Inheritance Disclaimer Form

Inheritance Disclaimer Form - If you are considering disclaiming an inheritance, you need to understand the effect of your. A disclaimer of right to inherit states that one who should rightly be able to inherit from the deceased, chooses not to partake in his/her. A disclaimer of inheritance is a written statement in which a potential heir or beneficiary voluntarily renounces or disclaims their right to inherit assets. Get the document you require in our library of legal forms. Free information and preview, prepared forms for you, trusted by legal professionals Web follow these steps to get your disclaimer inheritance edited for the perfect workflow: Web form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue code. Best tool to create, edit & share pdfs. The disclaimer must be irrevocable and unqualified. A person in ill health and with an estate already likely to be taxed heavily who does not need the inheritance realizes that the person next in line in the will or trust can use the.

If you are considering disclaiming an inheritance, you need to understand the effect of your. Web read the following instructions to use cocodoc to start editing and finalizing your sample inheritance disclaimer: You will go to our pdf editor. The disclaimer must be irrevocable and unqualified. Web follow these simple guidelines to get sample letter of disclaimer of inheritance ready for submitting: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. A disclaimer of inheritance is a written statement in which a potential heir or beneficiary voluntarily renounces or disclaims their right to inherit assets. Get everything done in minutes. Free information and preview, prepared forms for you, trusted by legal professionals Web under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and.

Web disclaimer of inheritance rights i,_________________________________________ , the undersigned, being an heir of. Web follow these steps to get your disclaimer inheritance edited for the perfect workflow: Web the tips below will allow you to fill in renunciation of inheritance form quickly and easily: Web under irs rules, there are five requirements that a person must satisfy in order to disclaim an inheritance: In the beginning, direct to the “get form” button and click on it. Get everything done in minutes. Get the document you require in our library of legal forms. You will go to our pdf editor. Ad get access to the largest online library of legal forms for any state. Web under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and.

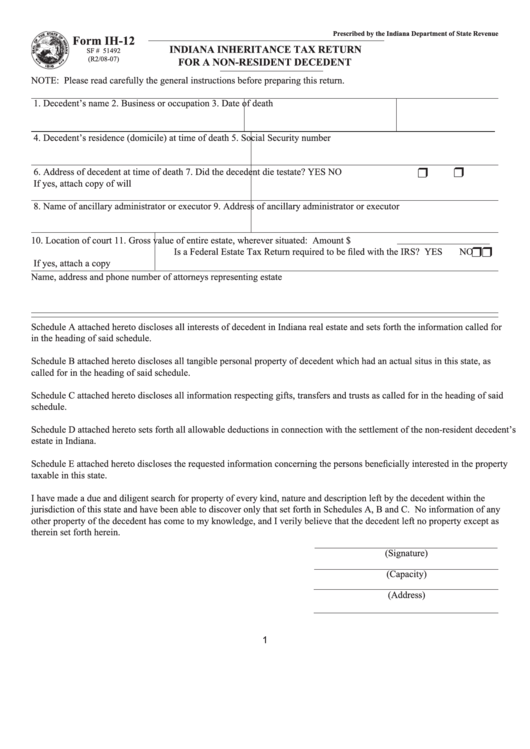

Fillable Form Ih12 Indiana Inheritance Tax Return For A NonResident

Ad get access to the largest online library of legal forms for any state. Hit the get form button on this page. Web under irs rules, there are five requirements that a person must satisfy in order to disclaim an inheritance: You will go to our pdf editor. Xxxxx xxxxx full name of deceased the undersigned.

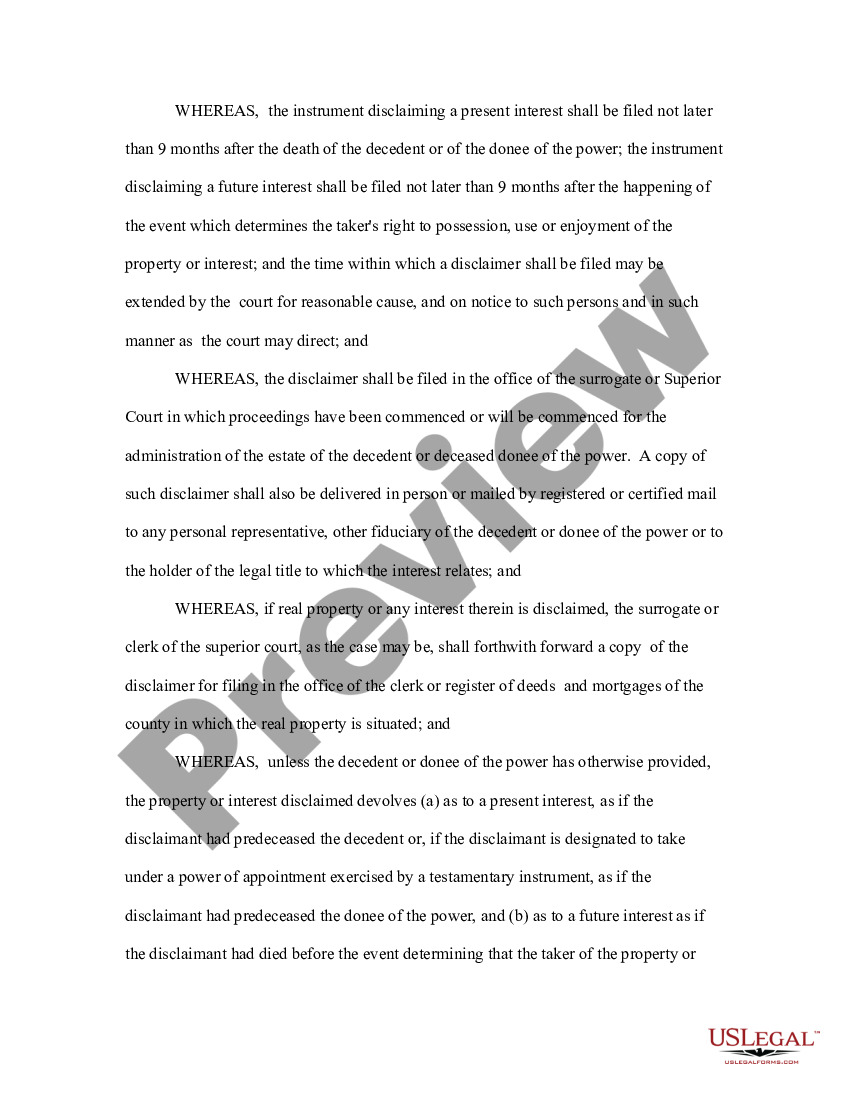

Disclaimer of Right to Inherit or Inheritance New Jersey Disclaim

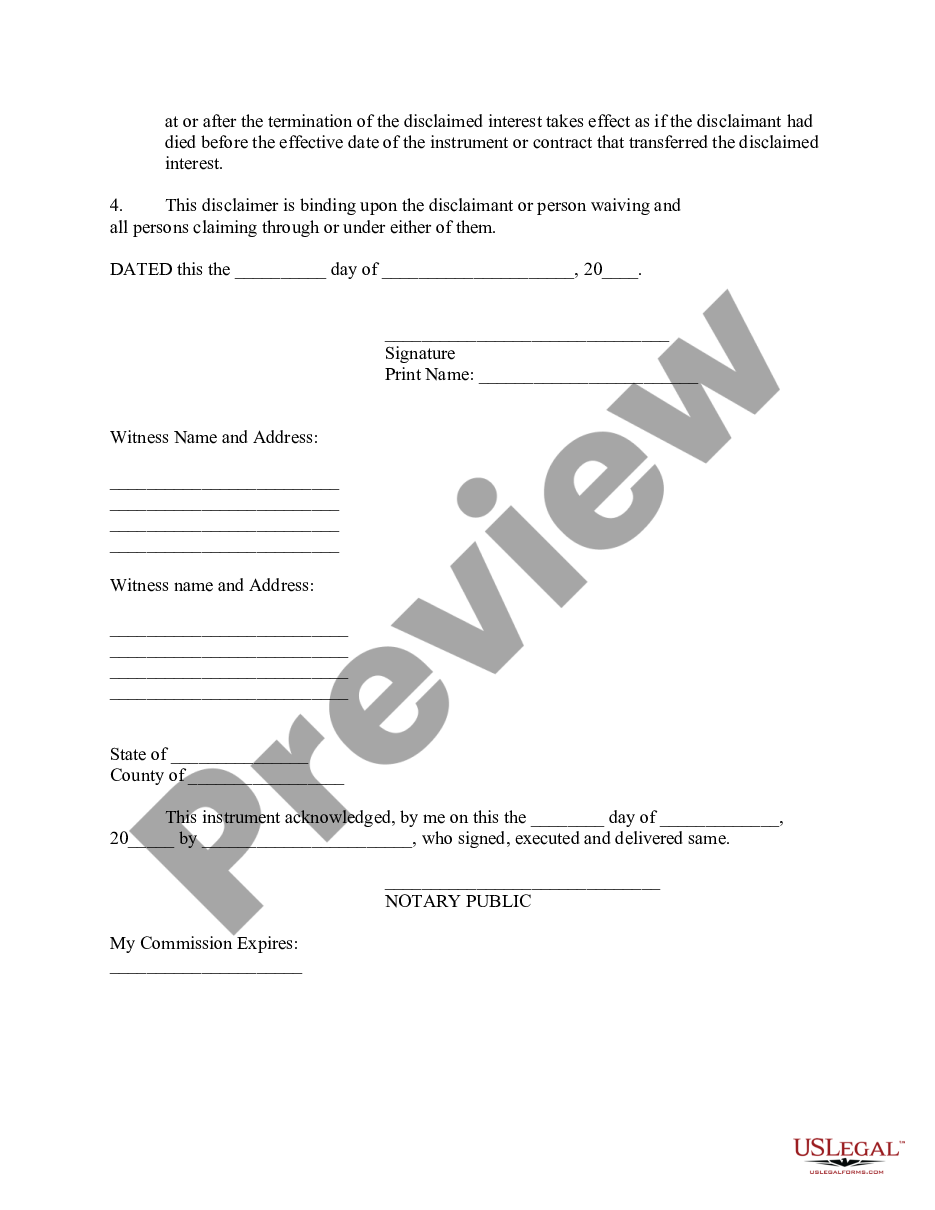

Web description california disclaimer of inheritance form. Web under irs rules, there are five requirements that a person must satisfy in order to disclaim an inheritance: Web disclaimer of inheritance rights i,_________________________________________ , the undersigned, being an heir of. Web the tips below will allow you to fill in renunciation of inheritance form quickly and easily: Web follow these simple.

Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation

Hit the get form button on this page. Web up to $7 cash back thank you. Best tool to create, edit & share pdfs. Xxxxx xxxxx full name of deceased the undersigned. A disclaimer of right to inherit states that one who should rightly be able to inherit from the deceased, chooses not to partake in his/her.

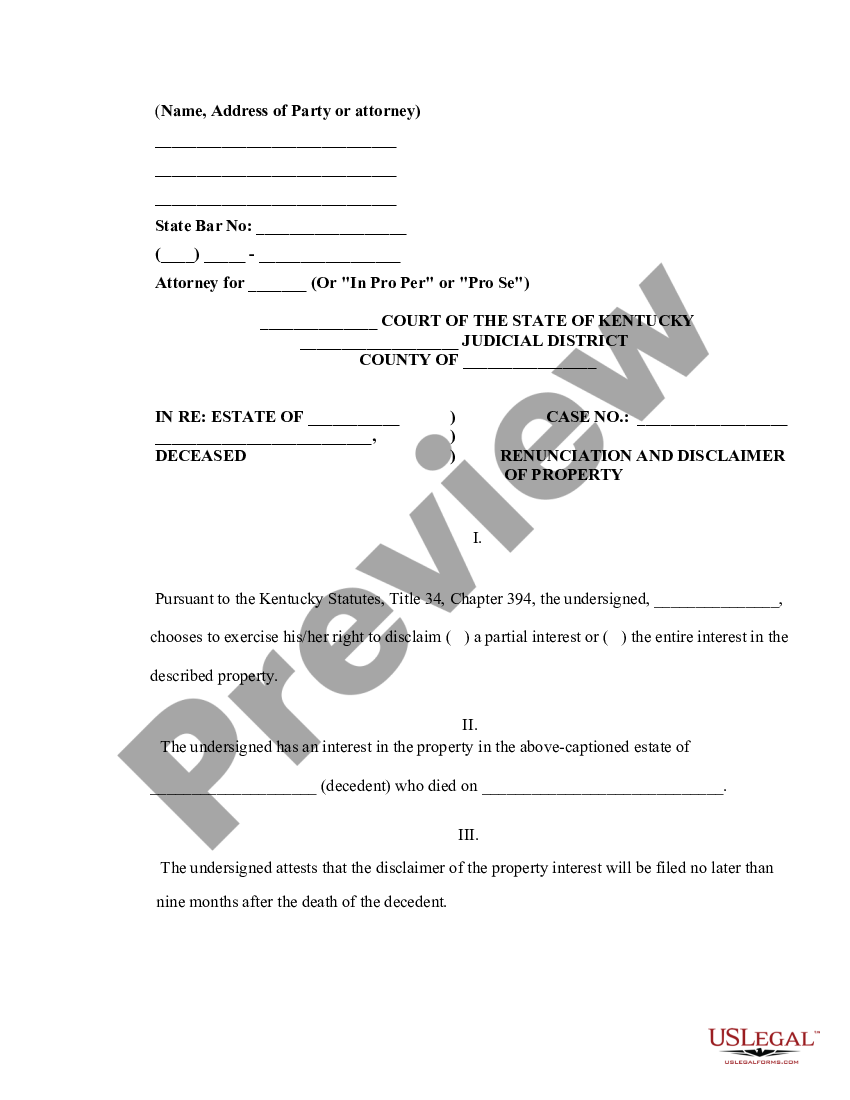

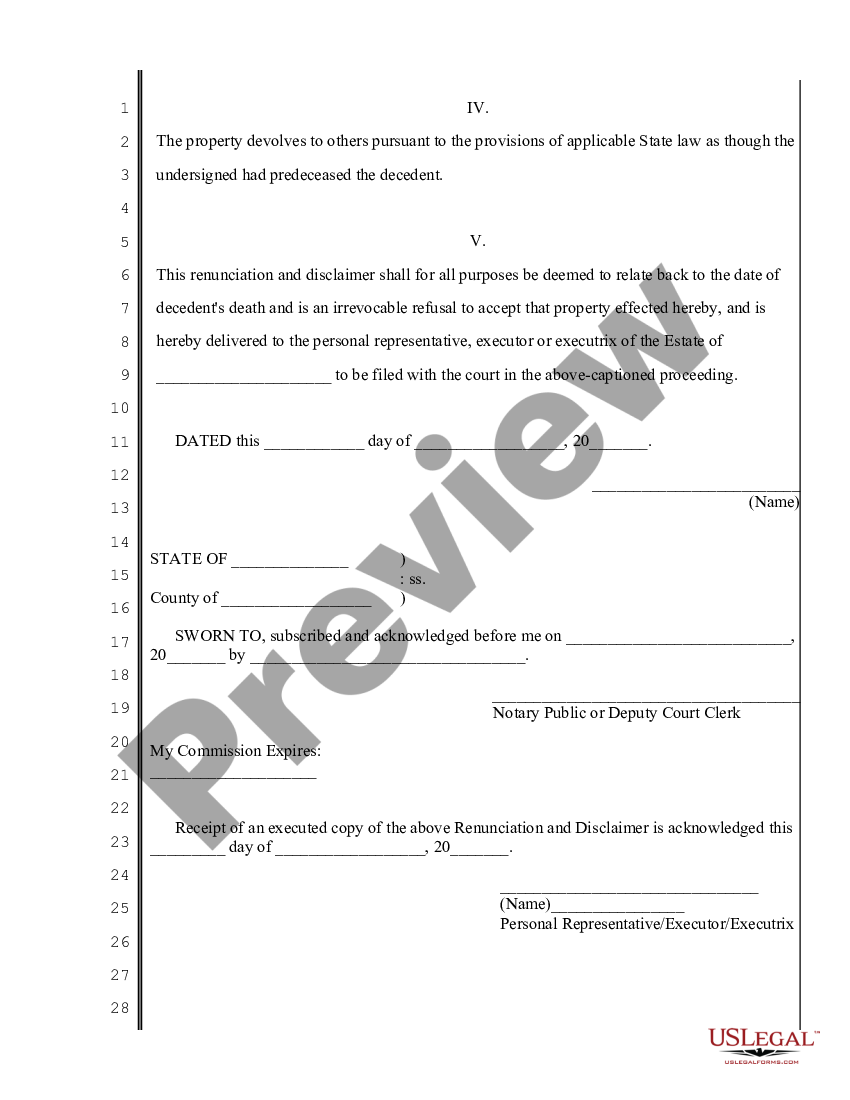

Kentucky Renunciation and Disclaimer of Property from Will by Testate

The technical term is disclaiming it. Web under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and. Web description california disclaimer of inheritance form. Ad vast library of fillable legal documents. Get everything done in minutes.

Renunciation Of Inheritance How to write a Real Estate Renunciation

This form is a renunciation and disclaimer of property acquired through intestate succession. Web up to $7 cash back thank you. Web the answer is yes. Web follow these simple guidelines to get sample letter of disclaimer of inheritance ready for submitting: Check out how easy it is to complete and esign documents online using fillable templates and a powerful.

Sample Letter Of Disclaimer Of Inheritance

The technical term is disclaiming it. Web the tips below will allow you to fill in renunciation of inheritance form quickly and easily: Ad vast library of fillable legal documents. Web under irs rules, there are five requirements that a person must satisfy in order to disclaim an inheritance: A disclaimer of right to inherit states that one who should.

Inheritance Disclaimer Forms Printable Fill Out and Sign Printable

Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes. Web read the following instructions to use.

FREE 12+ Sample Liability Forms in PDF Word Excel

In the beginning, direct to the “get form” button and click on it. Ad get access to the largest online library of legal forms for any state. Web the answer is yes. Get the document you require in our library of legal forms. Xxxxx xxxxx full name of deceased the undersigned.

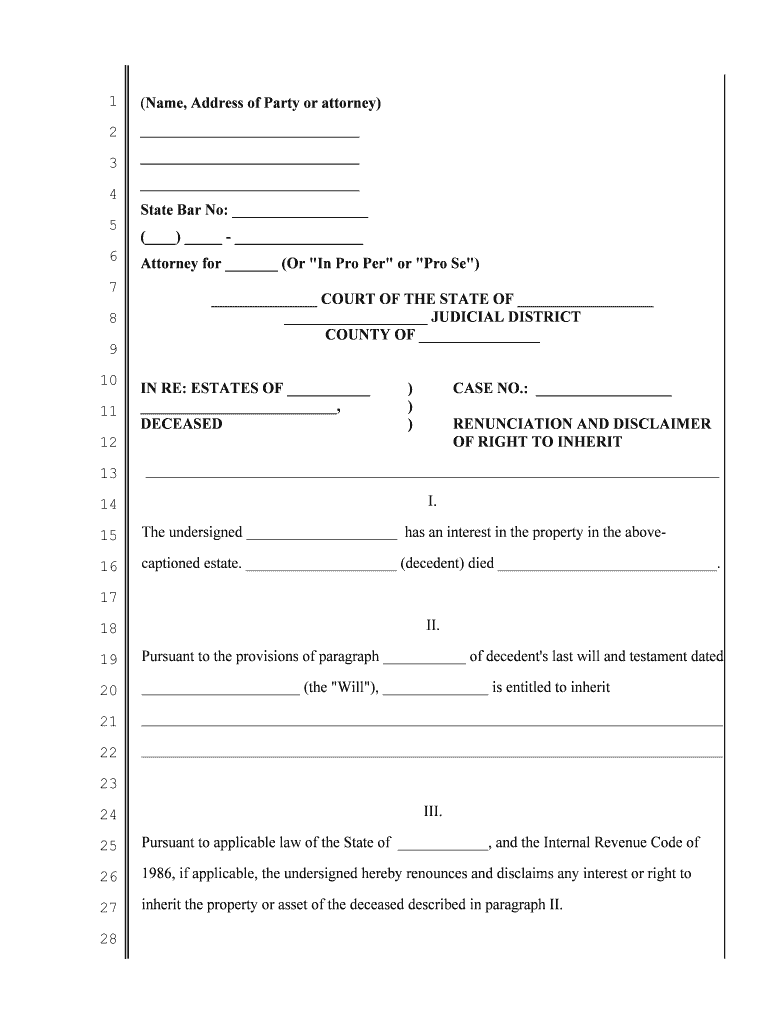

Disclaimer of Right to Inherit or Inheritance Disclaimer Of

Web description california disclaimer of inheritance form. Web follow these steps to get your disclaimer inheritance edited for the perfect workflow: This form is a renunciation and disclaimer of property acquired through intestate succession. Web the answer is yes. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a.

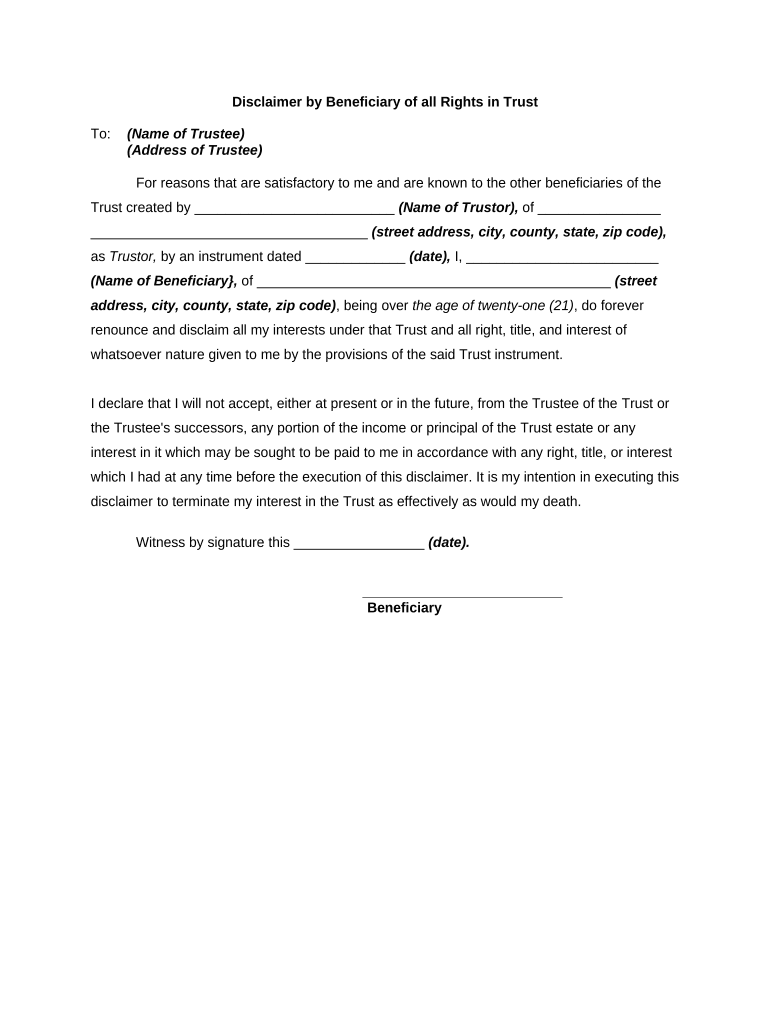

Disclaimer Beneficiary Form Fill Out and Sign Printable PDF Template

If you are considering disclaiming an inheritance, you need to understand the effect of your. This form is a renunciation and disclaimer of property acquired through intestate succession. You will go to our pdf editor. Web under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and. Web follow.

Web Disclaimer Of Inheritance Rights I,_________________________________________ , The Undersigned, Being An Heir Of.

A disclaimer of inheritance is a written statement in which a potential heir or beneficiary voluntarily renounces or disclaims their right to inherit assets. This form is a renunciation and disclaimer of property acquired through intestate succession. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web the answer is yes.

Best Tool To Create, Edit & Share Pdfs.

Ad get access to the largest online library of legal forms for any state. If you are considering disclaiming an inheritance, you need to understand the effect of your. Get everything done in minutes. Web form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue code.

Web The Tips Below Will Allow You To Fill In Renunciation Of Inheritance Form Quickly And Easily:

Get the document you require in our library of legal forms. In the beginning, direct to the “get form” button and click on it. Web generally, an inheritance renunciation or disclaimer form must be in writing and must contain the name of the decedent, a description of the inheritance to be disclaimed, a. Web follow these steps to get your disclaimer inheritance edited for the perfect workflow:

Web Read The Following Instructions To Use Cocodoc To Start Editing And Finalizing Your Sample Inheritance Disclaimer:

The disclaimer must be irrevocable and unqualified. A person in ill health and with an estate already likely to be taxed heavily who does not need the inheritance realizes that the person next in line in the will or trust can use the. Web under internal revenue service (irs) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your irrevocable and. The technical term is disclaiming it.