Ira Recharacterization Form

Ira Recharacterization Form - Web what you need to know • transferring a contribution from one type of ira to another is known as a recharacterization. you can recharacterize part or all of your contribution. Treat a contribution made to one type of ira as having been made to another ira type. Use this form to recharacterize contributions made to a roth ira or. Contributions that are reported on form 5498 include a. Web a recharacterization lets you treat a regular contribution that you made to a roth ira or a traditional ira as one that you made to another type of ira. Web a recharacterization allows you to treat a regular contribution made to a roth ira or to a traditional ira as having been made to the other type of ira. Use this form to add or terminate a user's access to invesco retirement plan manager (rpm) or to. Web recharacterization is the process of “fixing” ira contributions by moving them from one type of ira to another type of ira. Web a contribution to an ira is reported on a form 5498 by the trustee of the ira to which the contribution is made. Web once you have completed and submitted the request form, your contribution will be recharacterized as a traditional ira contribution.

Web request a recharacterization or remove an excess ira contribution general information and instructions. Web use this form to recharacterize (change contribution) from one ira plan type to another ira plan type for the same person. A recharacterization must be completed by your tax filing deadline, including extensions, for the year the. The original contribution or conversion must also be reported to the. Use this form to recharacterize contributions made to a roth ira or. For example, say you maxed out your. Contributions that are reported on form 5498 include a. Web ira recharacterization use this form to: Code r is used in box 7 to report prior year contributions and code n is used to report. Web a contribution to an ira is reported on a form 5498 by the trustee of the ira to which the contribution is made.

Web a recharacterization lets you treat a regular contribution that you made to a roth ira or a traditional ira as one that you made to another type of ira. A recharacterization must be completed by your tax filing deadline, including extensions, for the year the. Web once you have completed and submitted the request form, your contribution will be recharacterized as a traditional ira contribution. Contributions that are reported on form 5498 include a. You made a contribution to a. Web request a recharacterization or remove an excess ira contribution general information and instructions. Your contribution will be treated. Form used to recharacterize a traditional to a roth ira or vice versa. Web you can complete most recharacterization using the ira recharacterization form below. Treat a contribution made to one type of ira as having been made to another ira type.

Fill Free fillable IRA Recharacterization Request (Fidelity

Web a recharacterization allows you to treat a regular contribution made to a roth ira or to a traditional ira as having been made to the other type of ira. Code r is used in box 7 to report prior year contributions and code n is used to report. Web use this form to recharacterize (change contribution) from one ira.

Fill Free fillable IRA Recharacterization Request (Fidelity

A recharacterization must be completed by your tax filing deadline, including extensions, for the year the. For example, say you maxed out your. Form used to recharacterize a traditional to a roth ira or vice versa. Web request a recharacterization or remove an excess ira contribution general information and instructions. Your contribution will be treated.

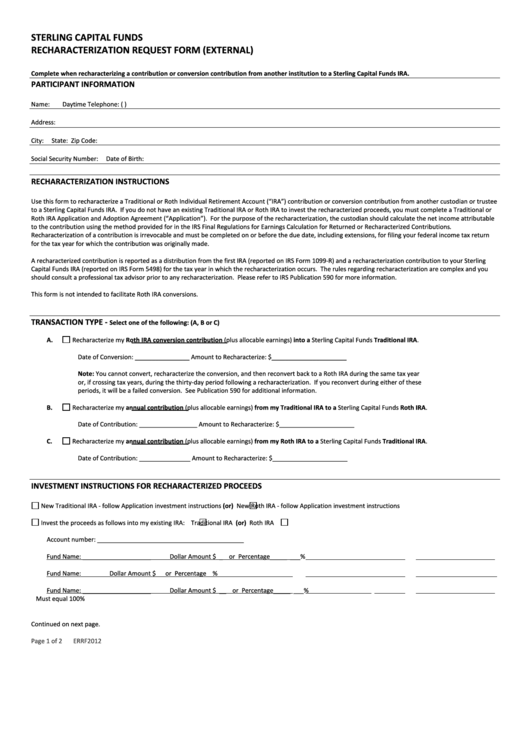

Ira Recharacterization Form (External) printable pdf download

Use this form to add or terminate a user's access to invesco retirement plan manager (rpm) or to. Contributions that are reported on form 5498 include a. A recharacterization must be completed by your tax filing deadline, including extensions, for the year the. Web a recharacterization lets you treat a regular contribution that you made to a roth ira or.

Fill Free fillable IRA CONTRIBUTION RECHARACTERIZATION (FORM 2319

Web request a recharacterization or remove an excess ira contribution general information and instructions. Use this form to recharacterize contributions made to a roth ira or. Web traditional and roth ira recharacterization request. For example, say you maxed out your. Web a contribution to an ira is reported on a form 5498 by the trustee of the ira to which.

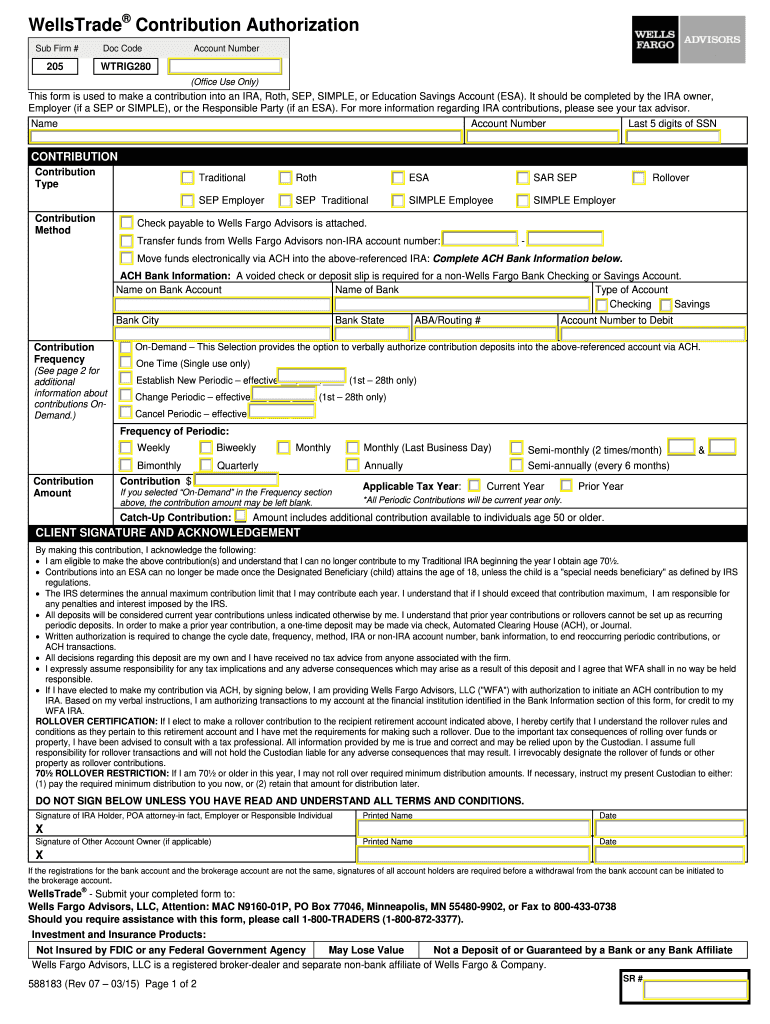

Wells Fargo Sep Ira Contribution Form Fill Out and Sign Printable PDF

The original contribution or conversion must also be reported to the. Code r is used in box 7 to report prior year contributions and code n is used to report. Web ira recharacterization use this form to: Web request a recharacterization or remove an excess ira contribution general information and instructions. Web traditional and roth ira recharacterization request.

Recharacterization of IRA Contributions to Correct Mistakes

A recharacterization must be completed by your tax filing deadline, including extensions, for the year the. Web recharacterization timing and important deadlines. The original contribution or conversion must also be reported to the. Contributions that are reported on form 5498 include a. Web request a recharacterization or remove an excess ira contribution general information and instructions.

united states How to file form 8606 when doing a recharacterization

Web a recharacterization lets you treat a regular contribution that you made to a roth ira or a traditional ira as one that you made to another type of ira. Web within certain limits, the irs allows you to treat certain ira contributions made to one type of ira as having been made to another type of ira. Web ira.

Your Guide To IRA Recharacterization & FAQs (2022) Michael Ryan Money

Use a separate form for each ira plan. Use this form to add or terminate a user's access to invesco retirement plan manager (rpm) or to. Code r is used in box 7 to report prior year contributions and code n is used to report. A recharacterization must be completed by your tax filing deadline, including extensions, for the year.

IRA recharacterizations Vanguard

Web once you have completed and submitted the request form, your contribution will be recharacterized as a traditional ira contribution. Web a recharacterization lets you treat a regular contribution that you made to a roth ira or a traditional ira as one that you made to another type of ira. Web ira recharacterization use this form to: For example, say.

Recharacterization of IRA Contributions to Correct Mistakes

Web recharacterization is the process of “fixing” ira contributions by moving them from one type of ira to another type of ira. Web use this form to recharacterize (change contribution) from one ira plan type to another ira plan type for the same person. Use this form to add or terminate a user's access to invesco retirement plan manager (rpm).

Contributions That Are Reported On Form 5498 Include A.

Use a separate form for each ira plan. Web a recharacterization allows you to treat a regular contribution made to a roth ira or to a traditional ira as having been made to the other type of ira. Web traditional and roth ira recharacterization request. Web once you have completed and submitted the request form, your contribution will be recharacterized as a traditional ira contribution.

Your Contribution Will Be Treated.

Code r is used in box 7 to report prior year contributions and code n is used to report. Form used to recharacterize a traditional to a roth ira or vice versa. Web use this form to recharacterize (change contribution) from one ira plan type to another ira plan type for the same person. Web within certain limits, the irs allows you to treat certain ira contributions made to one type of ira as having been made to another type of ira.

Web A Contribution To An Ira Is Reported On A Form 5498 By The Trustee Of The Ira To Which The Contribution Is Made.

Web what you need to know • transferring a contribution from one type of ira to another is known as a recharacterization. you can recharacterize part or all of your contribution. Web recharacterization timing and important deadlines. Treat a contribution made to one type of ira as having been made to another ira type. Web request a recharacterization or remove an excess ira contribution general information and instructions.

Web Ira Recharacterization Use This Form To:

Web you can complete most recharacterization using the ira recharacterization form below. For example, say you maxed out your. Web recharacterization is the process of “fixing” ira contributions by moving them from one type of ira to another type of ira. Web a recharacterization lets you treat a regular contribution that you made to a roth ira or a traditional ira as one that you made to another type of ira.