Irs Form 9423

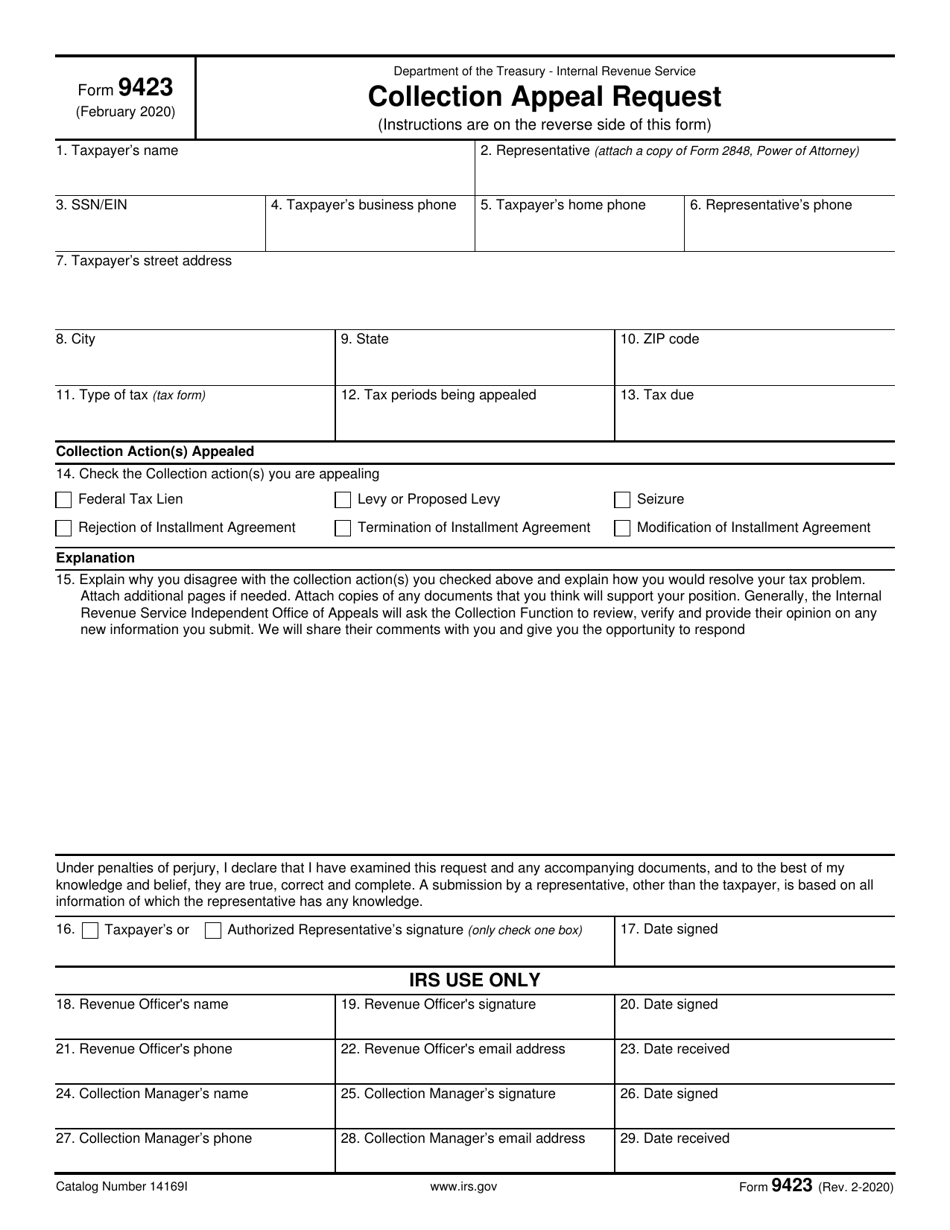

Irs Form 9423 - We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Step 1) the first part of the form preparation involves the taxpayer providing personal information such as: Web instructions for form 9423, collection appeal request for liens, levies, seizures, and rejection, modification or termination of installment agreements a taxpayer, or third party whose property is subject to a collection action, may appeal the following actions under the collection appeals Web what is the purpose of tax form 9423? Web complete form 9423, collection appeals request pdf; Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals (appeals) preferably via form 9423, collection appeal request if you have been contacted by a revenue officer or verbally or in writing if your only contact with the irs has been. Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you. Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment agreement. The way you request the cap depends on the type of action you are appealing and what contact you. Submit the completed form 9423 to the revenue officer within 3 business days of your conference with the collection manager;

Web what is the purpose of tax form 9423? We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The way you request the cap depends on the type of action you are appealing and what contact you. For more information, refer to. Step 1) the first part of the form preparation involves the taxpayer providing personal information such as: Request an appeal of the following actions: Representatives name and 2848 poa; Web taxpayer background (form 9423: Web complete form 9423, collection appeals request pdf; Form 12153, request for a collection due process hearing pdf.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. You can attach supporting documentation, and should explain how you intend to resolve your tax problem. Submit the completed form 9423 to the revenue officer within 3 business days of your conference with the collection manager; Web employer's quarterly federal tax return. Web what is the purpose of tax form 9423? Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Web taxpayer background (form 9423: We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Step 1) the first part of the form preparation involves the taxpayer providing personal information such as: Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals (appeals) preferably via form 9423, collection appeal request if you have been contacted by a revenue officer or verbally or in writing if your only contact with the irs has been.

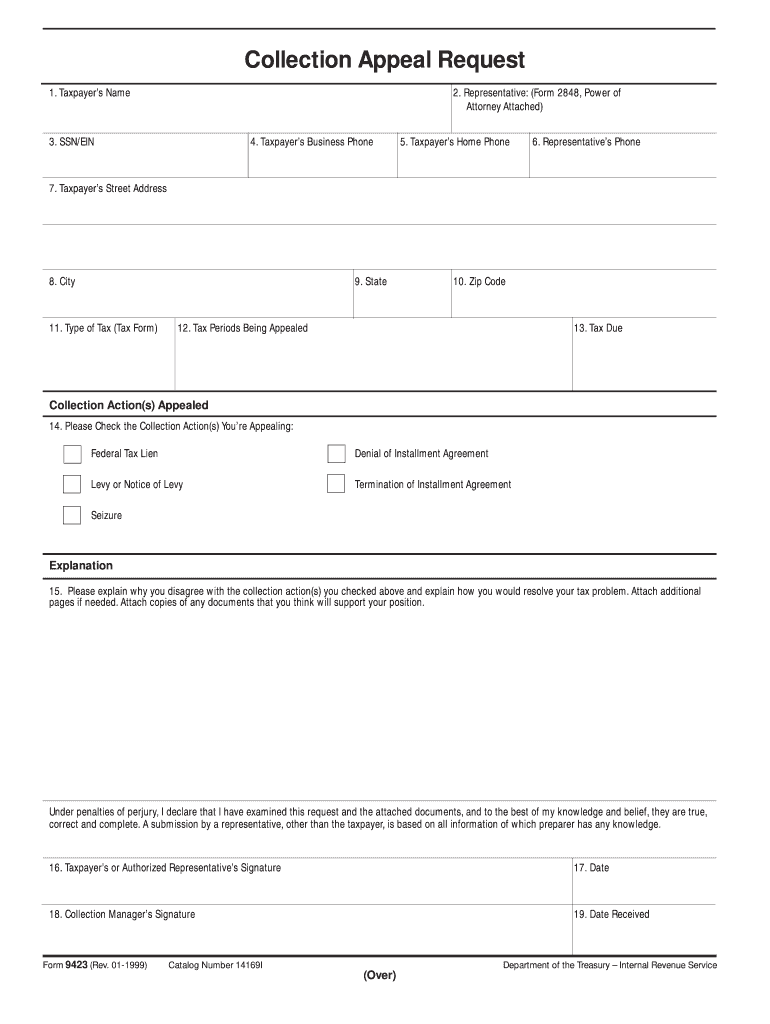

1999 Form IRS 9423 Fill Online, Printable, Fillable, Blank PDFfiller

Collection action appealed (form 9423: Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment agreement. You can attach supporting documentation, and should explain how you intend to resolve your tax problem. Web what is the purpose.

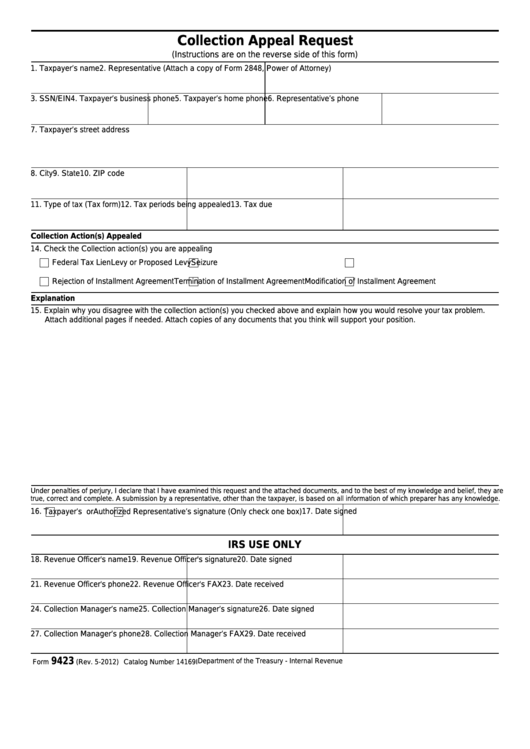

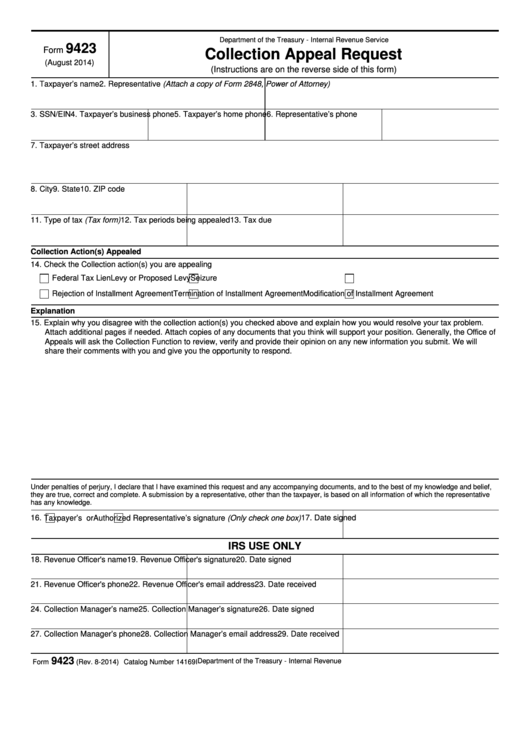

Form 9423 Collection Appeal Request (2014) Free Download

Submit the completed form 9423 to the revenue officer within 3 business days of your conference with the collection manager; Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals (appeals) preferably via form 9423, collection appeal request if you have been contacted.

Fillable Form 9423 Collection Appeal Request printable pdf download

Web complete form 9423, collection appeals request pdf; The way you request the cap depends on the type of action you are appealing and what contact you. What is the collection appeals program (cap)? This form is for income earned in tax year 2022, with tax returns due in april 2023. Collection action appealed (form 9423:

Form 9423 Collection Appeal Request 2014 printable pdf download

Step 1) the first part of the form preparation involves the taxpayer providing personal information such as: Web if you do not resolve your disagreement with the collection manager, you can submit a written request for consideration by the irs independent office of appeals (appeals) preferably via form 9423, collection appeal request if you have been contacted by a revenue.

IRS Form 9423A Guide to Your Collection Appeal Request

Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you. The way you request the cap depends on the type of action you are appealing and what contact you. What is the collection appeals program (cap)? We will update this page with a new version of the form for 2024 as.

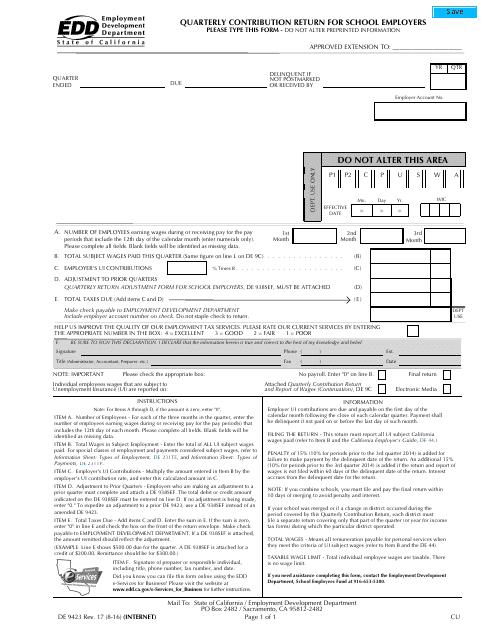

Form DE9423 Download Fillable PDF or Fill Online Quarterly

Collection action appealed (form 9423: Taxpayers use the collection appeals program (cap) to appeal irs collection actions. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web if you do not resolve your disagreement with the collection manager, you can submit a written request.

IRS Form 982 is Your Friend if You Got a 1099C

Web instructions for form 9423, collection appeal request for liens, levies, seizures, and rejection, modification or termination of installment agreements a taxpayer, or third party whose property is subject to a collection action, may appeal the following actions under the collection appeals The way you request the cap depends on the type of action you are appealing and what contact.

Form 9423 Collection Appeal Request (2014) Free Download

Web form 9423, collection appeals request pdf. Form 12153, request for a collection due process hearing pdf. Web taxpayer background (form 9423: We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web if you do not resolve your disagreement with the collection manager, you.

Fill Free fillable I942 (USCIS) PDF form

Web taxpayer background (form 9423: For more information, refer to. Collection action appealed (form 9423: Instructions for form 941 pdf Submit the completed form 9423 to the revenue officer within 3 business days of your conference with the collection manager;

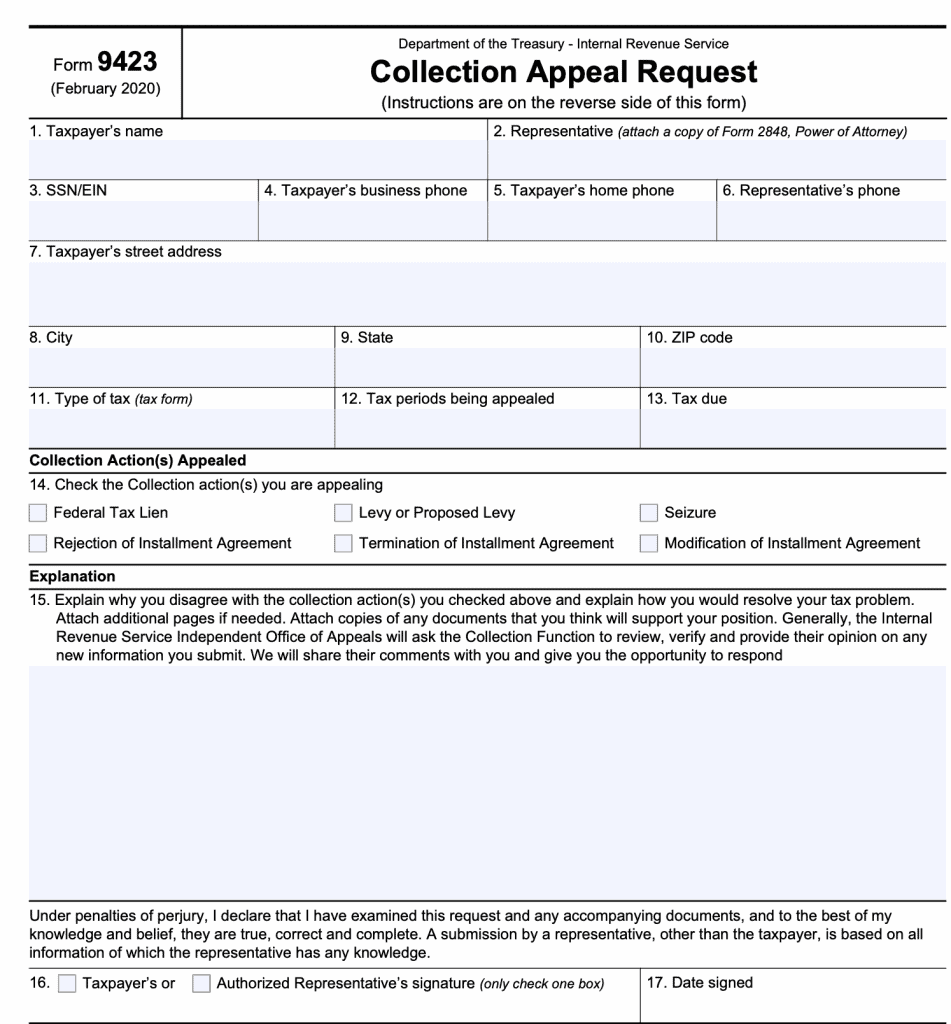

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

This form is for income earned in tax year 2022, with tax returns due in april 2023. The way you request the cap depends on the type of action you are appealing and what contact you. Representatives name and 2848 poa; Taxpayers use the collection appeals program (cap) to appeal irs collection actions. Web we last updated federal form 9423.

You Can Attach Supporting Documentation, And Should Explain How You Intend To Resolve Your Tax Problem.

Collection action appealed (form 9423: Step 1) the first part of the form preparation involves the taxpayer providing personal information such as: What is the collection appeals program (cap)? Tax form 9423 (collection appeal request) is used to appeal a collection action taken by the irs against you.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Web complete form 9423, collection appeals request pdf; Form 12153, request for a collection due process hearing pdf. Representatives name and 2848 poa; The way you request the cap depends on the type of action you are appealing and what contact you.

Instructions For Form 941 Pdf

Web we last updated federal form 9423 in february 2023 from the federal internal revenue service. Web taxpayer background (form 9423: Web submit this form to the irs to appeal a collection action being taken against you for unpaid federal taxes, such as a federal tax lien, tax levy, seizure, or rejection of installment agreement. Request an appeal of the following actions:

Notice Of Federal Tax Lien, Levy, Seizure, Or Termination Of An Installment Agreement.

Web instructions for form 9423, collection appeal request for liens, levies, seizures, and rejection, modification or termination of installment agreements a taxpayer, or third party whose property is subject to a collection action, may appeal the following actions under the collection appeals We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Submit the completed form 9423 to the revenue officer within 3 business days of your conference with the collection manager; Taxpayers use the collection appeals program (cap) to appeal irs collection actions.