Form 990-Ez Schedule A Instructions

Form 990-Ez Schedule A Instructions - Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. Return of organization exempt from income tax. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Enter amount of tax imposed on organization managers or disqualified. Complete, edit or print tax forms instantly. Public charity status and public support. For paperwork reduction act notice, see the separate instructions. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Short form return of organization exempt from income tax.

These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Open to public go to www.irs.gov/form990 for instructions and the latest information. For paperwork reduction act notice, see the separate instructions. Short form return of organization exempt from income tax. Upload, modify or create forms. Complete, edit or print tax forms instantly. This form is used for tax filing purposes, and it will be sent to the. Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Complete if the organization is a section. Return of organization exempt from income tax.

Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Return of organization exempt from income tax. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Enter amount of tax imposed on organization managers or disqualified. Web schedule a (form 990) department of the treasury internal revenue service. Public charity status and public support. Web expresstaxexempt is here to generate the correct schedules for your nonprofit and help you file on time. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Open to public go to www.irs.gov/form990 for instructions and the latest information. Complete, edit or print tax forms instantly.

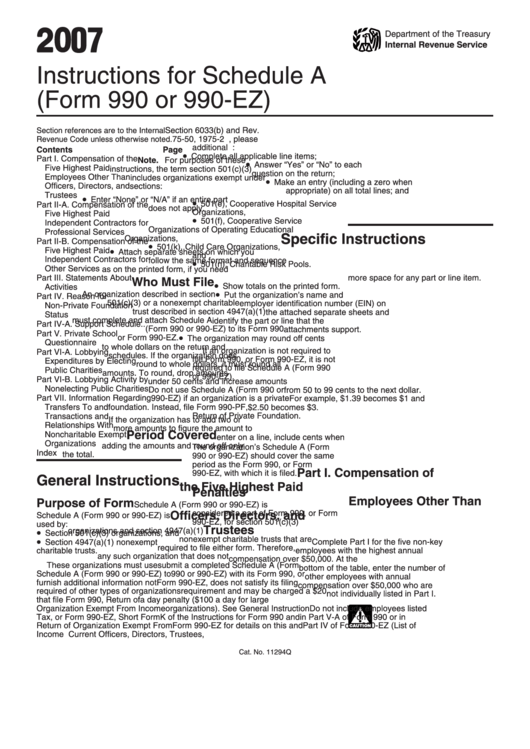

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether. For paperwork reduction act notice, see the separate instructions. Complete if the organization is a section. This form is used for tax filing purposes, and it will be sent to the. Web if.

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Public charity status and public support. Ad get ready for tax season deadlines by completing any required tax forms today. Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Web.

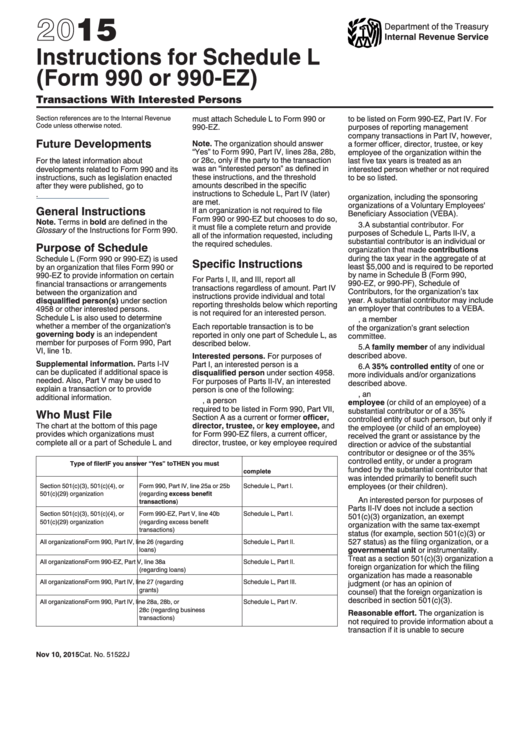

Instructions For Schedule L (Form 990 Or 990Ez) Transactions With

Open to public go to www.irs.gov/form990 for instructions and the latest information. Public charity status and public support. Return of organization exempt from income tax. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web schedule o (form 990) 2022 omb no.

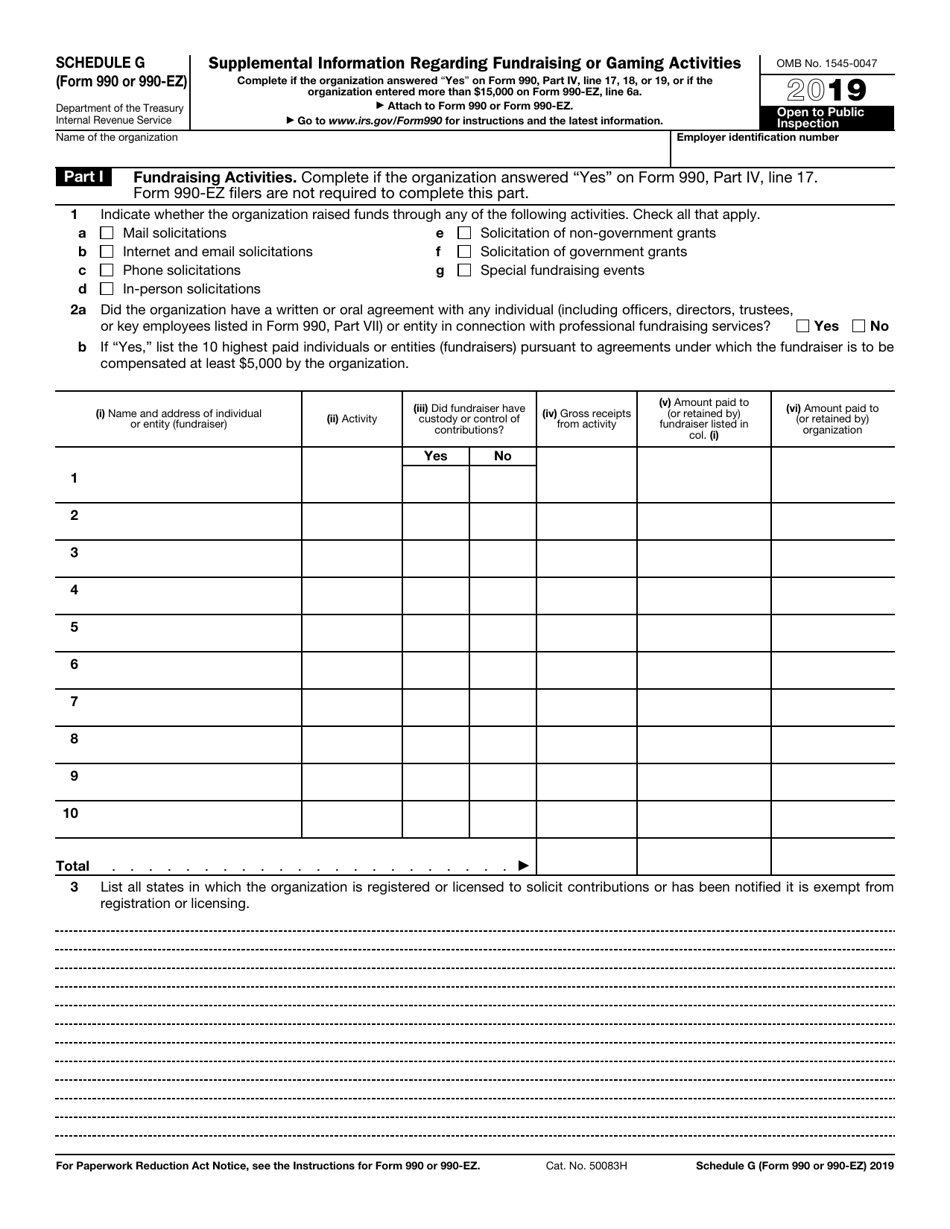

IRS Form 990 (990EZ) Schedule G Download Fillable PDF or Fill Online

Complete if the organization is a section. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web schedule o (form 990) 2022 omb no. Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

This form is used for tax filing purposes, and it will be sent to the. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web instructions for schedule a. Complete if the organization is a section. Try it for free now!

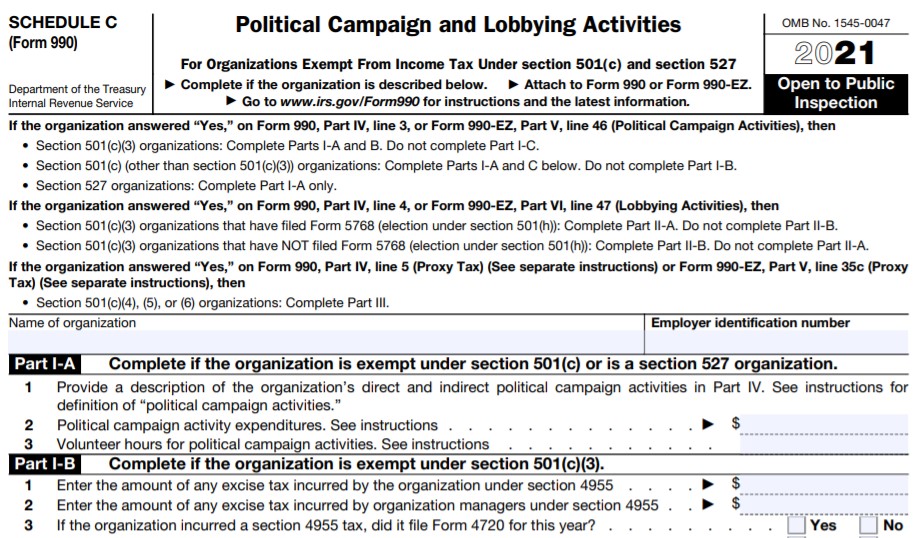

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

Click on the button get form to open it and begin. Complete, edit or print tax forms instantly. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Public charity status and public support. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community.

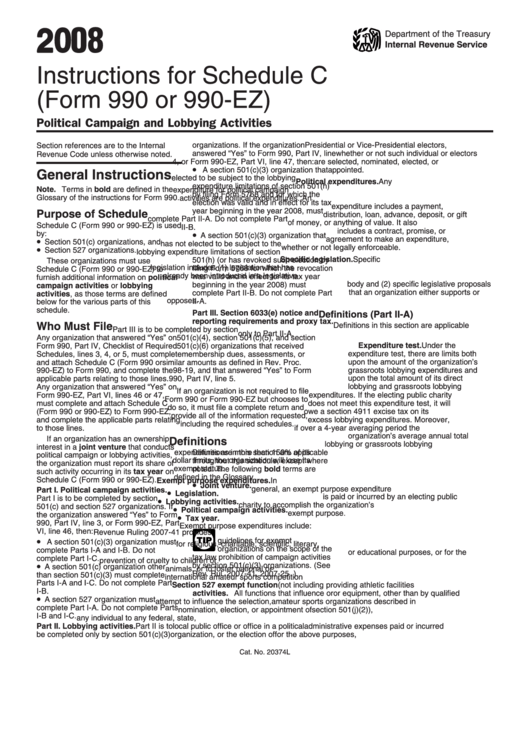

Instructions For Schedule C (Form 990 Or 990Ez) 2008 printable pdf

Open to public go to www.irs.gov/form990 for instructions and the latest information. Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation. Public charity status and public support. Web a section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for schedule.

2023 Form 990 Schedule F Instructions Fill online, Printable

Short form return of organization exempt from income tax. This form is used for tax filing purposes, and it will be sent to the. These instructions are intended for local ptas to help clarify the “instructions for schedule a (990ez)” as published by the internal revenue. Ad get ready for tax season deadlines by completing any required tax forms today..

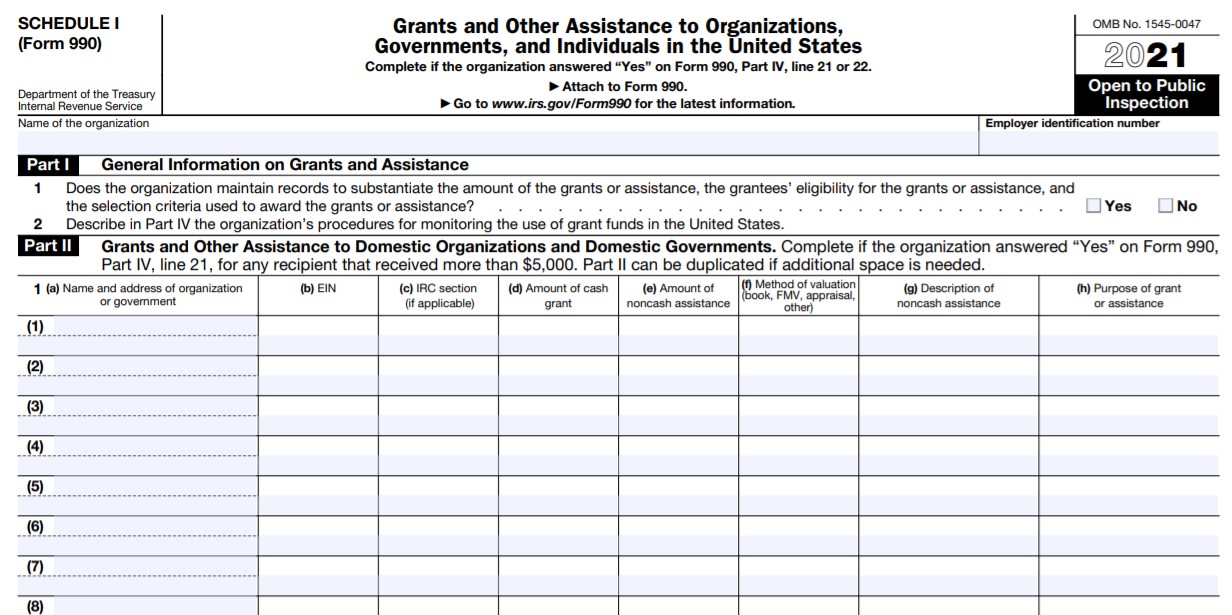

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Complete, edit or print tax forms instantly. Web schedule o (form 990) 2022 omb no. Enter amount of tax imposed on organization managers or disqualified. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

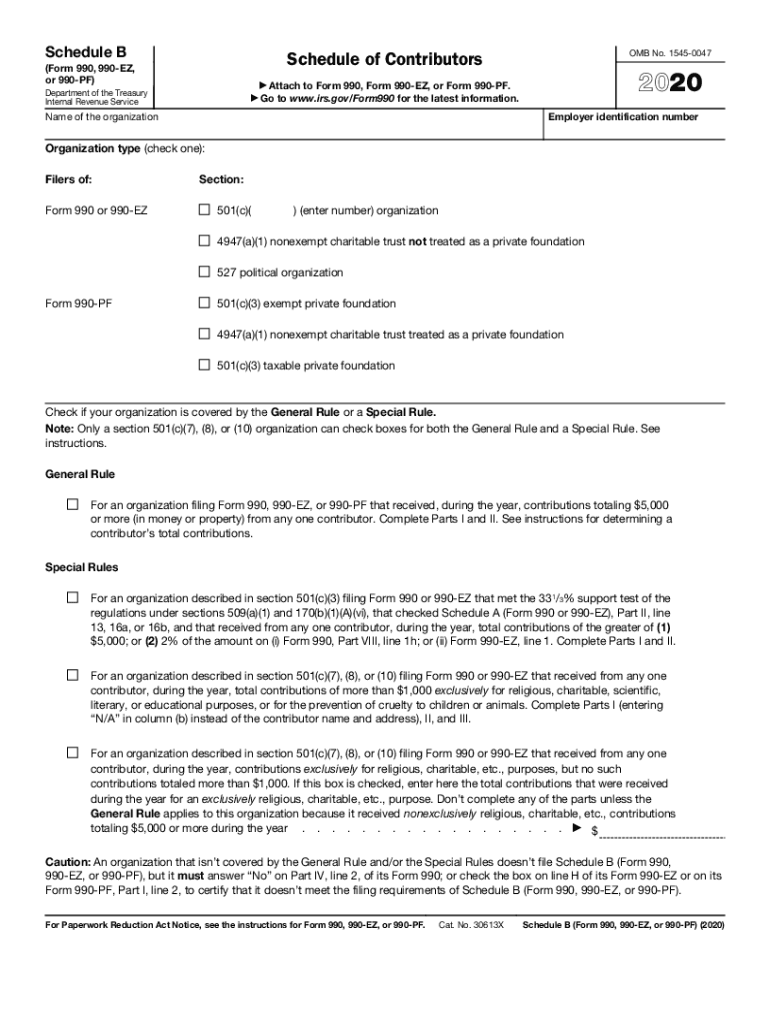

Gallery of Irs form 990 Ez Schedule B Instructions Unique Ibss Federal

Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Web schedule o (form 990) 2022 omb no. Complete, edit or print tax forms instantly. This form is used for tax filing purposes, and it will be sent to the. Open to public go to www.irs.gov/form990 for instructions and the latest information.

Web A Section 501(C)(3) Or Section 4947(A)(1) Organization Should Refer To The Instructions For Schedule A (Form 990), Public Charity Status And Public Support, To Determine Whether.

Click on the button get form to open it and begin. Schedule a (form 990) 2022 (all organizations must complete this part.) see. For paperwork reduction act notice, see the separate instructions. Web instructions for schedule a.

Short Form Return Of Organization Exempt From Income Tax.

Public charity status and public support. Upload, modify or create forms. Enter amount of tax imposed on organization managers or disqualified. Complete, edit or print tax forms instantly.

These Instructions Are Intended For Local Ptas To Help Clarify The “Instructions For Schedule A (990Ez)” As Published By The Internal Revenue.

Web schedule a (form 990) department of the treasury internal revenue service. Return of organization exempt from income tax. This form is used for tax filing purposes, and it will be sent to the. Complete if the organization is a section.

Try It For Free Now!

Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Web schedule o (form 990) 2022 omb no. Reason for public charity status to complete schedule a, all organizations should check any one of the boxes. Web (1) organization should refer to the instructions for schedule a (form 990), public charity status and public support, to determine whether it is a private foundation.