2022 Form 3922

2022 Form 3922 - Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully. Web forms 3921 and 3922, see the form instructions; Web guide for filing form 3922 for 2022 tax year. Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. Web form 3922 is available on the irs website. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Get ready for tax season deadlines by completing any required tax forms today. Irs form 3922 is used by the companies to report. Complete, edit or print tax forms instantly. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or.

Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web instructions for forms 3921 and 3922. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. Irs form 3922 is used by the companies to report. Complete, edit or print tax forms instantly. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Persons with a hearing or speech disability with access to. Get ready for tax season deadlines by completing any required tax forms today. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase plan.

Web form 3922 is available on the irs website. Web the irs instructions to form 3921 and 3922 may be obtained here. Web forms 3921 and 3922, see the form instructions; Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price. You can also obtain the latest developments for each of the. Web instructions for forms 3921 and 3922. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Complete, edit or print tax forms instantly. Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan.

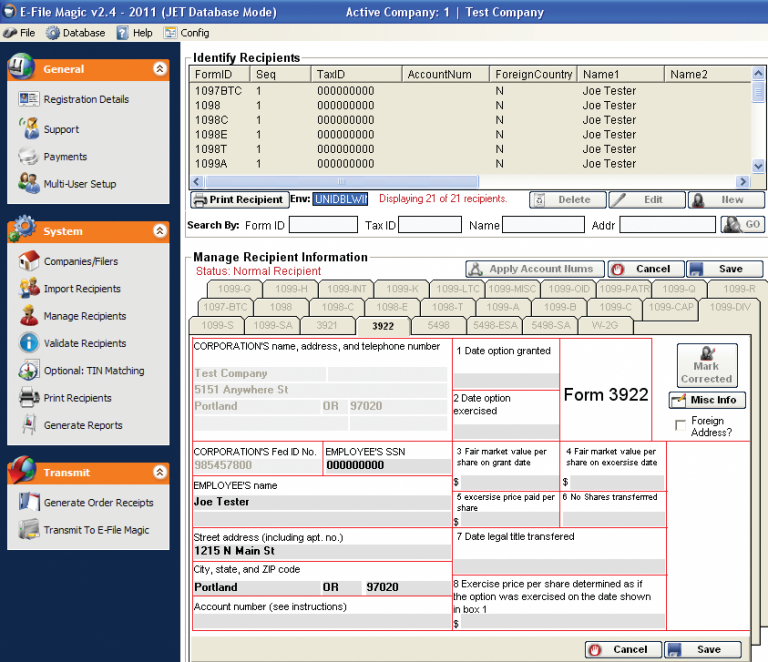

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web your.

IRS Form 3922

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web forms 3921 and 3922, see the form instructions; Web form 3922 provides the following information to the irs and an employee or former employee for whom the corporation records in 2021 the first transfer of legal title. Persons with.

Form 3922 Software Transfer of Stock Acquired Through an Employee

When you need to file form 3922 you are required to. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Complete, edit or print tax forms instantly. Persons with a hearing or speech disability with access to. Web instructions for forms 3921 and 3922.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Copy a of form 3922 is filed with the irs, copy b is furnished to the current or former employee, and copy c is retained by. Web irs form 3922 is an.

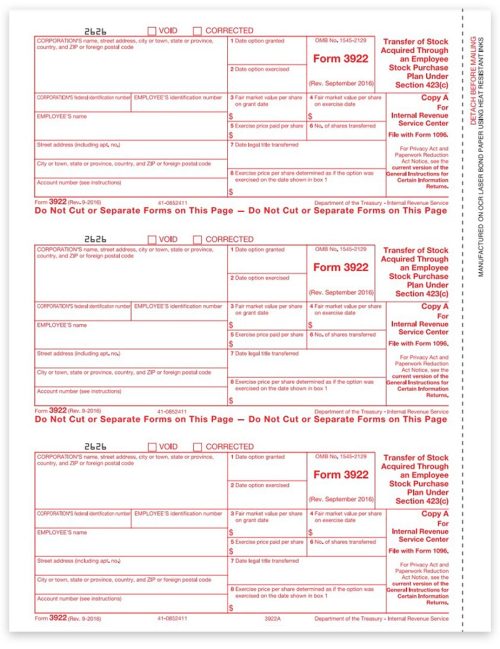

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. Web form 3922 is available on the irs website. Persons with a hearing or speech disability with access to. You can also obtain the latest developments for each of.

What Is IRS Form 3922?

Get ready for tax season deadlines by completing any required tax forms today. Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price. Web forms 3921 and 3922, see the form instructions; Irs form 3922 is used by the companies to report..

File IRS Form 3922 Online EFile Form 3922 for 2022

Complete, edit or print tax forms instantly. You can also obtain the latest developments for each of the. Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Form 3922 is used when the employee. Get ready for tax season deadlines by completing.

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Web instructions for forms 3921 and 3922. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock..

Form 1099K Notices & Penalties For 2022 Tax1099 Blog

Persons with a hearing or speech disability with access to. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. You can also obtain the latest developments for each of the. Web form 4419 must be submitted to the irs at least.

3922 2020 Public Documents 1099 Pro Wiki

Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase plan. On the other hand, under copy a, 28th february. When you.

Copy A Of Form 3922 Is Filed With The Irs, Copy B Is Furnished To The Current Or Former Employee, And Copy C Is Retained By.

Web in the case of copy b, isos or espps exercised in 2022, will be required to file form 3921 and form 3922 by 31st january 2023. Web we last updated the transfer of stock acquired through an employee stock purchase plan under section 423(c) in february 2023, so this is the latest version of form 3922, fully. On the other hand, under copy a, 28th february. Complete, edit or print tax forms instantly.

Form 3922 Is Used When The Employee.

Web the irs instructions to form 3921 and 3922 may be obtained here. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. When you need to file form 3922 you are required to. Web irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase plan.

Web Form 3922 Provides The Following Information To The Irs And An Employee Or Former Employee For Whom The Corporation Records In 2021 The First Transfer Of Legal Title.

Complete, edit or print tax forms instantly. You can also obtain the latest developments for each of the. Web form 3922 is available on the irs website. Web instructions for forms 3921 and 3922.

Web Forms 3921 And 3922, See The Form Instructions;

Get ready for tax season deadlines by completing any required tax forms today. Web form 4419 must be submitted to the irs at least 45 days prior to filing a return electronically and, thus, must be submitted no later than february 14, 2022 (or. Web form 3922 is required for reporting the transfer of stock acquired through an employee stock purchase plan. Web a form a corporation files with the irs upon an employee's exercise of a stock option at a price less than 100% of the stock's market price.