California Tax Form 590

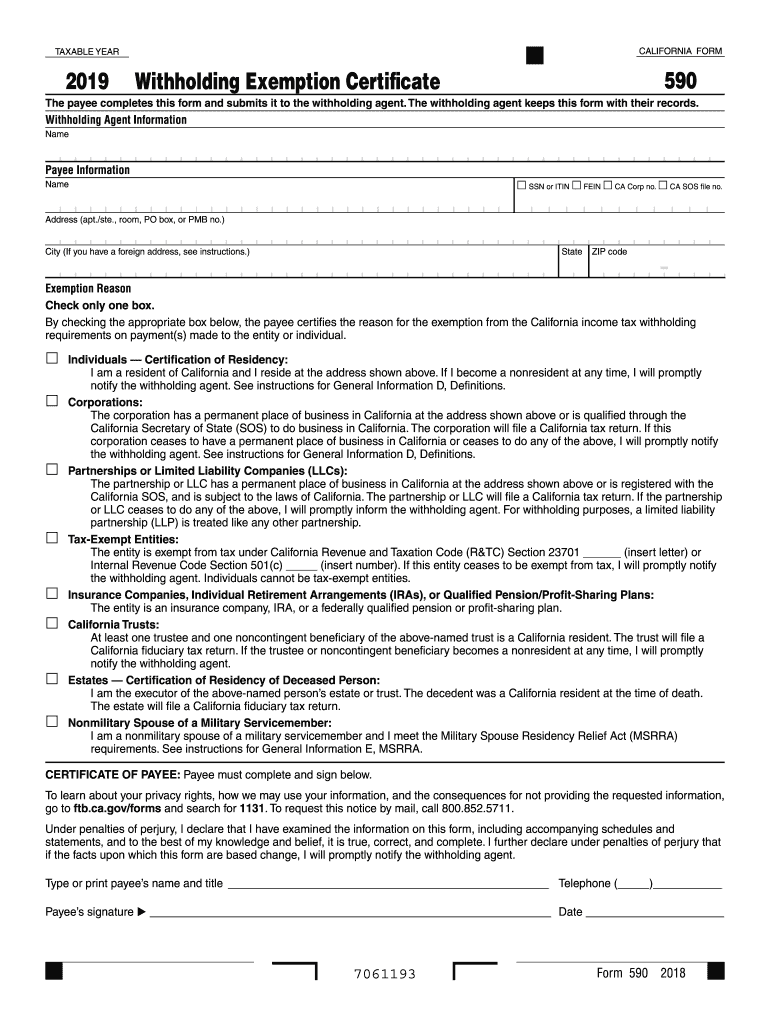

California Tax Form 590 - Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes this form and submits it to the withholding agent. Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Payee must complete and sign below. Form 590 does not apply to payments for wages to employees. Wage withholding is administered by the california employment development department (edd). Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Individuals — certification of residency: Payee’s certificate of previously reported income:

Web check only one box. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Form 590 does not apply to payments for wages to employees. Form 590 does not apply to payments of backup withholding. Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The withholding agent keeps this form with their records.

Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Individuals — certification of residency: Form 590 does not apply to payments of backup withholding. Form 590 does not apply to payments for wages to employees. Wage withholding is administered by the california employment development department (edd). California residents or entities should complete and present form 590 to the withholding agent. For more information, go to ftb.ca.gov and search for backup withholding. Web 2022 form 590 withholding exemption certificate. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes this form and submits it to the withholding agent.

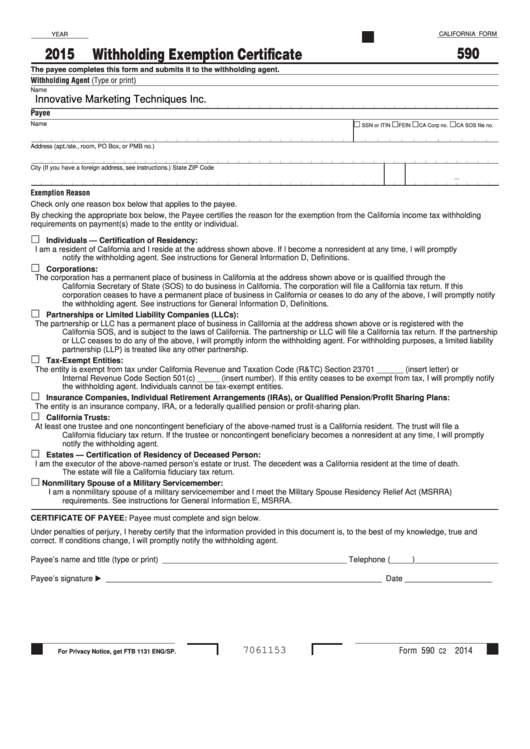

California Form 590 Withholding Exemption Certificate 2015

Web check only one box. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual..

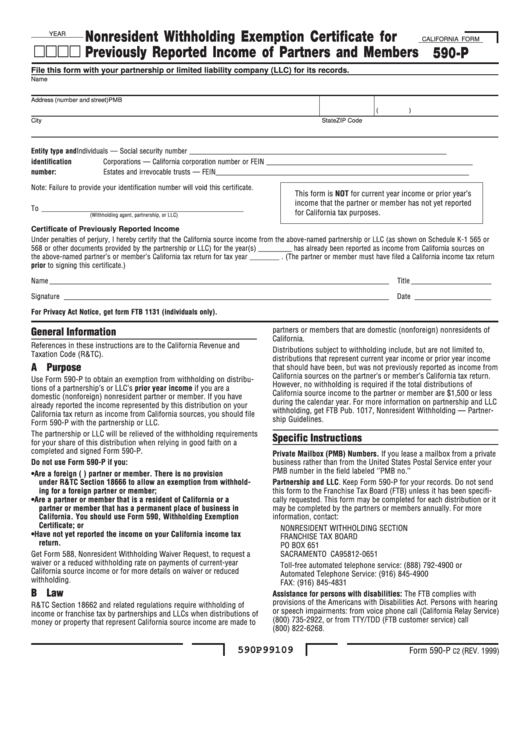

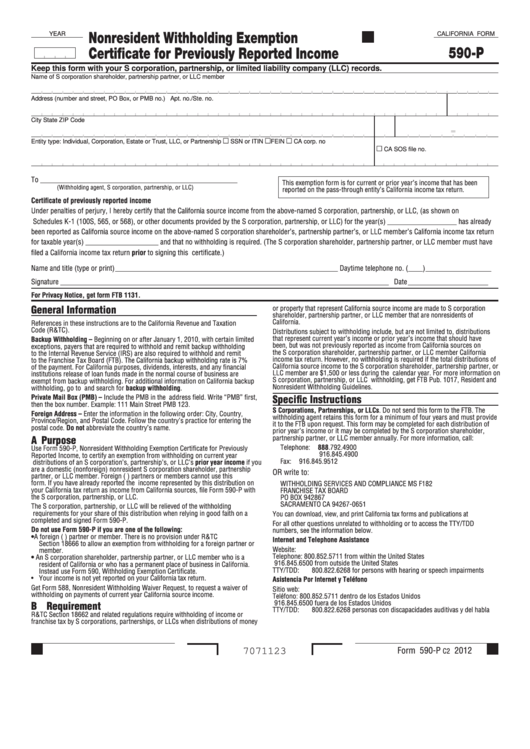

Form 590P Nonresident Withholding Exemption Certificate For

Form 590 does not apply to payments for wages to employees. Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Payee’s certificate of previously reported income: By checking the.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Web check only one box. California residents or entities should complete and present form 590 to the withholding agent. Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. For more information, go to ftb.ca.gov and search for backup withholding. The payee completes this.

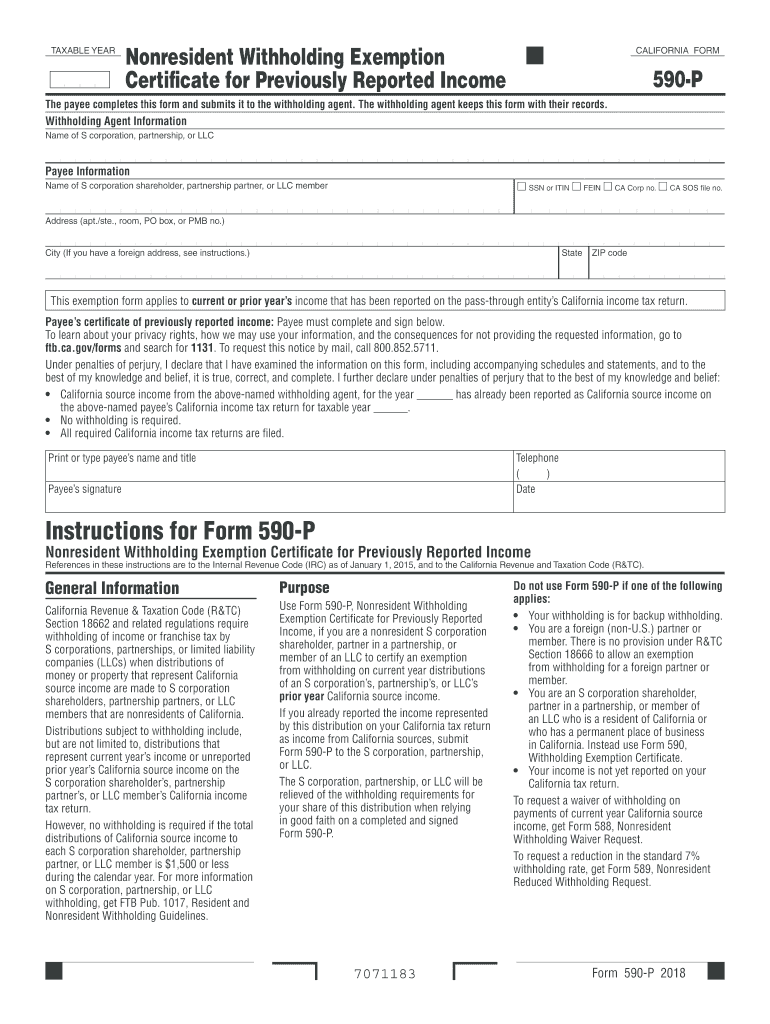

2019 Form CA FTB 590P Fill Online, Printable, Fillable, Blank PDFfiller

Web simplified income, payroll, sales and use tax information for you and your business Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Web form 590 does not apply to payments for wages to employees. The payee completes this form and submits it to the withholding agent. The withholding.

Fillable California Form 590P Nonresident Withholding Exemption

Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. For more information, go to ftb.ca.gov and search for backup withholding. Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Form 590 does.

Ca590 Fill Out and Sign Printable PDF Template signNow

Am a resident of california and i reside at the address shown above. Web form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The withholding agent keeps this form with their records. Web simplified income, payroll, sales and use tax information for you and.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

Form 590 does not apply to payments of backup withholding. Payee must complete and sign below. Wage withholding is administered by the california employment development department (edd). Payee’s certificate of previously reported income: Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s.

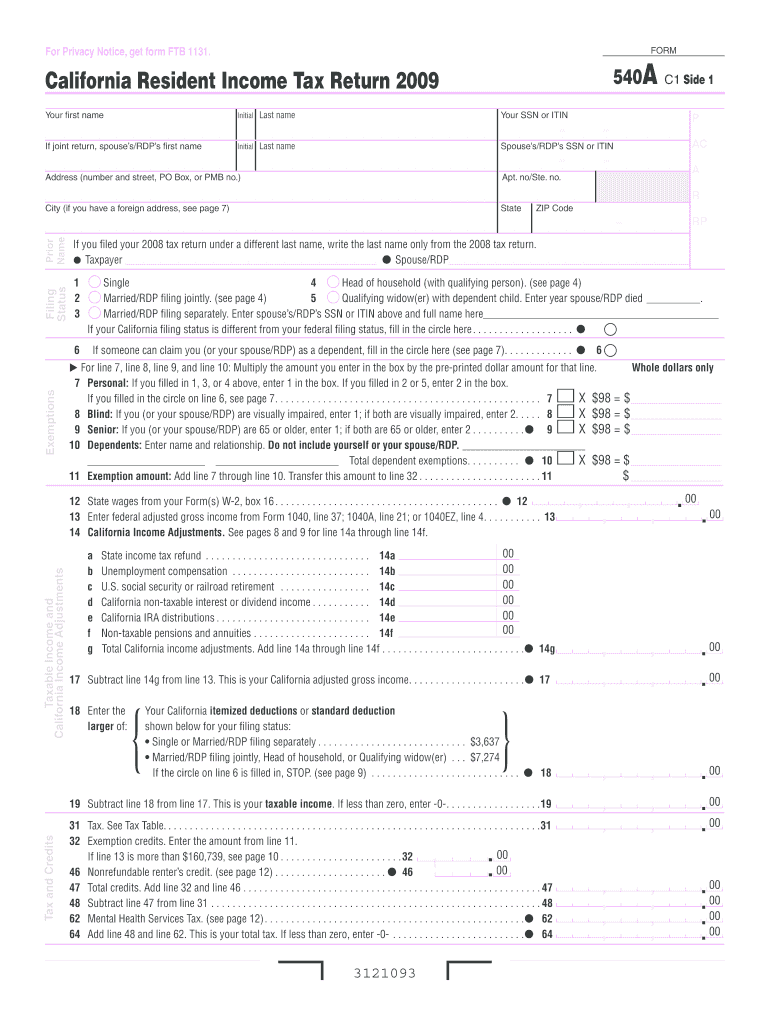

2009 Ca Tax Fill Out and Sign Printable PDF Template signNow

Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Web check only one box. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to.

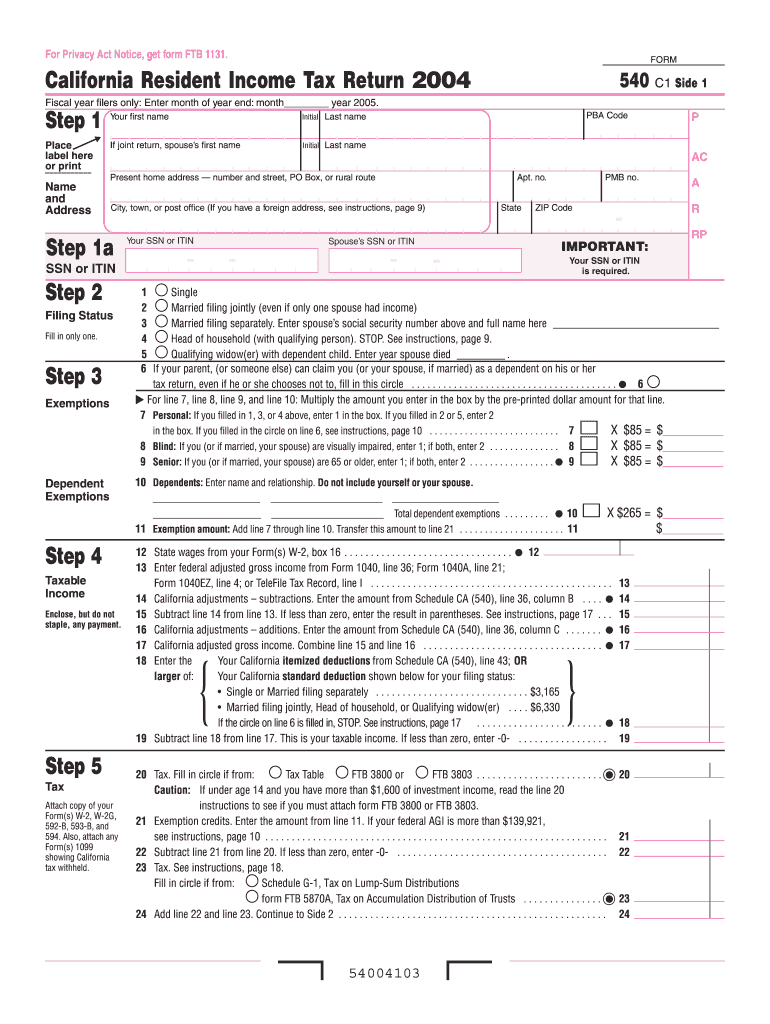

2004 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet For more information, go to ftb.ca.gov and search for backup withholding. Wage withholding is administered by the california employment development department (edd). Web simplified income, payroll, sales and use tax.

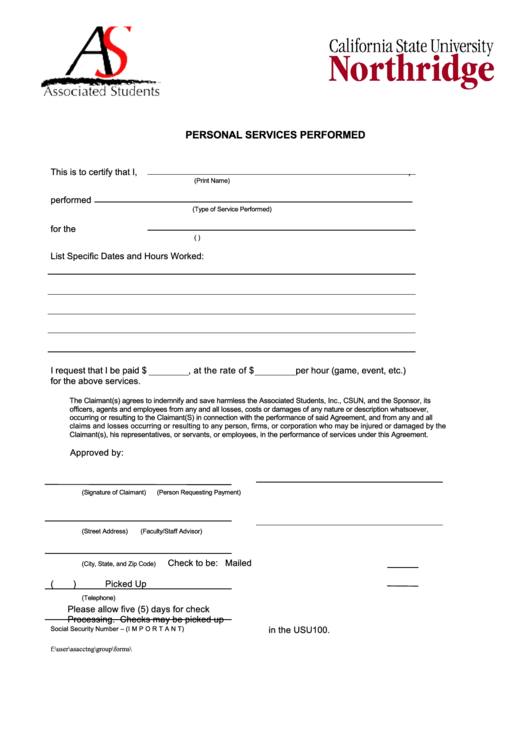

Fillable Personal Services Performed Form/california Form 590

Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. The withholding agent keeps this form with their records. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to.

The Payee Completes This Form And Submits It To The Withholding Agent.

Web home forms forms and publications california counts on all of us forms and publications get forms, instructions, and publications online location near you by u.s. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form 590 does not apply to payments for wages to employees. Individuals — certification of residency:

Form 590 Does Not Apply To Payments For Wages To Employees.

Do not use form 590 to certify an exemption from withholding if you are a seller of california real estate. Form 590 does not apply to payments of backup withholding. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual.

Wage Withholding Is Administered By The California Employment Development Department (Edd).

Web check only one box. Web 2022 form 590 withholding exemption certificate. Mail by phone popular forms 540 california resident income tax return form 540 form 540 booklet 540 2ez california resident income tax return form 540 2ez form 540 2ez booklet Am a resident of california and i reside at the address shown above.

Payee Must Complete And Sign Below.

For more information, go to ftb.ca.gov and search for backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. California residents or entities should complete and present form 590 to the withholding agent. Web simplified income, payroll, sales and use tax information for you and your business