Do Churches Have To File Form 990

Do Churches Have To File Form 990 - This means you are not required. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web do churches have to file a 990? Web requirements for nonprofit churches. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet. Web ubi analysis can be tricky, and a church may need to consult with a tax or legal professional in order to properly determine if a certain activity subjects a church to tax. Web churches are exempt from having to file form 990 with the irs. Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or simplified version of form 990. Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. Churches need to file the information on the income & expenses for a given accounting year by filing.

If the church’s gross receipts are below. Web churches are exempt from having to file form 990 with the irs. It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Web do churches have to file a 990? Web churches that have completed form 1023 are not required to complete form 990. Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. Web one difference is that churches are not required to file the annual 990 form. We recommend that you do not submit form 990. Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except:

Web every organization exempt from federal income tax under internal revenue code section 501 (a) must file an annual information return except: If the church’s gross receipts are below. This means you are not required. Nonprofit churches have 2 options to request a retail sales and use tax exemption: It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Your church is not required to file a form 990 with the federal government. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet. Web what 990 form do churches need to file with the irs? It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web another difference is filing requirements.

Do Churches Employ Counselors? Top Counseling Schools

Churches need to file the information on the income & expenses for a given accounting year by filing. Web churches are exempt from having to file form 990 with the irs. Web churches typically do not have to file 990 tax returns. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet. Web another.

Why do churches have stained glass windows? YouTube

It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web churches are exempt from having to file form 990 with the irs. This means you are not required. Web what 990 form do churches need to file with the irs?.

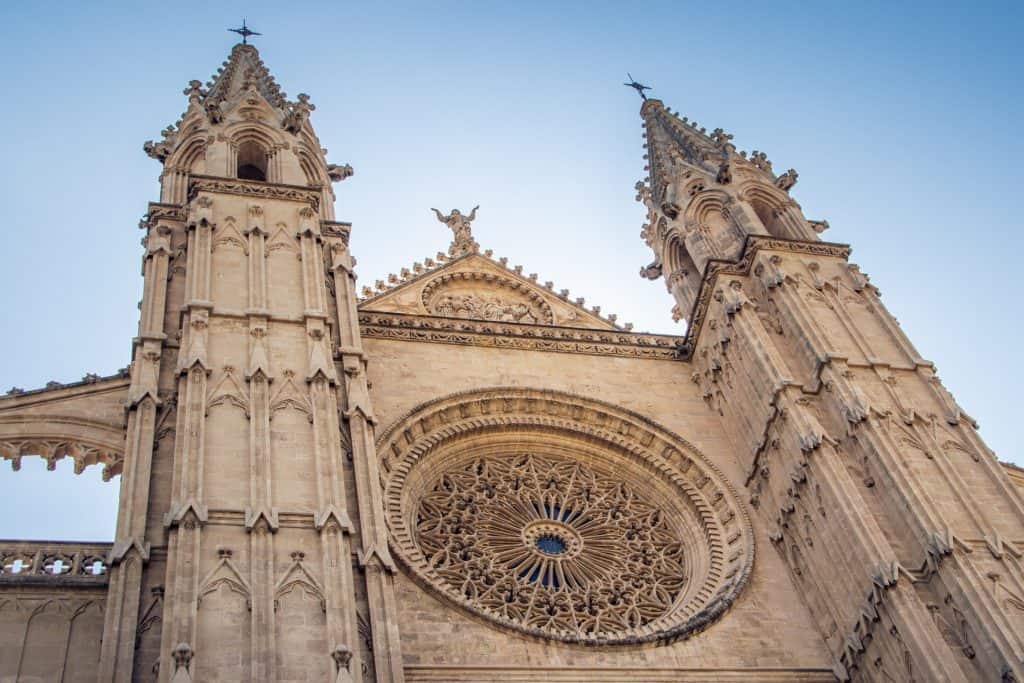

Why Do Churches Have Steeples 5 Distinctive Reasons

Web we have received conflicting opinions. Churches need to file the information on the income & expenses for a given accounting year by filing. If the church’s gross receipts are below. Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. Web churches are exempt from having to file form 990 with.

Why do churches have towers?

Web what 990 form do churches need to file with the irs? Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web requirements for nonprofit churches. For several evangelical organizations, that advantage—no 990 filing—has been a. Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or.

Do churches have the right to discriminate?

It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. This means you are not required. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet. If the church’s gross receipts are below. For several.

Why Do Churches Have Steeples? Delicious Bookmark

It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Section 6033 of the internal revenue code requires every. This means you are not required. Web another difference is filing requirements. Web what 990 form do churches need to file with.

Do Churches Have Customers?

For several evangelical organizations, that advantage—no 990 filing—has been a. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Web churches are exempt from federal income.

Do Churches File Form 990? YouTube

Web do churches have to file a 990? Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or simplified version of form 990. Web churches that have completed form 1023 are not required to complete form 990. Web every organization exempt from federal income tax under internal revenue code section 501.

7 Things You Need to Know About Churches and Form 990

Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Web houses of worship (churches, synagogues, mosques and temples) are exempt from charitable solicitation registration in every state if they aren’t required to.

Why do churches have steeples?

Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Web for some organizations, it may be more practical to file form 990ez, which is a “short form” or simplified version of form 990. Section 6033 (a) (3) (a) (i) exempts.

It Is True That Churches, Synagogues, Temples, Mosques, And Other Places Of Religious Worship Are Not Required To File A Form 1023 With The Irs To Be Considered Tax.

Section 6033 of the internal revenue code requires every. Web what 990 form do churches need to file with the irs? Web bona fide duly constituted religious institutions and such separate groups or corporations which form an integral part of a religious institution and are exempt from filing an annual. Churches need to file the information on the income & expenses for a given accounting year by filing.

For Several Evangelical Organizations, That Advantage—No 990 Filing—Has Been A.

It is true that churches, synagogues, temples, mosques, and other places of religious worship are not required to file a form 1023 with the irs to be considered tax. Web churches need to file a tax return with the irs if they fall under section 501(c)(3) status. Section 6033 (a) (3) (a) (i) exempts churches, their integrated auxiliaries, and conventions of churches from filing form. We recommend that you do not submit form 990.

Web Houses Of Worship (Churches, Synagogues, Mosques And Temples) Are Exempt From Charitable Solicitation Registration In Every State If They Aren’t Required To File A Form 990.

Web requirements for nonprofit churches. Web churches typically do not have to file 990 tax returns. Nonprofit churches have 2 options to request a retail sales and use tax exemption: Web we have received conflicting opinions.

Web One Difference Is That Churches Are Not Required To File The Annual 990 Form.

Web do churches have to file a 990? Web churches that have completed form 1023 are not required to complete form 990. Web churches are exempt from federal income tax, applying for exempt status, unemployment tax, and many tax information returns. Based on irs regulations, churches (including integrated auxiliaries and conventions or associations of churches) that meet.