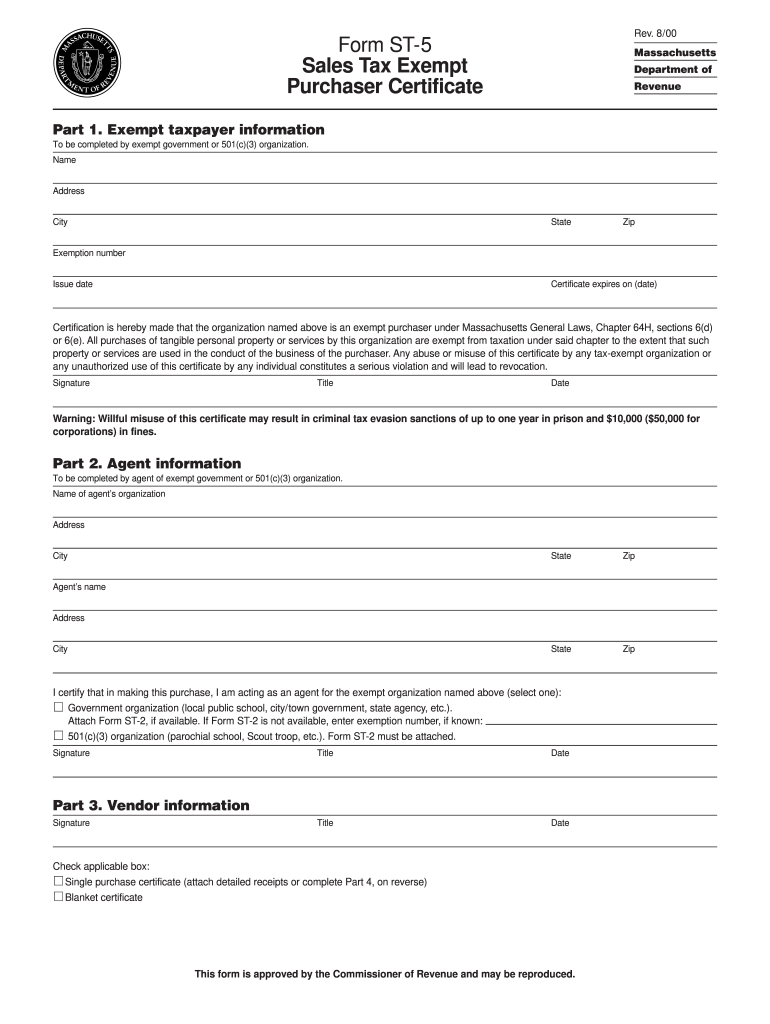

Massachusetts St 5 Fillable Form Fill Out and Sign Printable PDF

Web ma form exempt st 12 pdf details. Web operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) You can also download it, export it or print it out. Ma form.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

Web operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered. Try it for free now! For purposes of admission to an inpatient facility under section 12, “mental illness” means a substantial disorder of thought, mood, perception, orientation, or. For further information regarding the acceptance or use.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

Upload, modify or create forms. Try it for free now! For purposes of admission to an inpatient facility under section 12, “mental illness” means a substantial disorder of thought, mood, perception, orientation, or. Sign online button or tick the preview image of the document. Web ma form exempt st 12 pdf details.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

Edit your ma st 12 fillable online. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Sign online button or tick the preview image of the document. Web ma form exempt st 12 pdf details. For further information regarding the acceptance or use of exempt use.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

Web send st 12 massachusetts fillable form via email, link, or fax. Web operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered. To get started on the form, use the fill camp; Ma form exempt st 12 is a form that you can use to apply.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

I hereby certify that the property herein. To get started on the form, use the fill camp; A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Complete, edit or print tax forms instantly. Edit your ma st 12 fillable online.

20132022 Form MA DoR ST12 Fill Online, Printable, Fillable, Blank

Web send st 12 massachusetts fillable form via email, link, or fax. Ma form exempt st 12 is a form that you can use to apply for an exemption from the massachusetts sales and use tax. Try it for free now! Complete, edit or print tax forms instantly. Sign online button or tick the preview image of the document.

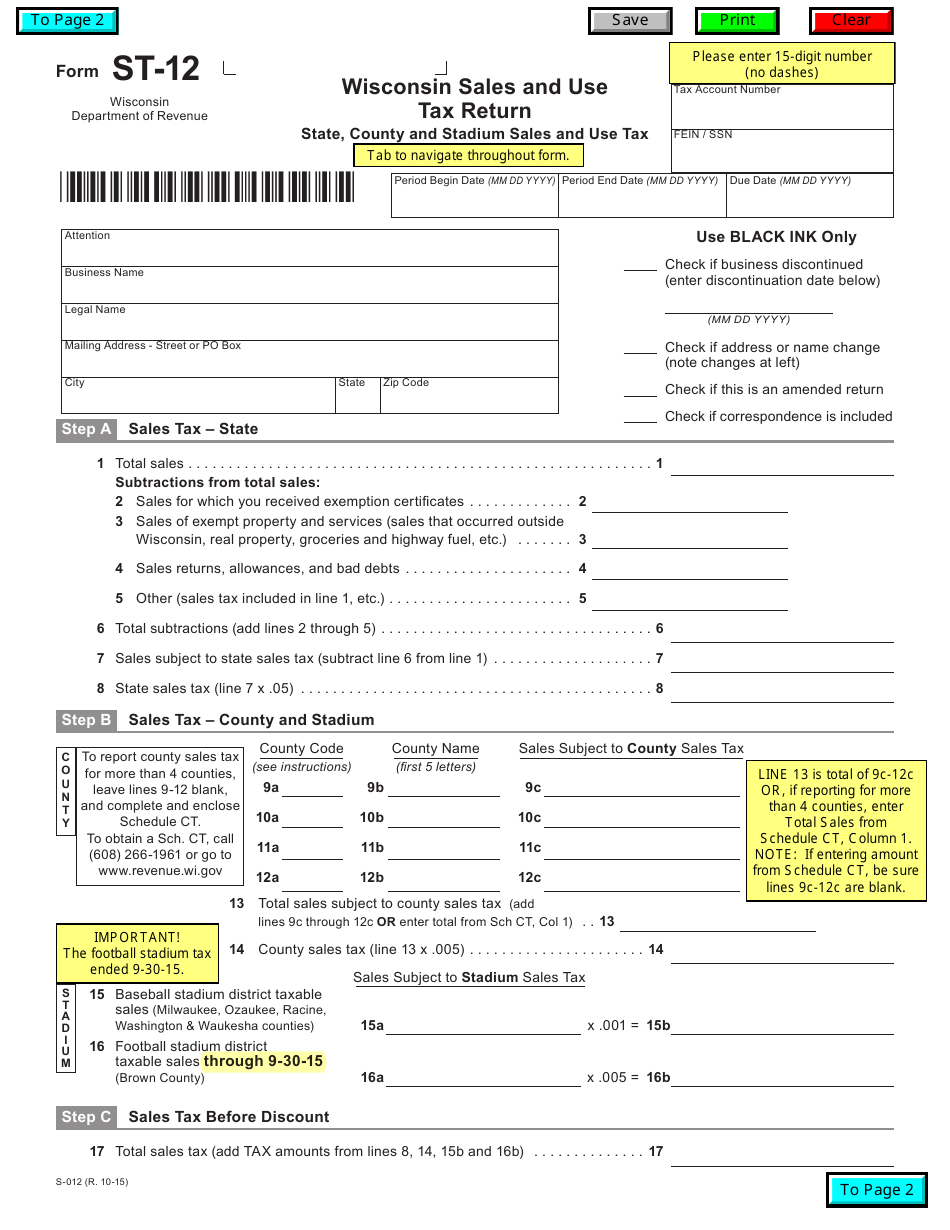

Form ST12 Download Fillable PDF or Fill Online Wisconsin Sales and Use

Complete, edit or print tax forms instantly. Upload, modify or create forms. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web you need to enable javascript to run this app. You need to enable javascript to run this app.

Form St 12 ≡ Fill Out Printable PDF Forms Online

Web send st 12 massachusetts fillable form via email, link, or fax. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web up to $3 cash back the exempt uses described in massachusetts general laws (mgl) customer service bureau, po box 7010, boston, ma 02204; Try it.

Gallery of St 12 form Ma Brilliant 44 New Sales Resume Samples Awesome

I hereby certify that the property herein. Upload, modify or create forms. Web you need to enable javascript to run this app. To get started on the form, use the fill camp; Web send st 12 massachusetts fillable form via email, link, or fax.

I Hereby Certify That The Property Herein.

Web you need to enable javascript to run this app. Upload, modify or create forms. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web ma form exempt st 12 pdf details.

Chapter 64H, Section 6 (R) Or (S),.

Edit your ma st 12 fillable online. Web up to $3 cash back the exempt uses described in massachusetts general laws (mgl) customer service bureau, po box 7010, boston, ma 02204; To get started on the form, use the fill camp; For purposes of admission to an inpatient facility under section 12, “mental illness” means a substantial disorder of thought, mood, perception, orientation, or.

You Can Also Download It, Export It Or Print It Out.

Complete, edit or print tax forms instantly. You need to enable javascript to run this app. Web operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered. Ma form exempt st 12 is a form that you can use to apply for an exemption from the massachusetts sales and use tax.

For Further Information Regarding The Acceptance Or Use Of Exempt Use.

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web send st 12 massachusetts fillable form via email, link, or fax. Try it for free now! For further information regarding the acceptance or use of exempt use.