Form 2441 For 2021

Form 2441 For 2021 - Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. Form 2441 is used to by. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. The maximum child tax credit increased to $3,600 for children under the age of 6 and to $3,000 per. If you paid 2021 expenses. Once your adjusted gross income is over $43,000,. March 02, 2021 share on social do you have a child or dependent to report on your tax return? Web form 2441 based on the income rules listed in the instructions under. Web 2021 are added to the maximum amount of dependent care benefits that are allowed for 2022.

The child and dependent care credit is a percentage of your qualified expenses. If the child turned 13 during the year, the child is a qualifying. Your expenses are subject to both the earned income limit and the. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Once your adjusted gross income is over $43,000,. There is a new line b that has a. See the instructions for line 13. Web to complete form 2441 child and dependent care expenses in the taxact program: Get ready for tax season deadlines by completing any required tax forms today. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441.

Web 2021 are added to the maximum amount of dependent care benefits that are allowed for 2022. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. Form 2441 is used to by. If you paid 2021 expenses. Web form 2441 based on the income rules listed in the instructions under. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. If the child turned 13 during the year, the child is a qualifying. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441.

All About IRS Form 2441 SmartAsset

Web qualifying person (s) a qualifying person is: Your expenses are subject to both the earned income limit and the. March 02, 2021 share on social do you have a child or dependent to report on your tax return? Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent.

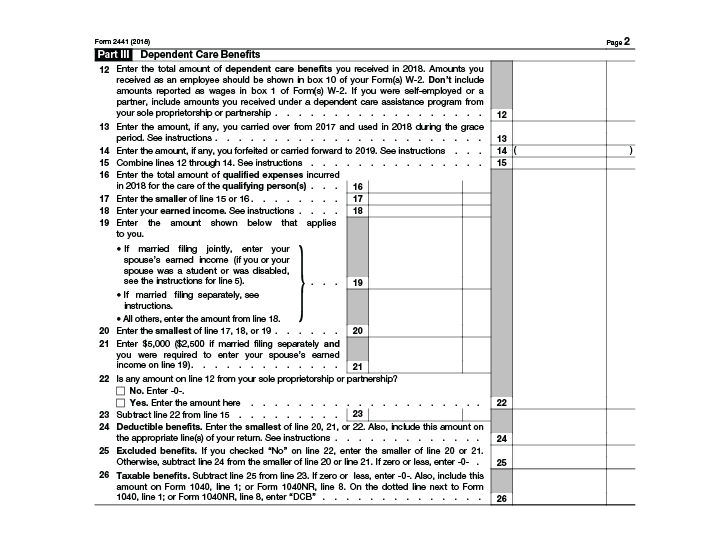

2441 Form 2022

See the instructions for line 13. Ad edit, fill, sign 2441 2010 form & more fillable forms. The credit amounts will increase for many taxpayers. If you or your spouse was a student or disabled, check this box. If the child turned 13 during the year, the child is a qualifying.

David Fleming is a single taxpayer living at 169 Trendie Street

Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. A qualifying child under age 13 whom you can claim as a dependent. Ad download or email irs 2441 & more fillable forms, register and subscribe now! March 02, 2021 share on social do.

Form 2441 Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web form 2441 based on the income rules listed in the instructions under. Web to complete form 2441 child and dependent care expenses in the taxact program: Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and.

Irs form 2441 instructions Canadian Manuals Stepbystep Guidelines

Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441. The credit amounts will increase for many taxpayers. The child and dependent care credit is a percentage of your qualified expenses. Web for more information on the percentage applicable to your income level, please.

Irs Form 2441 2023 Fill online, Printable, Fillable Blank

Web form 2441 based on the income rules listed in the instructions under. If you or your spouse was a student or disabled, check this box. Once your adjusted gross income is over $43,000,. See the instructions for line 13. Form 2441 is used to by.

Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

Web 2021 are added to the maximum amount of dependent care benefits that are allowed for 2022. Ad edit, fill, sign 2441 2010 form & more fillable forms. Ad download or email irs 2441 & more fillable forms, register and subscribe now! From within your taxact return ( online or desktop), click federal (on smaller devices, click in. The amount.

ACC124 2021 Form 2441 YouTube

There is a new line b that has a. If the child turned 13 during the year, the child is a qualifying. Ad download or email irs 2441 & more fillable forms, register and subscribe now! The maximum child tax credit increased to $3,600 for children under the age of 6 and to $3,000 per. Web irs releases 2021 form.

Ssurvivor Form 2441 Child And Dependent Care Expenses

There is a new line b that has a. Ad download or email irs 2441 & more fillable forms, register and subscribe now! See the instructions for line 13. The amount shown as paid to the provider (s) must equal the amount entered as qualified expenses for your dependent (s). Web qualifying person (s) a qualifying person is:

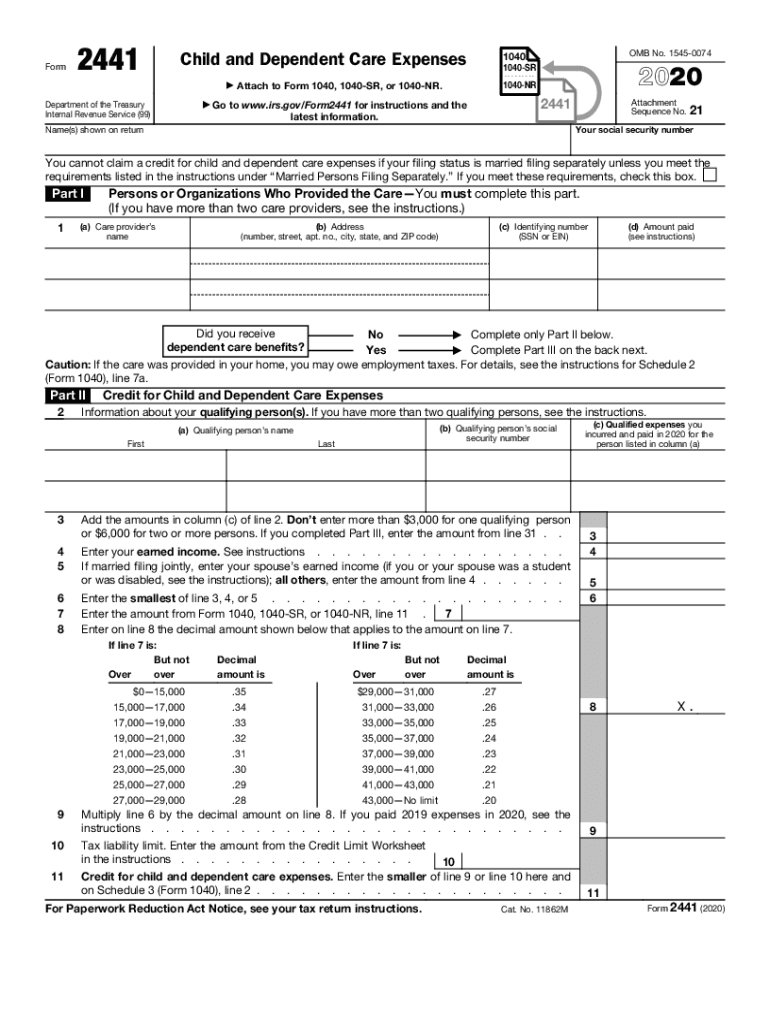

2020 Tax Form 2441 Create A Digital Sample in PDF

Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Your expenses are subject to both the earned income limit and the. Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. Web jo willetts,.

Web Information About Form 2441, Child And Dependent Care Expenses, Including Recent Updates, Related Forms, And Instructions On How To File.

Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. The child and dependent care credit is a percentage of your qualified expenses. Web taxes advertiser disclosure the child and dependent care credit is worth up to $8,000 this tax season ellen chang, kemberley washington contributor, editor. Web irs releases 2021 form 2441 and instructions for reporting child and dependent care expenses ebia december 22, 2021 · 5 minute read irs form 2441.

A Qualifying Child Under Age 13 Whom You Can Claim As A Dependent.

Form 2441 is used to by. If the child turned 13 during the year, the child is a qualifying. See the instructions for line 13. The maximum child tax credit increased to $3,600 for children under the age of 6 and to $3,000 per.

Once Your Adjusted Gross Income Is Over $43,000,.

The amount shown as paid to the provider (s) must equal the amount entered as qualified expenses for your dependent (s). Web bif you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income. Ad download or email irs 2441 & more fillable forms, register and subscribe now! Web qualifying person (s) a qualifying person is:

Web For More Information On The Percentage Applicable To Your Income Level, Please Refer To The 2021 Instructions For Form 2441 Or Irs Publication 503, Child And.

From within your taxact return ( online or desktop), click federal (on smaller devices, click in. Get ready for tax season deadlines by completing any required tax forms today. Web form 2441 based on the income rules listed in the instructions under. March 02, 2021 share on social do you have a child or dependent to report on your tax return?