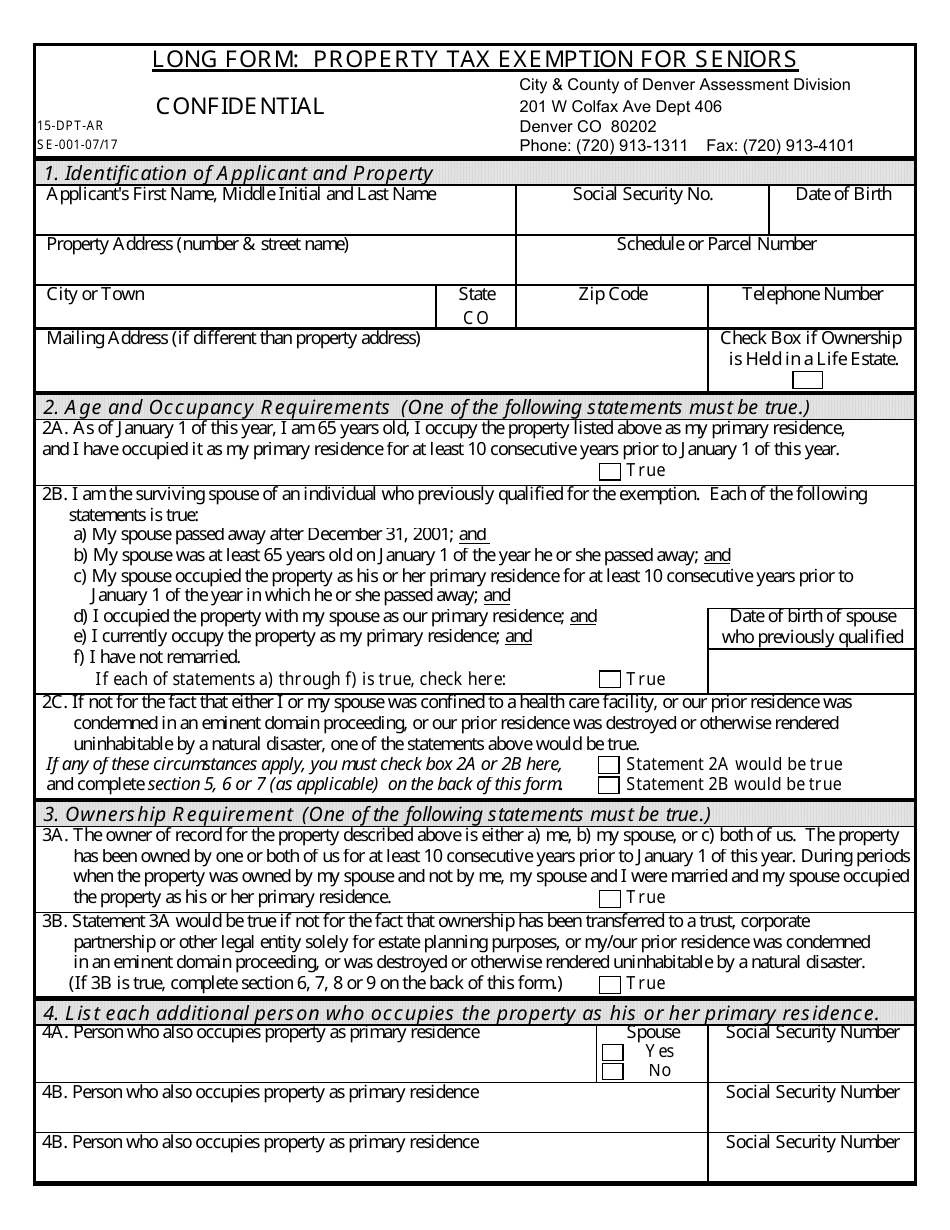

Colorado Senior Property Tax Exemption Form

Colorado Senior Property Tax Exemption Form - 201 w colfax ave dept 406. To apply for the exemption, or get. Web general information great news! Late filing fee waiver request. Web there are three basic requirements to qualify: Web application form senior property tax exemption.pdf 305.4 kb. Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. Your total income from all sources was less than $16,925 for single. The filing deadline is july 1. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified.

The colorado general assembly has reinstated funding for the senior property tax exemption (a/k/a senior homestead exemption) for tax. 2) he or she must be the owner of record and must. For 1 and 3 below, you. Web the senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. 1) the qualifying senior must be at least 65 years old on january 1 of the year of application; 1) the qualifying senior must be at least 65 years old on january 1 of the year in which he or she applies; Web taxpayers who are at least 65 years old as of january 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for. Property tax exemption for seniors city & county of denverassessment division confidential. Web there are three basic requirements to qualify: Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified.

Web for those who qualify for the exemption, 50% of the first $200,000 in actual value — $100,000 — is exempted from property tax. Web application for property tax exemption. Remedies for recipients of notice of forfeiture of right to claim exemption. 201 w colfax ave dept 406. Your total income from all sources was less than $16,925 for single. The state reimburses the local governments for the loss in. Web taxpayers who are at least 65 years old as of january 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for. Web general information great news! To apply for the exemption, or get. This is resulting in return adjustments and delays.

Colorado Disabled Veterans' 2 Problems home healthcare & property

Web the senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. Web application for property tax exemption. Web for those who qualify for the exemption, 50% of the first $200,000 in actual value — $100,000 — is exempted from property tax. An individual or married couple is only entitled to one exemption, either.

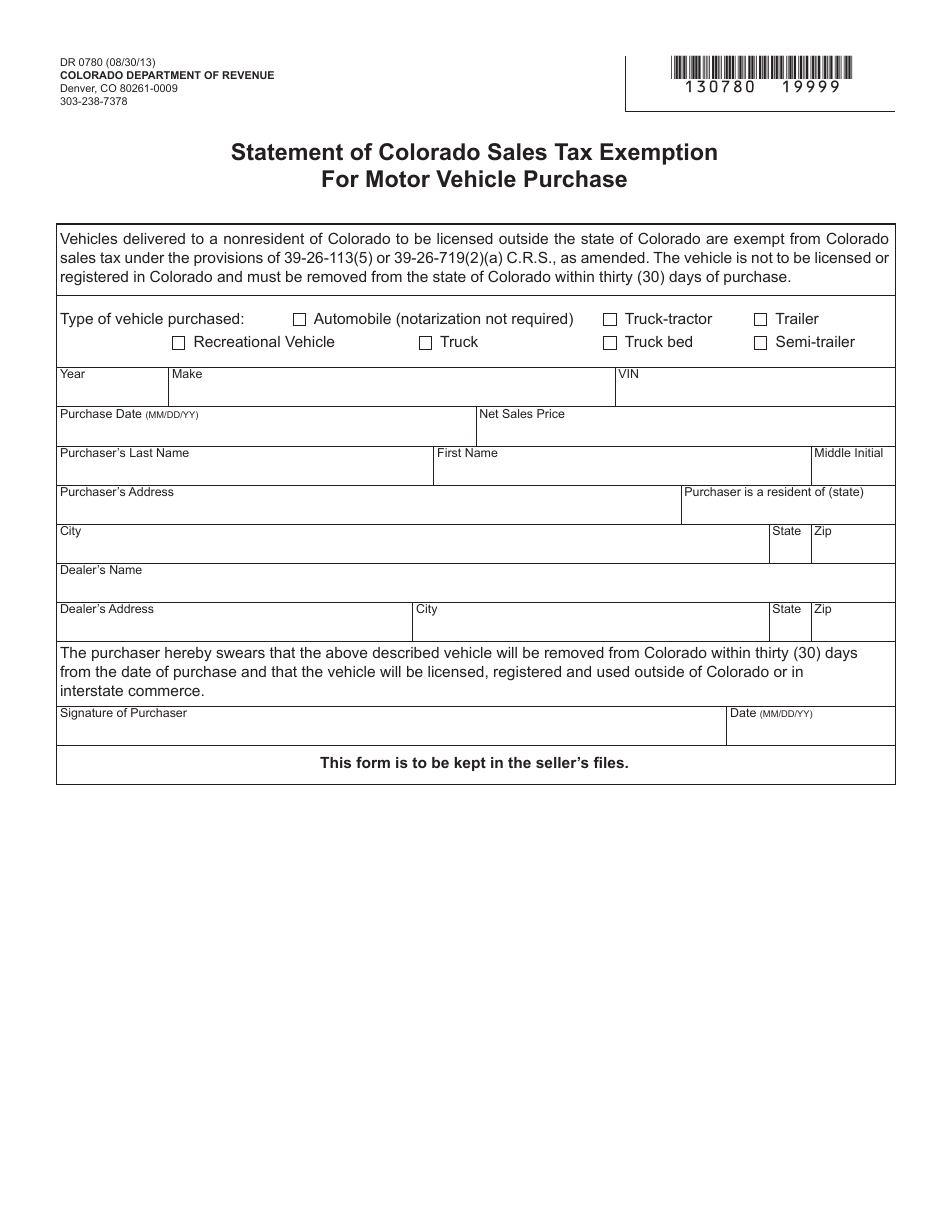

Form DR0780 Download Fillable PDF or Fill Online Statement of Colorado

Web there are two application forms for the senior property tax exemption. Web the department is finding that many taxpayers claiming the senior housing income tax credit for tax year 2022 do not qualify. To apply for the exemption, or get. 2) he or she must be the owner of record and must. Web application form senior property tax exemption.pdf.

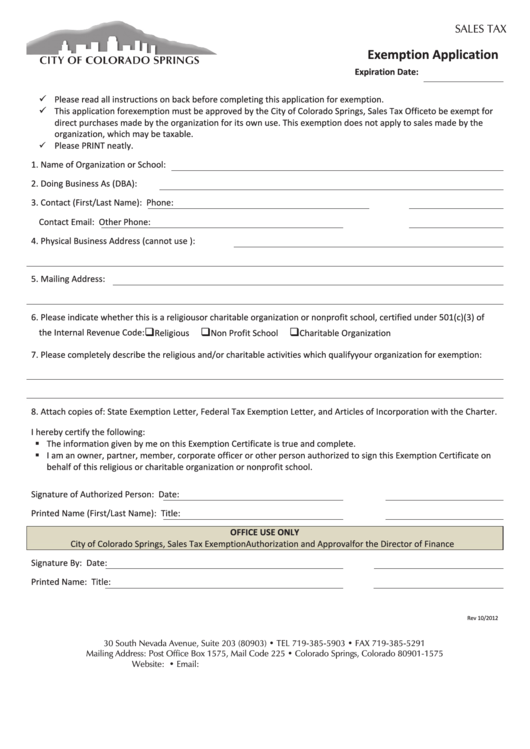

Exemption Application Form Colorado Springs printable pdf download

The filing deadline is july 1. The colorado general assembly has reinstated funding for the senior property tax exemption (a/k/a senior homestead exemption) for tax. As of january 1 st the taxpayer. 201 w colfax ave dept 406. Property tax exemption for seniors city & county of denverassessment division confidential.

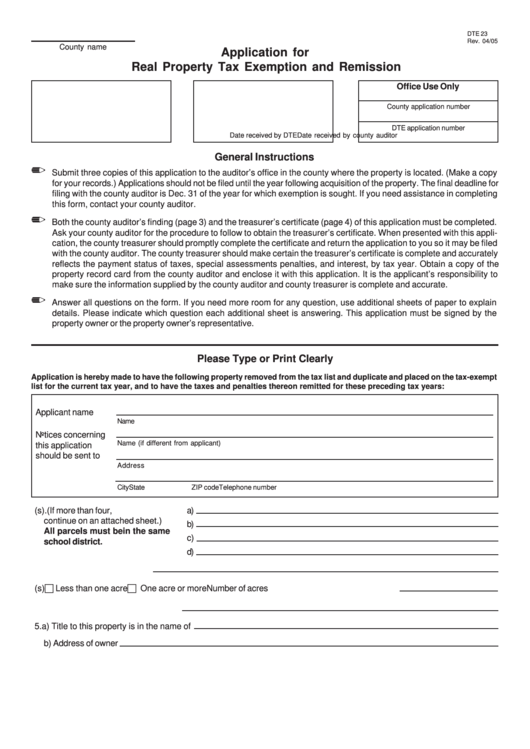

Fillable Form Dte 23 Application For Real Property Tax Exemption And

Web there are three basic requirements to qualify: The state reimburses the local governments for the loss in. The short form is for applicants who meet the basic eligibility requirements. Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to.

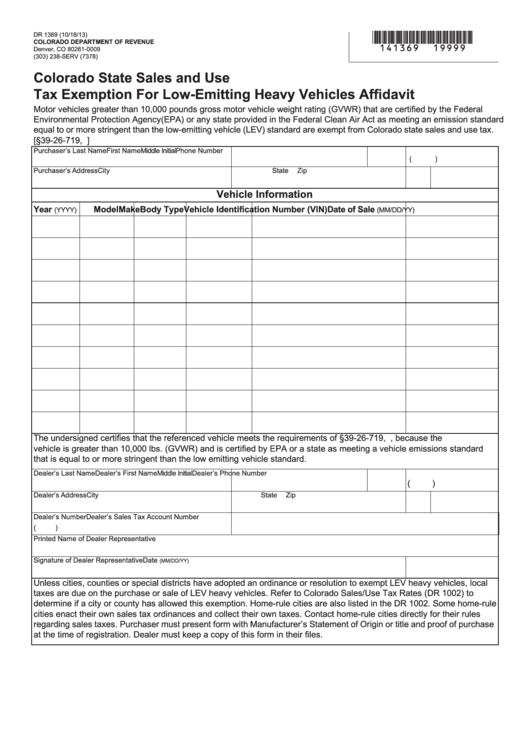

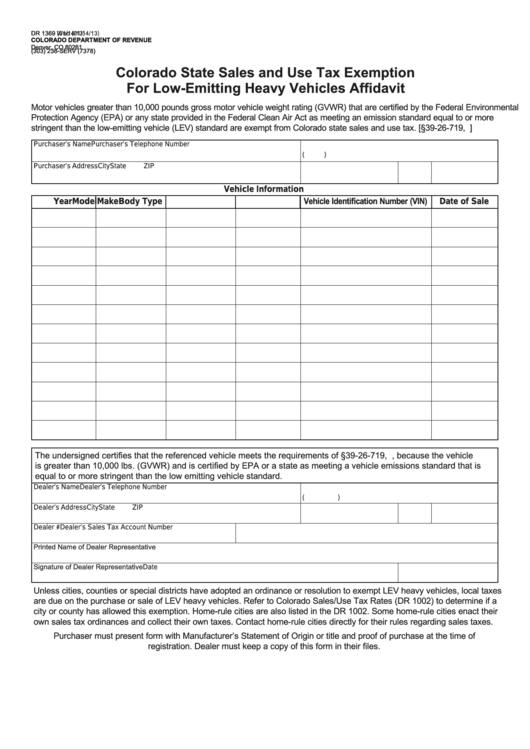

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Property tax exemption for seniors city & county of denverassessment division confidential. Web the filing deadline is july 1. Web there are three basic requirements to qualify: Property tax exemption for seniors city & county of denverassessment division confidential. 1) the qualifying senior must be at least 65 years old on january 1 of the year of application;

colorado estate tax exemption Fucking Incredible Blawker Ajax

Web there are three basic requirements to qualify: 2) he or she must be the owner of record and must. The state reimburses the local governments for the loss in. The long form is for surviving. Late filing fee waiver request.

Jefferson County Property Tax Exemption Form

Web for those who qualify for the exemption, 50% of the first $200,000 in actual value — $100,000 — is exempted from property tax. Web taxpayers who are at least 65 years old as of january 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for. Web senior property.

New Tax Exempt Form

The long form is for surviving. 201 w colfax ave dept 406. Web the filing deadline is july 1. As of january 1 st the taxpayer. Web you may be able to claim the 2022 ptc rebate if:

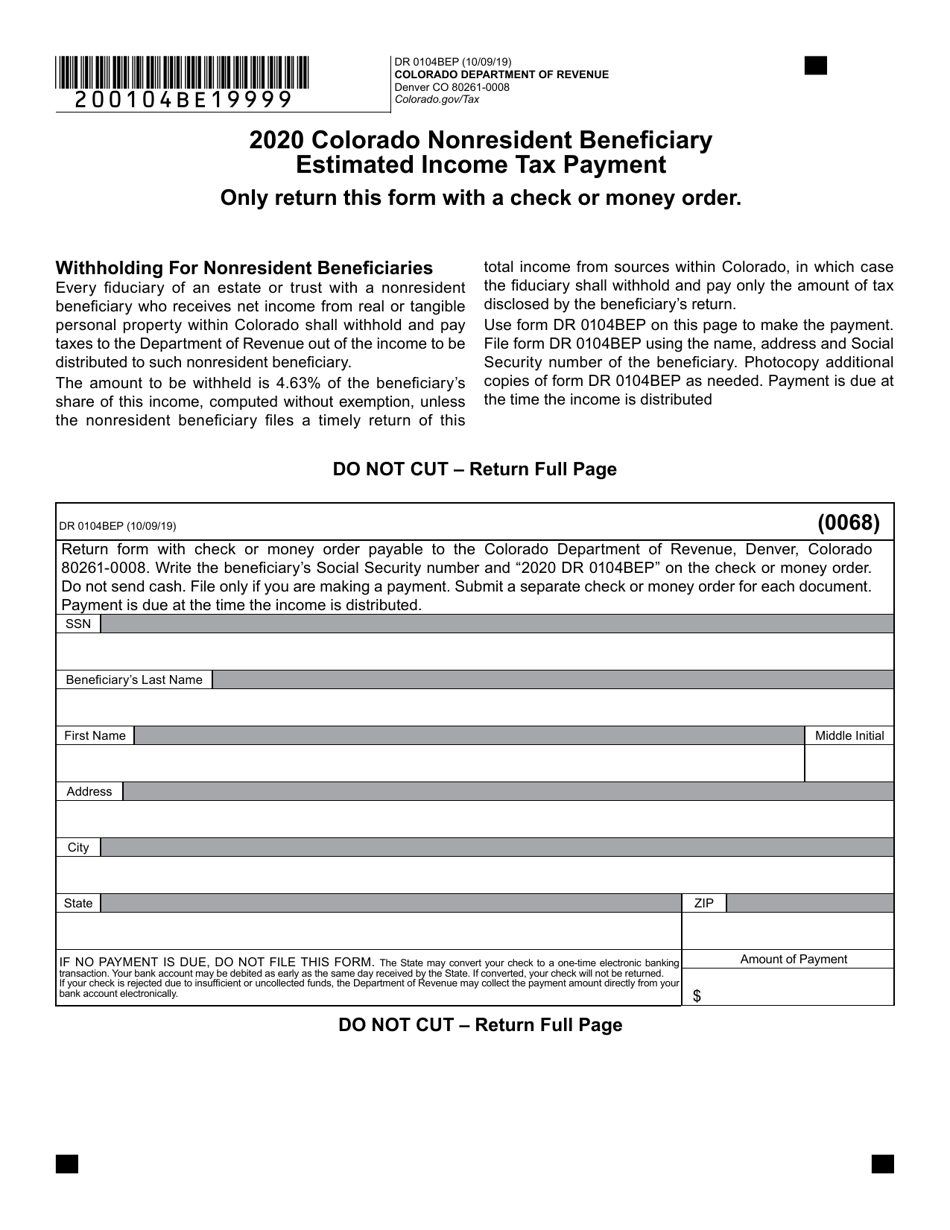

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Your total income from all sources was less than $16,925 for single. To apply for the exemption or get. Web for those who qualify for the exemption, 50% of the first $200,000 in actual value — $100,000 — is exempted from property tax. Web the senior property tax exemption is available to senior citizens and the surviving spouses of senior.

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Web web site of the colorado division of property taxation at www.dola.colorado.gov/dpt. Web the senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. 1) the qualifying senior must be at least 65 years old on january 1 of the year of application; Web for those who qualify for the exemption, 50% of the.

2) He Or She Must Be The Owner Of Record And Must.

Late filing fee waiver request. 201 w colfax ave dept 406. Web general information great news! Remedies for recipients of notice of forfeiture of right to claim exemption.

Web The Partial Tax Exemption For Senior Citizens Was Created For Qualifying Seniors As Well As The Surviving Spouses Of Seniors Who Previously Qualified.

Property tax relief programs for senior citizens summary this memorandum provides information on five types of programs that provide property tax and/or rental. To apply for the exemption, or get. This is resulting in return adjustments and delays. Property tax exemption for seniors city & county of denverassessment division confidential.

1) The Qualifying Senior Must Be At Least 65 Years Old On January 1 Of The Year Of Application;

Web the three basic requirements are: Web there are two application forms for the senior property tax exemption. Web on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. Web you may be able to claim the 2022 ptc rebate if:

1) The Qualifying Senior Must Be At Least 65 Years Old On January 1 Of The Year In Which He Or She Applies;

The state reimburses the local governments for the loss in. As of january 1 st the taxpayer. Web application for property tax exemption. An individual or married couple is only entitled to one exemption, either senior.