Form 8915 Ft

Form 8915 Ft - It shows it won’t be available until 2/16/23. Replace all references to worksheet 2 with worksheet 1b. Web 1 ft = 12 in. In prior tax years, form 8915. Get ready for tax season deadlines by completing any required tax forms today. Web when and where to file. To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches. Web worksheet 1b on page 13: See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so.

Your social security number before you begin (see instructions for details): Replace all references to worksheet 2 with worksheet 1b. Web when and where to file. Replace “the $20,000 limit” with “the $22,000 limit” in the fourth sentence. We can also form a simple. Web home forms and instructions about form 8915, qualified disaster retirement plan distributions and repayments about form 8915, qualified disaster. It shows it won’t be available until 2/16/23. January 2022), please be advised that those. Returns prepared in 2021 ultratax/1040 will proforma these. Web updated january 13, 2023.

Web updated january 13, 2023. January 2022), please be advised that those. Web worksheet 1b on page 13: You can choose to use worksheet 1b even if you are not required to do so. Get ready for tax season deadlines by completing any required tax forms today. Replace “the $20,000 limit” with “the $22,000 limit” in the fourth sentence. Web 1 ft = 12 in. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web home forms and instructions about form 8915, qualified disaster retirement plan distributions and repayments about form 8915, qualified disaster. To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches.

Fill Free fillable Form by Itself and Not 8915 D Qualified (IRS

Web home forms and instructions about form 8915, qualified disaster retirement plan distributions and repayments about form 8915, qualified disaster. Web when and where to file. We can also form a simple. It shows it won’t be available until 2/16/23. In prior tax years, form 8915.

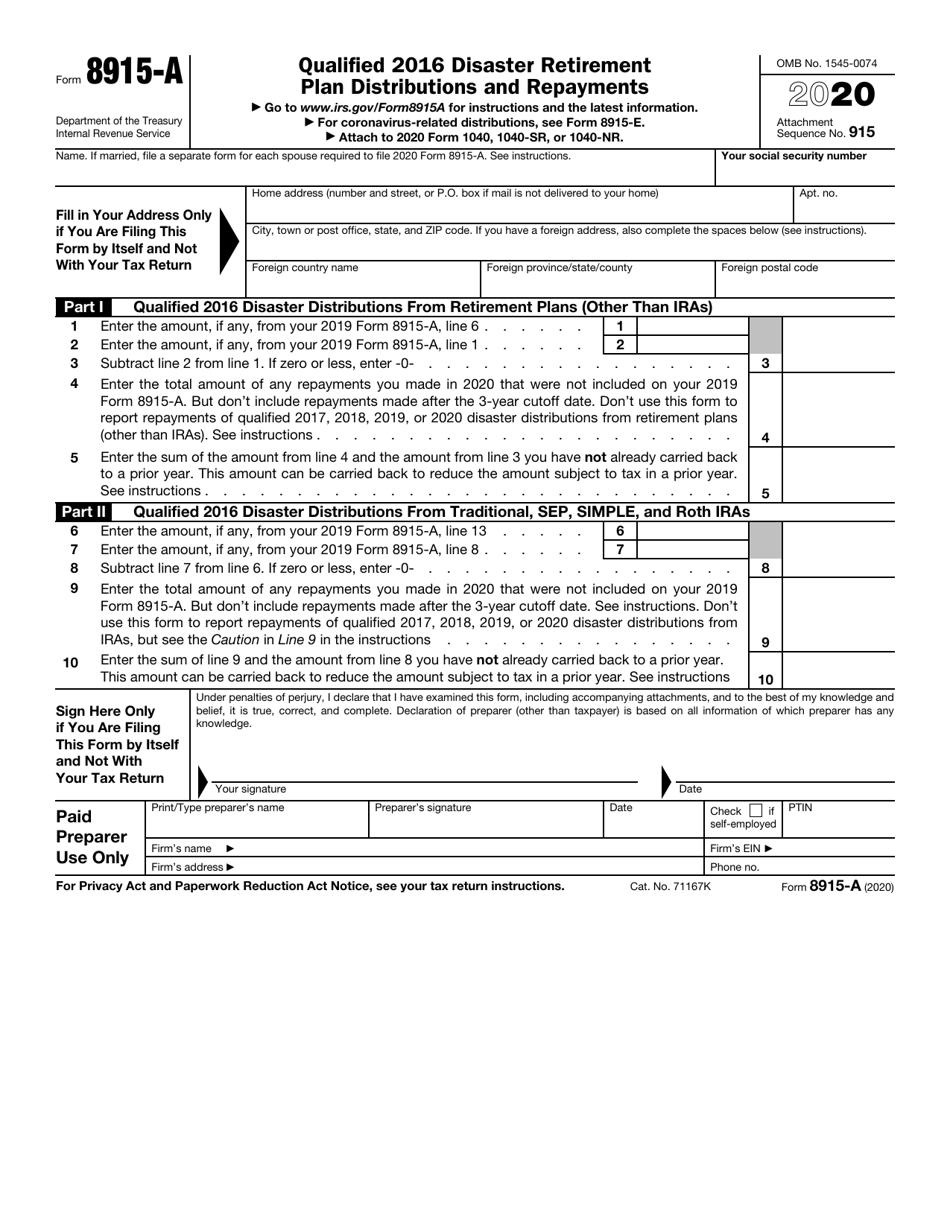

IRS Form 8915A Download Fillable PDF or Fill Online Qualified 2016

Your social security number before you begin (see instructions for details): Web updated january 13, 2023. You can choose to use worksheet 1b even if you are not required to do so. Web 1 best answer. It shows it won’t be available until 2/16/23.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches. In prior tax years, form 8915. Web when and where to file. Web 1 best answer. See worksheet 1b, later, to determine whether you must use worksheet 1b.

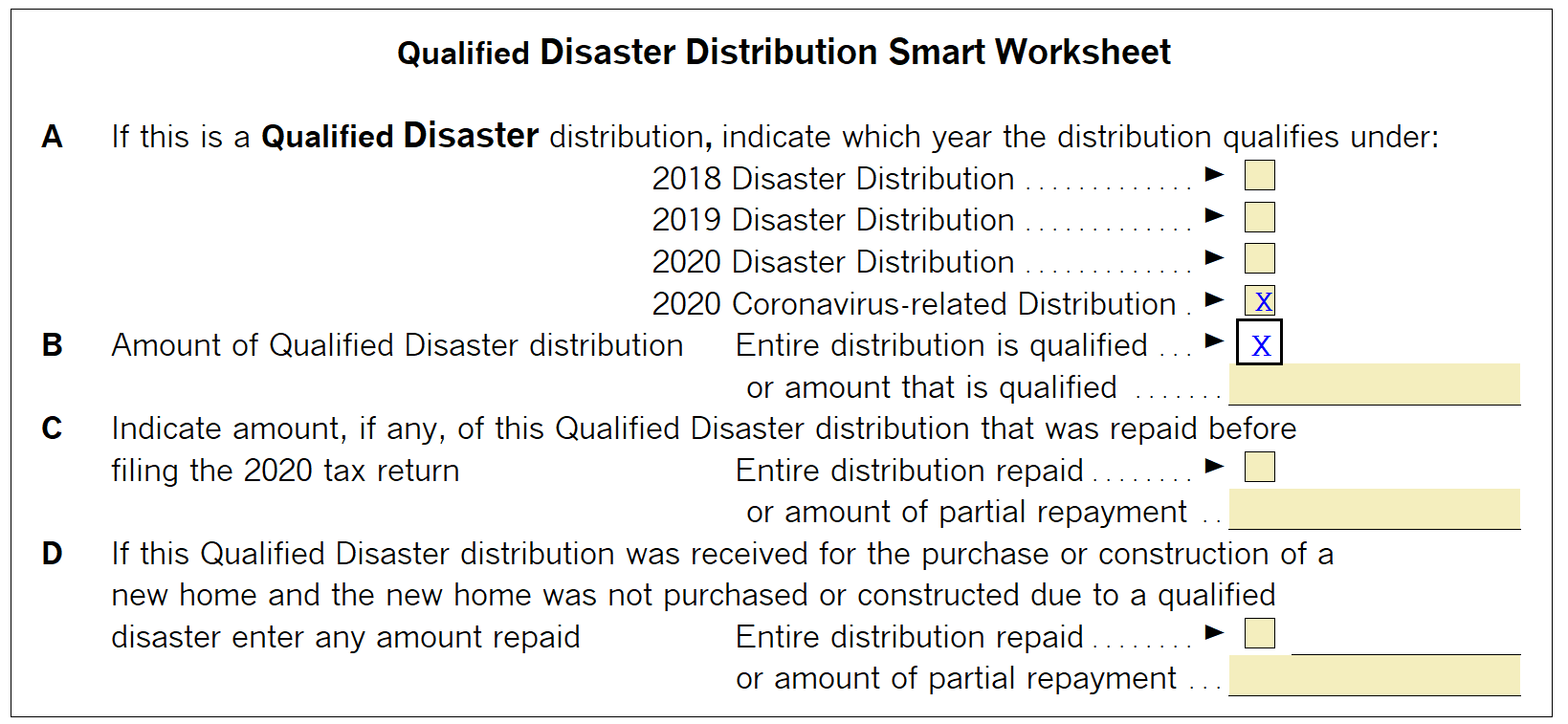

Generating Form 8915E in ProSeries Intuit Accountants Community

Your social security number before you begin (see instructions for details): Web 1 ft = 12 in. It shows it won’t be available until 2/16/23. Returns prepared in 2021 ultratax/1040 will proforma these. Web 1 best answer.

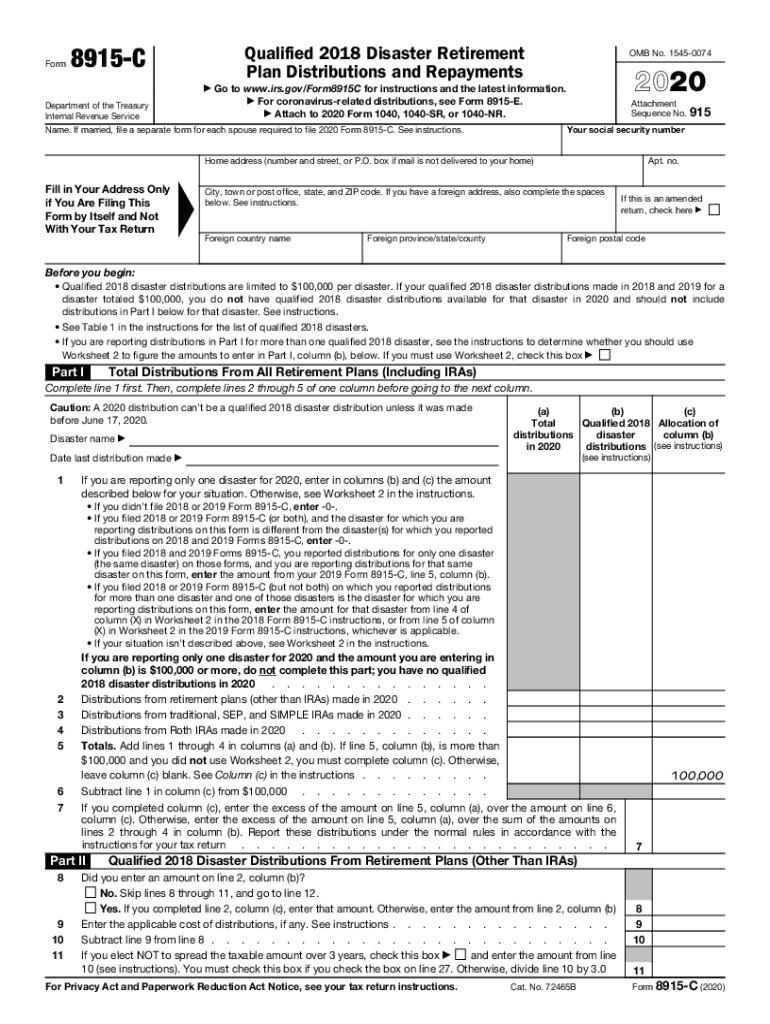

Fill Free fillable Form 8915C Plan Distributions and Repayments

Web updated january 13, 2023. Web 1 ft = 12 in. January 2022), please be advised that those. To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches. See the following for a list of forms and when they are available.

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

Replace “the $20,000 limit” with “the $22,000 limit” in the fourth sentence. Web 1 best answer. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web 1 ft = 12 in. In prior tax years, form 8915.

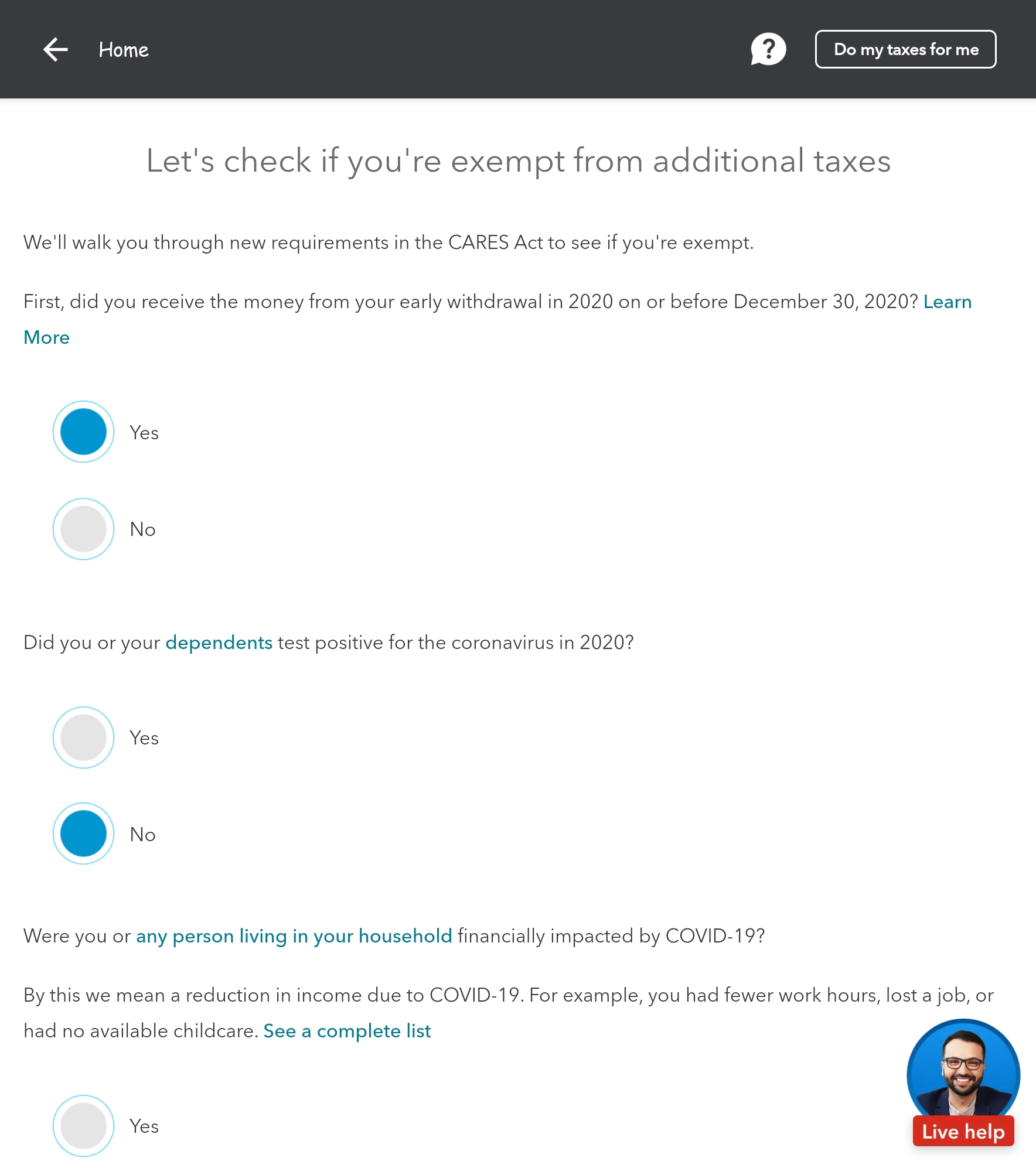

When will form 8915E 2020 be available in turbo t... Page 23

See the following for a list of forms and when they are available. Web when and where to file. We can also form a simple. It shows it won’t be available until 2/16/23. January 2022), please be advised that those.

Generating Form 8915E in ProSeries Intuit Accountants Community

To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches. January 2022), please be advised that those. Get ready for tax season deadlines by completing any required tax forms today. Web 1 best answer. Web worksheet 1b on page 13:

Instructions 8915 form Fill out & sign online DocHub

Get ready for tax season deadlines by completing any required tax forms today. Web 1 best answer. Your social security number before you begin (see instructions for details): Web when and where to file. Replace “the $20,000 limit” with “the $22,000 limit” in the fourth sentence.

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Web updated january 13, 2023. Web home forms and instructions about form 8915, qualified disaster retirement plan distributions and repayments about form 8915, qualified disaster. Your social security number before you begin (see instructions for details): See worksheet 1b, later, to determine whether you must use worksheet 1b. Get ready for tax season deadlines by completing any required tax forms.

You Can Choose To Use Worksheet 1B Even If You Are Not Required To Do So.

Returns prepared in 2021 ultratax/1040 will proforma these. To convert 815 feet into inches we have to multiply 815 by the conversion factor in order to get the length amount from feet to inches. Get ready for tax season deadlines by completing any required tax forms today. In prior tax years, form 8915.

January 2022), Please Be Advised That Those.

It shows it won’t be available until 2/16/23. Your social security number before you begin (see instructions for details): Web home forms and instructions about form 8915, qualified disaster retirement plan distributions and repayments about form 8915, qualified disaster. Web 1 ft = 12 in.

Web 1 Best Answer.

Web worksheet 1b on page 13: Web when and where to file. Replace all references to worksheet 2 with worksheet 1b. See worksheet 1b, later, to determine whether you must use worksheet 1b.

We Can Also Form A Simple.

Replace “the $20,000 limit” with “the $22,000 limit” in the fourth sentence. See the following for a list of forms and when they are available. Web updated january 13, 2023.

.jpeg)