Form 1139 Instructions

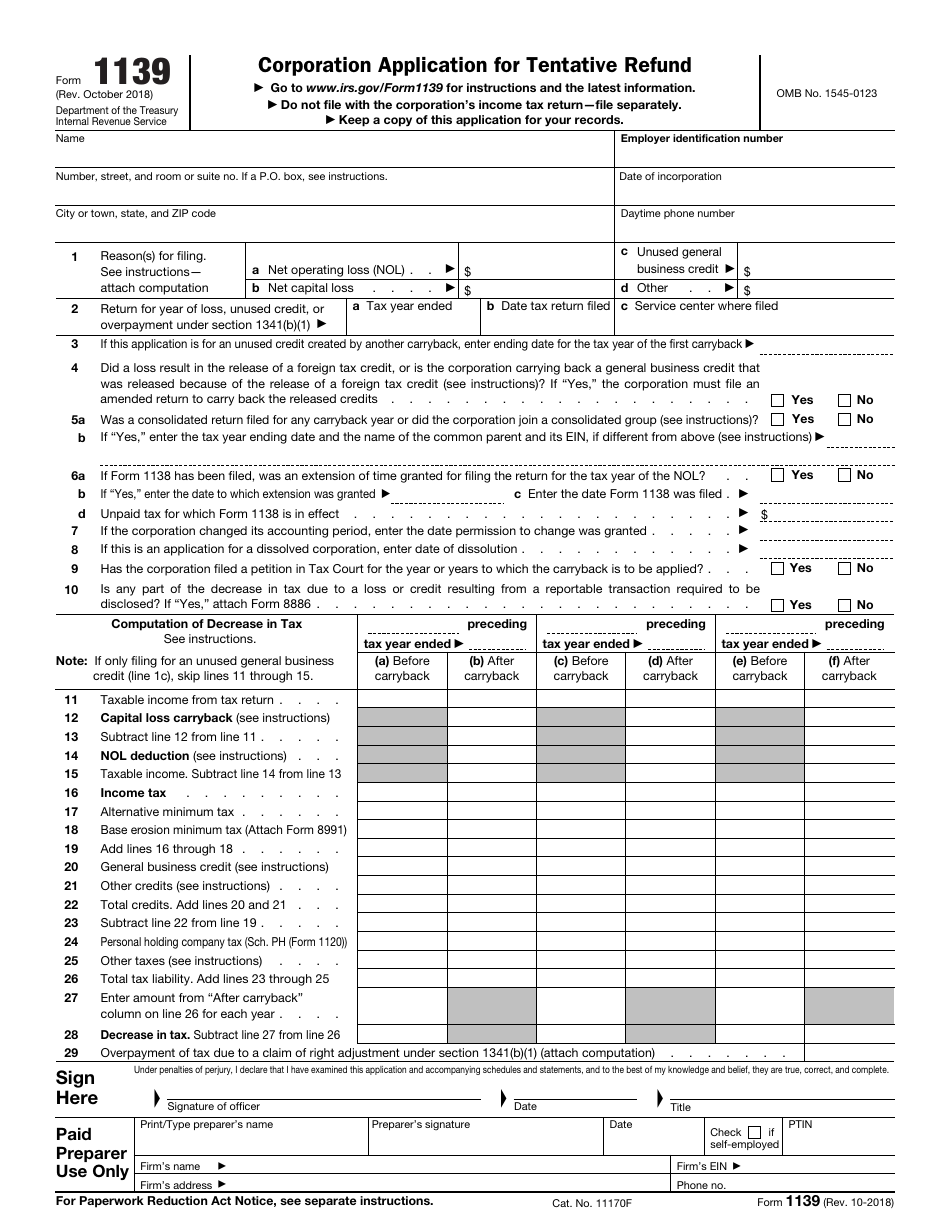

Form 1139 Instructions - • the carryback of a net capital loss; The carryback of an nol; Web how should i complete the 2018 form 8827? Keep a copy of this application for your records. An overpayment of tax due to a claim of right adjustment under section 1341 (b) (1); Web for taxpayers that wish to claim both an nol carryback and accelerated amt credits on the same form 1139, the irs provided the following instructions: Web the taxpayer can make a carryback claim on form 1139 (corporation application for tentative refund) or on form 1120x (amended us corporate income tax return) for each of the carryback years. Do not file with the corporation’s income tax return—file separately. Date of incorporation city or town, state, and. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from:

Do not file with the corporation’s income tax return—file separately. The carryback of a net operating loss (or a loss from operations of a life insurance company), the carryback of a net capital loss, the carryback of an unused general business credit, or. When you electronically file a corporate return that includes form 1139, you can file a paper copy of the form at a later date. Is there a due date by which a c corporation must make the section 53(e)(5) election? • an overpayment of tax due to a claim Web a form 1139 or corporation application for tentative refund form is an official document by the irs that corporations fill to request a refund on taxes. At this time, form 1139 cannot be efiled. Web preparing form 1139 (1120) this topic provides guidelines for preparing form 1139. The carryback of an nol; The carryback of an unused general business credit;

• the carryback of an nol; The form leverages different tax acts, especially the recent cares acts and employs. Do not file with the corporation’s income tax return—file separately. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Is there a due date by which a c corporation must make the section 53(e)(5) election? Number, street, and room or suite no. Date of incorporation city or town, state, and. Web a corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from: The following instructions apply for the 2018 forms 1139 and 8827 to allow for the changes per cares act section 2305(b). The carryback of a net operating loss (or a loss from operations of a life insurance company), the carryback of a net capital loss, the carryback of an unused general business credit, or.

Form 113 DWI Offense Report

Do not file with the corporation’s income tax return—file separately. Web preparing form 1139 (1120) this topic provides guidelines for preparing form 1139. An overpayment of tax due to a claim of right adjustment under section 1341 (b) (1); The form leverages different tax acts, especially the recent cares acts and employs. Corporations (other than s corporations) use this form.

Instructions For Form 1139 Corporation Application For Tentative

An overpayment of tax due to a claim of right adjustment under section 1341 (b) (1); • the carryback of an nol; Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Keep a copy of this application for your records. Number, street, and room or suite no.

IRS Form 1139 Download Fillable PDF or Fill Online Corporation

The quickest way to obtain a refund is by filing form 1139, known as a “quickie refund” claim. An overpayment of tax due to a claim of right adjustment under section 1341 (b) (1); Web how should i complete the 2018 form 8827? Web the taxpayer can make a carryback claim on form 1139 (corporation application for tentative refund) or.

IRS Form 1139 Corporation Application for Tentative Refund

• the carryback of a net capital loss; Web a form 1139 or corporation application for tentative refund form is an official document by the irs that corporations fill to request a refund on taxes. Keep a copy of this application for your records. The carryback of a net operating loss (or a loss from operations of a life insurance.

Instructions for Form 1139, Corporation Application for Tentative Ref…

Number, street, and room or suite no. Web instructions for line 14. At this time, form 1139 cannot be efiled. An election on form 1139 must be filed no later than december 30, 2020. Keep a copy of this application for your records.

Instructions For Form 1139 Corporation Application For Tentative

The quickest way to obtain a refund is by filing form 1139, known as a “quickie refund” claim. When you electronically file a corporate return that includes form 1139, you can file a paper copy of the form at a later date. An overpayment of tax due to a claim of right adjustment under section 1341 (b) (1); At this.

Instructions for Form 1139 (Rev. August 2006)

Is there a due date by which a c corporation must make the section 53(e)(5) election? Do not file with the corporation’s income tax return—file separately. • the carryback of a net capital loss; An election on form 1139 must be filed no later than december 30, 2020. The carryback of a net operating loss (or a loss from operations.

Instructions for Form 1139, Corporation Application for Tentative Ref…

Date of incorporation city or town, state, and. Web for taxpayers that wish to claim both an nol carryback and accelerated amt credits on the same form 1139, the irs provided the following instructions: • the carryback of a net capital loss; The carryback of a net operating loss (or a loss from operations of a life insurance company), the.

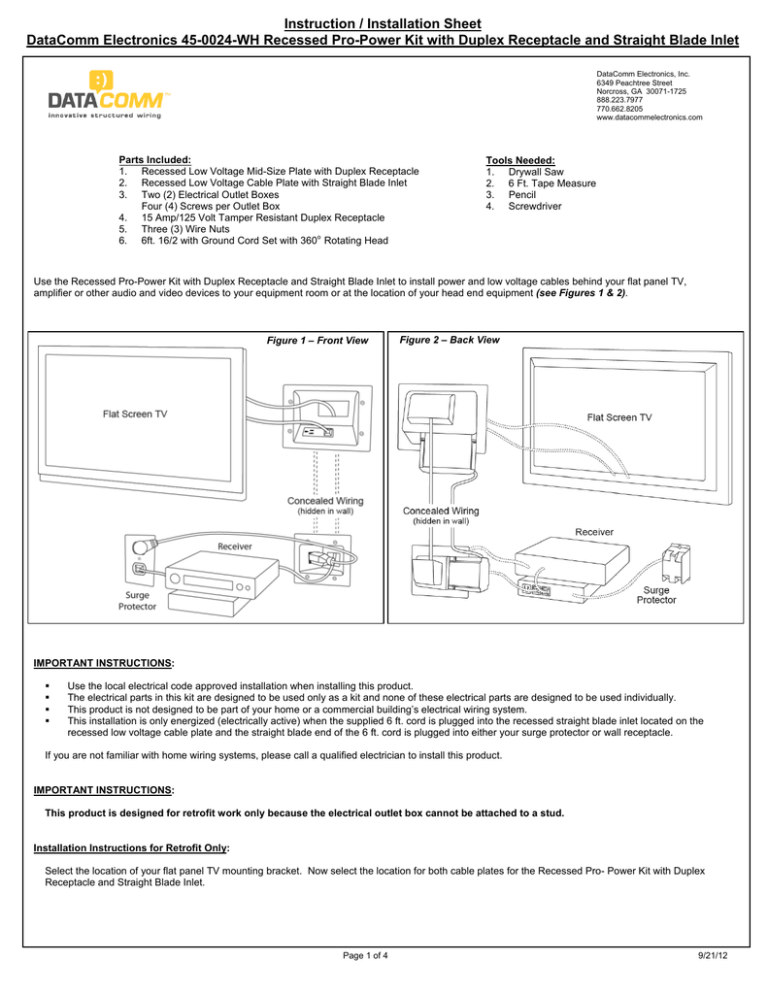

PDF Installation Sheet

• the carryback of a net capital loss; Web how should i complete the 2018 form 8827? • the carryback of an unused general business credit; Web preparing form 1139 (1120) this topic provides guidelines for preparing form 1139. Web about form 1139, corporation application for tentative refund.

Fill Free fillable F1139 Accessible Form 1139 (Rev. October 2018) PDF

Complete lines 1a through 1c and 2 through 28 as appropriate, following the existing form 1139 instructions to report the nol carryback. The quickest way to obtain a refund is by filing form 1139, known as a “quickie refund” claim. • the carryback of an unused general business credit; When you electronically file a corporate return that includes form 1139,.

An Overpayment Of Tax Due To A Claim Of Right Adjustment Under Section 1341 (B) (1);

The carryback of an nol; • the carryback of a net capital loss; Web how should i complete the 2018 form 8827? The quickest way to obtain a refund is by filing form 1139, known as a “quickie refund” claim.

Complete Lines 1A Through 1C And 2 Through 28 As Appropriate, Following The Existing Form 1139 Instructions To Report The Nol Carryback.

Web preparing form 1139 (1120) this topic provides guidelines for preparing form 1139. The carryback of an unused general business credit; When you electronically file a corporate return that includes form 1139, you can file a paper copy of the form at a later date. Web a form 1139 or corporation application for tentative refund form is an official document by the irs that corporations fill to request a refund on taxes.

The Carryback Of A Net Capital Loss;

The carryback of a net operating loss (or a loss from operations of a life insurance company), the carryback of a net capital loss, the carryback of an unused general business credit, or. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: At this time, form 1139 cannot be efiled. General instructions purpose of form a corporation (other than an s corporation) files form 1139 to apply for a quick refund of taxes from:

Date Of Incorporation City Or Town, State, And.

• an overpayment of tax due to a claim Web for taxpayers that wish to claim both an nol carryback and accelerated amt credits on the same form 1139, the irs provided the following instructions: Web the taxpayer can make a carryback claim on form 1139 (corporation application for tentative refund) or on form 1120x (amended us corporate income tax return) for each of the carryback years. An election on form 1139 must be filed no later than december 30, 2020.