Form 3922 Reporting On 1040

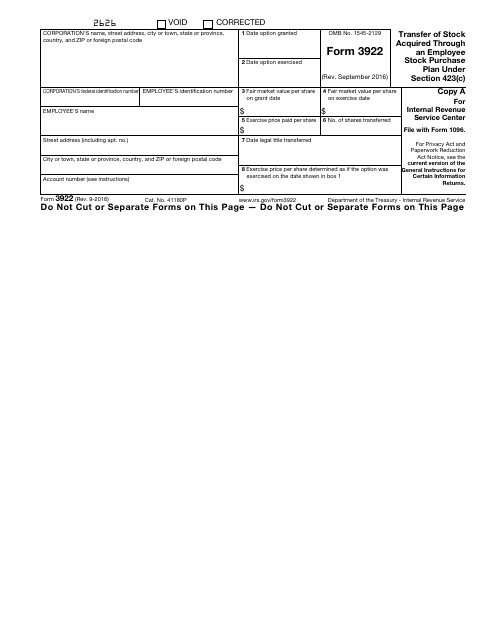

Form 3922 Reporting On 1040 - The irs was unable to verify the income and/or deductions claimed on the return with the records. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) form 3922 is an informational statement and would not. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web what is irs form 3922? You filed a tax return that is being audited. Like form 3921, save form 3922s with your investment records. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option.

Web why you received irs letter 1022. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web instructions for forms 3921 and 3922 (rev. The irs was unable to verify the income and/or deductions claimed on the return with the records. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. This is the first day of the offering period, also referred to as the subscription date or enrollment. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web only if you sold stock that was purchased through an espp (employee stock purchase plan).

Web what is irs form 3922? Web form 3922 is issued to report the income on your tax return when you sell the units. You filed a tax return that is being audited. Web this needs to be reported on your tax return. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Keep the form for your records because you’ll need the information when you sell, assign, or. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.

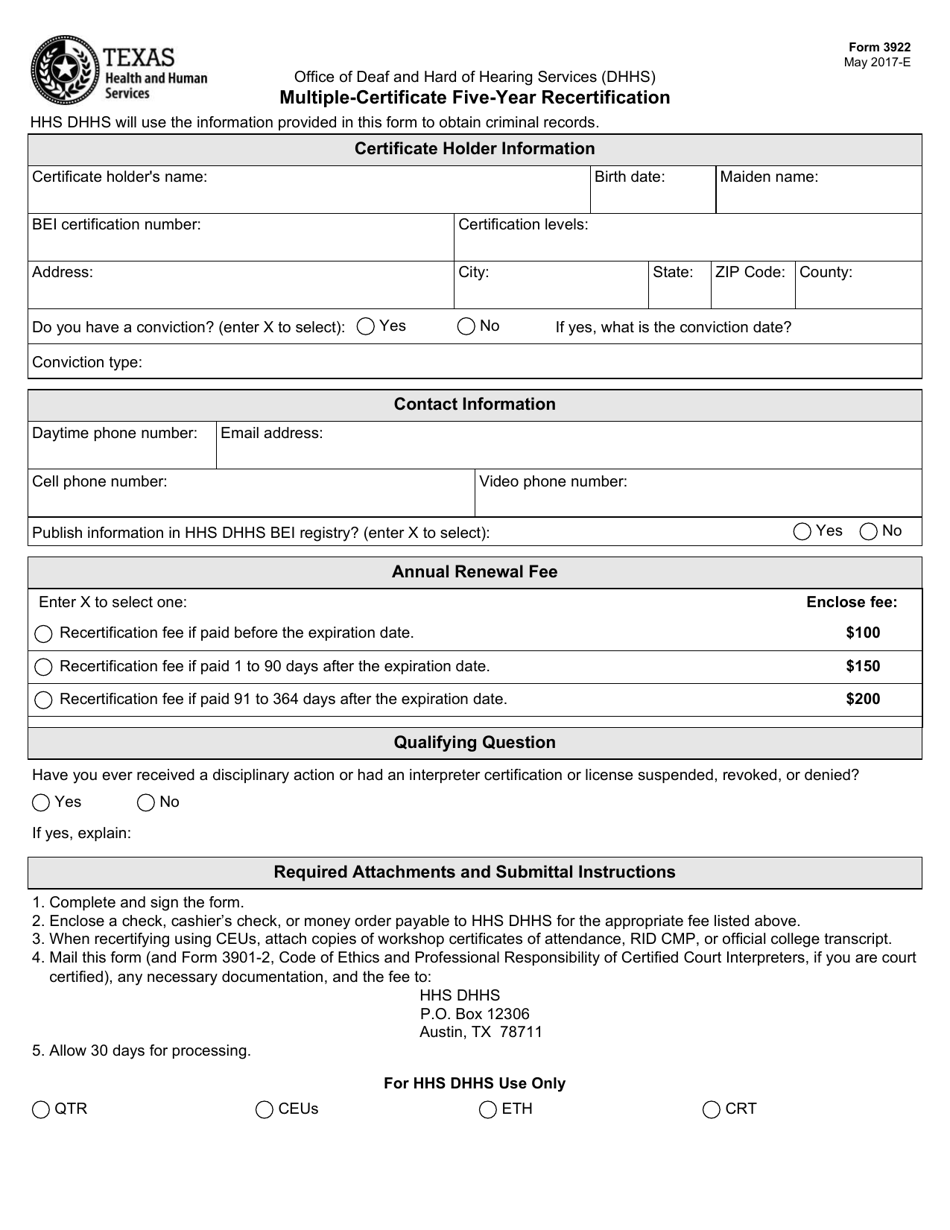

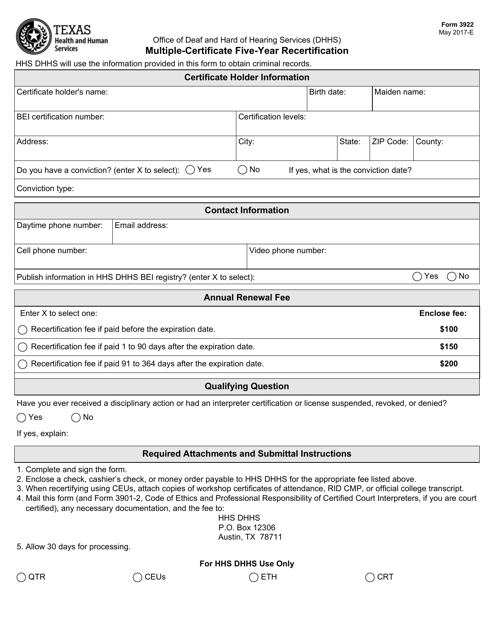

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) form 3922 is an informational statement and would not. You filed a tax return that is being audited. Keep the form for your records because you’ll need the information when you sell, assign, or. Web instructions for forms 3921 and 3922 (rev. Web.

IRS Form 3922

The irs was unable to verify the income and/or deductions claimed on the return with the records. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Like form 3921, save form 3922s with your investment records. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section.

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

You filed a tax return that is being audited. The irs was unable to verify the income and/or deductions claimed on the return with the records. This is the first day of the offering period, also referred to as the subscription date or enrollment. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c),.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web why you received irs letter 1022. The irs was unable to verify the income and/or deductions claimed on the return with the records. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. Web irs form 3922 is for.

Form 3922 Edit, Fill, Sign Online Handypdf

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web every corporation which in any calendar year transfers to any.

Form 3921 & Form 3922 IRC 6039 Reporting SPSGZ

Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option. Keep the form for your records because you’ll need the information when you sell, assign, or. This is the first day of the offering period, also referred.

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

This is the first day of the offering period, also referred to as the subscription date or enrollment. The irs was unable to verify the income and/or deductions claimed on the return with the records. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the.

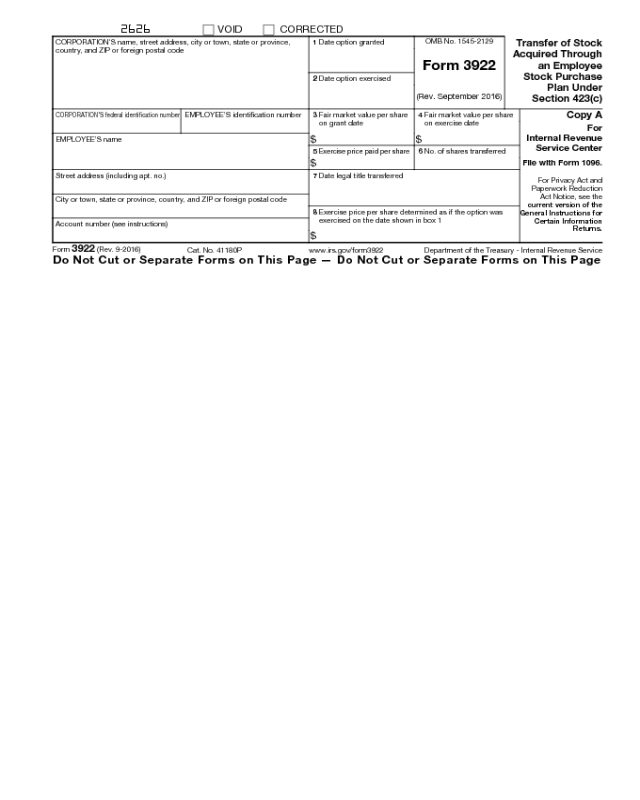

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired.

Documents to Bring To Tax Preparer Tax Documents Checklist

Like form 3921, save form 3922s with your investment records. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option. You filed a tax.

IRS Form 3922 Software 289 eFile 3922 Software

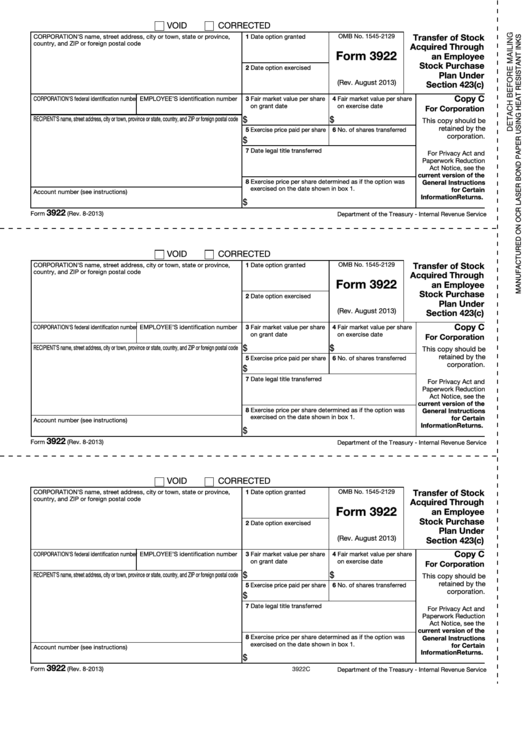

Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web every corporation which in.

Web Form 3922 Tax Reporting Includes The Following Information:

This needs to be reported on your tax return. Instructions for forms 3921 and 3922, exercise of an incentive stock option under. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web why you received irs letter 1022.

Web Form 3922 Is Issued To Report The Income On Your Tax Return When You Sell The Units.

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of the stock acquired through the espp. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you acquired pursuant to your exercise of an option. The irs was unable to verify the income and/or deductions claimed on the return with the records.

Keep The Form For Your Records Because You’ll Need The Information When You Sell, Assign, Or.

You filed a tax return that is being audited. The information on form 3922 will help determine your cost or other basis, as well as your holding period. Like form 3921, save form 3922s with your investment records. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a.

This Is The First Day Of The Offering Period, Also Referred To As The Subscription Date Or Enrollment.

Web it sends two copies of form 3922—one to the employee and another to the irs—to document the transfer of the shares. Web instructions for forms 3921 and 3922 (rev. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option.