Ohio Employee Withholding Form

Ohio Employee Withholding Form - This is due to the federal tax law changes. Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: Web this requirement to file an individual estimated income tax form it 1040es may also apply to an individual who has two jobs, both of which are subject to withholding. The ohio department of taxation provides a searchable repository of individual tax forms for. Please use the link below. Other tax forms — a. Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Employers engaged in a trade or business who. Web ohio — employee's withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. Web 1 my company administers retirement plans for our clients, which may include withholding ohio income tax from an individual’s retirement income.

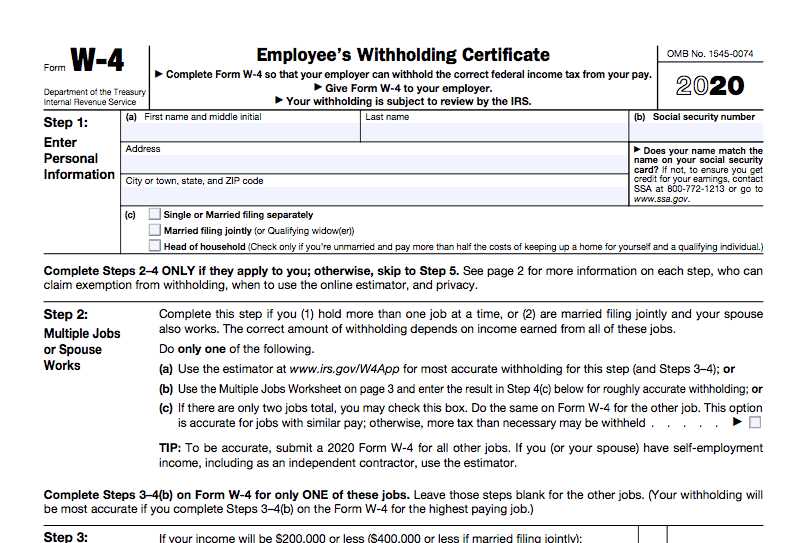

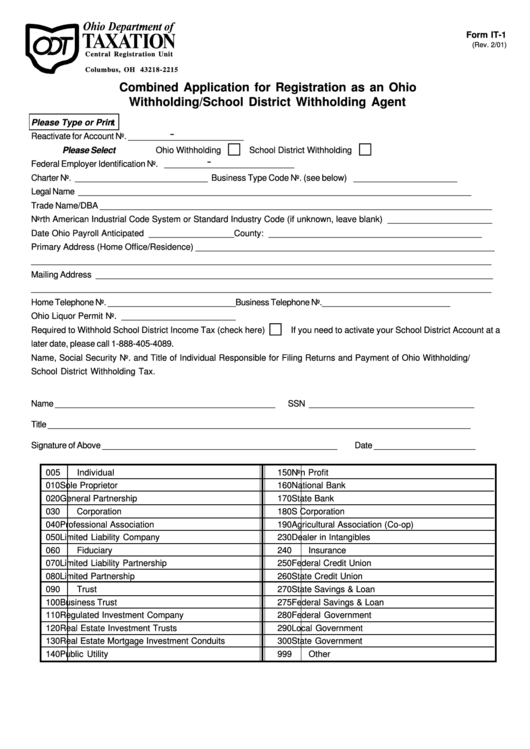

Otherwise, skip to step 5. Web access the forms you need to file taxes or do business in ohio. Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: Employers engaged in a trade or business who. Please use the link below. Web 1 my company administers retirement plans for our clients, which may include withholding ohio income tax from an individual’s retirement income. If your income will be $200,000 or less ($400,000 or less if. Complete and file form it 1, application for registration as an ohio withholding agent and mail the completed form to us. See page 2 for more information on each step, who can claim. The ohio department of taxation provides a searchable repository of individual tax forms for.

Employers engaged in a trade or business who. See page 2 for more information on each step, who can claim. Complete and file form it 1, application for registration as an ohio withholding agent and mail the completed form to us. Web ohio — employee's withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. By signing that form, both the employee and employer agree to be bound exclusively by the workers’ compensation laws of ohio. Web 1 my company administers retirement plans for our clients, which may include withholding ohio income tax from an individual’s retirement income. Employers engaged in a trade or business who pay. Web this requirement to file an individual estimated income tax form it 1040es may also apply to an individual who has two jobs, both of which are subject to withholding. Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: Web 2017 employer’s withholding instructions ohio withholding tax returns:

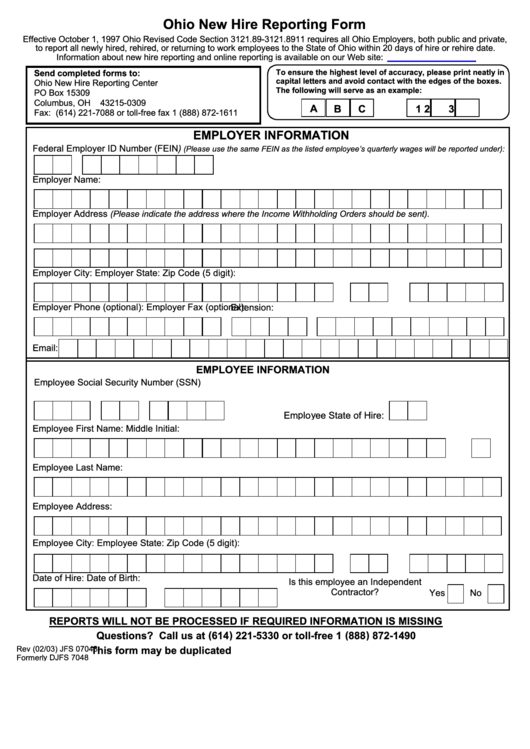

Ohio New Hire Reporting Form printable pdf download

By signing that form, both the employee and employer agree to be bound exclusively by the workers’ compensation laws of ohio. Web access the forms you need to file taxes or do business in ohio. See page 2 for more information on each step, who can claim. Please use the link below. Web if the employee does not complete the.

Ohio Farm Sales Tax Exemption Form Tax

Complete and file form it 1, application for registration as an ohio withholding agent and mail the completed form to us. Web 1 my company administers retirement plans for our clients, which may include withholding ohio income tax from an individual’s retirement income. Please use the link below. Employers engaged in a trade or business who pay. Web there are.

State Of Ohio Employee Withholding Form

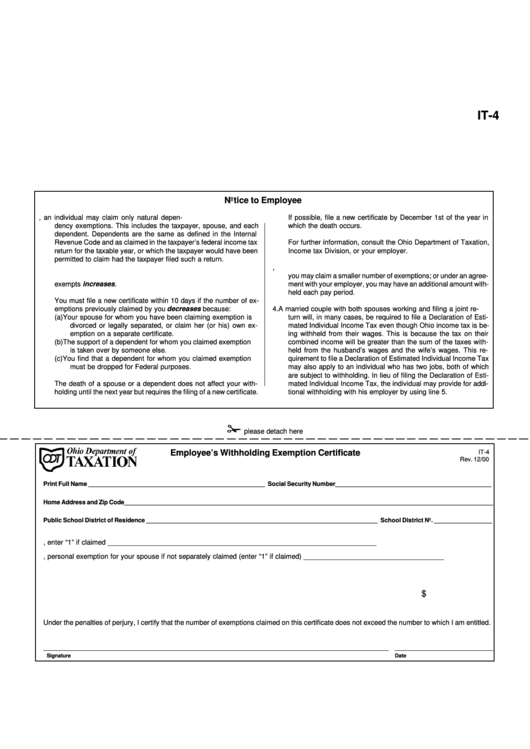

Web if the employee does not complete the it 4 and return it to his/her employer, the employer: Employee's withholding certificate form 941; Other tax forms — a. Please use the link below. If your income will be $200,000 or less ($400,000 or less if.

Ohio State Withholding Form It4 Exemptions

Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: If your income will be $200,000 or less ($400,000 or less if. Web 1 my company administers retirement plans for our clients, which may include withholding ohio income tax from an individual’s retirement.

Employee's Withholding Exemption Certificate Ohio Free Download

Web access the forms you need to file taxes or do business in ohio. See page 2 for more information on each step, who can claim. Web if the employee does not complete the it 4 and return it to his/her employer, the employer: Employee's withholding certificate form 941; Otherwise, skip to step 5.

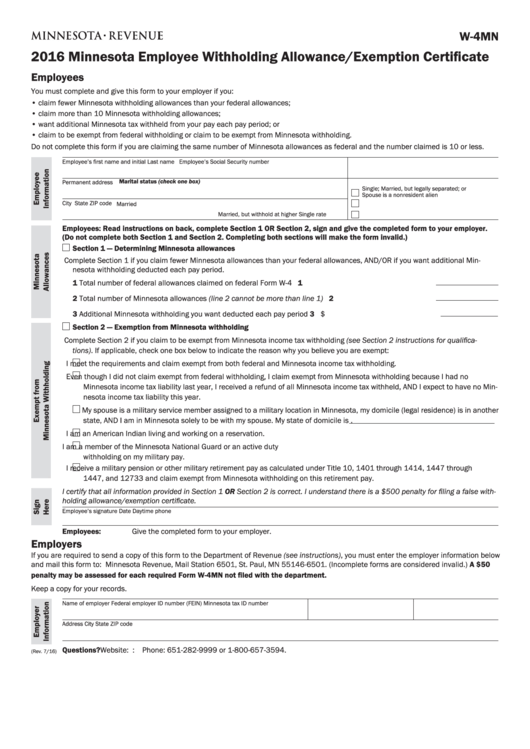

Idaho Withholding Forms For 2020 2022 W4 Form

Web if the employee does not complete the it 4 and return it to his/her employer, the employer: How do i report the ohio. Web 2017 employer’s withholding instructions ohio withholding tax returns: Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes:.

Federal Tax Withholding Certificate Gettrip24

Employers engaged in a trade or business who pay. How do i report the ohio. Web ohio — employee's withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. Please use the link below. Employee's withholding certificate form 941;

Fillable Form It1 Combined Application For Registration As An Ohio

If your income will be $200,000 or less ($400,000 or less if. By signing that form, both the employee and employer agree to be bound exclusively by the workers’ compensation laws of ohio. The ohio department of taxation provides a searchable repository of individual tax forms for. Web there are two ways to register: Employee's withholding certificate form 941;

Ohio Department Of Taxation Employee Withholding Form 2023

See page 2 for more information on each step, who can claim. How do i report the ohio. Z will withhold ohio tax based on the employee claiming zero exemptions, and zwill. Web access the forms you need to file taxes or do business in ohio. Employers engaged in a trade or business who.

Withholding Employee Form 2023

Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: Web if the employee does not complete the it 4 and return it to his/her employer, the employer: This is due to the federal tax law changes. Employee's withholding certificate form 941; Employers.

Otherwise, Skip To Step 5.

Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: Web ohio — employee's withholding exemption certificate download this form print this form it appears you don't have a pdf plugin for this browser. By signing that form, both the employee and employer agree to be bound exclusively by the workers’ compensation laws of ohio. Web this requirement to file an individual estimated income tax form it 1040es may also apply to an individual who has two jobs, both of which are subject to withholding.

If Your Income Will Be $200,000 Or Less ($400,000 Or Less If.

Employee's withholding certificate form 941; The ohio department of taxation provides a searchable repository of individual tax forms for. How do i report the ohio. Other tax forms — a.

Web 1 My Company Administers Retirement Plans For Our Clients, Which May Include Withholding Ohio Income Tax From An Individual’s Retirement Income.

Complete and file form it 1, application for registration as an ohio withholding agent and mail the completed form to us. Employee's withholding certificate form 941; Web we last updated the employee's withholding exemption certificate in february 2023, so this is the latest version of form it 4, fully updated for tax year 2022. Z will withhold ohio tax based on the employee claiming zero exemptions, and zwill.

Web There Are Two Ways To Register:

Employers engaged in a trade or business who pay. Web employee's withholding exemption certificate ohio department of taxation submit form it 4 to your employer on or before the start date of employment so your employer will. Employers engaged in a trade or business who. This is due to the federal tax law changes.