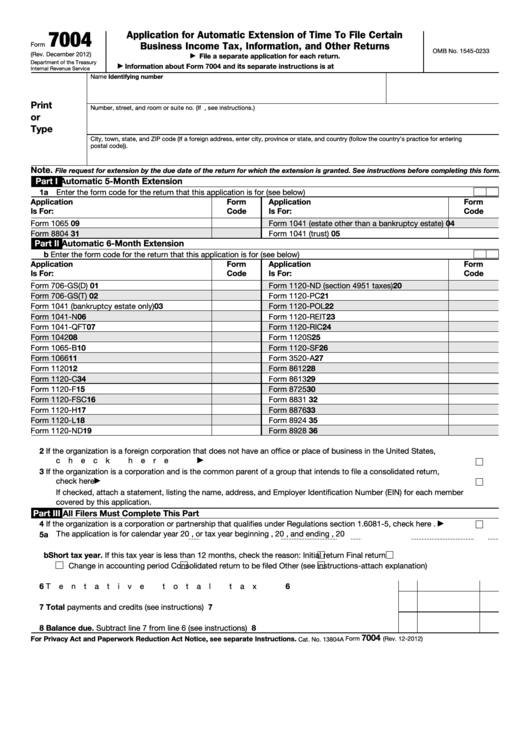

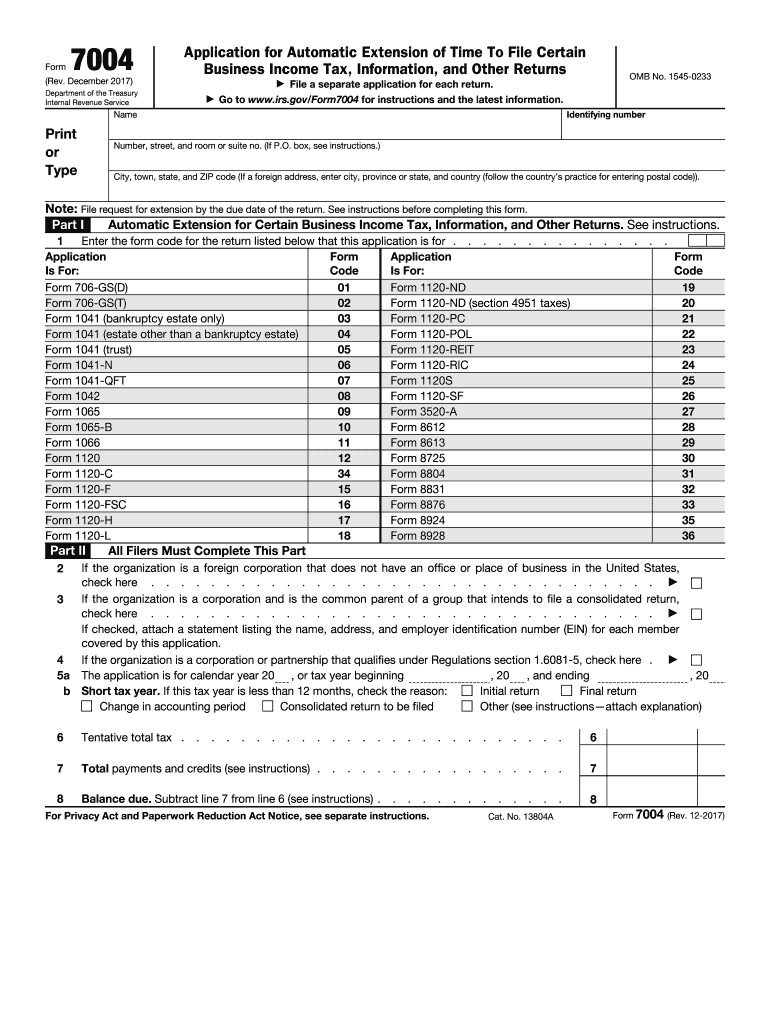

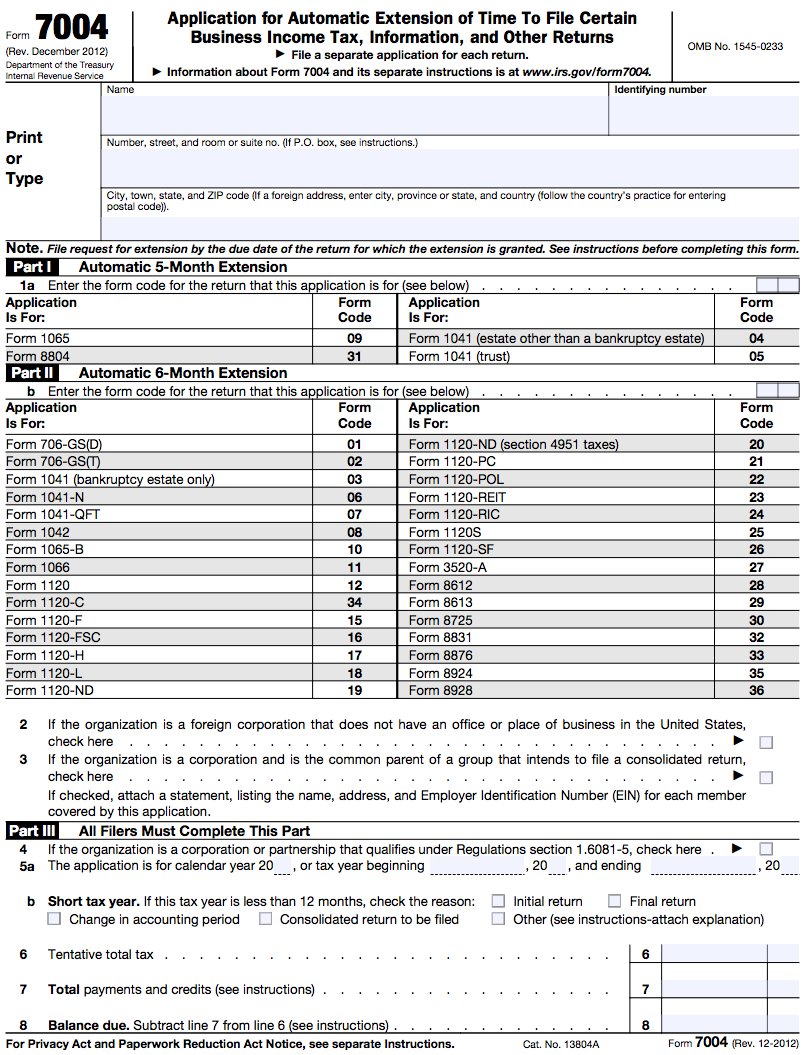

Form 7004 Instructions Where To File

Form 7004 Instructions Where To File - Web form 7004 is a federal corporate income tax form. Form 7004 can be filed electronically for most returns. You can also download and print an interactive version of. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Web address changes for filing form 7004. January 6, 2022 | last updated: Web navigate to the forms & instructions section, search for 2022 form 7004, and download the pdf file. Web get more assistance make an appointment who is eligible for an irs form 7004 extension? The address for filing form 7004 has changed for some entities. Most types of business entities can use form 7004.

Using the updated 2022 version is important to ensure you're submitting the. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Web navigate to the forms & instructions section, search for 2022 form 7004, and download the pdf file. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Most types of business entities can use form 7004. The address for filing form 7004 has changed for some entities. Web address changes for filing form 7004. Web 13 rows how and where to file. Web form 7004 is a document used by taxpayers to request a correction of a tax return.

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,. Similar irs forms there are also other irs forms with a similar purpose that. It is completed during a taxpayer’s preparation of a federal return and sent to the irs. January 6, 2022 | last updated: Web address changes for filing form 7004. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web form 7004 is a federal corporate income tax form. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. You can also download and print an interactive version of. Web get more assistance make an appointment who is eligible for an irs form 7004 extension?

How to file extension for business tax return arlokasin

Web irs form 7004 extends the filing deadline for another: Most types of business entities can use form 7004. Web for the latest information about developments related to form 7004 and its instructions, such as. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form.

Tax file application form pdf Australian guide User Instructions

Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Web in this guide, we cover it all, including: Similar irs forms there are also other irs forms with a similar purpose that. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Web all types of businesses.

2017 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Web for the latest information about developments related to form 7004 and its instructions, such as. Similar irs forms there are also other irs forms with a similar purpose that. Web irs form 7004 extends the filing deadline for another: Form 7004 can be filed electronically for most returns. Form 1041 6 monthsform 1120 follow these steps to print a.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Most types of business entities can use form 7004. Form 7004 can be filed electronically for most returns. The address for filing form 7004 has changed for some entities. You can also download and print an interactive version of. Web 13 rows how and where to file.

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

You can also download and print an interactive version of. Web form 7004 is a document used by taxpayers to request a correction of a tax return. Similar irs forms there are also other irs forms with a similar purpose that. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and.

Last Minute Tips To Help You File Your Form 7004 Blog

Web irs form 7004 extends the filing deadline for another: Form 7004 can be filed electronically for most returns. It is completed during a taxpayer’s preparation of a federal return and sent to the irs. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Using the updated 2022 version.

のん様ご専用 ありがとうございます♡ トートバッグ バッグ レディース 新着商品

Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web get more assistance make an appointment who is eligible for an irs form 7004 extension? Using the updated 2022 version is important to ensure you're submitting the. The address for filing form 7004 has changed for.

Where to file Form 7004 Federal Tax TaxUni

Web form 7004 is a document used by taxpayers to request a correction of a tax return. Web irs form 7004 extends the filing deadline for another: Web navigate to the forms & instructions section, search for 2022 form 7004, and download the pdf file. Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business:.

Irs Form 7004 amulette

Web navigate to the forms & instructions section, search for 2022 form 7004, and download the pdf file. Web address changes for filing form 7004. The address for filing form 7004 has changed for some entities. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,..

Form 7004 Instructions 2021 2022 IRS Forms TaxUni

Web in this guide, we cover it all, including: Form 7004 can be filed electronically for most returns. Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial.

Web For The Latest Information About Developments Related To Form 7004 And Its Instructions, Such As.

It'll also assist you with generating the. Using the updated 2022 version is important to ensure you're submitting the. Web navigate to the forms & instructions section, search for 2022 form 7004, and download the pdf file. The address for filing form 7004 has changed for some entities.

It Is Completed During A Taxpayer’s Preparation Of A Federal Return And Sent To The Irs.

Form 1041 6 monthsform 1120 follow these steps to print a 7004 in turbotax business: Web certain addresses where form 7004 needs to be sent were changed in the states of illinois, georgia, kentucky, michigan, tennessee, and wisconsin. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,. Web address changes for filing form 7004.

Web 13 Rows How And Where To File.

Web irs form 7004 extends the filing deadline for another: You can also download and print an interactive version of. Form 7004 can be filed electronically for most returns. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022.

January 6, 2022 | Last Updated:

February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Web form 7004 is a document used by taxpayers to request a correction of a tax return.