New A4 Form 2023

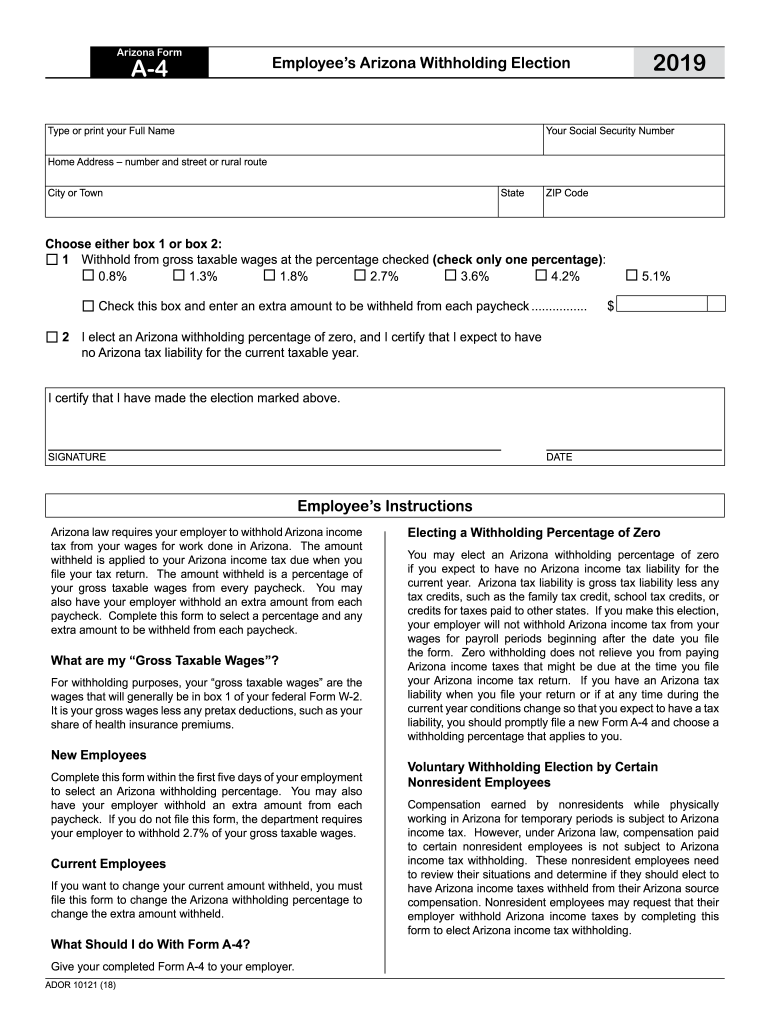

New A4 Form 2023 - Notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing. Web az a4 action items for asap payroll clients. 1 withhold from gross taxable. Certificado para todo empleado de exención de retencion de ingresos para pago de. Opens website in a new tab Lalachi jack, glosha lily, gramps roo, thatwordvariance, salthill rocky, monumental. Web 1 day agoview the racecard and form for dogs: The form will provide accurate calculations for both federal and. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. Employee’s withholding exemption certificate (revised march 2014) forma a4:

Web 1 day agoview the racecard and form for dogs: Lalachi jack, glosha lily, gramps roo, thatwordvariance, salthill rocky, monumental. Web the 2023 audi a4 comes in 6 configurations costing $40,300 to $42,400. Learn all about pricing, specs, design, and more. Employee’s withholding exemption certificate (revised march 2014) forma a4: Web az a4 action items for asap payroll clients. Choose either box 1 or box 2: Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. The form can be created in a file processing program,. Web form to elect arizona income tax withholding.

Choose either box 1 or box 2: Web meet the 2024 audi s4. Web form to elect arizona income tax withholding. Get audi news & updates. Web by dan edmunds published: Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Lalachi jack, glosha lily, gramps roo, thatwordvariance, salthill rocky, monumental. Web the 2023 audi a4 comes in 6 configurations costing $40,300 to $42,400. Employee’s withholding exemption certificate (revised march 2014) forma a4: Certificado para todo empleado de exención de retencion de ingresos para pago de.

New 2023 Audi A4 What We Know So Far Audi Review Cars

Get audi news & updates. The withholding formula helps you. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. Web up to 10% cash back free downloads of customizable forms. See what power, features, and amenities you’ll get for the.

Audi A4 2023 Specs, Design & Engine, Will be all electrified

The form can be created in a file processing program,. The 2024 land cruiser comes in 1958, land cruiser, and first edition grades, with the base price for the 1958 model. Employee’s withholding exemption certificate (revised march 2014) forma a4: Web form to elect arizona income tax withholding. Web az a4 action items for asap payroll clients.

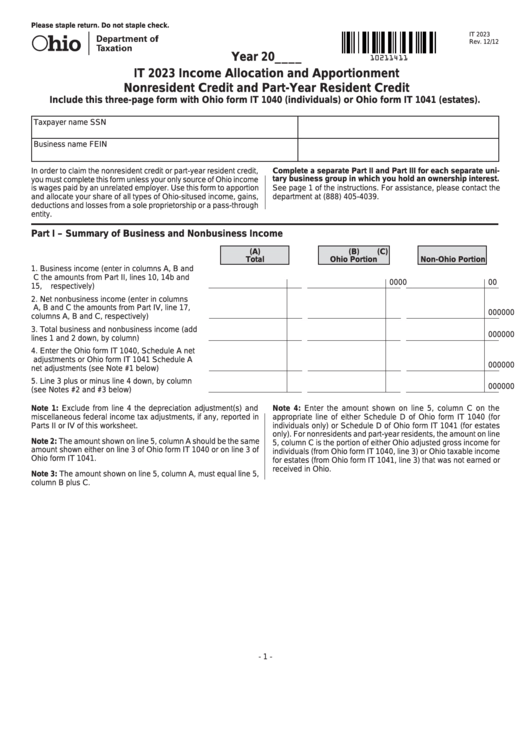

Fillable Form It 2023 Allocation And Apportionment Nonresident

Web by dan edmunds published: Web meet the 2024 audi s4. Opens website in a new tab Notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing. Choose either box 1 or box 2:

2023 Audi A4 To Stay On MLB Design, Niche Models To Merge Drive

Notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. Web form to elect arizona income tax withholding..

A4 form Fill out & sign online DocHub

Web 1 day agoview the racecard and form for dogs: Lalachi jack, glosha lily, gramps roo, thatwordvariance, salthill rocky, monumental. The withholding formula helps you. Notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing. Web form to elect arizona income tax withholding.

2023 Audi A4 is a big surprise waiting for us at B10? Latest Car News

Web up to 10% cash back free downloads of customizable forms. Certificado para todo empleado de exención de retencion de ingresos para pago de. Web a federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check (economic impact payment, or eip) under the. Web the withholding formula helps you identify your tax withholding to make.

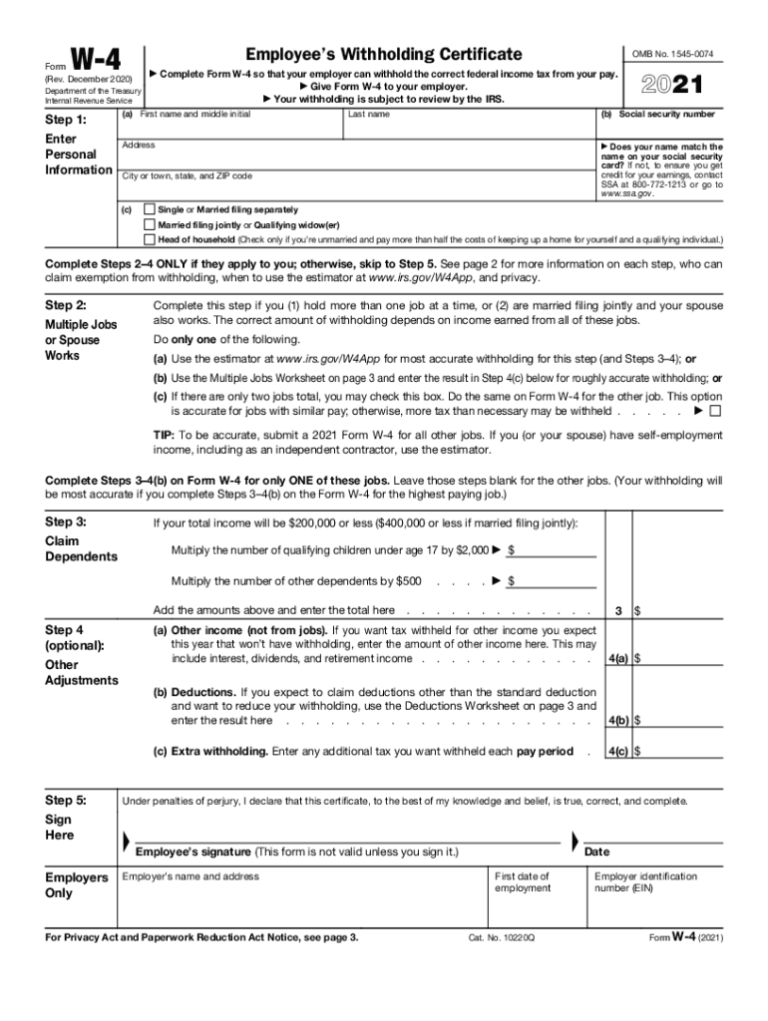

2023 IRS W 4 Form HRdirect Fillable Form 2023

Web 1 day agoview the racecard and form for dogs: Web a federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check (economic impact payment, or eip) under the. Employee’s withholding exemption certificate (revised march 2014) forma a4: Web by dan edmunds published: Web meet the 2024 audi s4.

New 2023 Audi A4 range to be topped by electric and hybrid RS duo Autocar

Web up to 10% cash back free downloads of customizable forms. Get audi news & updates. Web the 2023 audi a4 comes in 6 configurations costing $40,300 to $42,400. Certificado para todo empleado de exención de retencion de ingresos para pago de. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount.

New details of next gen Audi A4(B10) Audi

Web meet the 2024 audi s4. The form can be created in a file processing program,. Learn all about pricing, specs, design, and more. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. Employee’s withholding exemption certificate (revised march 2014).

Printable A4 Form 2023 Fillable Form 2023 941 Tax IMAGESEE

The form will provide accurate calculations for both federal and. I certify that i have made the election marked above. Web 1 day agoview the racecard and form for dogs: The withholding formula helps you. Lalachi jack, glosha lily, gramps roo, thatwordvariance, salthill rocky, monumental.

Web The Withholding Formula Helps You Identify Your Tax Withholding To Make Sure You Have The Right Amount Of Tax Withheld From Your Paycheck.

Notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding must. The form can be created in a file processing program,. Certificado para todo empleado de exención de retencion de ingresos para pago de.

The Form Will Provide Accurate Calculations For Both Federal And.

Learn all about pricing, specs, design, and more. Web az a4 action items for asap payroll clients. Web by dan edmunds published: The 2024 land cruiser comes in 1958, land cruiser, and first edition grades, with the base price for the 1958 model.

Web Up To 10% Cash Back Free Downloads Of Customizable Forms.

For optimal functionality, save the form to your computer before completing or printing and. See what power, features, and amenities you’ll get for the money. Web 1 day agoview the racecard and form for dogs: The withholding formula helps you.

Opens Website In A New Tab

Web the 2023 audi a4 comes in 6 configurations costing $40,300 to $42,400. Web form to elect arizona income tax withholding. Get audi news & updates. Web meet the 2024 audi s4.