Ohio Nonresident Tax Form

Ohio Nonresident Tax Form - Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. The only ohio money made is the money from that rental property. Web access the forms you need to file taxes or do business in ohio. Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it. Ohio it 1040 and sd 100 forms. Your average tax rate is 11.67% and your marginal tax rate is. It will take several months for the department to process your paper return. If you make $70,000 a year living in california you will be taxed $11,221.

Your average tax rate is 11.67% and your marginal tax rate is. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. This statement is for individuals claiming to. Web ohio income tax tables. Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. The only ohio money made is the money from that rental property. It will take several months for the department to process your paper return. Ohio it 1040 and sd 100 forms. An exception is for full year nonresidents.

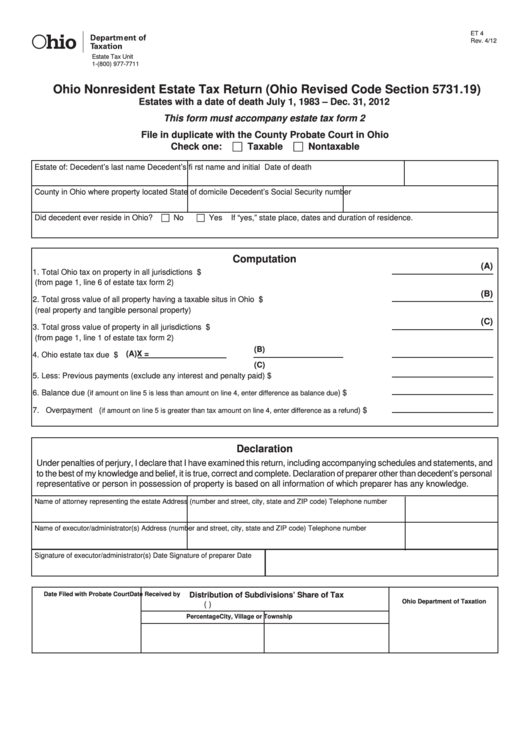

Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year 2022. This statement is for individuals claiming to. Your average tax rate is 11.67% and your marginal tax rate is. My wife owns a rental property in ohio. An exception is for full year nonresidents. You can download or print current. Web ohio it 1040 and sd 100 forms. The only ohio money made is the money from that rental property. Web ohio state tax non resident i live and work in texas. This form is for taxpayers claiming the nonresident.

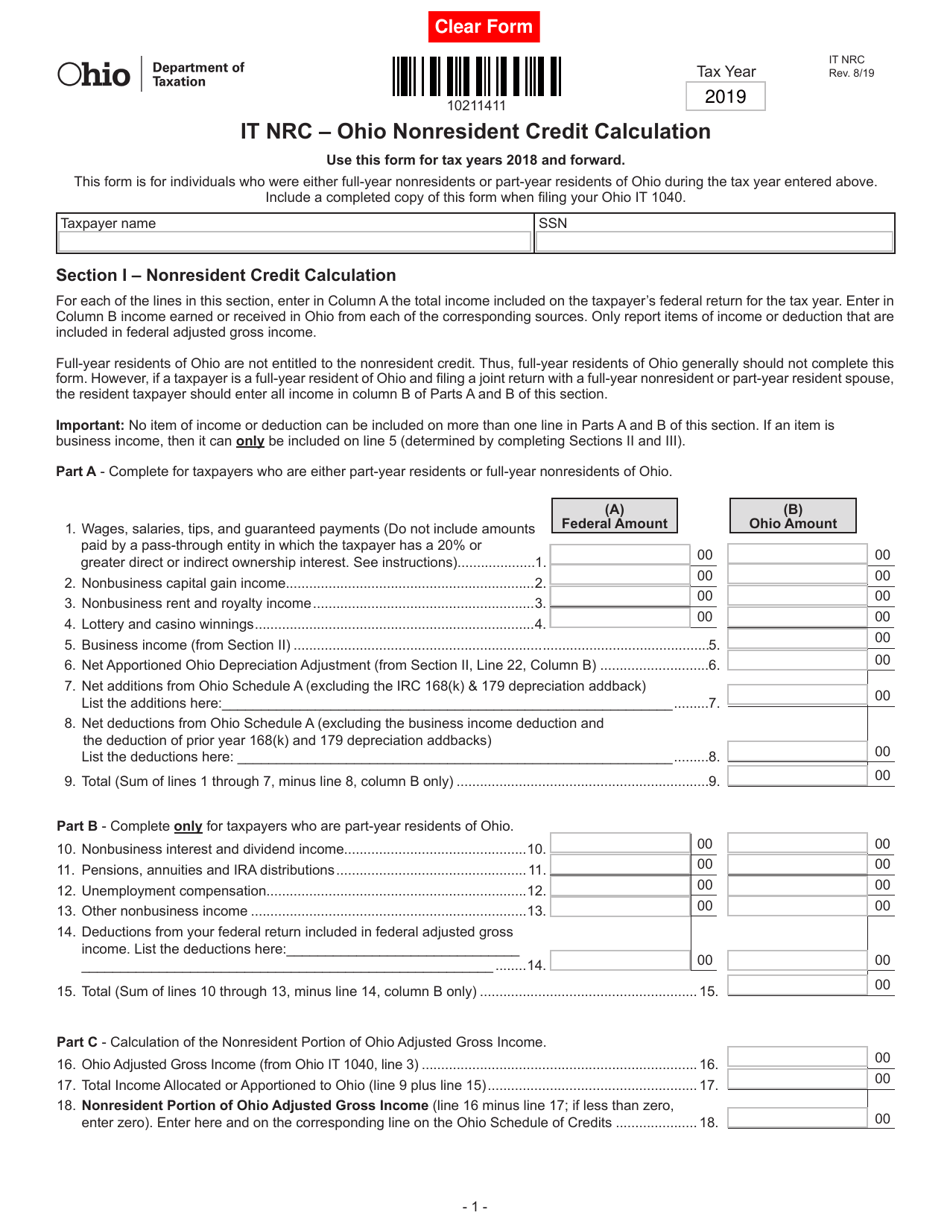

Fill Free fillable IT NRC Ohio Nonresident Credit Calculation 8/19

This form is for income earned in tax year 2022, with tax returns due in april 2023. This form is for taxpayers claiming the nonresident. It will take several months for the department to process your paper return. Web access the forms you need to file taxes or do business in ohio. Web ohio income tax tables.

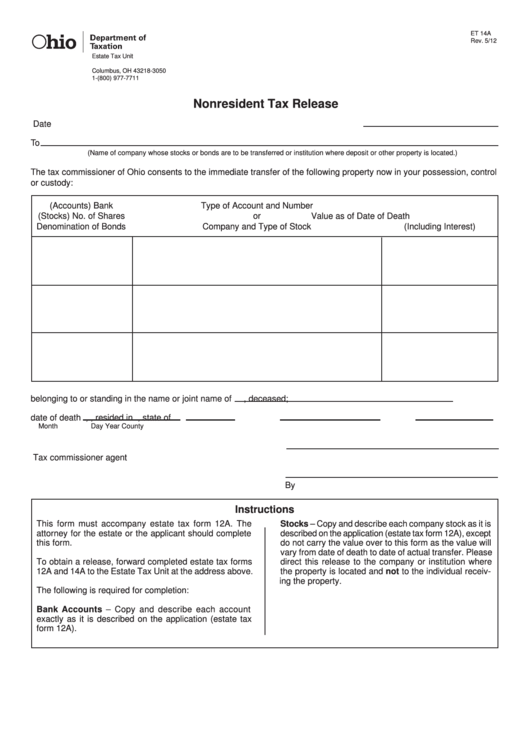

Fillable Form Et 14a Nonresident Tax Release Ohio Department Of

Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. Ohio it 1040 and sd 100 forms..

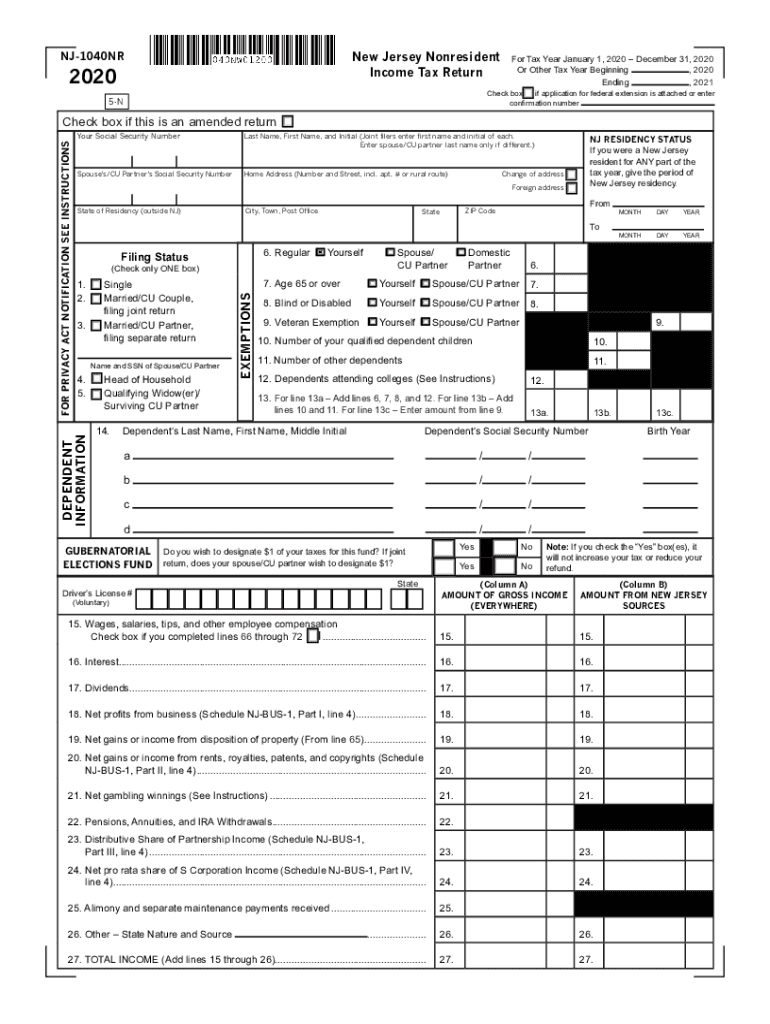

2020 Nj 1040Nr Fill Out and Sign Printable PDF Template signNow

Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it. Web ohio it 1040 and sd 100 forms. Register and subscribe now to work on oh ez individual resident tax return city of toledo. Web we last updated ohio form it nrs in february 2023 from the ohio department of taxation. My.

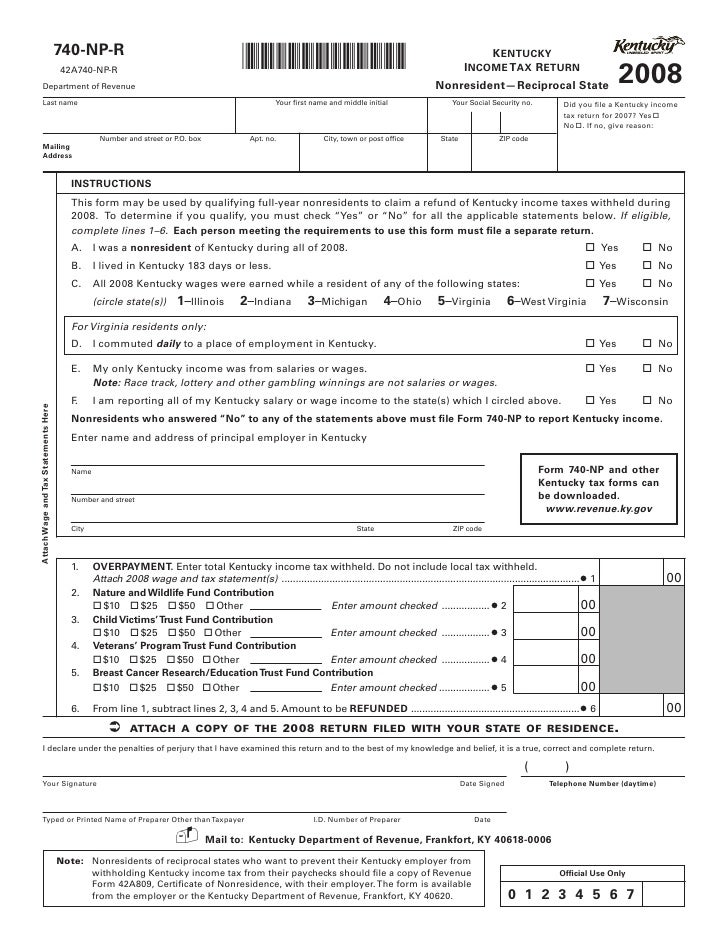

Kentucky Unemployment Back Pay Form NEMPLOY

5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. Register and subscribe now to work on oh ez.

Form IT NRC Download Fillable PDF or Fill Online Ohio Nonresident

An exception is for full year nonresidents. You can download or print current. The only ohio money made is the money from that rental property. Web ohio income tax tables. Your average tax rate is 11.67% and your marginal tax rate is.

State Of Ohio Tax Withholding Tables 2017 Review Home Decor

Web 4) did not claim homestead exemption for an ohio property during the tax year. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022. My wife owns a rental property in ohio. Ohio it 1040 and sd 100.

Fillable Form Et 4 Ohio Nonresident Estate Tax Return (Ohio Revised

This form is for taxpayers claiming the nonresident. An exception is for full year nonresidents. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Web ohio it 1040 and sd 100 forms. The ohio department of taxation provides a searchable repository of individual tax forms for.

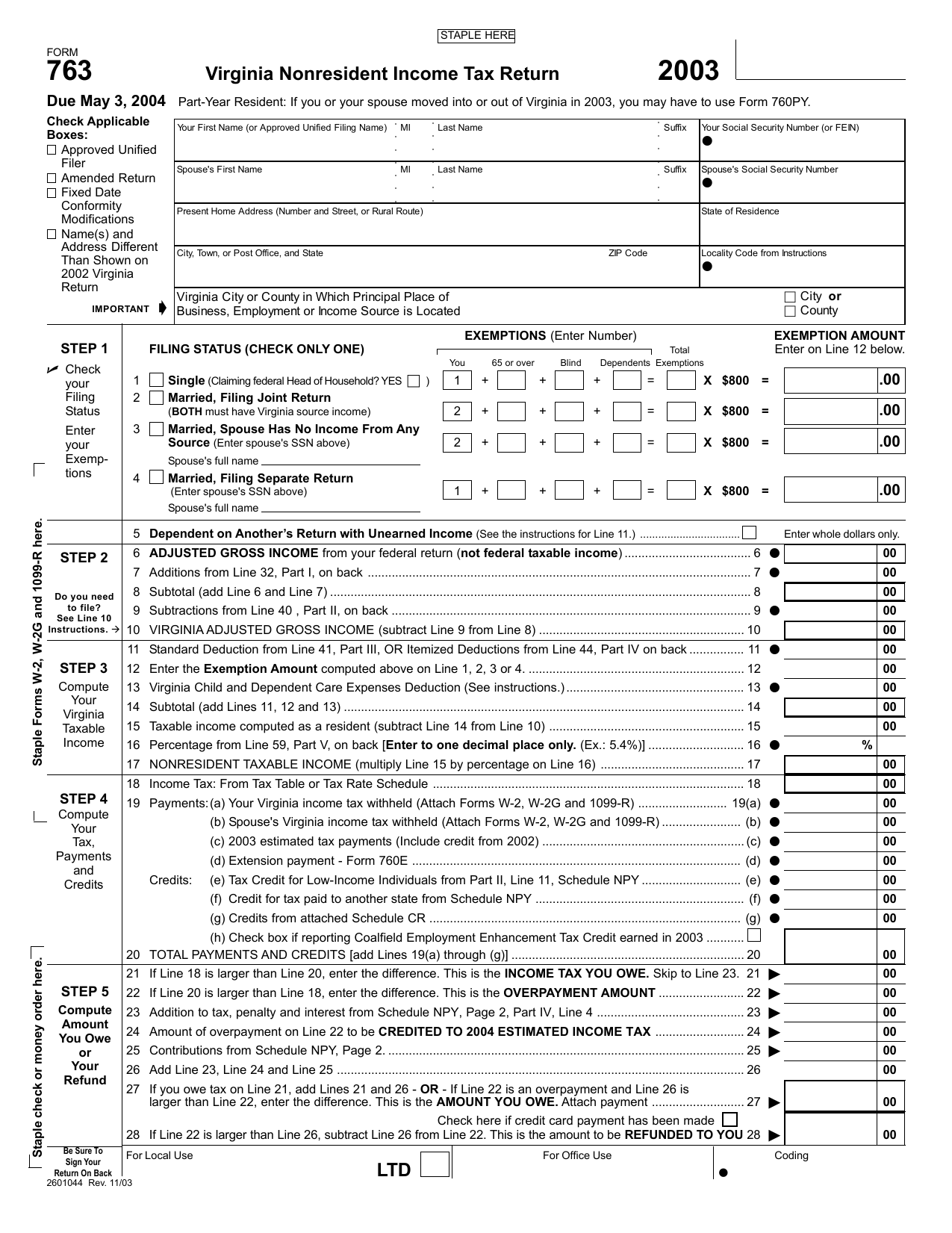

Virginia Nonresident Tax Return LTD

5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year 2022. Web we last updated the ohio nonresident statement (formerly form it.

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

This form is for taxpayers claiming the nonresident. Web we last updated the ohio nonresident estate tax return in march 2023, so this is the latest version of form et 4, fully updated for tax year 2022. Web ohio state tax non resident i live and work in texas. If you make $70,000 a year living in california you will.

Web Ohio State Tax Non Resident I Live And Work In Texas.

Ohio it 1040 and sd 100 forms. Web access the forms you need to file taxes or do business in ohio. Beginning with tax year 2021, individuals with ohio taxable nonbusiness income of $25,000 or less are not subject to ohio income tax. Register and subscribe now to work on oh ez individual resident tax return city of toledo.

My Wife Owns A Rental Property In Ohio.

Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april 2023. 5) did not receive “in state” tuition at an ohio institution of higher learning by claiming to be an ohio. Web we last updated the ohio nonresident statement (formerly form it da) in february 2023, so this is the latest version of form it nrs, fully updated for tax year 2022.

Your Average Tax Rate Is 11.67% And Your Marginal Tax Rate Is.

Web ohio it 1040 and sd 100 forms. The ohio department of taxation provides a searchable repository of individual tax forms for. The only ohio money made is the money from that rental property. An exception is for full year nonresidents.

This Statement Is For Individuals Claiming To.

Nonresident taxpayers who are eligible to file form it nrs may now make their statement using the it. If you make $70,000 a year living in california you will be taxed $11,221. Web we last updated ohio form it nrs in february 2023 from the ohio department of taxation. It will take several months for the department to process your paper return.