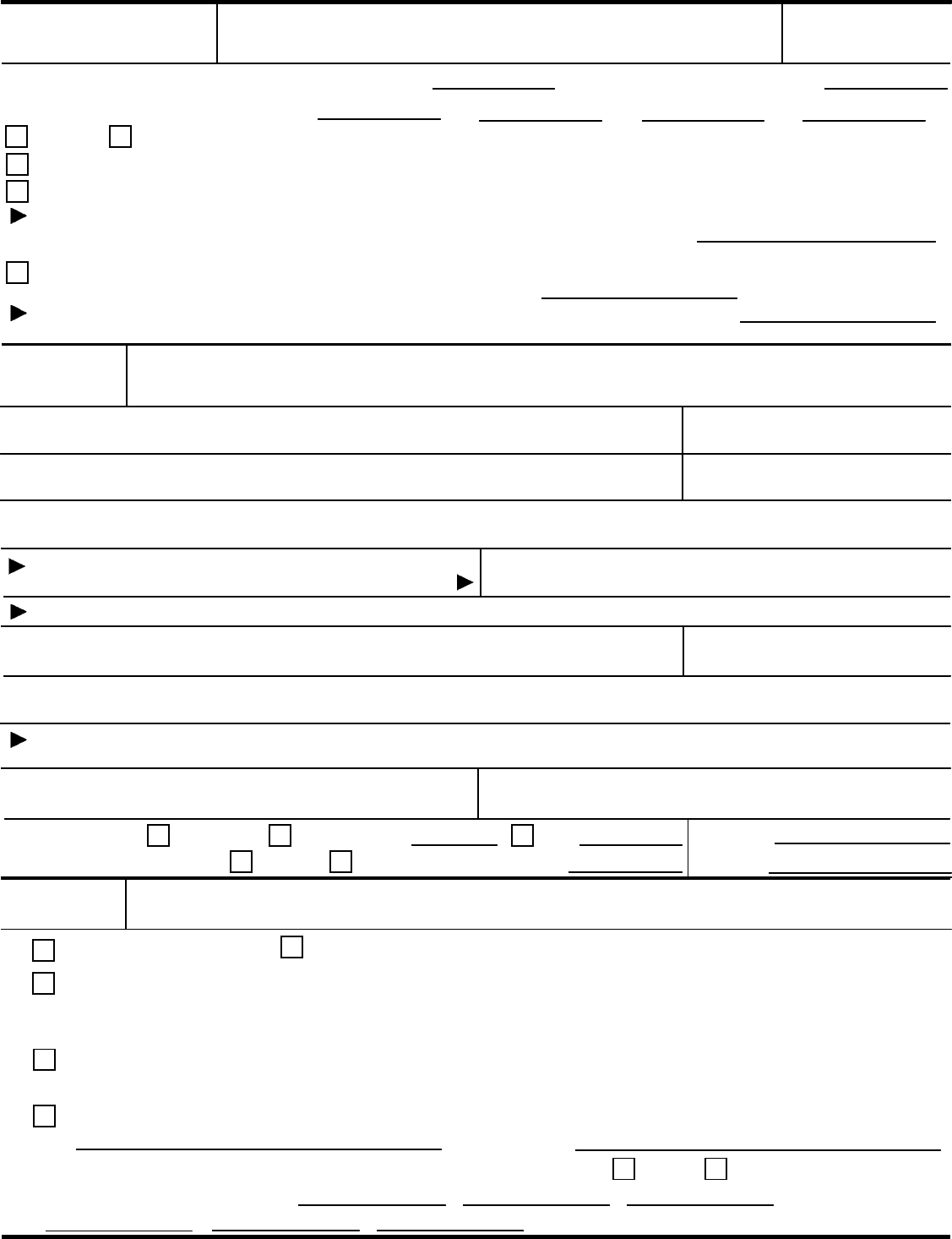

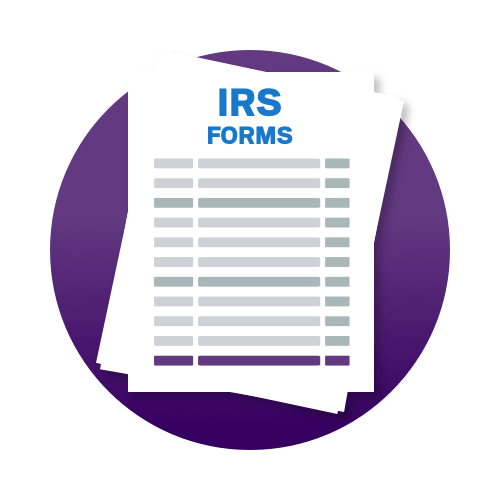

Form 3911 Filled Out Example

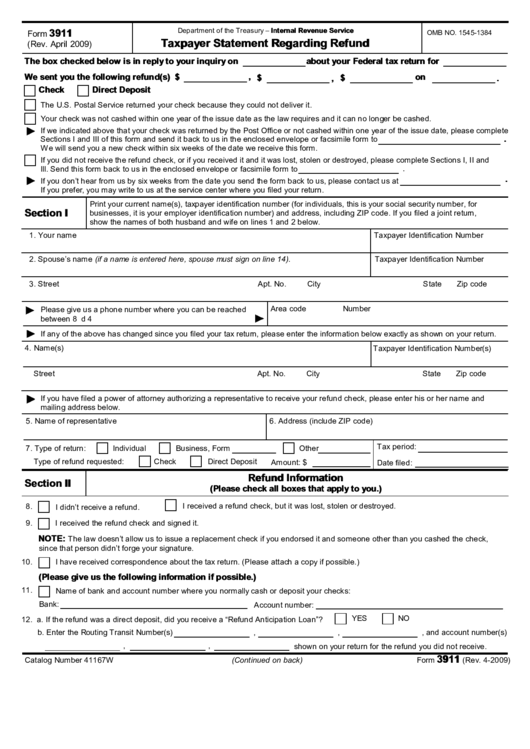

Form 3911 Filled Out Example - To complete this document, you'll need certain information about the tax return for which you are inquiring. Web irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. John doe, 123 main st., anytown, usa, ssn: Web 15 february 2021 from the irs economic impact payment information center faq : Web jo willetts, ea director, tax resources published on: Web updated video with example: The form initiates a ‘payment trace’ and includes the phrase: The irs will usually fill out the top part of the form. Web form 3911 is also known as a taxpayer statement regarding refund. Get everything done in minutes.

Select the document you will need in the library of templates. Examples of 3911 form sections. Download the irs form 3911. John doe, 123 main st., anytown, usa, ssn: About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. The information below is in reply to your inquiry on. Web select the get form option to begin editing. Select the fillable fields and put the requested data. You should consider filing form 3911 to get the irs to send a new refund check. Web form 3911 is used by a taxpayer who was issued a refund either by direct deposit or paper check and has not received it.

John doe, 123 main st., anytown, usa, ssn: Get everything done in minutes. If successful, the irs will issue a replacement check to the taxpayer. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more. Fill in every fillable field. Web jo willetts, ea director, tax resources published on: Form 3911 is completed by the taxpayer to provide the service with information needed to trace the nonreceipt or loss of the already issued refund check. To complete this document, you'll need certain information about the tax return for which you are inquiring. The form's initial purpose was notifying the irs that the refund check was missing.

Form 3911 Taxpayer Statement Regarding Refund (2012) Free Download

• how to fill out i. John doe, 123 main st., anytown, usa, ssn: Web updated video with example: Web follow these simple guidelines to get form 3911 completely ready for sending: The 3911 form consists of several sections that require your personal information, tax details, and a description of the issue you are experiencing.

Form 3911 Edit, Fill, Sign Online Handypdf

Web updated video with example: Web irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. Select the fillable fields and put the requested data. Web 15 february 2021 from the irs economic impact payment information center faq : The irs will usually fill out the top.

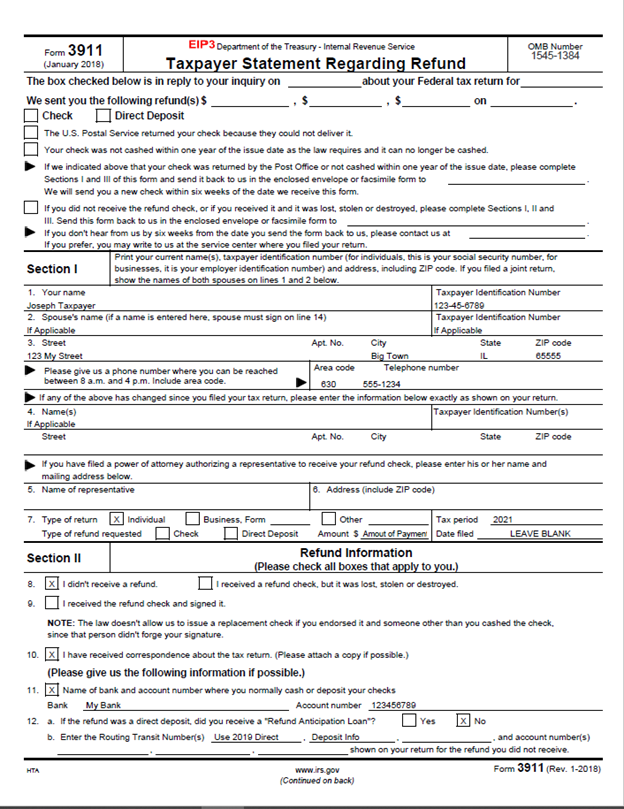

2019 Form IRS 2441 Fill Online, Printable, Fillable, Blank pdfFiller

The irs will usually fill out the top part of the form. Web mail or fax irs form 3911, if you live in: Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. Step 1 visit irs official irs page and find the form.

Form 3911 Fill out & sign online DocHub

Select the fillable fields and put the requested data. About your federal tax refund forif you did not receive your refund or if the refund check you received was lost, stolen or destroyed, complete the. Web jo willetts, ea director, tax resources published on: Web form 3911 is used by a taxpayer who was issued a refund either by direct.

Form 3911 Never received tax refund or Economic Impact Payment

Web select the get form option to begin editing. Web follow these simple guidelines to get form 3911 completely ready for sending: The form's initial purpose was notifying the irs that the refund check was missing. A taxpayer completes this form to inquire about the status of an expected refund. If successful, the irs will issue a replacement check to.

FORM FDA 3911 Instructional Supplement. Instructions for Completion of

Examples of 3911 form sections. The form initiates a ‘payment trace’ and includes the phrase: Web mail or fax irs form 3911, if you live in: Did you not receive your tax refund or stimulus check? The information below is in reply to your inquiry on.

Third Round Economic Impact Payment Discrepancy

Fill in every fillable field. To complete this document, you'll need certain information about the tax return for which you are inquiring. Web form 3911 is also known as a taxpayer statement regarding refund. The 3911 form consists of several sections that require your personal information, tax details, and a description of the issue you are experiencing. You may use.

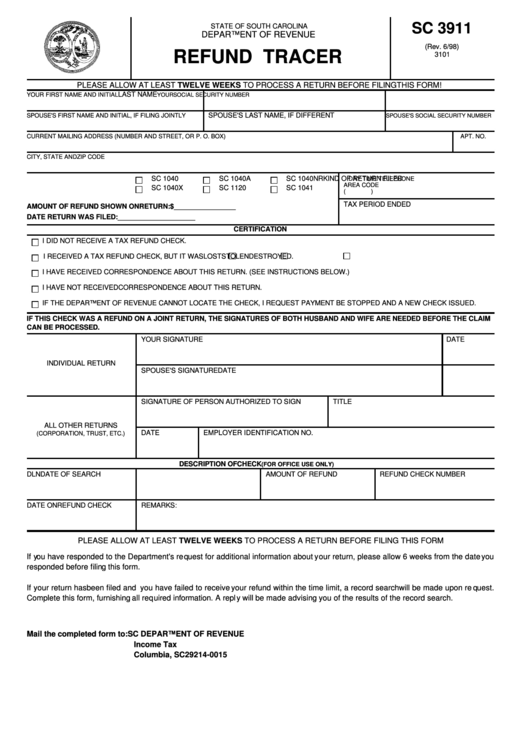

Fillable Form Sc 3911 Refund Tracer 1998 printable pdf download

Form 3911 is completed by the taxpayer to provide the service with information needed to trace the nonreceipt or loss of the already issued refund check. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web how to fill out the 3911 form. Under penalties of perjury, i declare that.

3.11.15 Return of Partnership Internal Revenue Service

Knott 13k subscribers join save 38k views 1 year ago #stimuluscheck #irs correction: Get everything done in minutes. The information below is in reply to your inquiry on. To complete this document, you'll need certain information about the tax return for which you are inquiring. Download the irs form 3911.

Form 3911 Taxpayer Statement Regarding Refund (Fillible) printable

You aren’t required to give us the information since the refund you claimed has already been issued. Switch on the wizard mode in the top toolbar to get more suggestions. Did you not receive your tax refund or stimulus check? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Download.

Open The Document In The Online Editing Tool.

First, you need to download the irs form 3911 from the internal revenue service. Web irs form 3911, taxpayer statement regarding refund, is the tax form that a taxpayer may use to inform the irs of a missing tax refund. We ask for the information on this form to carry out the internal revenue laws of the united states. Web select the get form option to begin editing.

If This Refund Was From A Joint Return, We Need The Signatures Of Both Husband And Wife Before We Can Trace It.

Get everything done in minutes. Web how to fill out irs form 3911 for a lost stimulus check jason d. Examples of 3911 form sections. Get everything done in minutes.

Fill In Every Fillable Field.

Form 3911 is completed by the taxpayer to provide the service with information needed to trace the nonreceipt or loss of the already issued refund check. Make sure the details you fill in printable irs form 3911 form is updated and correct. To complete this document, you'll need certain information about the tax return for which you are inquiring. John doe, 123 main st., anytown, usa, ssn:

Web Form 3911 Is Also Known As A Taxpayer Statement Regarding Refund.

Web updated video with example: A taxpayer completes this form to inquire about the status of an expected refund. Web irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. Download the irs form 3911.