Where To File Form 3520

Where To File Form 3520 - Web the form 3520 is generally required when a u.s. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web form 3520 is an information return for a u.s. It does not have to be a “foreign gift.” rather, if a. Owner, is march 15, and the due date for. Send form 3520 to the. Owners of a foreign trust. Web as the title suggests, form 3520 is used by u.s. If the answer is “yes,” then you need to file. Ad talk to our skilled attorneys by scheduling a free consultation today.

Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. Web form 3520 & instructions: Owners of a foreign trust. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web as the title suggests, form 3520 is used by u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web form 3520 is an information return for a u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Owner, is march 15, and the due date for.

Owner, is march 15, and the due date for. Web form 3115 mailing addresses. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web form 3520 & instructions: Send form 3520 to the. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. The form provides information about the foreign trust, its u.s.

Hecht Group Inheriting Property From A Foreigner What You Need To

Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web as the title suggests, form 3520 is used by u.s. Web form 3520 filing requirements. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520, also known as th.

Epa form 3520 21 Instructions Best Of File Biomed Central

Web form 3520 & instructions: Web form 3520 for u.s. It does not have to be a “foreign gift.” rather, if a. If you own any part of a foreign trust, you will probably have to file this form. Web as the title suggests, form 3520 is used by u.s.

When to File Form 3520 Gift or Inheritance From a Foreign Person

Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. It does not have to be a “foreign gift.” rather, if a. Form 3520 is technically referred to as the annual return to report transactions with foreign.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web form 3520 for u.s. Web form 3115 mailing addresses. Owners of a foreign trust. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Send form 3520 to the. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging.

DC Ruled That IRS Could Assess Only A 5 Penalty for an Untimely Filing

If you own any part of a foreign trust, you will probably have to file this form. Web form 3520 & instructions: Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. The form provides information about the foreign trust, its u.s. Web an income tax return, the.

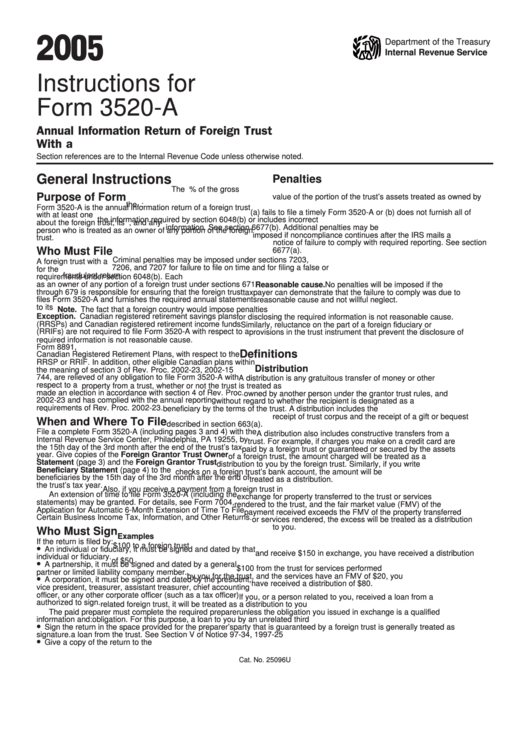

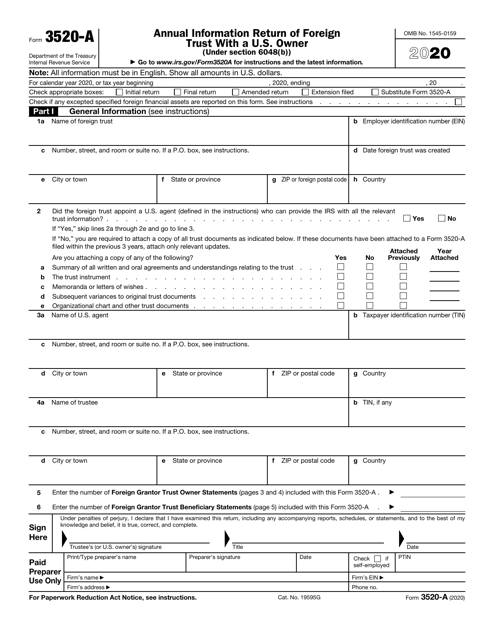

Instructions For Form 3520A Annual Information Return Of Foreign

It does not have to be a “foreign gift.” rather, if a. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Send form 3520 to the. Web as the title suggests, form 3520 is used by u.s. Web form 3520 filing requirements.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Web form 3520 for u.s. Owners of a foreign trust. Web the form 3520 is generally required when a u.s. Web form 3520 & instructions:

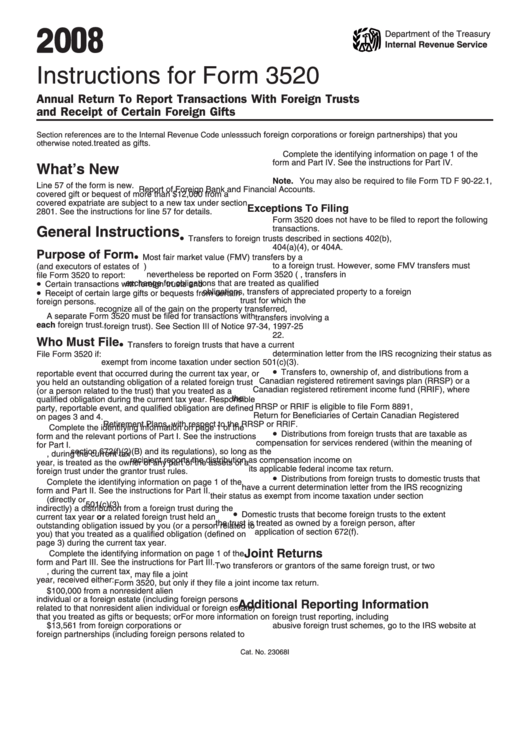

Instructions For Form 3520 Annual Return To Report Transactions With

The form provides information about the foreign trust, its u.s. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Web form 3520 for u.s. Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign. Web as the title suggests, form.

Web The Form 3520 Is Generally Required When A U.s.

The form provides information about the foreign trust, its u.s. Web as the title suggests, form 3520 is used by u.s. It does not have to be a “foreign gift.” rather, if a. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report.

Person Receives A Gift, Inheritance (A Type Of “Gift”) From A Foreign Person, Or A Foreign Trust Distribution.

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 filing requirements. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner, is march 15, and the due date for.

Form 3520 Is Technically Referred To As The Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts.

Web form 3520 is an information return for a u.s. Web form 3115 mailing addresses. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Owners of a foreign trust.

Persons To Report (1) Certain Transactions That Have Occurred With Respect To Foreign Trusts And (2) The Receipt Of Gifts From Foreign.

Web form 3520 & instructions: Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Ad talk to our skilled attorneys by scheduling a free consultation today.