Filing Deadline For Form 5500

Filing Deadline For Form 5500 - Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. If you’re unable to meet the. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. The filing due date for a form 5500 is seven months after the end of the. 15th, but if the filing due date falls on a saturday, sunday or. Web form 5500 filing deadline.

Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; The normal due date is. Web form 5500 filing deadlines and extensions standard filing deadline. If you’re unable to meet the. The filing due date for a form 5500 is seven months after the end of the. For an explanation of how to file your form 5500 return, in. Web form 5500 filing deadline. 15th, but if the filing due date falls on a saturday, sunday or. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

Web form 5500 filing deadlines and extensions standard filing deadline. Form 5500 must be filed by the last day of the seventh month following the end of the. Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Posting on the web does not constitute acceptance of the filing by the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. The normal due date is. If you’re unable to meet the.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

The form 5500 must be filed electronically as noted. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web form 5500 filing deadline. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web form 5500 filing deadlines and extensions standard.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

The normal due date is. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. 15th, but if the filing due date falls on a saturday, sunday or. Web form 5500 filing deadlines.

What is Form 5500 & What Plan Sponsors Need to Know About It? NESA

Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. The form 5500 must be filed electronically as noted. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain..

DOL Tips on Filing Form 5500 PNC Insights

The normal due date is. Posting on the web does not constitute acceptance of the filing by the. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. The filing due date for a form 5500 is seven months after the end of the. If you’re unable to meet the.

Form 5500 Is Due by July 31 for Calendar Year Plans

The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. Posting on the web does not constitute acceptance of the filing by the. Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web form 5500 filing.

Form 5500 Instructions 5 Steps to Filing Correctly

Posting on the web does not constitute acceptance of the filing by the. The form 5500 must be filed electronically as noted. Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of.

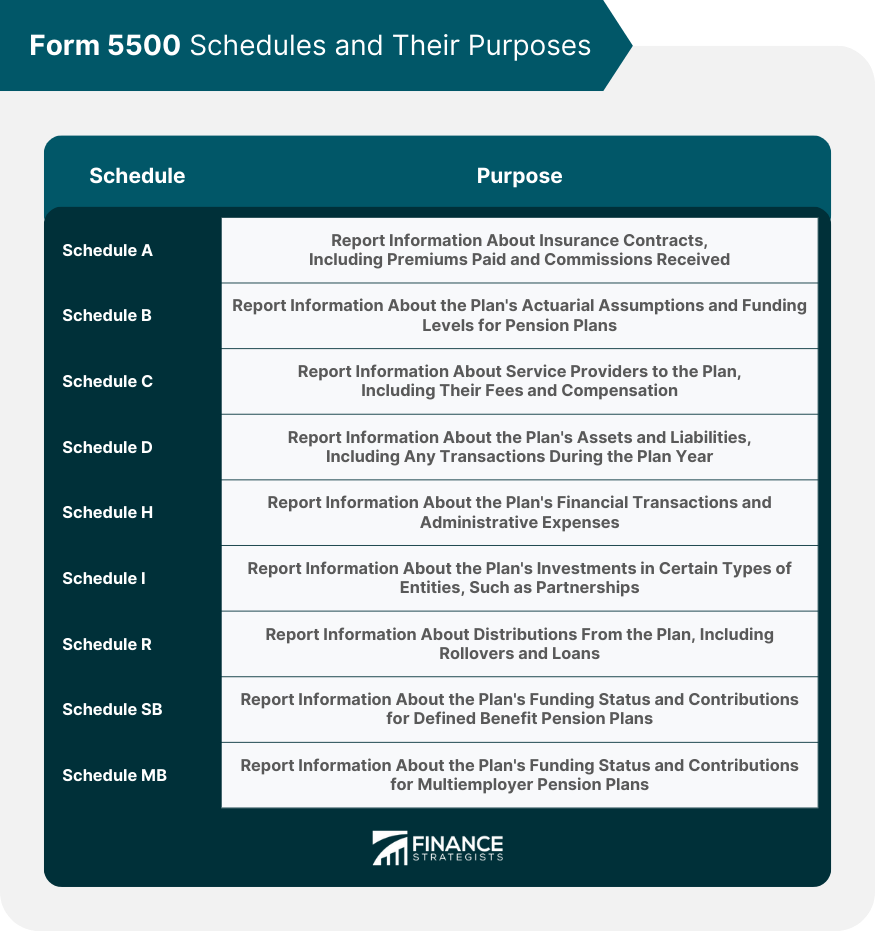

Form 5500 Definition, Components, Schedules, and Deadlines

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. The filing due date for a form 5500 is seven months after the end of the. Web form 5500 filing deadlines and extensions standard filing deadline. Web secure act section 202 directed dol and irs to establish a consolidated form.

Form 5500 Instructions 5 Steps to Filing Correctly

For an explanation of how to file your form 5500 return, in. If you’re unable to meet the. Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october,.

Solo 401k Reporting Requirements Solo 401k

The filing due date for a form 5500 is seven months after the end of the. 15th, but if the filing due date falls on a saturday, sunday or. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. The deadline for filing form 5500 is the seventh month following the end of.

Form 5500 Deadline Coming Up In August! MyHRConcierge

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend. The filing due date for a form 5500 is seven months after the end of the. Web.

The Form 5500 Must Be Filed Electronically As Noted.

15th, but if the filing due date falls on a saturday, sunday or. The filing due date for a form 5500 is seven months after the end of the. Web posted on june 14, 2021 form 5500 filing deadline is july 31, 2021 we wanted to remind you that this important deadline is approaching. The deadline for filing form 5500 is the seventh month following the end of the plan year, or july 31 on a weekend.

Web Missing The Final Deadline For Filing Your Form 5500 Is A Common Pitfall For Plan Administrators.

Web form 5500, annual return/report of employee benefit plan; Web distribute all plan assets as soon as administratively feasible (generally within 12 months) after the plan termination date to participants and beneficiaries; Web form 5500 filing deadline. Web form 5500 filing deadlines and extensions standard filing deadline.

For An Explanation Of How To File Your Form 5500 Return, In.

Web this search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Form 5500 must be filed by the last day of the seventh month following the end of the. Web secure act section 202 directed dol and irs to establish a consolidated form 5500 filing option for groups of defined contribution plans that satisfy certain. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for.

Posting On The Web Does Not Constitute Acceptance Of The Filing By The.

Web most 401 (k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. The normal due date is. If you’re unable to meet the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.