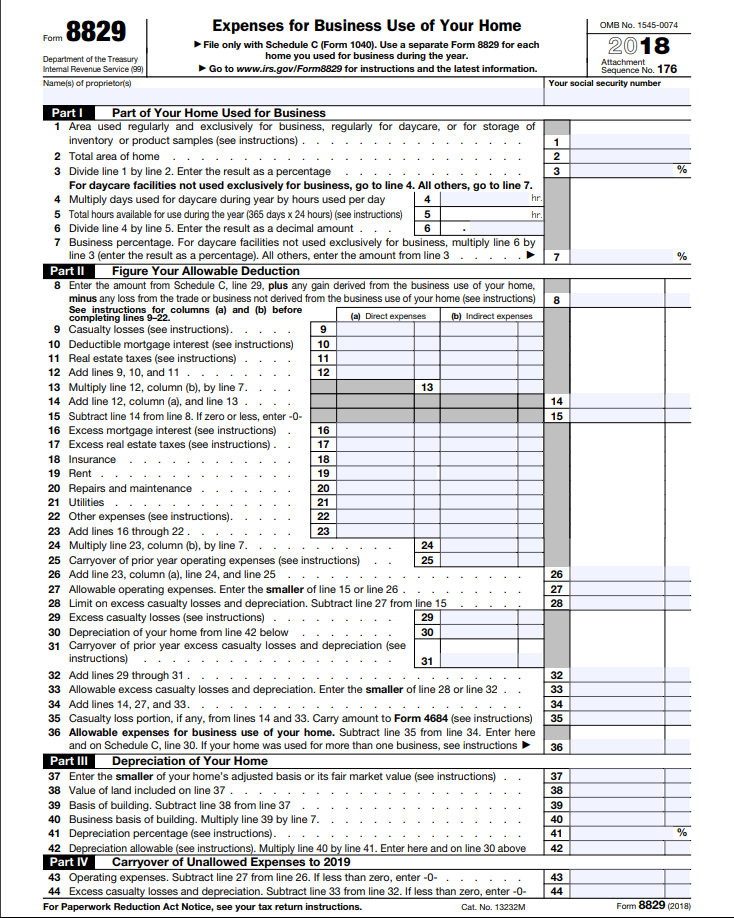

Form 8829 Instructions

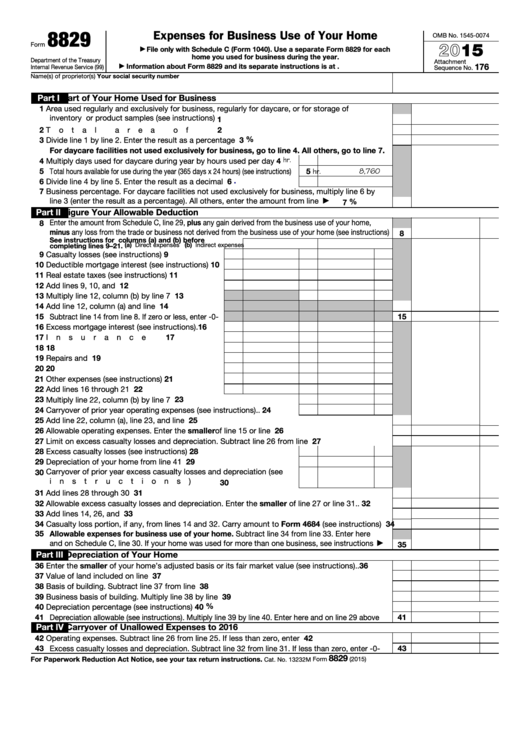

Form 8829 Instructions - Department of the treasury internal revenue service. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Business use of your home on schedule c (form 1040) • keeping books and records. Use a separate form 8829 for each home you used for business during the year. And any carryover to 2011 of amounts not deductible in • ordering supplies. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction. Web for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8829.

Web instructions for form 8829 expenses for business use of your home department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web use form 8829 to figure the allowable expenses for • billing customers, clients, or patients. Expenses for business use of your home. File only with schedule c (form 1040). Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. Department of the treasury internal revenue service. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction. You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web irs form 8829 is made for individuals that want to deduct home office expenses.

Web there are two ways to claim the deduction: For instructions and the latest information. Web for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8829. Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. Department of the treasury internal revenue service. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. File only with schedule c (form 1040). Future developments for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction.

Fillable Form 8829 Expenses For Business Use Of Your Home 2015

Use a separate form 8829 for each home you used for business during the year. For instructions and the latest information. Department of the treasury internal revenue service. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. One of the many benefits of working at home.

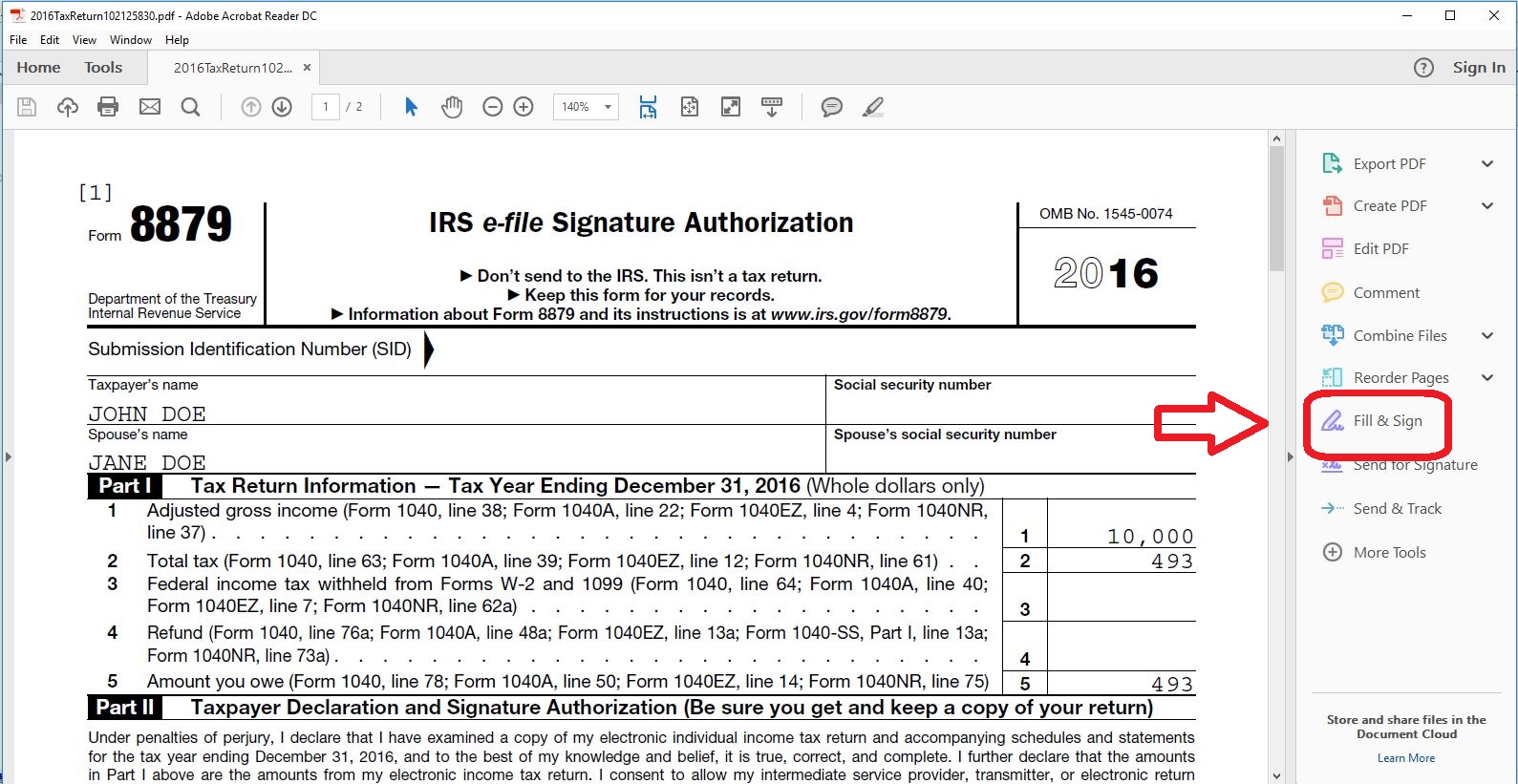

Blog Taxware Systems

Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Use form 8829 to figure the allowable expenses for business use of your home on.

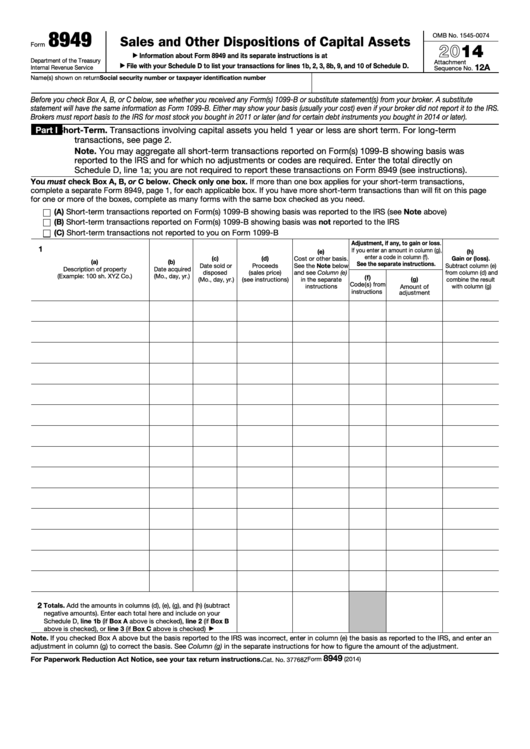

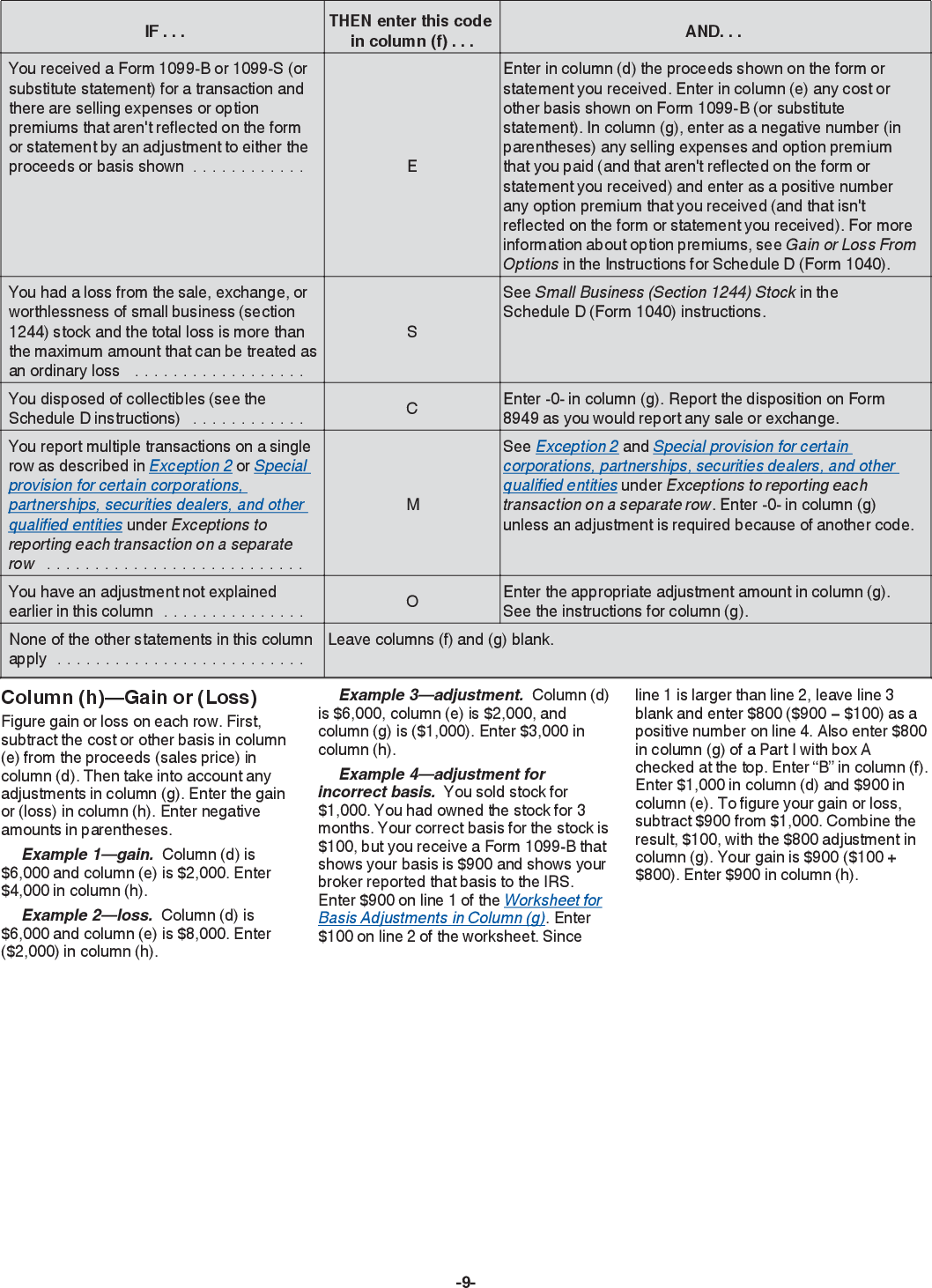

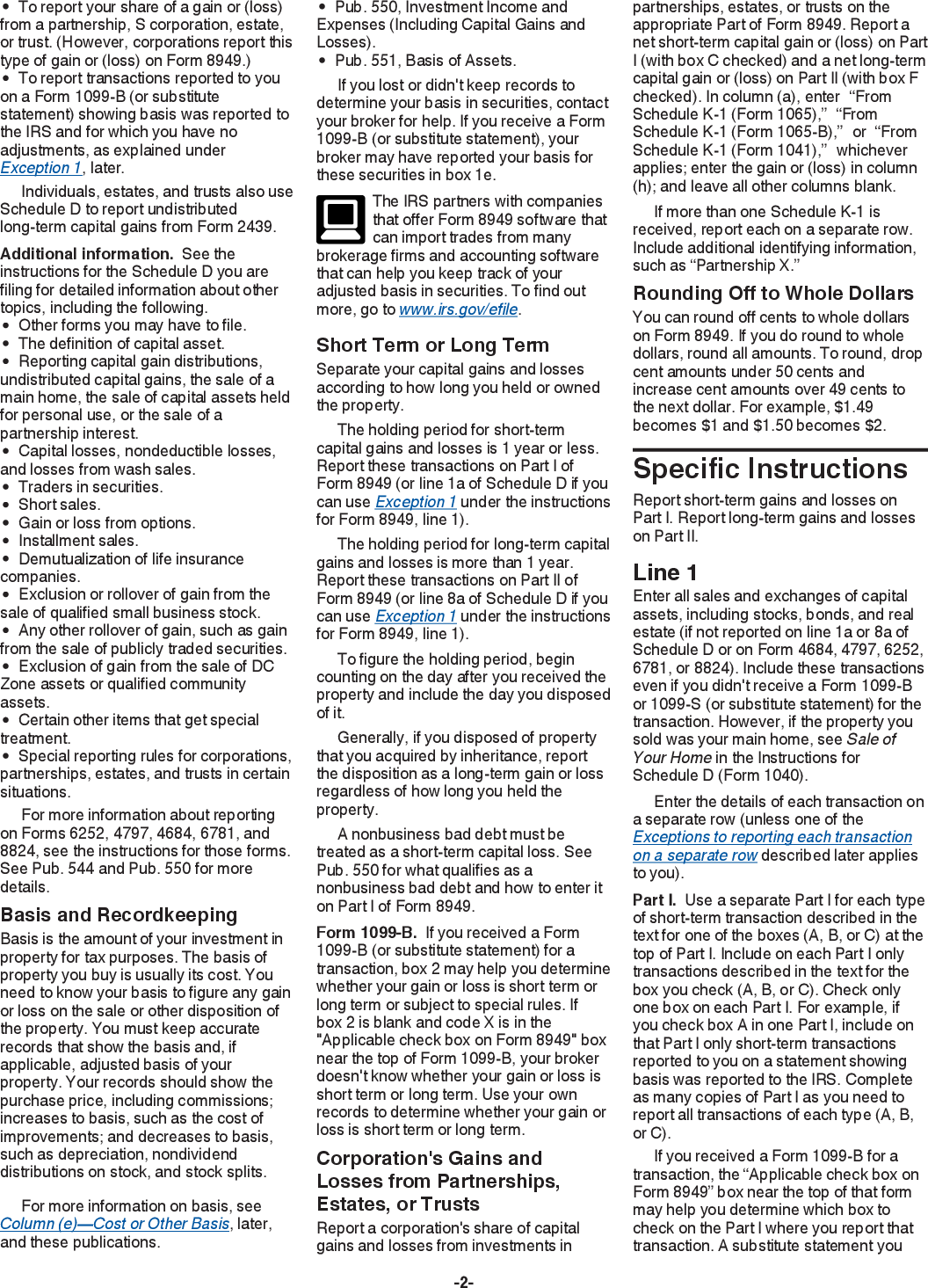

Top Form 8949 Templates free to download in PDF format

You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. And any carryover to 2011 of amounts not deductible in • ordering supplies. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of.

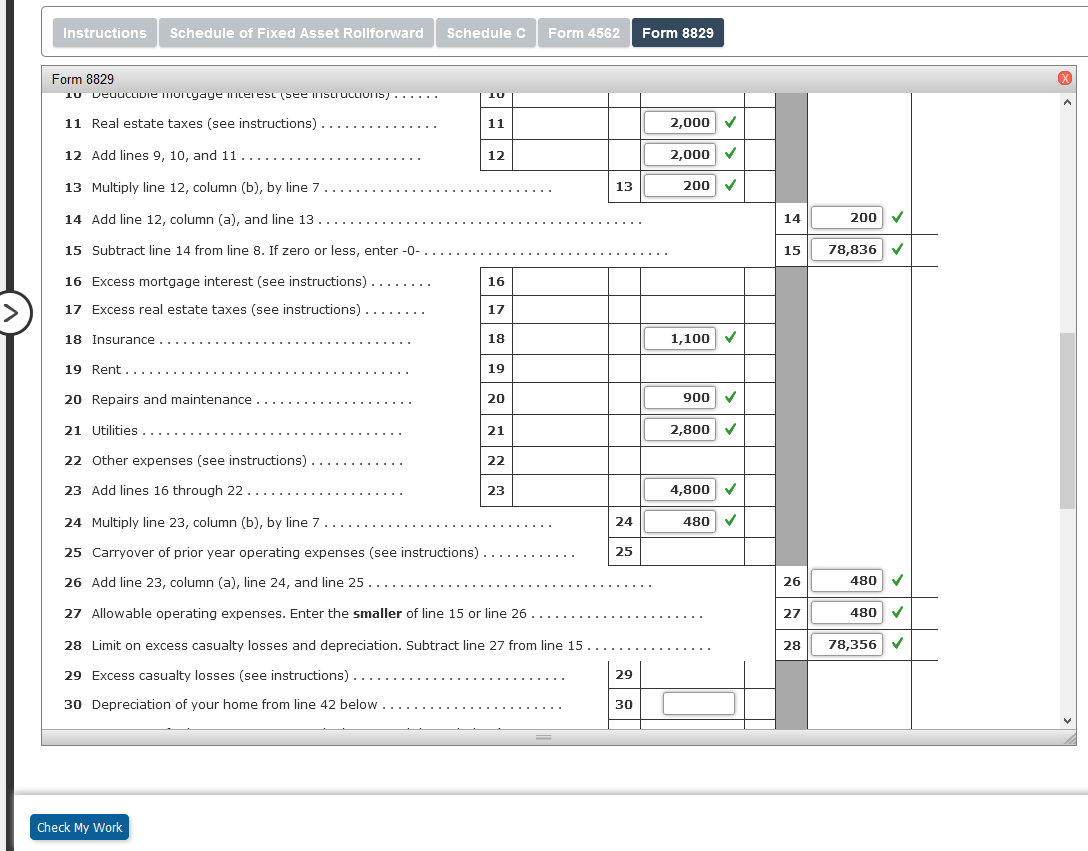

I NEED HELP WITH THE BLANKS PLEASE. """ALL

File only with schedule c (form 1040). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Expenses for business.

Business Use Of Home Form 8829 Instructions Daniel Bonner's Template

Business use of your home on schedule c (form 1040) • keeping books and records. Web use form 8829 to figure the allowable expenses for • billing customers, clients, or patients. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction. Web instructions for form.

Online generation of Schedule D and Form 8949 for 10.00

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. One of the many benefits of working at home is that you can deduct legitimate expenses.

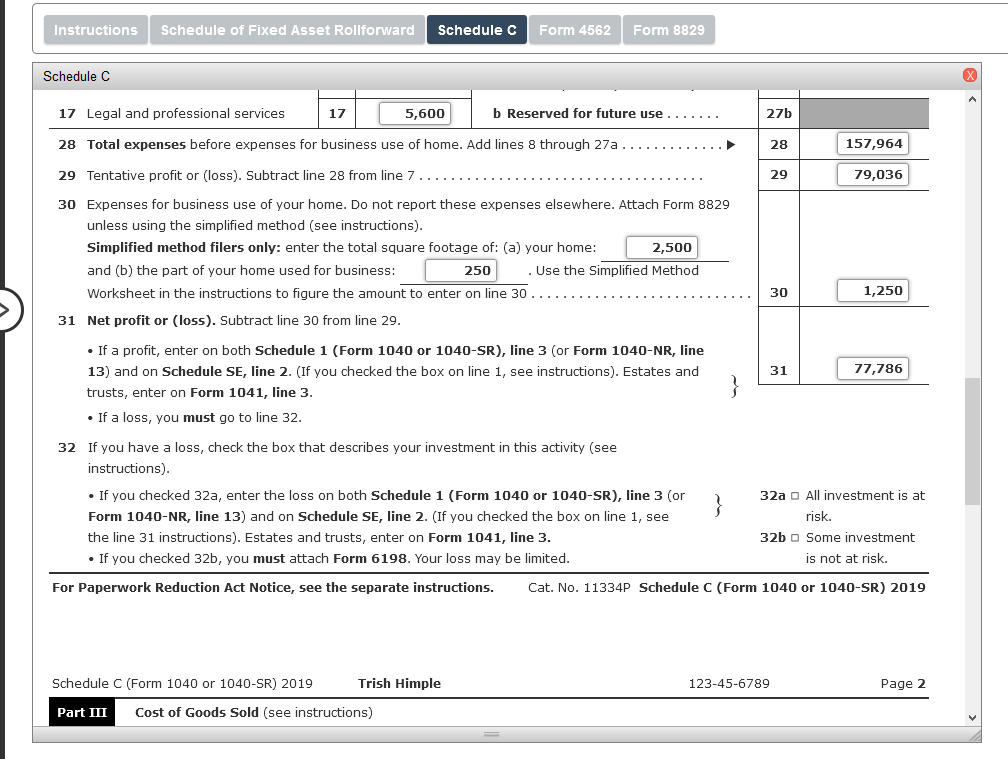

Solved Instructions Comprehensive Problem 81 Trish Himple

Web irs form 8829 is made for individuals that want to deduct home office expenses. Web instructions for form 8829 expenses for business use of your home department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web use form 8829 to figure the allowable expenses for • billing customers, clients, or.

2019 2020 IRS Instructions 8829 Fill Out Digital PDF Sample

For instructions and the latest information. Web for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8829. And any carryover to 2011 of amounts not deductible in • ordering supplies. Using the simplified method and reporting it directly on your schedule c, or by filing irs.

Online generation of Schedule D and Form 8949 for 10.00

Use a separate form 8829 for each home you used for business during the year. You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. And.

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

Department of the treasury internal revenue service. Web for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8829. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction. Use form 8829.

Web There Are Two Ways To Claim The Deduction:

Department of the treasury internal revenue service. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. For instructions and the latest information.

And Any Carryover To 2011 Of Amounts Not Deductible In • Ordering Supplies.

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Expenses for business use of your home. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. The irs determines the eligibility of an allowable home business space using two criterion:

File Only With Schedule C (Form 1040).

Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web instructions for form 8829 expenses for business use of your home department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You file it with your annual tax return, and information from this form appears on line 30 of your schedule c. Business use of your home on schedule c (form 1040) • keeping books and records.

Web Use Form 8829 To Figure The Allowable Expenses For • Billing Customers, Clients, Or Patients.

Web irs form 8829 is the form used to deduct expenses for your home business space. Web irs form 8829 helps you determine what you can and cannot claim. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction. Web for the latest information about developments related to form 8829 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8829.