Form 1310 E File

Form 1310 E File - Get ready for tax season deadlines by completing any required tax forms today. Web 1 did the decedent leave a will? Then you have to provide all other required information in the. Ad access irs tax forms. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Complete, edit or print tax forms instantly. Yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. It must be in the same.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. The best way is to have. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Get ready for tax season deadlines by completing any required tax forms today. Web 1 did the decedent leave a will? Get ready for tax season deadlines by completing any required tax forms today. Then you have to provide all other required information in the. B if you answered “no” to 2a, will one be appointed? Yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. It must be in the same.

The person claiming the refund. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Complete, edit or print tax forms instantly. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Web 3 best answer. A person other than the surviving spouse or personal. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. 2a has a court appointed a personal representative for the estate of the decedent?

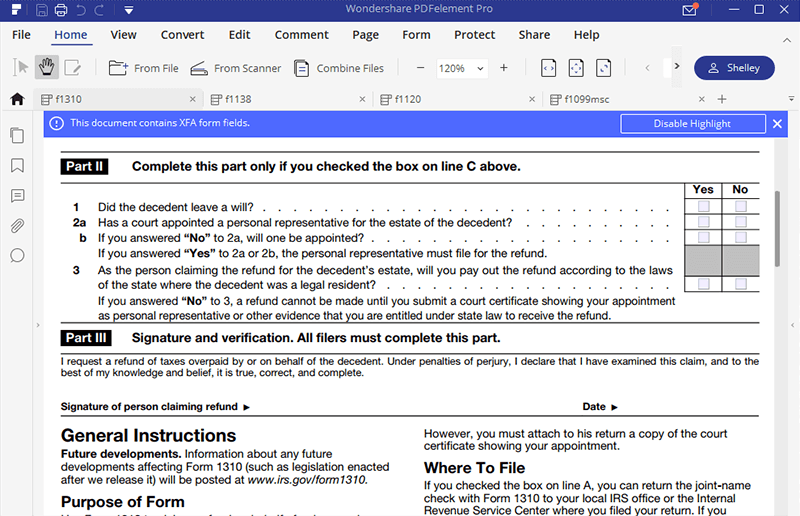

IRS Form 1310 How to Fill it Right

It must be in the same. Ad access irs tax forms. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Ad access irs tax forms. You can prepare the form and then mail it in to the same irs service.

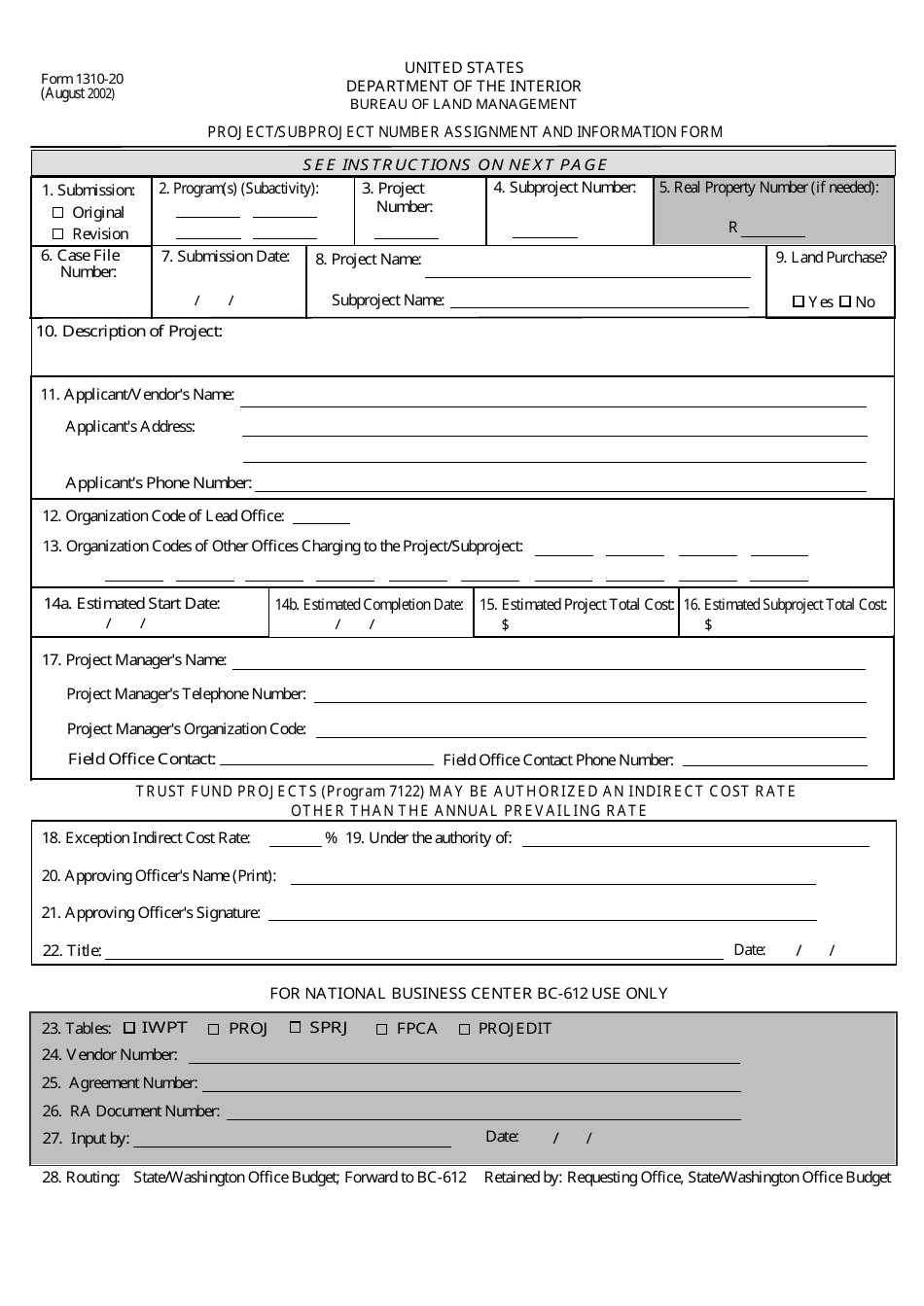

Form 131020 Download Fillable PDF or Fill Online Project/Subproject

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). It must be in the same. A person other than the.

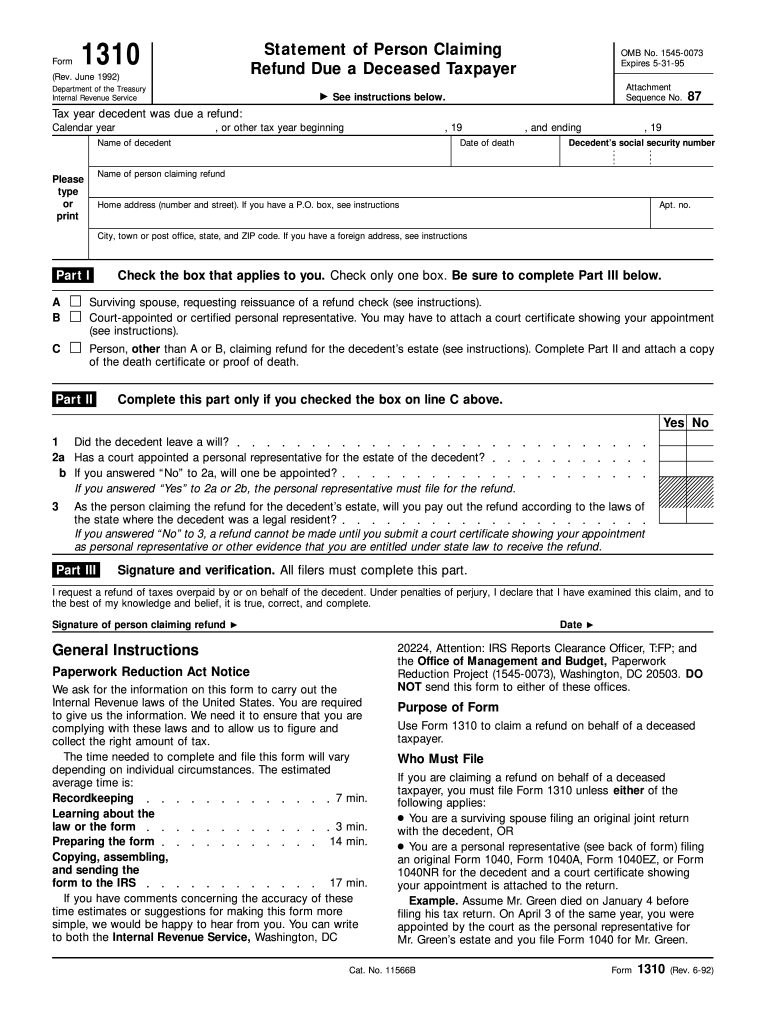

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

This return must be filed as a paper return. Ad access irs tax forms. The best way is to have. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Complete, edit or print tax forms instantly.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

Then you have to provide all other required information in the. Web 3 best answer. Web up to $40 cash back the penalty for the late filing of irs form 1310 is 5% of the amount due for each month or part of a month that the form is late, up to a maximum of 25%. 2a has a court.

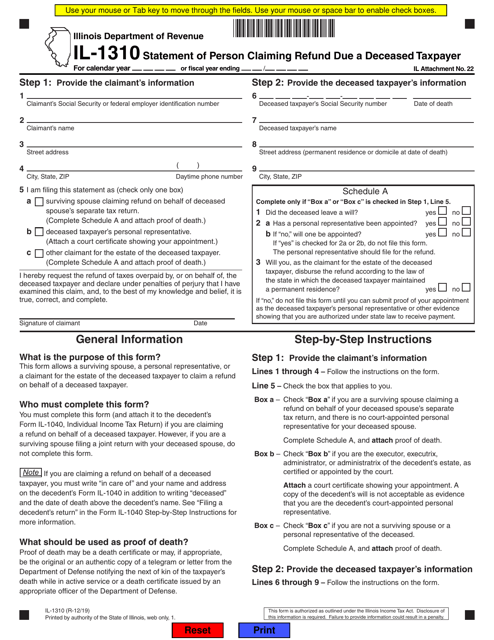

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Then you have to provide all other required information in the. It must be in the same. Get ready for tax season deadlines by completing any required tax forms today. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. You can prepare the form and then mail it in.

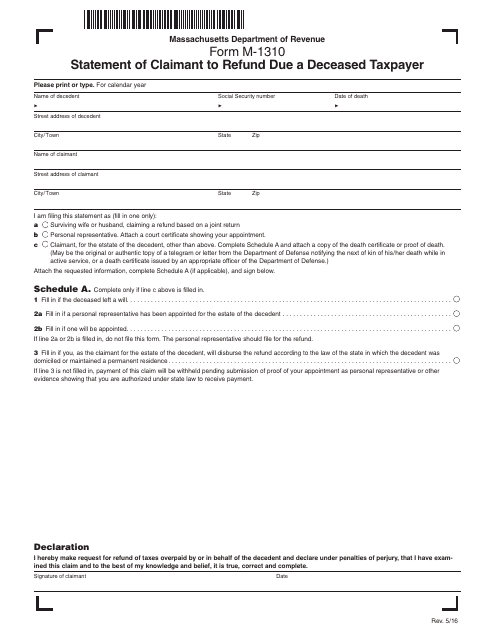

Form M1310 Download Printable PDF or Fill Online Statement of Claimant

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web 1 did the decedent leave a will? For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Complete, edit or print tax forms instantly. Web up to $40 cash back the penalty for the late.

Form 1310 Edit, Fill, Sign Online Handypdf

Then you have to provide all other required information in the. Web 1 did the decedent leave a will? Ad access irs tax forms. Yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement. Ad access irs tax forms.

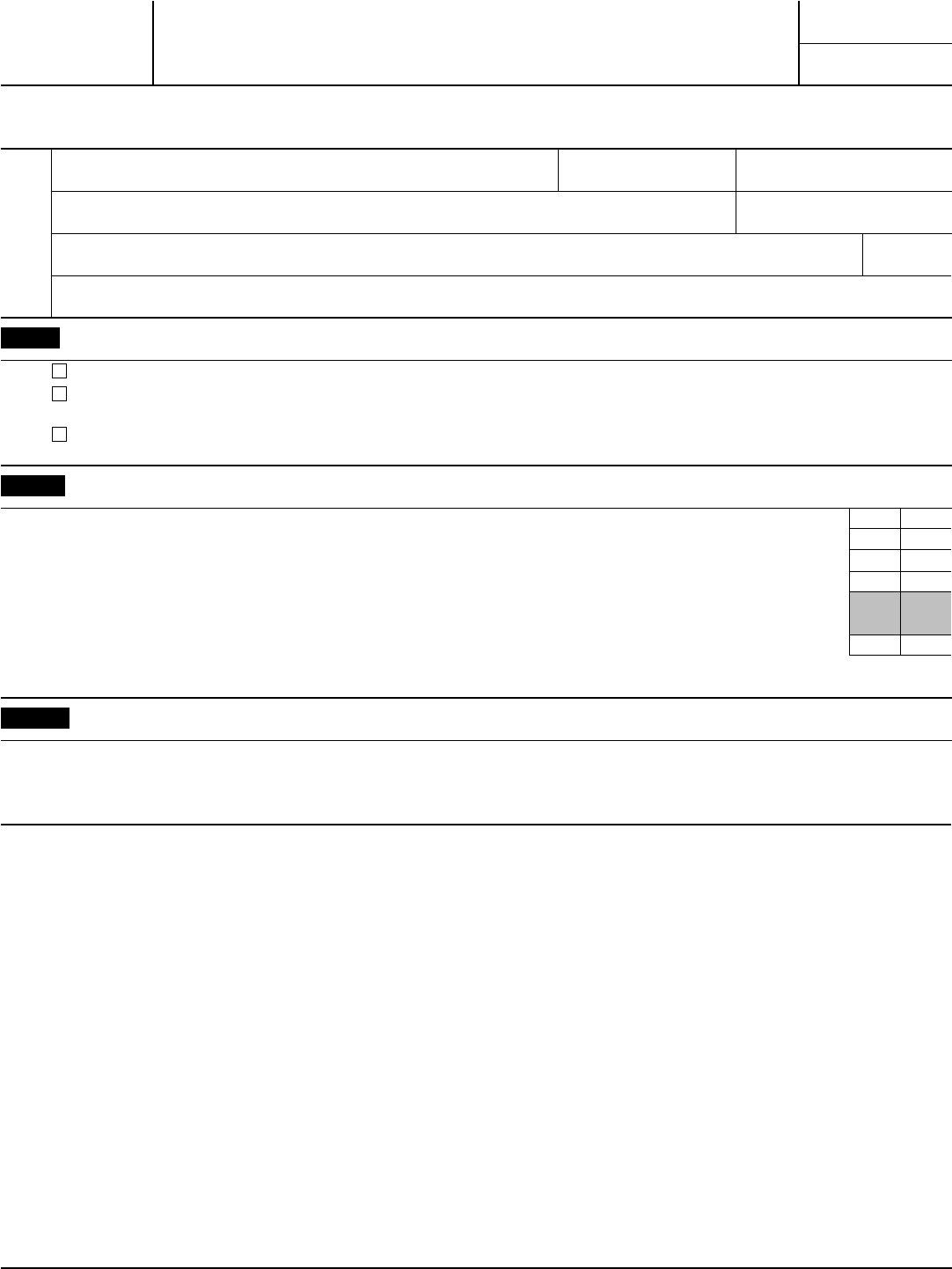

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Web 3 best answer. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). The person claiming the refund. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. 2a has a court appointed a personal representative.

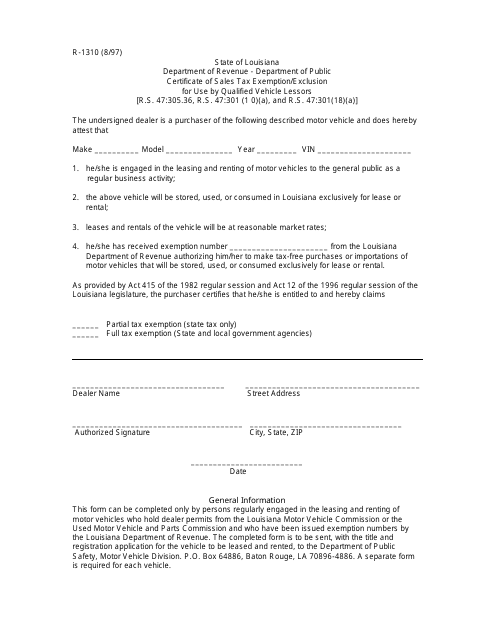

Form R1310 Download Fillable PDF or Fill Online Certificate of Sales

Then you have to provide all other required information in the. Web 3 best answer. Complete, edit or print tax forms instantly. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Complete, edit or print tax forms instantly.

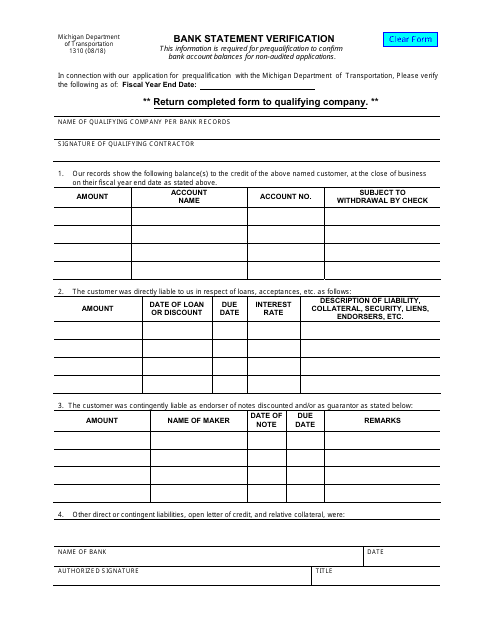

Form 1310 Download Fillable PDF or Fill Online Bank Statement

Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). A person other than the surviving spouse or personal. Web.

Web Up To $40 Cash Back The Penalty For The Late Filing Of Irs Form 1310 Is 5% Of The Amount Due For Each Month Or Part Of A Month That The Form Is Late, Up To A Maximum Of 25%.

Complete, edit or print tax forms instantly. 2a has a court appointed a personal representative for the estate of the decedent? This return must be filed as a paper return. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Then you have to provide all other required information in the. The person claiming the refund. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Yes, you are correct you cannot efile the return due to form 1310 this is an irs requirement.

Web Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

Web this information includes name, address, and the social security number of the person who is filing the tax return. The best way is to have. Ad access irs tax forms. It must be in the same.

B If You Answered “No” To 2A, Will One Be Appointed?

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. A person other than the surviving spouse or personal. Web 3 best answer.