What Is Considered Cash For Form 8300

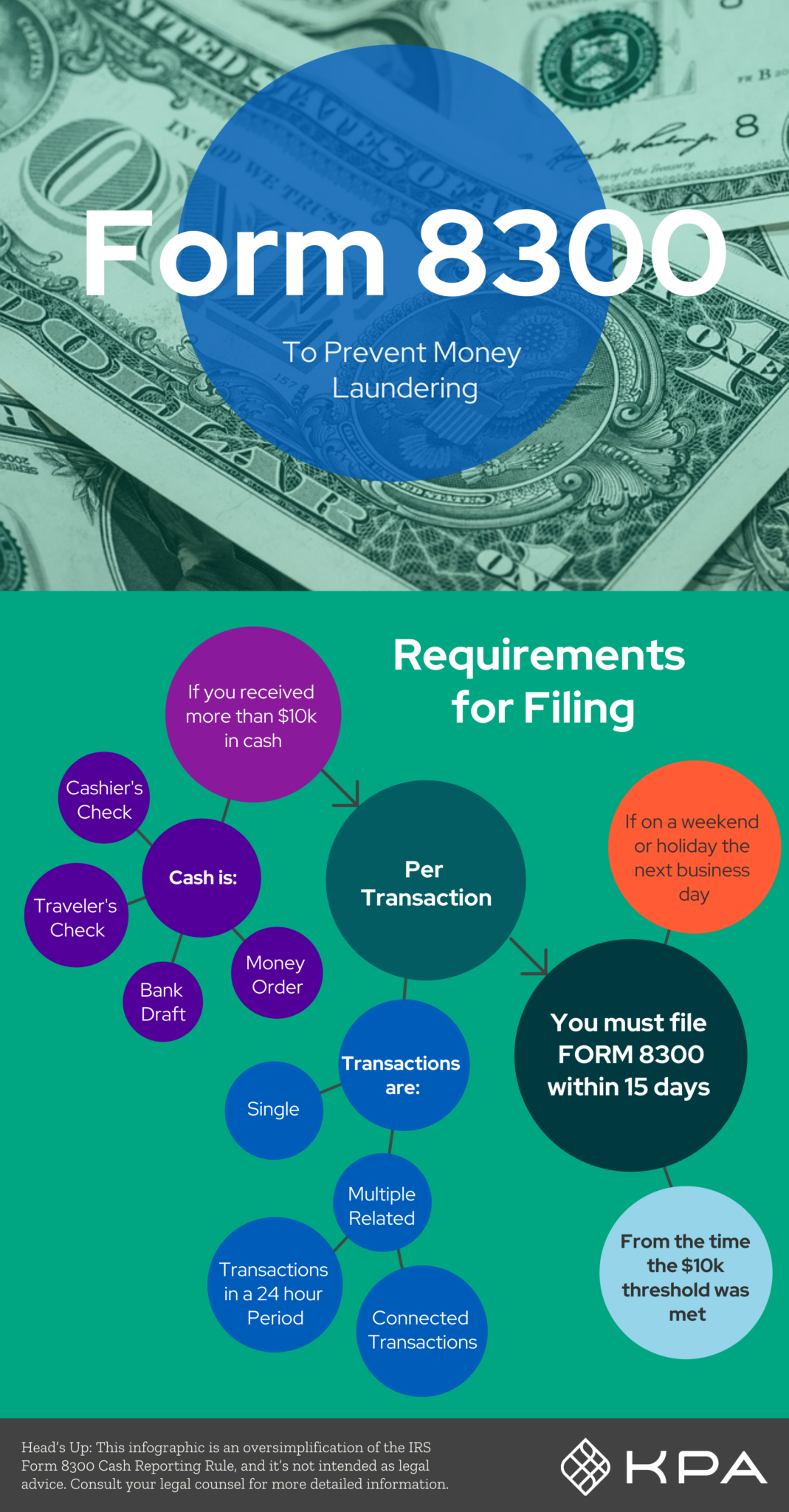

What Is Considered Cash For Form 8300 - Also, transactions are considered related even. Web form 8300 requires a person that receives more than $10,000 in cash during the course of its trade or business report the receipt of such cash to the irs and sends a written. For form 8300 reporting, cash includes coins and currency of the united states or any foreign country. Web if your school accepts payments via any of these methods, it is considered to have accepted a cash payment in the eyes of the irs and should file form 8300 if. It's also cash equivalents that include cashier's. Drug dealers and terrorists often have. Web what is considered cash for form 8300, includes u.s. Web what's cash for form 8300 reporting, cash includes coins and currency of the united states or any foreign country. Checks are considered cash transactions. Web the form that is used to satisfy both reporting requirements is form 8300, report of cash payments over $10,000 received in a trade or business.

Web who must file form 8300? Web what's cash for form 8300 reporting, cash includes coins and currency of the united states or any foreign country. Web transactions are considered related even if they occur over a period of more. It also includes cash equivalents such as cashier’s checks. Clerks of federal or state. Web english español each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of. Web is the atm or debit card amount considered cash or a cash equivalent that makes the total amount received over $10,000 and thus reportable on form 8300? Currency and coins, as well as foreign money.

Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. Also, transactions are considered related even. Web is the atm or debit card amount considered cash or a cash equivalent that makes the total amount received over $10,000 and thus reportable on form 8300? Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form. Clerks of federal or state. Web who must file form 8300? Currency and coins, as well as foreign money. Web form 8300 requires a person that receives more than $10,000 in cash during the course of its trade or business report the receipt of such cash to the irs and sends a written. What the irs considers as a. Web transactions are considered related even if they occur over a period of more.

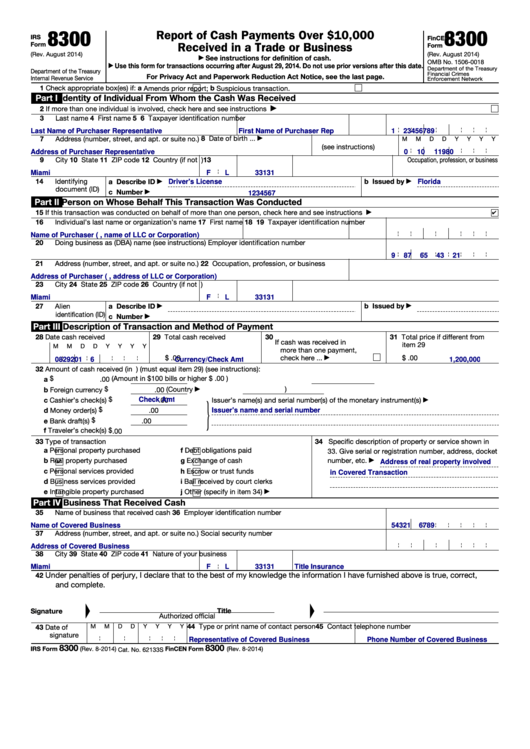

Fillable Form 8300 Fincen printable pdf download

You may wonder whether checks need to be reported on form 8300. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of. It's also cash equivalents that include cashier's. It’s also cash equivalents that include cashier’s checks. Web if your school accepts payments.

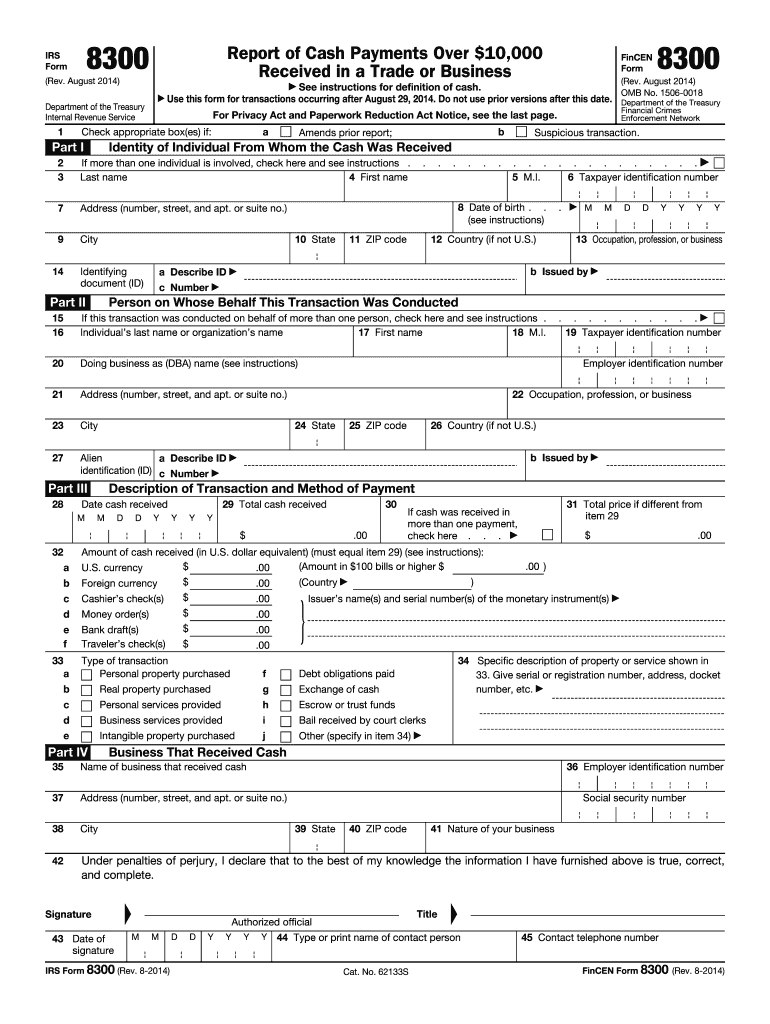

IRS Form 8300 It's Your Yale

It's also cash equivalents that include cashier's. You may wonder whether checks need to be reported on form 8300. Web is the atm or debit card amount considered cash or a cash equivalent that makes the total amount received over $10,000 and thus reportable on form 8300? Web form 8300 is a document filed with the irs when an individual.

EFile 8300 File Form 8300 Online

It's also cash equivalents that include cashier's. Web form 8300 requires a person that receives more than $10,000 in cash during the course of its trade or business report the receipt of such cash to the irs and sends a written. Web form 8300 is an irs form which requires businesses that receive large cash payments (usually in excess of.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. Web what's cash for form 8300 reporting, cash includes coins and currency of the united states or any foreign country. For form 8300 reporting, cash includes coins and currency of the united states or any foreign country. You may wonder whether.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web the form that is used to satisfy both reporting requirements is form 8300, report of cash payments over $10,000 received in a trade or business. Web now, what about “cash”? Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. Tax laws require taxpayers to file an 8300. It’s also.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

For form 8300 reporting, cash includes coins and currency of the united states or any foreign country. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file form. It also includes cash equivalents such as cashier’s checks. Web introduction the law requires that trades and.

Form 8300 Do You Have Another IRS Issue? ACCCE

Web is the atm or debit card amount considered cash or a cash equivalent that makes the total amount received over $10,000 and thus reportable on form 8300? Web what is considered cash for form 8300, includes u.s. Web form 8300 is an irs form which requires businesses that receive large cash payments (usually in excess of $10,000) to report.

Form 8300 Cheat Sheet When Should I Report Suspicious Activity? KPA

Web what is considered cash for form 8300, includes u.s. Web now, what about “cash”? Web is the atm or debit card amount considered cash or a cash equivalent that makes the total amount received over $10,000 and thus reportable on form 8300? It’s also cash equivalents that include cashier’s checks. It's also cash equivalents that include cashier's.

Reporting Cash Transactions Easier IRS Form 8300 Wichita CPA Firm

Keep a copy of each form 8300 for 5 years from the date you file it. Web funds that are considered cash when filing form 8300 include: Web what is considered cash for form 8300, includes u.s. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service.

Understanding How to Report Large Cash Transactions (Form 8300) Roger

Web transactions are considered related even if they occur over a period of more. Web if your school accepts payments via any of these methods, it is considered to have accepted a cash payment in the eyes of the irs and should file form 8300 if. Web now, what about “cash”? Web english español each person engaged in a trade.

Web What's Cash For Form 8300 Reporting, Cash Includes Coins And Currency Of The United States Or Any Foreign Country.

It's also cash equivalents that include cashier's. Drug dealers and terrorists often have. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. Clerks of federal or state.

You May Wonder Whether Checks Need To Be Reported On Form 8300.

Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web the form that is used to satisfy both reporting requirements is form 8300, report of cash payments over $10,000 received in a trade or business. It also includes cash equivalents such as cashier’s checks. Also, transactions are considered related even.

What The Irs Considers As A.

Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of. Currency and coins, as well as foreign money. Tax laws require taxpayers to file an 8300. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related.

For Form 8300 Reporting, Cash Includes Coins And Currency Of The United States Or Any Foreign Country.

Web english español each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction. Web transactions are considered related even if they occur over a period of more. Web are business or personal checks considered cash? Web who must file form 8300?