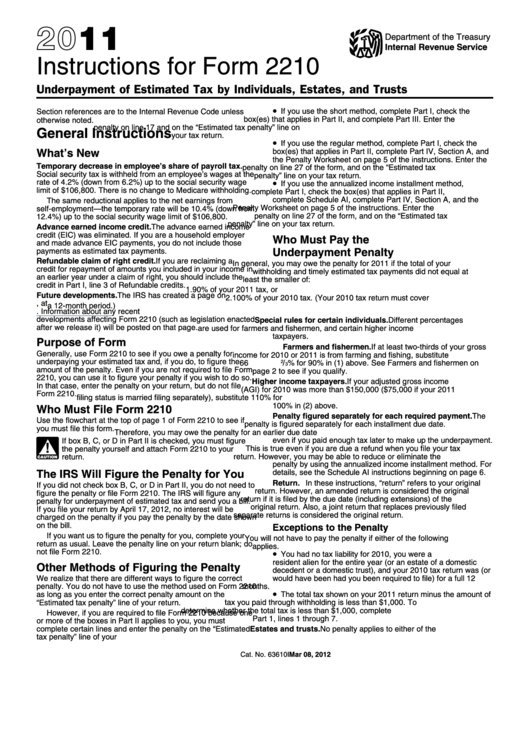

Instructions Form 2210

Instructions Form 2210 - This form contains both a short. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. You should figure out the amount of tax you have underpaid. You had no tax liability for 2021, you were a u.s. You owe underpayment penalties and are requesting a penalty waiver. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. I know it's currently a draft, but the basic. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web instructions provided with the software.

Citizen or resident alien for the entire year (or an estate of a. I know it's currently a draft, but the basic. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. You had no tax liability for 2021, you were a u.s. You owe underpayment penalties and are requesting a penalty waiver. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web instructions provided with the software. You should figure out the amount of tax you have underpaid. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Also, see the instructions for federal form 2210 for more information.

Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Also, see the instructions for federal form 2210 for more information. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. I know it's currently a draft, but the basic. Web you file your return and pay the tax due by march 1, 2023. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. This form contains both a short. You owe underpayment penalties and are requesting a penalty waiver. You should figure out the amount of tax you have underpaid.

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

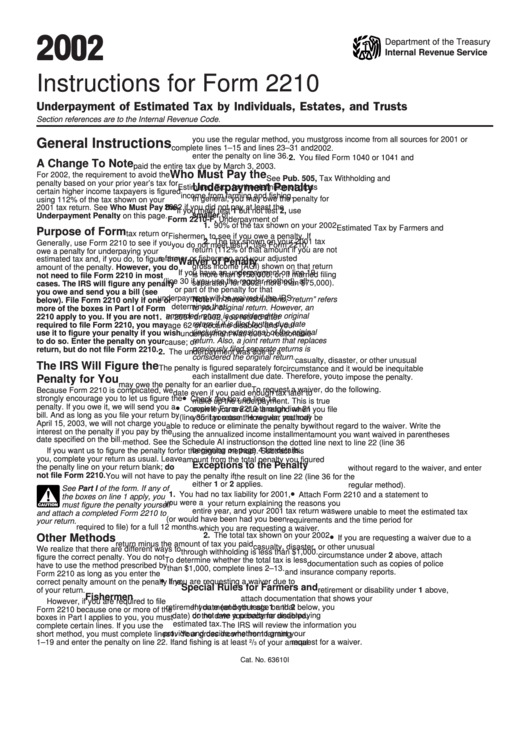

This form contains both a short. Web you file your return and pay the tax due by march 1, 2023. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. You should figure out the amount of.

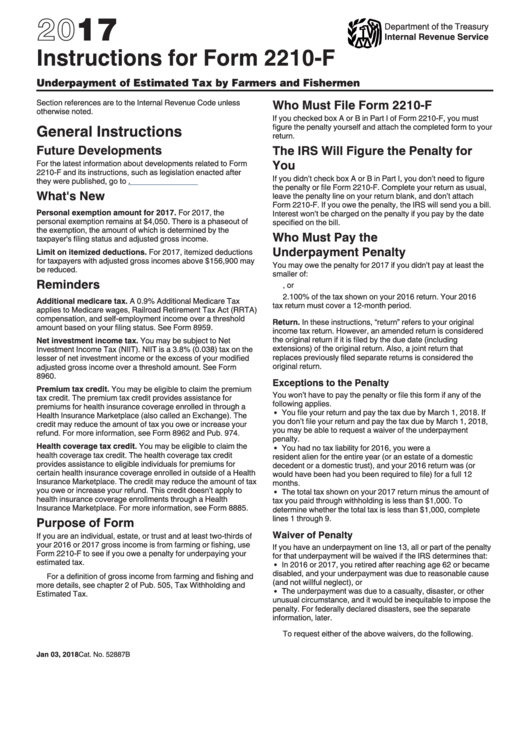

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

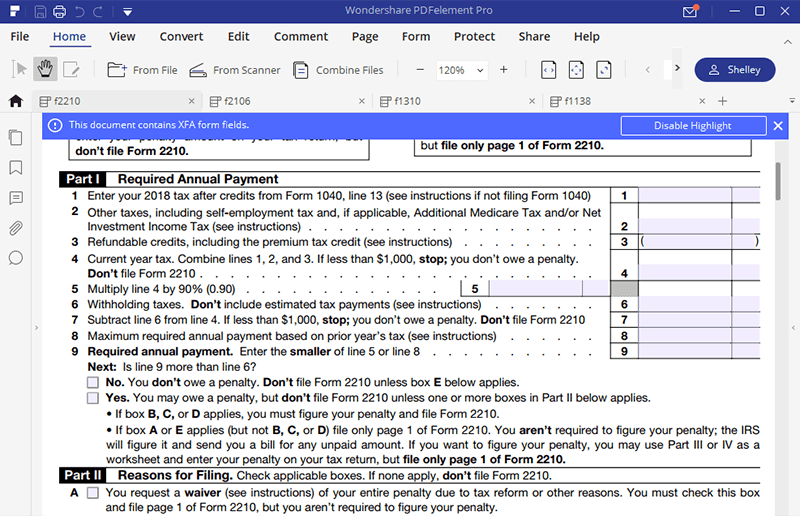

Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. Web you file your return and pay the tax due by march 1, 2023. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web for the latest information about developments related to form 2210 and its instructions, such.

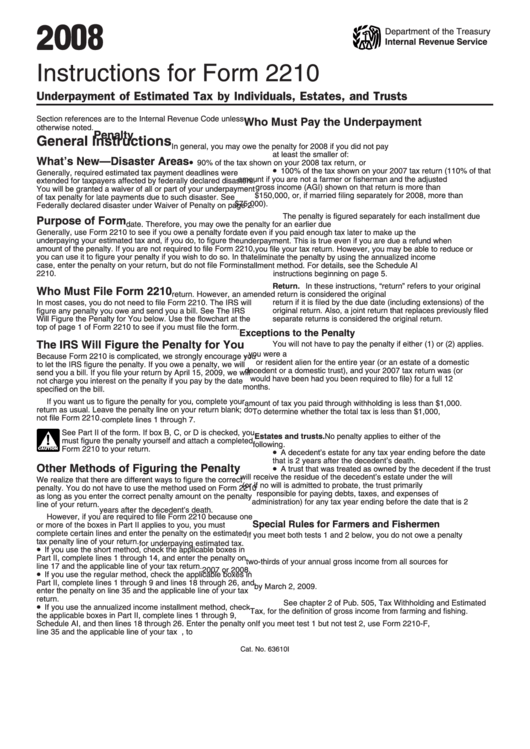

Instructions For Form 2210 2008 printable pdf download

Web instructions included on form: The irs will generally figure your penalty for you and you should. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. I know it's currently a draft, but the basic. Enter the penalty.

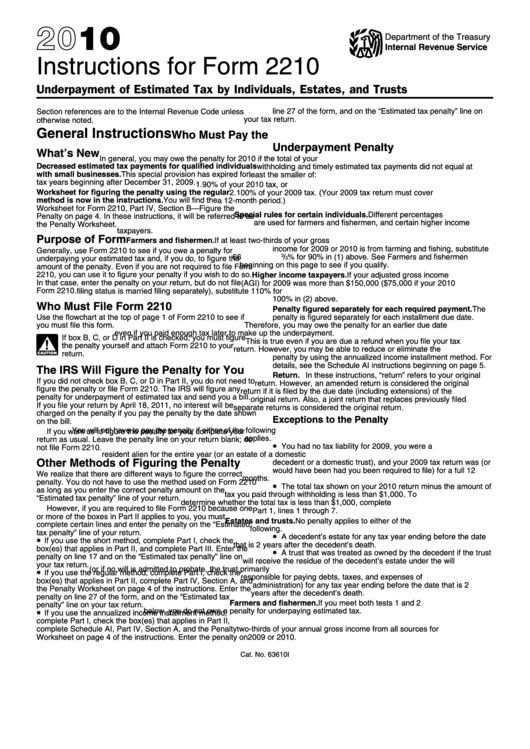

Instructions For Form 2210 Underpayment Of Estimated Tax By

Underpayment of estimated income tax: The irs will generally figure your penalty for you and you should. This form contains both a short. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or 2019 form 1041me, line 6 minus any refundable tax credit included.

IRS Form 2210Fill it with the Best Form Filler

The irs will generally figure your penalty for you and you should. Web instructions included on form: Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. Web instructions included on form: You had no tax liability for 2021, you were a u.s. Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or 2019 form 1041me, line 6 minus any refundable tax credit included.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web instructions provided with the software. Web you file your return and pay the tax due by march 1, 2023. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Web hi, i'm trying.

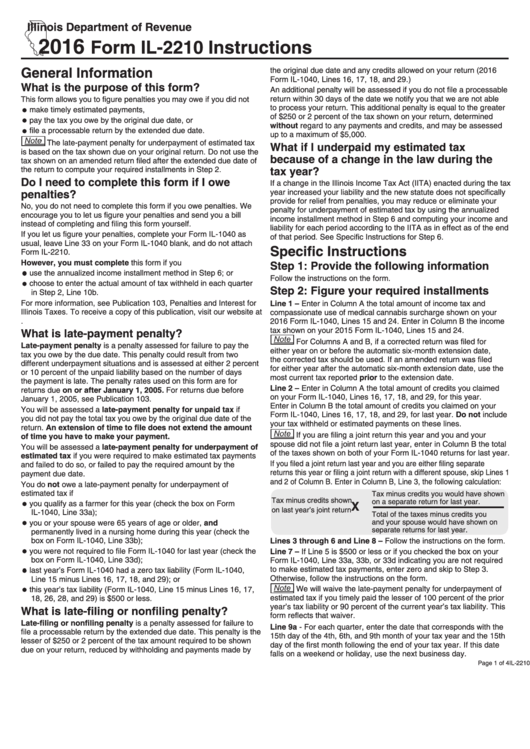

Form Il2210 Instructions 2016 printable pdf download

I know it's currently a draft, but the basic. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Underpayment of estimated income tax: Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. Web purpose of form use form 2210.

Instructions for Federal Tax Form 2210 Sapling

Special rules for farmers and ranchers. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of estimated income tax: Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your.

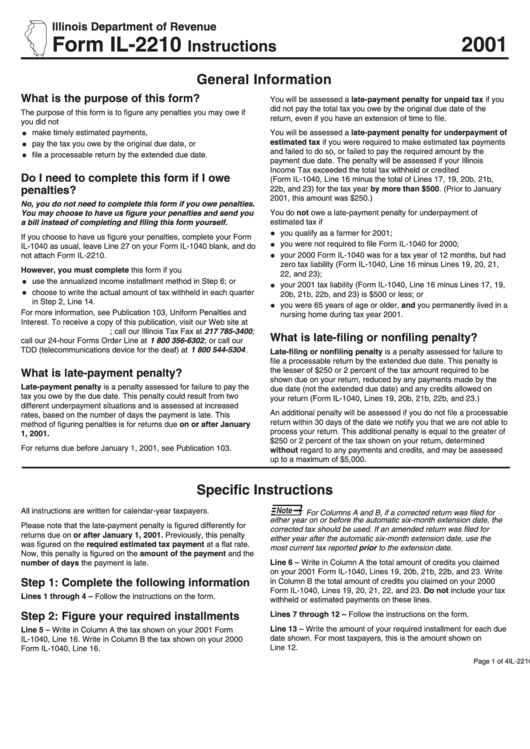

Form Il2210 Instructions 2001 printable pdf download

You had no tax liability for 2021, you were a u.s. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Web instructions included on form: You should figure out the amount of tax you have underpaid. Web you.

Citizen Or Resident Alien For The Entire Year (Or An Estate Of A.

This form contains both a short. Underpayment of estimated income tax: Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax.

Web Purpose Of Form Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Web the irs will require you to complete form 2210 if any of the following situations apply: You owe underpayment penalties and are requesting a penalty waiver. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form2210. You had no tax liability for 2021, you were a u.s.

In Order To Make Schedule Ai Available, Part Ii Of Form 2210 Underpayment Of Estimated Tax By.

Web hi, i'm trying to match my software's calculation of my underpayment penalty with instructions for form 2210 line 8. Web (2019 form 1040me, line 24 minus lines 25c, 25d, and 25e or 2019 form 1041me, line 6 minus any refundable tax credit included on form 1041me, line 7c.) if short year, enter. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount. The irs will generally figure your penalty for you and you should.

Also, See The Instructions For Federal Form 2210 For More Information.

Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to. You should figure out the amount of tax you have underpaid. Web instructions included on form: Web instructions provided with the software.