Form 3800 Instructions

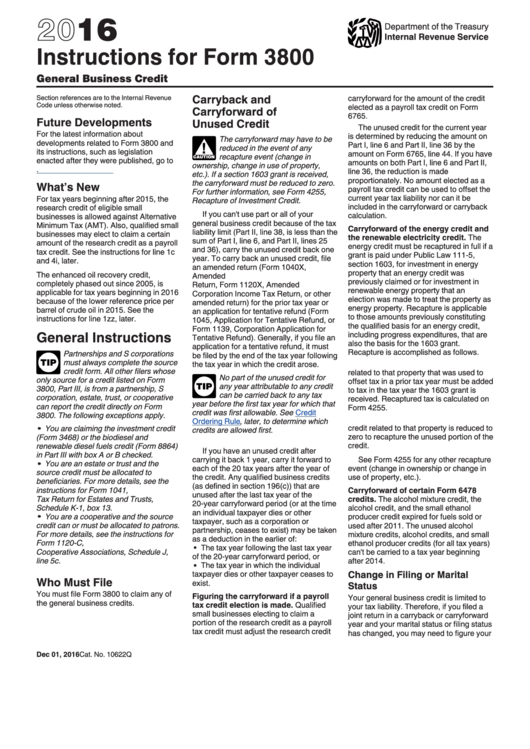

Form 3800 Instructions - Irs form 3800 is used to record certain tax credits to reduce taxes for the year. See the definition of eligible small business, earlier. For more information, please visit the shipping page. Required information for a valid research credit claim for refund. Department of the treasury internal revenue service. Web found in the 2021 instructions for form 540. Income tax return for cooperative associations, schedule j, line 5c. Tip carryback and carryforward of unused credit the carryforward may have to be reduced in the event of any recapture event (change in Tax credits are often set up to give incentives to businesses for certain activities. Web what is form 3800?

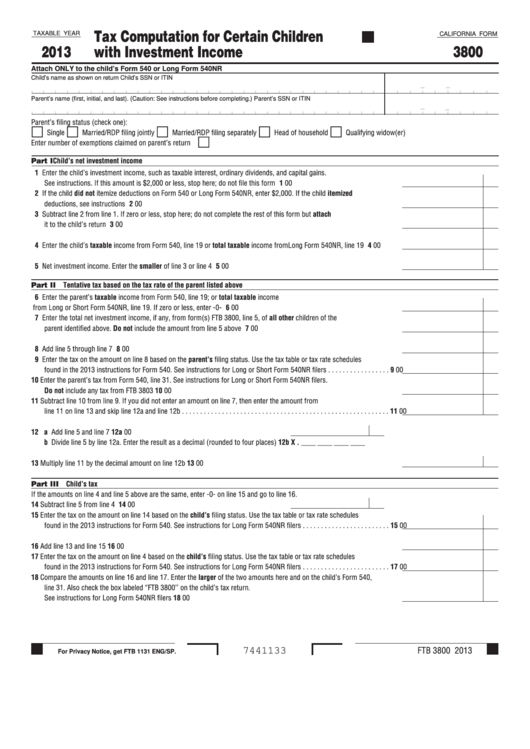

Compare the amounts on line 16 and line 17. Also check the box labeled “ftb 3800’’ on the child’s tax return. See instructions for form 540nr filers This product ships in a pack of 10. For more information, please visit the shipping page. Web a qualified small business must complete form 3800 before completing section d of form 6765 if the payroll tax credit is being claimed. Irs form 3800 is used to record certain tax credits to reduce taxes for the year. Tip carryback and carryforward of unused credit the carryforward may have to be reduced in the event of any recapture event (change in Required information for a valid research credit claim for refund. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax return.

For more information, please visit the shipping page. Enter the larger of the two amounts here and on the child’s form 540, line 31. Income tax return for cooperative associations, schedule j, line 5c. Department of the treasury internal revenue service. Web what is form 3800? See instructions for form 540nr filers Irs form 3800 is used to record certain tax credits to reduce taxes for the year. Pay the applicable extra services fee. For instructions and the latest information. This product ships in a pack of 10.

Instructions For Form 3800 General Business Credit 2007 printable

Web what is form 3800? Web complete ps form 3800. Tax credits are often set up to give incentives to businesses for certain activities. Department of the treasury internal revenue service. Required information for a valid research credit claim for refund.

Form 3800 Instructions How to Fill out the General Business Credit

This product ships in a pack of 10. Irs form 3800 is used to record certain tax credits to reduce taxes for the year. See instructions for form 540nr filers Request a postmark for your ps form 3800 for evidence the item was mailed. Who must file you must file form 3800 to claim any of the general business credits.

Irs form 3800 instructions

For instructions and the latest information. Tax credits are often set up to give incentives to businesses for certain activities. This product ships in a pack of 10. Request a postmark for your ps form 3800 for evidence the item was mailed. See instructions for form 540nr filers

Form 8936 Edit, Fill, Sign Online Handypdf

Web found in the 2021 instructions for form 540. Eligible small businesses, enter your research credit on line 4i. Required information for a valid research credit claim for refund. This product ships in a pack of 10. Compare the amounts on line 16 and line 17.

Form 3800 General Business Credit (2014) Free Download

See instructions for form 540nr filers. See the instructions for form 6765 for more details. Pay the applicable extra services fee. For more information, please visit the shipping page. Who must file you must file form 3800 to claim any of the general business credits.

Instructions For Form 3800 General Business Credit Internal Revenue

• section 45q carbon oxide sequestration credit with respect to new and existing equipment, earned and reported on form 8933, lines 1c, 2c, 3c, 4c, 5c, 6c, 7c, Enter the larger of the two amounts here and on the child’s form 540, line 31. See the instructions for form 6765 for more details. See instructions for form 540nr filers. See.

Form 3800 Instructions

Tax credits are often set up to give incentives to businesses for certain activities. Request a postmark for your ps form 3800 for evidence the item was mailed. Pay the applicable extra services fee. Irs form 3800 is used to record certain tax credits to reduce taxes for the year. You must attach all pages of form 3800, pages 1,.

Fillable California Form 3800 Tax Computation For Certain Children

You must attach all pages of form 3800, pages 1, 2, and 3, to your tax return. Tip carryback and carryforward of unused credit the carryforward may have to be reduced in the event of any recapture event (change in Eligible small businesses, enter your research credit on line 4i. For more information, please visit the shipping page. Irs form.

Form 3800General Business Credit

Web what is form 3800? This product ships in a pack of 10. Web complete ps form 3800. See the instructions for form 6765 for more details. Tip carryback and carryforward of unused credit the carryforward may have to be reduced in the event of any recapture event (change in

Instructions For Form 3800 2016 printable pdf download

For instructions and the latest information. Department of the treasury internal revenue service. Income tax return for cooperative associations, schedule j, line 5c. Also check the box labeled “ftb 3800’’ on the child’s tax return. See the instructions for form 6765 for more details.

Eligible Small Businesses, Enter Your Research Credit On Line 4I.

Who must file you must file form 3800 to claim any of the general business credits. Also check the box labeled “ftb 3800’’ on the child’s tax return. Compare the amounts on line 16 and line 17. Request a postmark for your ps form 3800 for evidence the item was mailed.

Web Complete Ps Form 3800.

Web what is form 3800? Income tax return for cooperative associations, schedule j, line 5c. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax return. Web found in the 2021 instructions for form 540.

Department Of The Treasury Internal Revenue Service.

A domestic certified mail receipt provides the sender with a mailing receipt and, upon request electronic verification that an article was delivered or a delivery attempt was made. This product ships in a pack of 10. Pay the applicable extra services fee. For more information, please visit the shipping page.

See The Definition Of Eligible Small Business, Earlier.

For instructions and the latest information. See the instructions for form 6765 for more details. Tip carryback and carryforward of unused credit the carryforward may have to be reduced in the event of any recapture event (change in Irs form 3800 is used to record certain tax credits to reduce taxes for the year.