Az Tax Credit Form

Az Tax Credit Form - Web 26 rows arizona corporation income tax return: Web we last updated the credit for contributions to qualifying charitable organizations in february 2023, so this is the latest version of form 321, fully updated for tax year 2022. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. Web april 15, 2021, may be claimed as a tax credit on either the 2020 or 2021 arizona income tax return. $500 single, married filing separate or head of household; June 27, 2022 july 4, 2023 kelly meltzer and brad nicholas. Web the public school tax credit is claimed by the individual taxpayer on form 322. Web april 18, 2023 may be claimed as a tax credit on either the 2022 or 2023 arizona income tax return. If you claim this credit in for a 2020contribution made from january 1, 2021,. If you claim this credit in for a 2022contribution made from january 1, 2023 to.

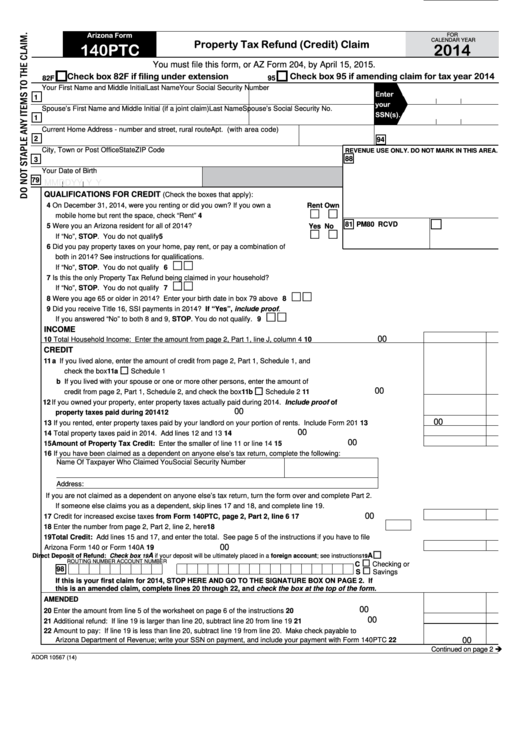

Web this form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the taxpayer. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Please print and fill out the tax credit form ( formulario del credito tributario) if you are paying by cash or check. Web 26 rows arizona corporation income tax return: Web the hearing was particularly timely, because the u.s. Web april 15, 2021, may be claimed as a tax credit on either the 2020 or 2021 arizona income tax return. If you claim this credit in for a 2020contribution made from january 1, 2021,. Web recurring online payments are now an option as well. Web 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Web please use our contribution forms (download forms, complete, enclose your check, and mail).

The maximum qfco credit donation amount for 2022: Please print and fill out the tax credit form ( formulario del credito tributario) if you are paying by cash or check. If you claim this credit in for a 2022contribution made from january 1, 2023 to. Web credit for contributions made or fees paid to public schools. Ad with the right expertise, federal tax credits and incentives could benefit your business. Drug deaths nationwide hit a record. Web arizona tax credit alert 2022. Work with federal tax credits and incentives specialists who have decades of experience. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year.

Arizona State Tax Credit for Sedona Charter School

Register and subscribe now to work on your az ador 140ptc & more fillable forms. The arizona legislature has retained and expanded some of the. Complete, edit or print tax forms instantly. Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or.

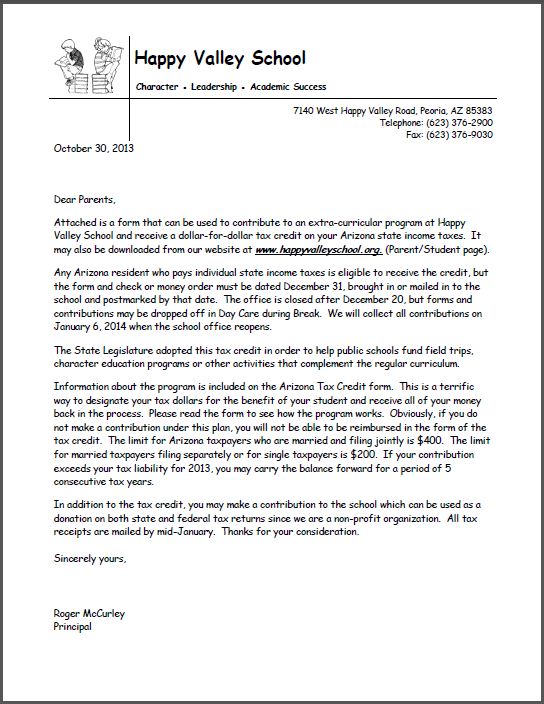

AZ Tax Credit 1 Happy Valley School

Web arizona tax credit alert 2022. Web 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. If you claim this credit in for a 2020contribution made from january 1, 2021,. Web 26 rows arizona corporation income tax return: June 27, 2022 july 4, 2023 kelly meltzer.

2022 Banking Forms Fillable, Printable PDF & Forms Handypdf

Complete, edit or print tax forms instantly. Register and subscribe now to work on your az ador 140ptc & more fillable forms. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. Donations by mail (forms) gilbert public schools tax credit. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt),.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Drug deaths nationwide hit a record. Web we last updated the credit for contributions to qualifying charitable organizations in february 2023, so this is the latest version of form 321, fully updated for tax year 2022. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of. $500 single, married filing separate or head.

Az Tax Withholding Chart Triply

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web please use our contribution forms (download forms, complete, enclose your check, and mail). Web april 15, 2021, may be claimed as a tax credit on either the 2020 or 2021 arizona income tax return. The maximum qfco credit donation amount for 2022:.

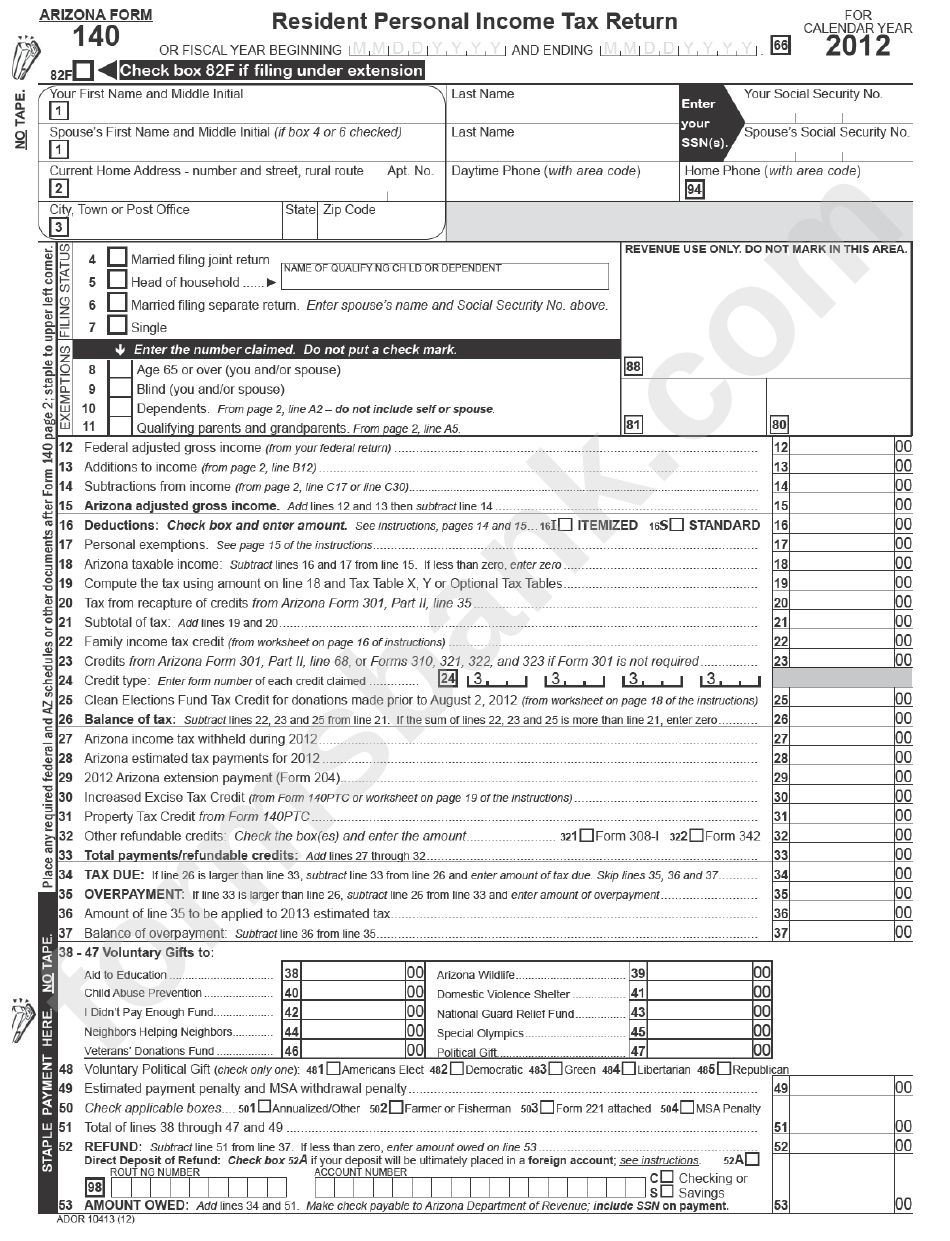

Printable Az 140 Tax Form Printable Form 2022

Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Web april 15, 2021, may be claimed as a tax credit on either the 2020 or 2021 arizona income tax return. If you claim this credit in for a.

Arizona Form 140ptc Property Tax Refund (Credit) Claim 2014

If you claim this credit in for a 2022contribution made from january 1, 2023 to. Web 26 rows arizona corporation income tax return: Web the tax credit is claimed on form 352. $500 single, married filing separate or head of household; June 27, 2022 july 4, 2023 kelly meltzer and brad nicholas.

Donate ⋆ Habitat for Humanity Tucson

Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. June 27, 2022 july 4, 2023 kelly meltzer and brad nicholas. Please print and fill out the tax credit form ( formulario del credito tributario) if you are paying.

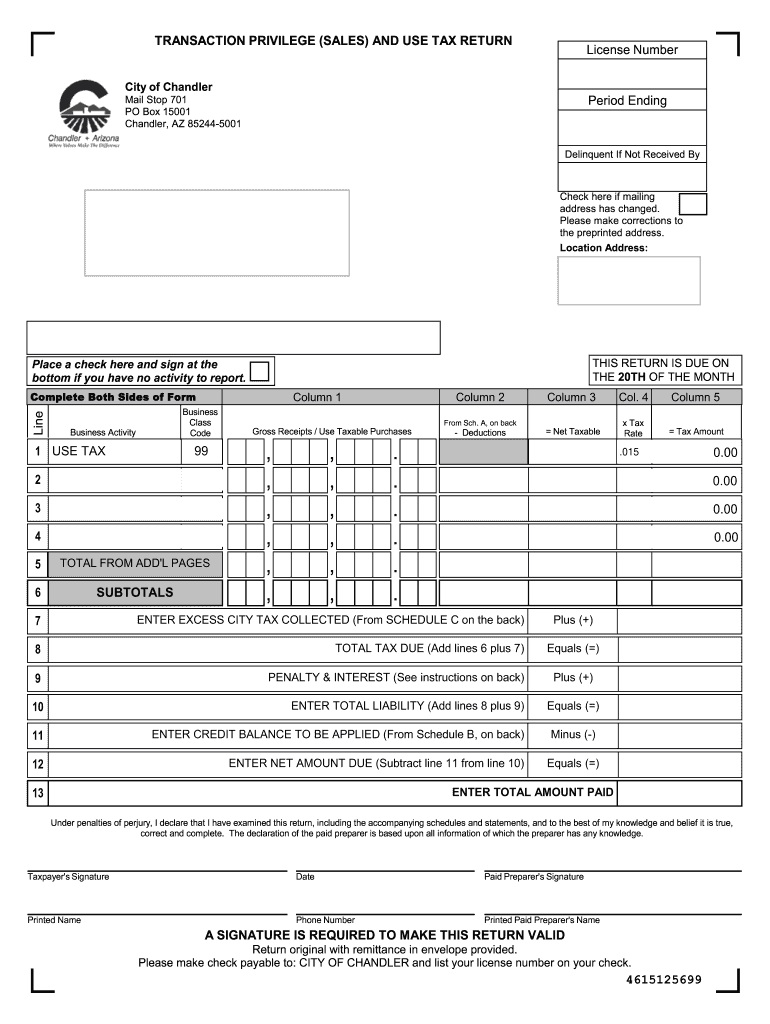

AZ Transaction Privilege (Sales) and Use Tax Return Fill out Tax

Complete, edit or print tax forms instantly. Web credit for contributions made or fees paid to public schools. Web april 18, 2023 may be claimed as a tax credit on either the 2022 or 2023 arizona income tax return. If you claim this credit in for a 2020contribution made from january 1, 2021,. Web april 15, 2021, may be claimed.

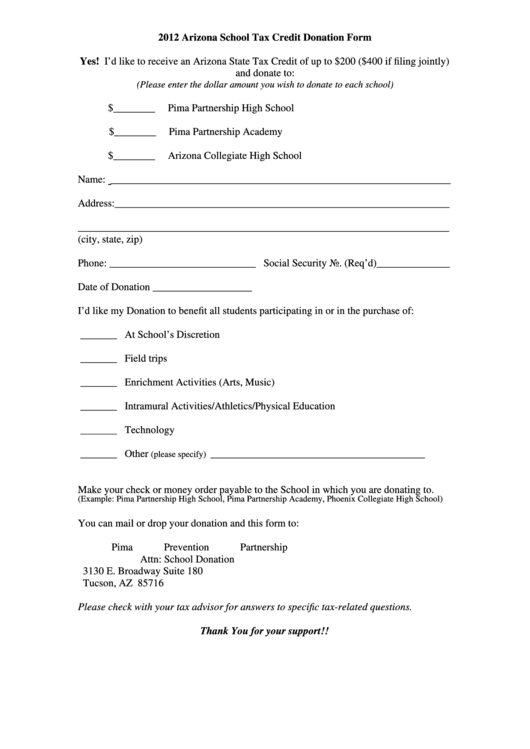

Az Tax Credit Form Arizona Collegiate High School printable pdf download

Please print and fill out the tax credit form ( formulario del credito tributario) if you are paying by cash or check. If you claim this credit in for a 2020contribution made from january 1, 2021,. Work with federal tax credits and incentives specialists who have decades of experience. A nonrefundable individual tax credit for fees or cash contributions paid.

The Arizona Legislature Has Retained And Expanded Some Of The.

Web form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the. Web the tax credit is claimed on form 352. Web arizona tax credit alert 2022. Web 26 rows arizona corporation income tax return:

Register And Subscribe Now To Work On Your Az Ador 140Ptc & More Fillable Forms.

A nonrefundable individual tax credit for fees or cash contributions paid to a public school located in. If you claim this credit in for a 2020contribution made from january 1, 2021,. Donations by mail (forms) gilbert public schools tax credit. Web this form is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or rented by the taxpayer.

Ad With The Right Expertise, Federal Tax Credits And Incentives Could Benefit Your Business.

Web the public school tax credit is claimed by the individual taxpayer on form 322. Web april 18, 2023 may be claimed as a tax credit on either the 2022 or 2023 arizona income tax return. • the balance of tax on form 140, 140py,. Drug deaths nationwide hit a record.

Web Recurring Online Payments Are Now An Option As Well.

Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web april 15, 2021, may be claimed as a tax credit on either the 2020 or 2021 arizona income tax return. Web tax credits georgia tax center help tax faqs, due dates and other resources important updates x motor vehicles all motor vehicle forms. $500 single, married filing separate or head of household;