1120 C Tax Form

1120 C Tax Form - Corporation income tax return, including recent updates, related forms and instructions on how to file. Completing form 1120 corporations can create basic tax. Corporation income tax return, is used to report corporate income taxes to the irs. If the corporation’s principal business, office, or agency is located in: Use this form to report the. Complete, edit or print tax forms instantly. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Businesses taxed as c corporations file their. Web if your business is taxed as a c corporation, form 1120 is the return you must use. This form is also used to figure out.

Maximize your deductions and save time with various imports & reports. Web taxact business 1120 easy guidance & tools for c corporation tax returns. Web mailing addresses for forms 1120. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Web forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are 100% correct. This form is also used to figure out. Web form 1120 is the tax form used by c corporations and llcs filing as a corporation to report profits and losses, deductions, credits and income. Complete, edit or print tax forms instantly. Go to federal > common state/city > state pte generation. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline.

When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Bundle & save $ 124 95. Web irs form 1120, the u.s. Use this form to report the. Web mailing addresses for forms 1120. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Income tax return for cooperative associations for calendar year 2020 or tax year beginning, 2020,. Web we last updated the u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web if your business is taxed as a c corporation, form 1120 is the return you must use.

Download C Corporation Tax (Form 1120) SoftArchive

Maximize your deductions and save time with various imports & reports. Ad easy guidance & tools for c corporation tax returns. Web irs form 1120, the u.s. Web taxact business 1120 easy guidance & tools for c corporation tax returns. Web mailing addresses for forms 1120.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Web form 1120 is the tax form used by c corporations and llcs filing as a corporation to report profits and losses, deductions, credits and income. Web irs form 1120, the u.s. Go to federal > common state/city > state pte generation. Easily fill out pdf blank, edit, and sign them. Maximize your deductions and save time with various imports.

1120 Tax Form Blank Sample to Fill out Online in PDF

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Businesses taxed as c corporations file their. And the total assets at the end of the tax year are: Web we last updated the u.s. It can also be used to report.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Go to federal > common state/city > state pte generation. This form is also used to figure out. Web we last updated the u.s. Save or instantly send your ready documents. Web taxact business 1120 easy guidance & tools for c corporation tax returns.

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

Maximize your deductions and save time with various imports & reports. Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. Use this form to report the. It can also be used to report income for other. Complete, edit or print tax.

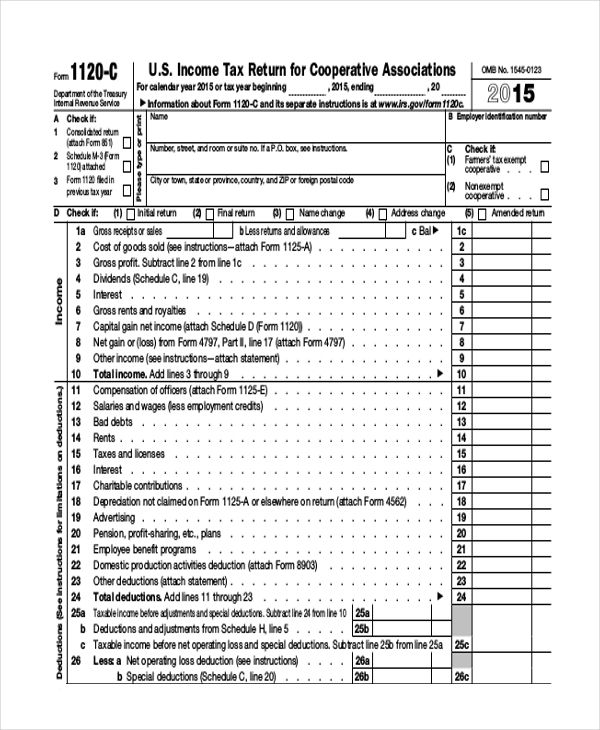

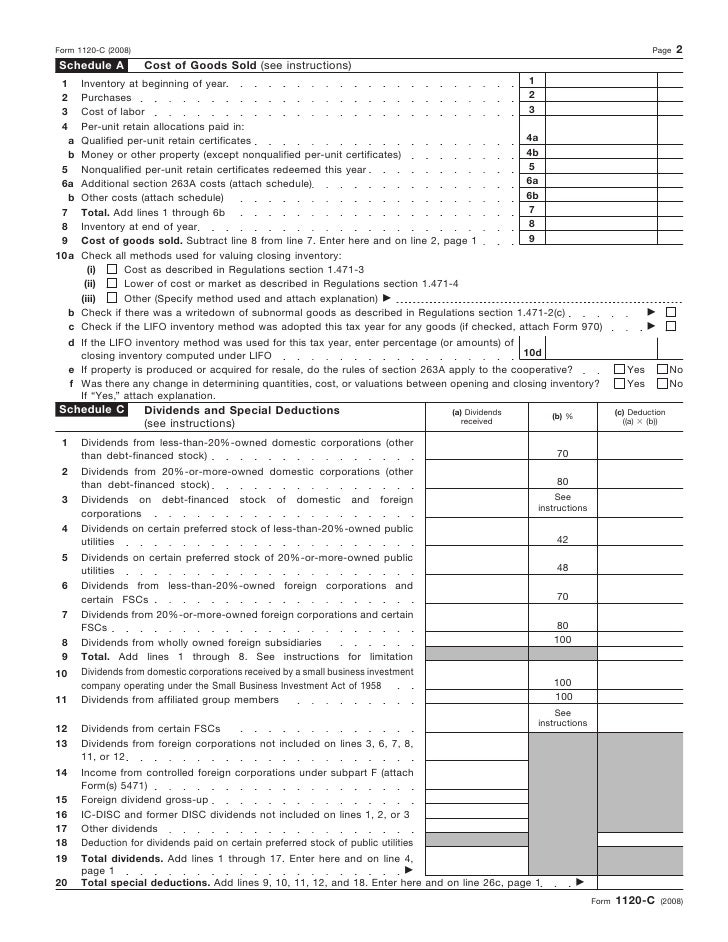

Form 1120CU.S. Tax Return for Cooperative Associations

Web forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are 100% correct. Web if your business is taxed as a c corporation, form 1120 is the return you must use. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Bundle & save $.

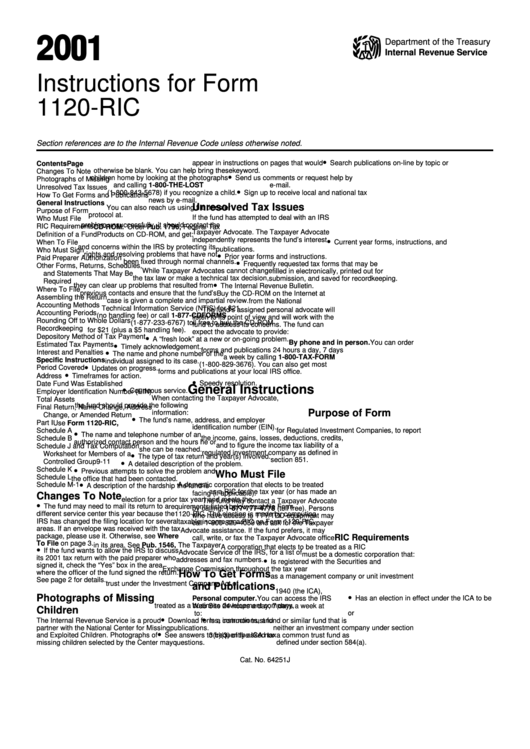

Form 1120Ric Instructions Tax 2001 printable pdf download

This form is also used to figure out. Web information about form 1120, u.s. And the total assets at the end of the tax year are: Completing form 1120 corporations can create basic tax. Save or instantly send your ready documents.

Form 1120C U.S. Tax Return for Cooperative Associations (2014

Corporation income tax return, is used to report corporate income taxes to the irs. If the corporation’s principal business, office, or agency is located in: Web we last updated the u.s. Ad easy guidance & tools for c corporation tax returns. Select box 15 for the state of.

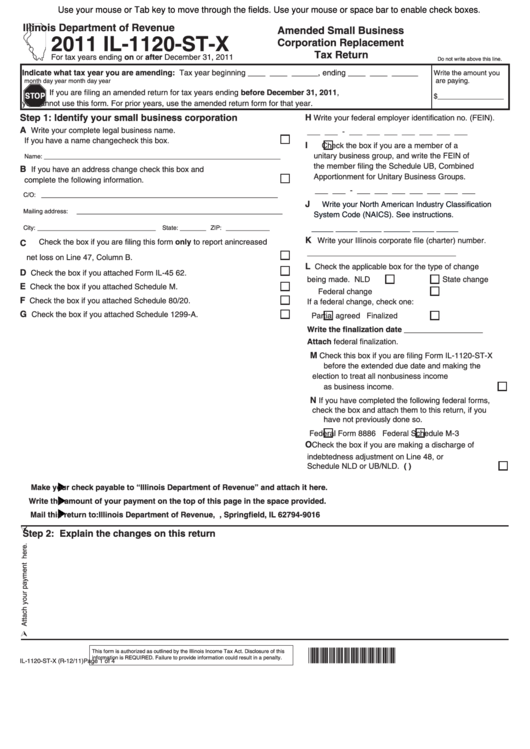

Fillable Form Il1120StX Amended Small Business Corporation

Web irs form 1120, the u.s. Easily fill out pdf blank, edit, and sign them. Bundle & save $ 124 95. Complete, edit or print tax forms instantly. If the corporation’s principal business, office, or agency is located in:

Tax form 1120 instructions

Web enter on form 1120 the totals for each item of income, gain, loss, expense, or deduction, net of eliminating entries for intercompany transactions between corporations within the. It can also be used to report income for other. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Bundle &.

It Can Also Be Used To Report Income For Other.

Corporation income tax return, is used to report corporate income taxes to the irs. Web c corporations must file form 1120 each year, whether or not they have taxable income for that period. Web irs form 1120, the u.s. Satisfaction guarantee with any taxact.

Maximize Your Deductions And Save Time With Various Imports & Reports.

Web form 1120 is the tax form used by c corporations and llcs filing as a corporation to report profits and losses, deductions, credits and income. Go to federal > common state/city > state pte generation. Income tax return for cooperative associations, to report income, gains, losses, deductions, credits, and to figure the income tax liability. Income tax return for cooperative associations for calendar year 2020 or tax year beginning, 2020,.

And The Total Assets At The End Of The Tax Year Are:

Corporation income tax return, including recent updates, related forms and instructions on how to file. This form is also used to figure out. Easily fill out pdf blank, edit, and sign them. If the corporation’s principal business, office, or agency is located in:

Use This Form To Report The.

Web if your business is taxed as a c corporation, form 1120 is the return you must use. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Web mailing addresses for forms 1120. Ad easy guidance & tools for c corporation tax returns.