Beneficial Ownership Form

Beneficial Ownership Form - These regulations go into effect on january 1, 2024. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals: Assess the bank’s written procedures and overall compliance with regulatory requirements for identifying and verifying beneficial owner(s) of legal entity customers. And (2) the company applicants of the entity. Web what is this form? (1) the beneficial owners of the entity; Beneficial ownership information will not be accepted prior to january 1, 2024. Web beneficial owners and documentation joint owner. A bank must establish and maintain written procedures

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Beneficial ownership information will not be accepted prior to january 1, 2024. Web what is this form? To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. (1) the beneficial owners of the entity; Web the rule describes who must file a boi report, what information must be reported, and when a report is due. If you (the withholding agent) make a payment to joint owners, you need to obtain documentation from each. Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals: Assess the bank’s written procedures and overall compliance with regulatory requirements for identifying and verifying beneficial owner(s) of legal entity customers. (1) the beneficial owners of the entity;

Web the rule describes who must file a boi report, what information must be reported, and when a report is due. If you (the withholding agent) make a payment to joint owners, you need to obtain documentation from each. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals: Web beneficial owners and documentation joint owner. Business name business address or primary residence address date of birth social security number (as applicable) the name of the issuing state or country passport or driver’s license number for the beneficial owners and control person as applicable beneficial ownership information is required: Web beneficial ownership information reporting. And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Beneficial ownership information will not be accepted prior to january 1, 2024. Generally, you can treat the payee as a u.s.

Beneficial Ownership Form Fill Out and Sign Printable PDF Template

Web the rule describes who must file a boi report, what information must be reported, and when a report is due. Web what is this form? Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and certifying.

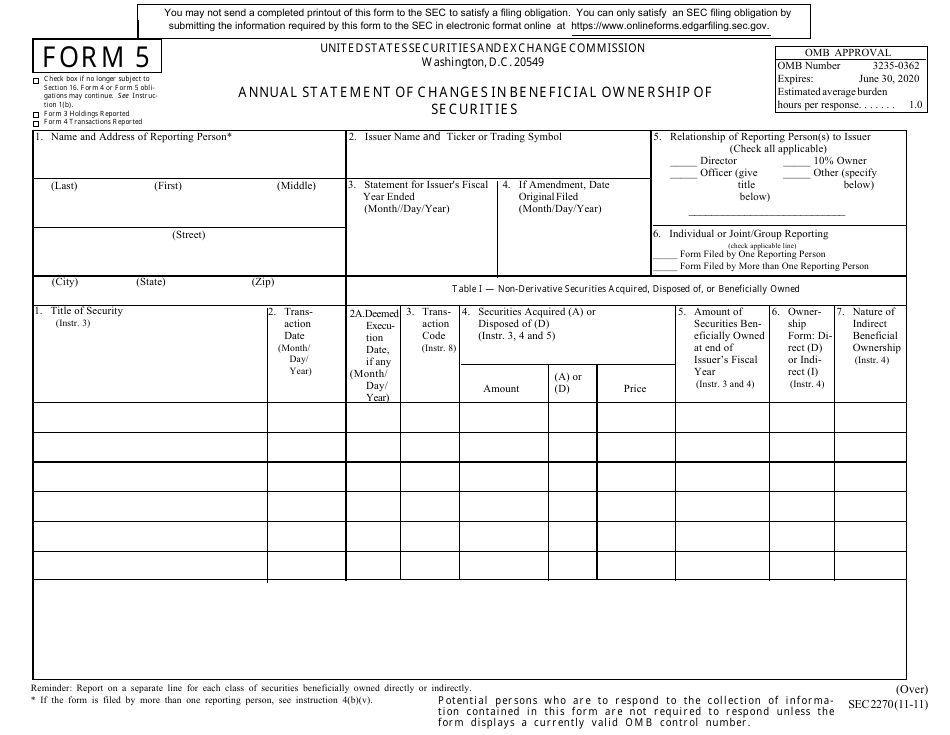

SEC Form 2270 (5) Download Printable PDF or Fill Online Annual

A bank must establish and maintain written procedures (1) the beneficial owners of the entity; Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals: And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Web the rule describes.

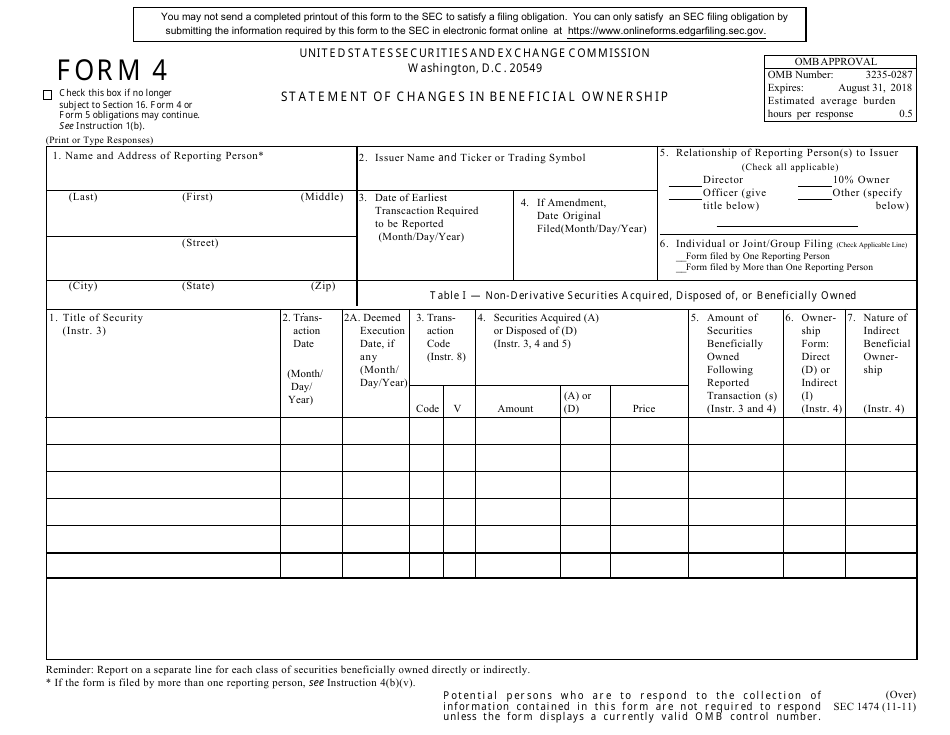

SEC Form 1474 (4) Download Printable PDF or Fill Online Statement of

Web specifically, the proposed rule would require reporting companies to file reports with fincen that identify two categories of individuals: Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and certifying this information. Web beneficial owners and.

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Business name business address or primary residence address date of birth social security number (as applicable) the name of the issuing state or country passport or driver’s license number for the beneficial owners and control person as applicable beneficial.

2021 Form UK Axis Bank Declaration of Beneficial Ownership for

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web beneficial ownership information reporting. Web what is this form? Web specifically, the proposed rule would require reporting companies to file reports with fincen that identify two categories of individuals: If you (the withholding agent) make a payment to.

Affidavit of Beneficial Ownership Declaration of Claim of Title

Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing and certifying this information. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. A bank must.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Under the beneficial ownership rule, 1..

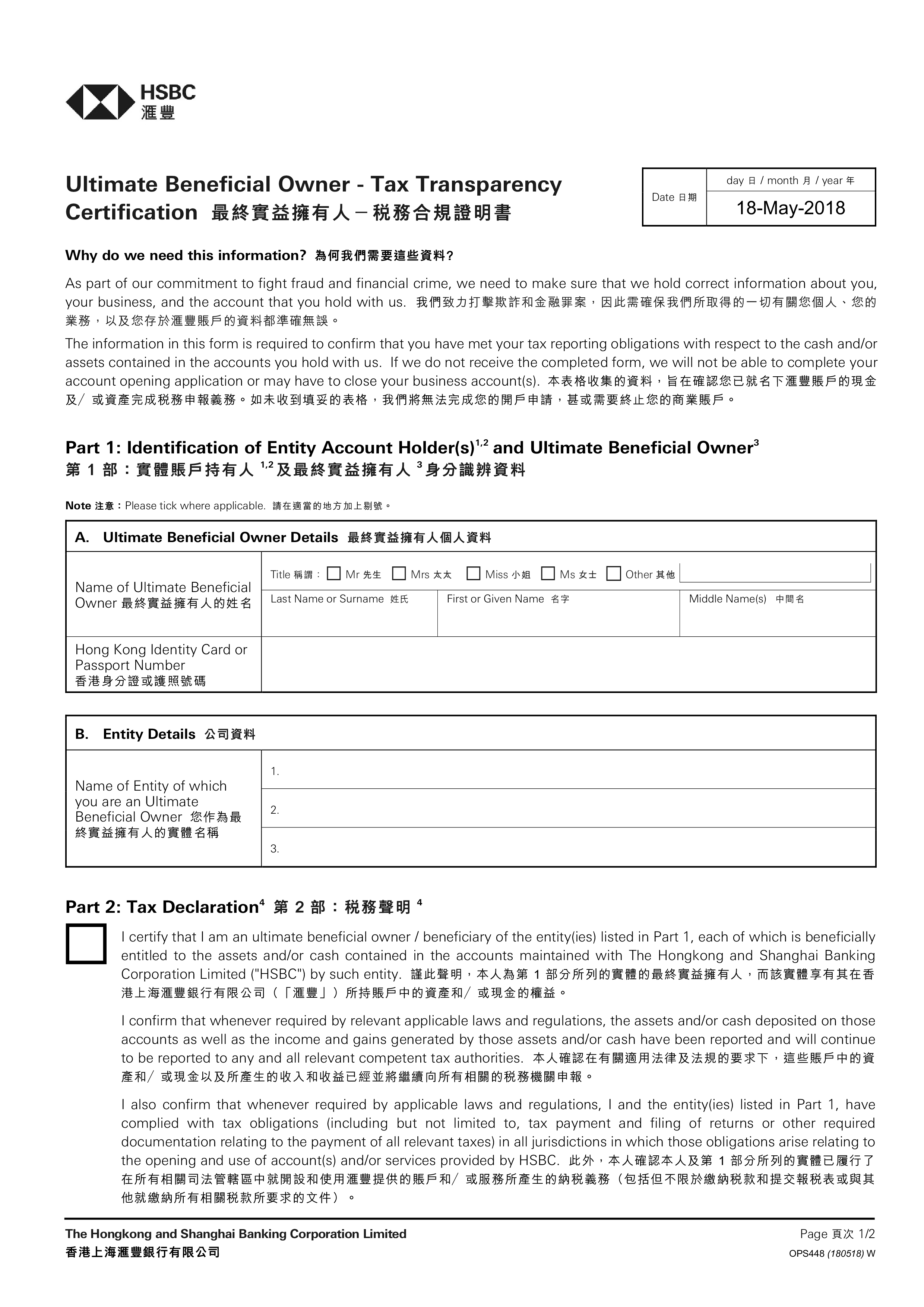

Beneficial Owner Tax Transparency Certification Templates at

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. (1) the beneficial owners of the entity; Web the form includes identity information about your organization's beneficial owners that have a 25% ownership interest, identity information about one individual with managerial control and a signature of the person providing.

FinCen's Customer Due Diligence Rule Certification Regarding

These regulations go into effect on january 1, 2024. To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web what is.

Federal Register Customer Due Diligence Requirements for Financial

Specifically, the rule requires reporting companies to file reports with fincen that identify two categories of individuals: And (2) the company applicants of the entity. Assess the bank’s written procedures and overall compliance with regulatory requirements for identifying and verifying beneficial owner(s) of legal entity customers. Beneficial ownership information will not be accepted prior to january 1, 2024. Web specifically,.

A Final Rule Implementing The Beneficial Ownership Information Reporting Requirements Of The Corporate Transparency Act (Cta) Was Issued In September 2022.

(1) the beneficial owners of the entity; Generally, you can treat the payee as a u.s. (1) the beneficial owners of the entity; Web what is this form?

Assess The Bank’s Written Procedures And Overall Compliance With Regulatory Requirements For Identifying And Verifying Beneficial Owner(S) Of Legal Entity Customers.

A bank must establish and maintain written procedures To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web beneficial owners and documentation joint owner. Under the beneficial ownership rule, 1.

To Help The Government Fight Financial Crime, Federal Regulation Requires Certain Financial Institutions To Obtain, Verify, And Record Information About The Beneficial Owners Of Legal Entity Customers.

And (2) individuals who have filed an application with specified governmental or tribal authorities to form the entity or register it to do business. Web what is this form? Web beneficial ownership information reporting. And (2) the company applicants of the entity.

Web The Rule Describes Who Must File A Boi Report, What Information Must Be Reported, And When A Report Is Due.

Beneficial ownership information will not be accepted prior to january 1, 2024. Business name business address or primary residence address date of birth social security number (as applicable) the name of the issuing state or country passport or driver’s license number for the beneficial owners and control person as applicable beneficial ownership information is required: Web what is this form? If you (the withholding agent) make a payment to joint owners, you need to obtain documentation from each.