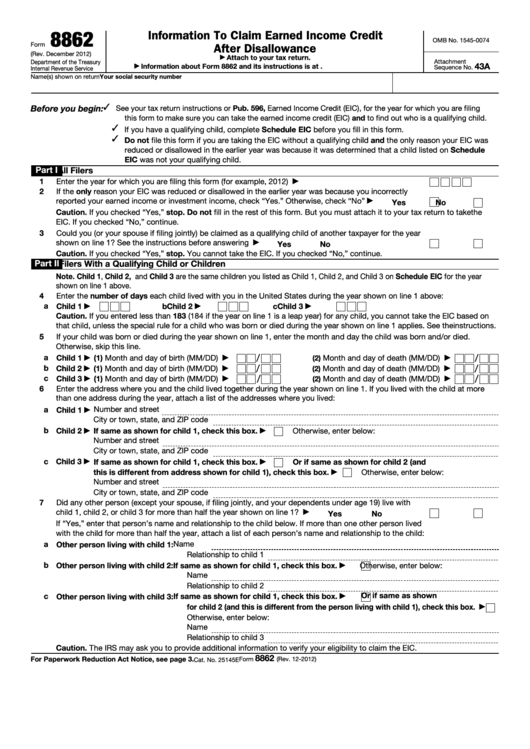

8862 Tax Form

8862 Tax Form - You must have earned income for the tax year and a valid social security number (ssn). You can't be a qualifying child on another return. Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim certain credits after disallowance. You must be a citizen of the united states, and must live in the u.s. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. Web several standards must be met for you to claim the eic: Filing this form allows you to reclaim credits for which you are now eligible.

Guide to head of household. You can't be a qualifying child on another return. You must be a citizen of the united states, and must live in the u.s. You must have earned income for the tax year and a valid social security number (ssn). You can download form 8862 from the irs website and file it. Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. December 2022) department of the treasury internal revenue service. For more than half of the year. March 23, 2022 6:03 pm. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again.

March 23, 2022 6:03 pm. Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim certain credits after disallowance. You now want to claim the eic and you meet all the requirements. Guide to head of household. You must be a citizen of the united states, and must live in the u.s. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. Filing this form allows you to reclaim credits for which you are now eligible. Married filing jointly vs separately. You can download form 8862 from the irs website and file it.

Fillable Form 8862 Information To Claim Earned Credit After

Filing this form allows you to reclaim credits for which you are now eligible. You must have earned income for the tax year and a valid social security number (ssn). If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web form 8862 is required when the.

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web tax tips & video homepage. You must be a citizen of the united states, and must live in the u.s. You must complete form 8862 and attach it to your tax return to claim the eic,.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) You must be a citizen of the united states, and must live in the u.s. You must have earned income for the tax year and a valid social security number (ssn)..

Irs Form 8862 Printable Master of Documents

You must be a citizen of the united states, and must live in the u.s. March 23, 2022 6:03 pm. Web several standards must be met for you to claim the eic: Web how do i enter form 8862? You can't be a qualifying child on another return.

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

For more than half of the year. Web march 26, 2020 7:26 am. Guide to head of household. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Information to claim certain credits.

IRS Publication Form 8867 Earned Tax Credit Irs Tax Forms

You can download form 8862 from the irs website and file it. File taxes with no income. You must be a citizen of the united states, and must live in the u.s. Filing this form allows you to reclaim credits for which you are now eligible. Your eic was reduced or disallowed for any reason other than a math or.

Form 8862 Information to Claim Earned Credit After

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. If you are filing form 8862 because you received an.

Form 8862Information to Claim Earned Credit for Disallowance

Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. March 23, 2022 6:03 pm. File taxes with no income. You can download form 8862 from the irs website and file it. You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year.

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to.

How Do I File My Form 8862? StandingCloud

Web several standards must be met for you to claim the eic: Guide to head of household. March 23, 2022 6:03 pm. Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic).

Guide To Head Of Household.

You now want to claim the eic and you meet all the requirements. Web how do i enter form 8862? December 2022) department of the treasury internal revenue service. You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs).

Their Earned Income Credit (Eic), Child Tax Credit (Ctc)/Additional Child Tax Credit (Actc), Credit For Other Dependents (Odc) Or American Opportunity Credit (Aotc) Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error.

Web several standards must be met for you to claim the eic: Solved • by turbotax • 7243 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. Web tax tips & video homepage. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc)

Web Taxpayers Complete Form 8862 And Attach It To Their Tax Return If:

Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Filing this form allows you to reclaim credits for which you are now eligible. File taxes with no income.

Web March 26, 2020 7:26 Am.

Married filing jointly vs separately. Information to claim certain credits after disallowance. Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. March 23, 2022 6:03 pm.