Form 1099 2016

Form 1099 2016 - Get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For a lender’s acquisition of property that was security for a loan, the date shown is generally the earlier of the date title was transferred to the lender or the date possession. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. Payment card and third party network transactions. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Download blank or fill out online in pdf format. At least $10 in royalties (see the instructions for box 2) or.

Save or instantly send your ready documents. At least $10 in royalties (see the instructions for box 2) or. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to. Web up to $40 cash back select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. At least $10 in royalties (see the instructions for box 2) or broker. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. If you’re mailing a printed copy, make sure it’s postmarked by.

Web up to $40 cash back select add new on your dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Payment card and third party network transactions. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. At least $10 in royalties (see the instructions for box 2) or. Principal payments for mortgage and asset backed. Complete, sign, print and send your tax documents easily with us legal forms. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

1099 Int Fill out in PDF Online

Get ready for tax season deadlines by completing any required tax forms today. Payment card and third party network transactions. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. Web if you are required to.

1099 Form Template 2016 Templates2 Resume Examples

If you’re mailing a printed copy, make sure it’s postmarked by. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to. Download blank.

IRS Form 1099INT 2016 Irs forms, Irs, Internal revenue service

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. If you’re mailing a printed copy, make sure it’s postmarked by. Payment card and third party network transactions. Web 22 rows form 1099 is one.

The Tax Times 2016 Form 1099's are FATCA Compliant

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Download blank or fill out online in pdf format..

form 1099 Gary M. Kaplan, C.P.A., P.A.

Download blank or fill out online in pdf format. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and.

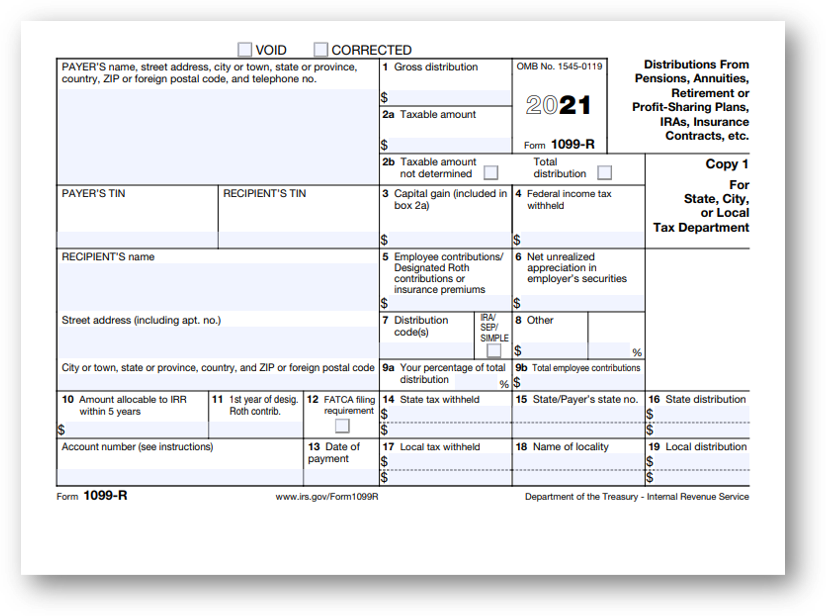

Tax Form Focus IRS Form 1099R » STRATA Trust Company

Complete, edit or print tax forms instantly. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web up to $40 cash back select add new on your dashboard and upload a file from your.

Form 1099INT Interest (2016) Free Download

At least $10 in royalties (see the instructions for box 2) or broker. Complete, sign, print and send your tax documents easily with us legal forms. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. If you’re mailing a printed copy, make sure it’s postmarked by. Web if you are required to file.

1099 Misc 2016 Fillable Form Free Universal Network

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Get ready for tax season deadlines by completing any required tax forms today. At least $10 in royalties (see the instructions for box 2) or..

IRS Form 1099int 2016 Irs forms, Irs, State tax

For a lender’s acquisition of property that was security for a loan, the date shown is generally the earlier of the date title was transferred to the lender or the date possession. Get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file a return, a negligence penalty or other sanction.

What is a 1099Misc Form? Financial Strategy Center

Get ready for tax season deadlines by completing any required tax forms today. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. Easily fill out pdf blank, edit, and sign them. Save or instantly send.

Complete, Edit Or Print Tax Forms Instantly.

Payment card and third party network transactions. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to. For a lender’s acquisition of property that was security for a loan, the date shown is generally the earlier of the date title was transferred to the lender or the date possession. At least $10 in royalties (see the instructions for box 2) or.

Web 22 Rows Form 1099 Is One Of Several Irs Tax Forms (See The Variants Section) Used In The United States To Prepare And File An Information Return To Report Various Types Of Income.

Get ready for tax season deadlines by completing any required tax forms today. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. At least $10 in royalties (see the instructions for box 2) or broker. Complete, sign, print and send your tax documents easily with us legal forms.

Principal Payments For Mortgage And Asset Backed.

Save or instantly send your ready documents. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Download blank or fill out online in pdf format. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

Web Up To $40 Cash Back Select Add New On Your Dashboard And Upload A File From Your Device Or Import It From The Cloud, Online, Or Internal Mail.

Easily fill out pdf blank, edit, and sign them. If you’re mailing a printed copy, make sure it’s postmarked by.