Form Mo Pte

Form Mo Pte - Web overview deloitte tax llp | july 7, 2022 overview on june 30, 2022, missouri house bill 2400 (h.b. Under the legislation, partnerships and s. 2400) was signed into law. Stop here if you do not have any nonapportionable income. Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. This form is for income. Select this box if you have an approved. Check the electing to become an affected business entity (mandatory for pte return) box to activate the. Web from the state & localsection, select taxes, then mo pte income tax.

Web how to enter missouri pte in proseries for tax years ending on or after december 31, 2022, missouri partnerships and s corporations can elect to pay pass. Check the electing to become an affected business entity (mandatory for pte return) box to activate the. In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. 2400) that, among other things: Per the state website, early payments can be. Check the electing to become an affected business entity (mandatory for pte. Under the legislation, partnerships and s. Web go to screen 48.285 missouri pte tax return ;

This form is for income. Per the state website, early payments can be. Check the electing to become an affected business entity (mandatory for pte. Select this box if you have an approved. In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. 2400) that, among other things: Web go to screen 48.285 missouri pte tax return ; Under the legislation, partnerships and s. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Web how to enter missouri pte in proseries for tax years ending on or after december 31, 2022, missouri partnerships and s corporations can elect to pay pass.

Mo Ptc 2020 Fillable Form Fill and Sign Printable Template Online

2400) that, among other things: Stop here if you do not have any nonapportionable income. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Form mo pte and the mopte. Web go to screen 48.285 missouri pte tax return ;

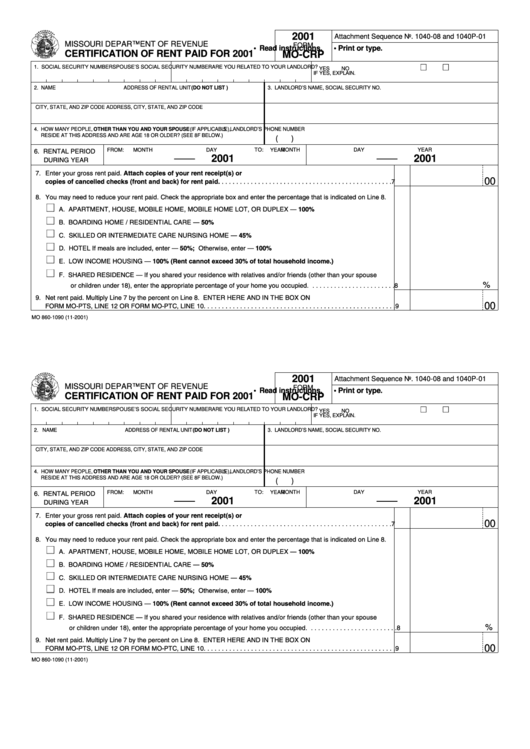

Form MoCrp Certification Of Rent Paid For 2001 printable pdf download

This form is for income. Web from the state & localsection, select taxes, then mo pte income tax. Stop here if you do not have any nonapportionable income. Check the electing to become an affected business entity (mandatory for pte return) box to activate the. You must use the chart to see.

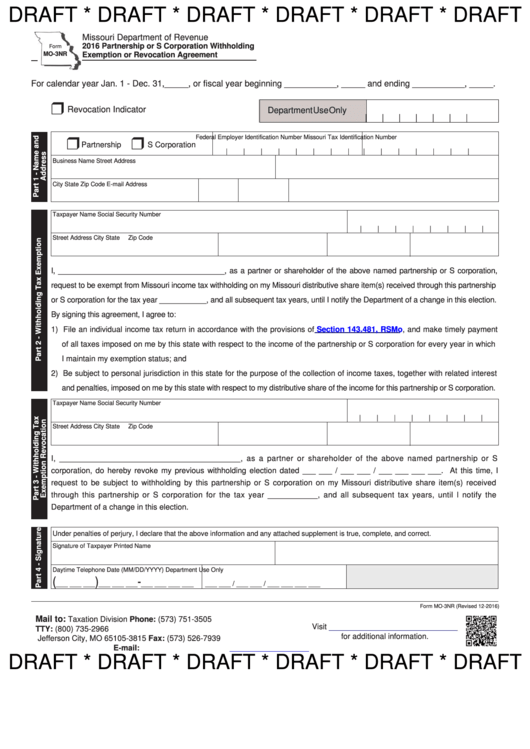

Form Mo3nr Draft Partnership Or S Corporation Withholding Exemption

2400) that, among other things: Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Check the electing to become an affected business entity (mandatory for pte. This form is for income. 2400) was signed into law.

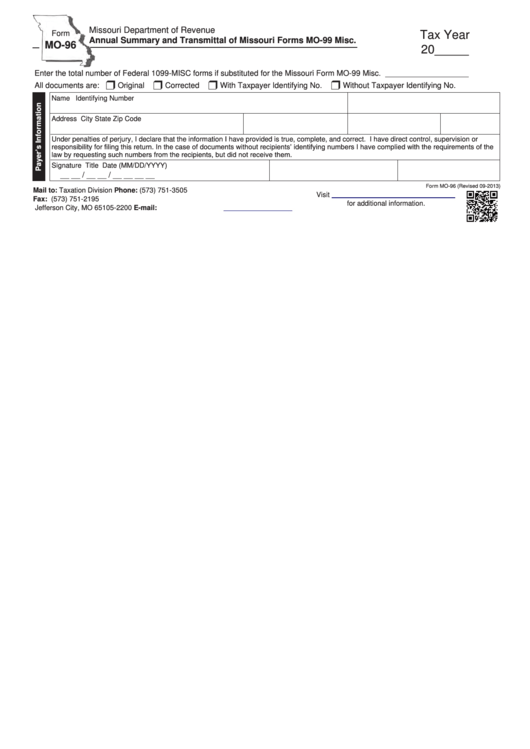

Fillable Form Mo96 Annual Summary And Transmittal Of Missouri Forms

2400) that, among other things: You must use the chart to see. Web go to screen 48.285 missouri pte tax return ; In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. Web overview deloitte tax llp | july 7, 2022 overview on june 30, 2022, missouri.

MO Form MO62(ef) 2012 Fill and Sign Printable Template Online US

2400) that, among other things: You must use the chart to see. Check the electing to become an affected business entity (mandatory for pte. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Per the state website, early payments can be.

Form MOMSS Download Fillable PDF or Fill Online S Corporation

Select this box if you have an approved. In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. Check the electing to become an affected business entity (mandatory for pte. Check the electing to become an affected business entity (mandatory for pte return) box to activate the..

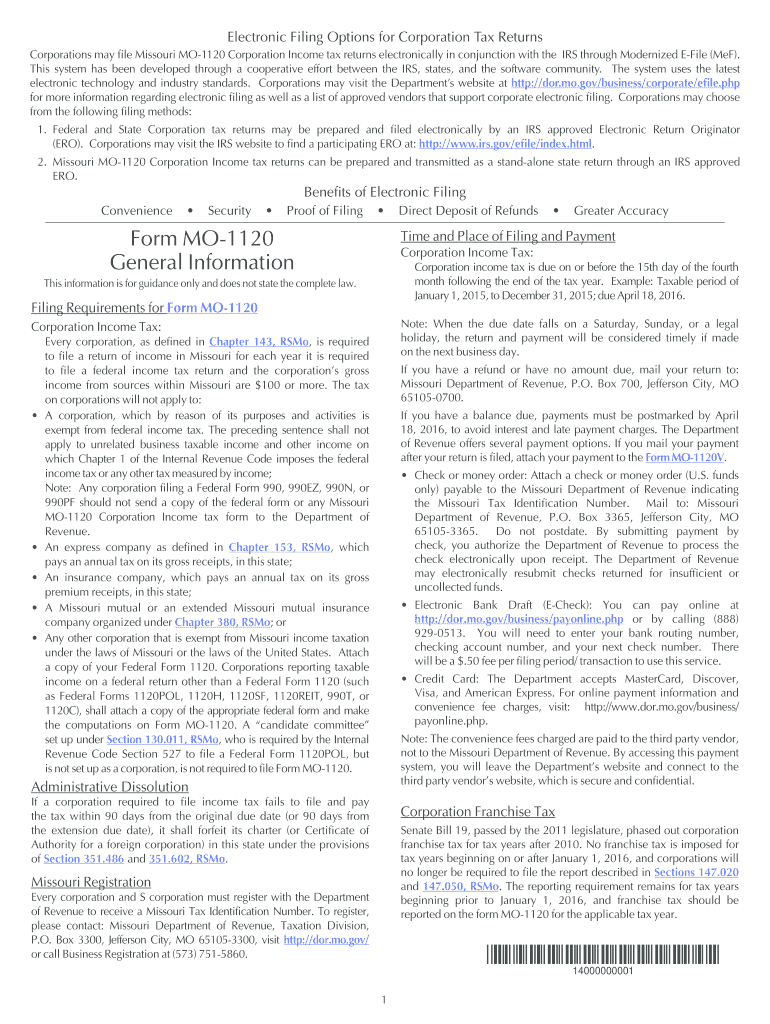

Form MO 1120 Instructions Dor Mo Fill Out and Sign Printable PDF

Web how to enter missouri pte in proseries for tax years ending on or after december 31, 2022, missouri partnerships and s corporations can elect to pay pass. Per the state website, early payments can be. Web from the state & localsection, select taxes, then mo pte income tax. Select this box if you have an approved. Web go to.

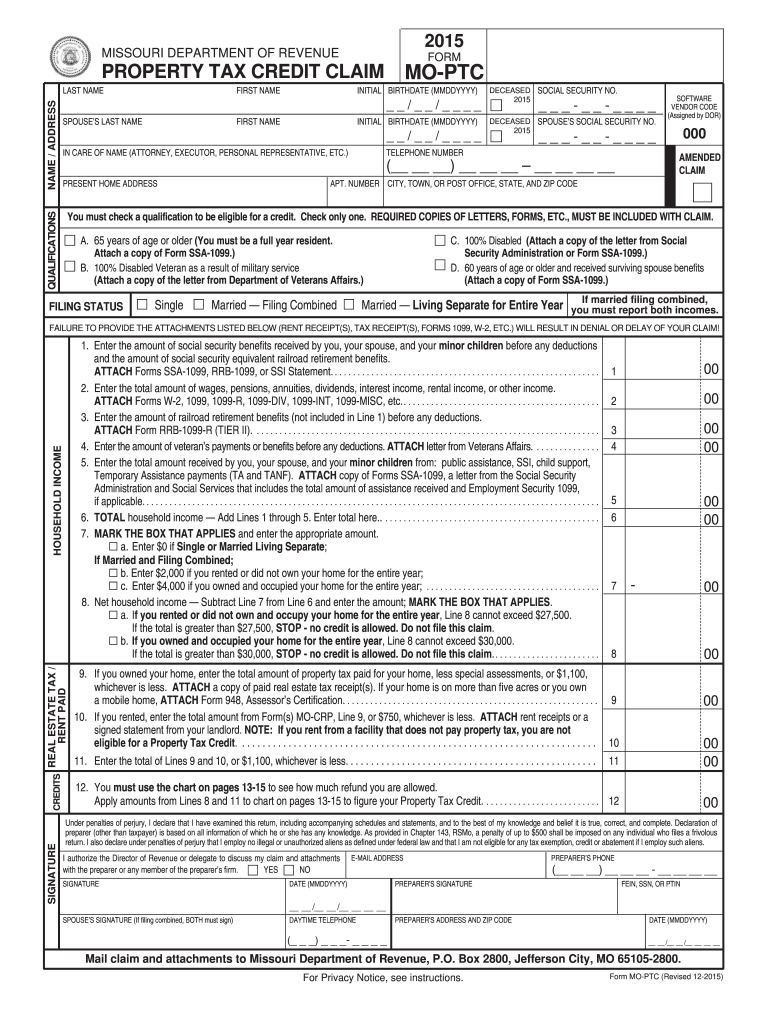

2015 Form MO MOPTC Fill Online, Printable, Fillable, Blank pdfFiller

2400) was signed into law. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated. Web overview deloitte tax llp | july 7, 2022 overview on june 30, 2022, missouri house bill 2400 (h.b. Web how to enter missouri pte in proseries for tax years ending on or after.

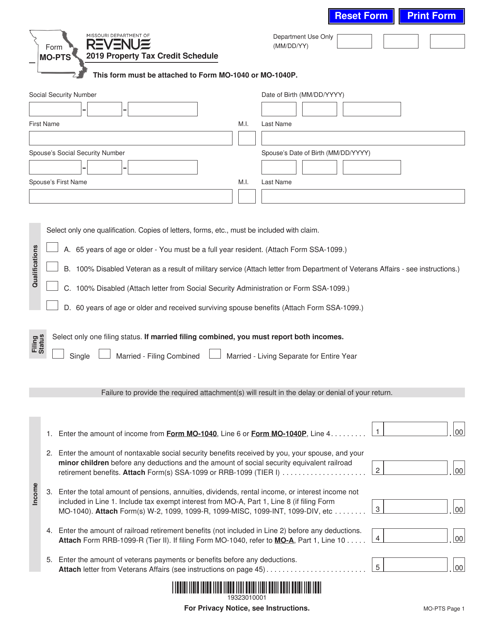

2022 Form MO DoR MOPTS Fill Online, Printable, Fillable, Blank pdfFiller

Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Per the state website, early payments can be. Under the legislation, partnerships and s. Check the electing to become an affected business entity (mandatory for pte return) box to activate the. Stop here if you do not have any nonapportionable income.

Form MOPTS Download Fillable PDF or Fill Online Property Tax Credit

In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Stop here if you do not have any nonapportionable income. Check the electing to become an affected business entity (mandatory for pte..

Form Mo Pte And The Mopte.

Web go to screen 48.285 missouri pte tax return ; In drake tax, to make the election, go to mo screen pte and mark the box election to become an affected business entity. This form is for income. Any taxpayer who donates cash or food to a food pantry, homeless shelter, or soup kitchen unless such food is donated.

Web Overview Deloitte Tax Llp | July 7, 2022 Overview On June 30, 2022, Missouri House Bill 2400 (H.b.

Per the state website, early payments can be. You must use the chart to see. Check the electing to become an affected business entity (mandatory for pte. Select this box if you have an approved.

Check The Electing To Become An Affected Business Entity (Mandatory For Pte Return) Box To Activate The.

Web governor mike parson on june 30, 2022, signed into law a bill ( h.b. Under the legislation, partnerships and s. Web from the state & localsection, select taxes, then mo pte income tax. 2400) that, among other things:

Web How To Enter Missouri Pte In Proseries For Tax Years Ending On Or After December 31, 2022, Missouri Partnerships And S Corporations Can Elect To Pay Pass.

2400) was signed into law. Stop here if you do not have any nonapportionable income.