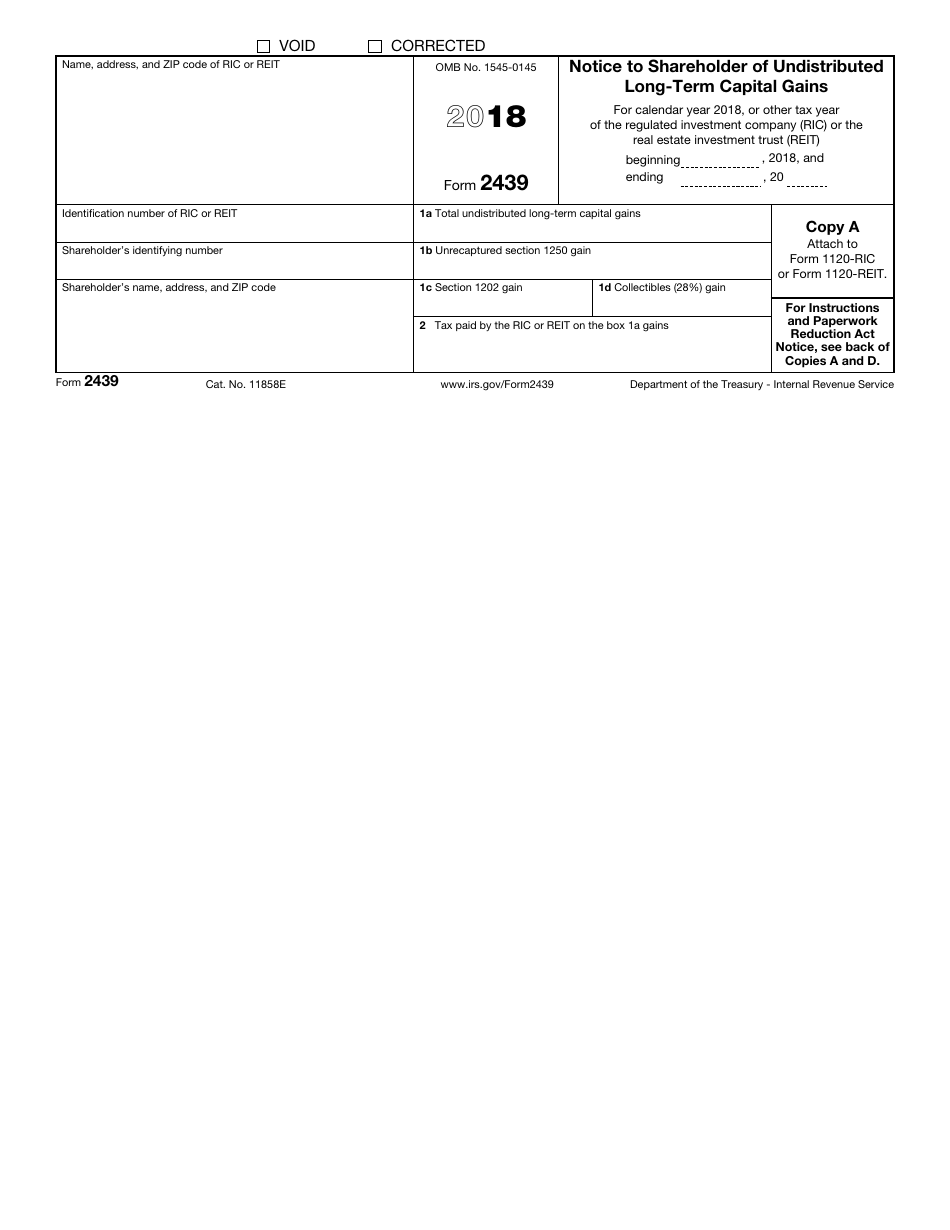

2439 Tax Form

2439 Tax Form - To enter form 2439 go to investment. Go to screen 17.1 dispositions (schedule d, 4797, etc.). And you are enclosing a payment, then use this. Web tax on certain net capital gain income it received during its tax year. Web the information on form 2439 is reported on schedule d. Web what is form 2439? As a shareholder, you are required to report your share of this gain on your tax return. From the dispositions section select form 2439. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Cp60 tax year 2016 january 30, 2017 social security.

Web tax on certain net capital gain income it received during its tax year. From the dispositions section select form 2439. And you are enclosing a payment, then use this. Web the information on form 2439 is reported on schedule d. Web what is form 2439? Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web to enter the 2439 in the individual module: Send all information returns filed on paper to the following. Cp60 tax year 2016 january 30, 2017 social security. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year.

Send all information returns filed on paper to the following. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web what is form 2439? Web to enter the 2439 in the individual module: Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. It will flow to your schedule d when it is entered into turbotax. Cp60 tax year 2016 january 30, 2017 social security. To enter form 2439 go to investment. Web the information on form 2439 is reported on schedule d. Go to screen 17.1 dispositions (schedule d, 4797, etc.).

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web the information on form 2439 is reported on schedule d. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. From the dispositions section select form 2439. And you are not enclosing a payment, then use this address. To enter form 2439 go to investment.

Ssurvivor Form 2439 Statements

Web tax on certain net capital gain income it received during its tax year. And you are filing a form. Go to screen 17.1 dispositions (schedule d, 4797, etc.). Cp60 tax year 2016 january 30, 2017 social security. And you are enclosing a payment, then use this.

Ssurvivor Form 2439 Statements

Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. As a shareholder, you are required to report your share of this gain on your tax return. And you are enclosing a payment, then use this. To enter form.

Fill Free fillable 2019 Form 1120REIT Tax Return for Real Estate

Web the information on form 2439 is reported on schedule d. It will flow to your schedule d when it is entered into turbotax. And you are filing a form. As a shareholder, you are required to report your share of this gain on your tax return. To enter form 2439 go to investment.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web tax on certain net capital gain income it received during its tax year. And you are filing a form. Send all information returns filed on paper to the following. And you are enclosing a payment, then use this. Web if you live in missouri.

Ssurvivor Form 2439 Instructions 2019

Send all information returns filed on paper to the following. Web if you live in missouri. It will flow to your schedule d when it is entered into turbotax. From the dispositions section select form 2439. As a shareholder, you are required to report your share of this gain on your tax return.

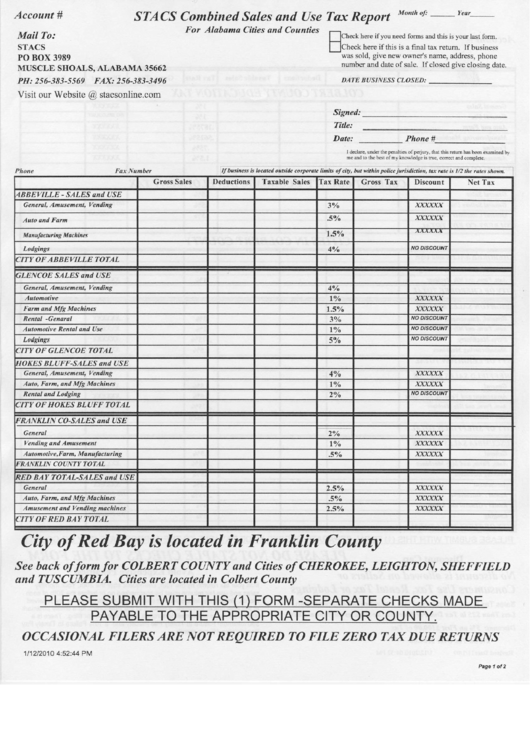

Stacs Combined Sales / Use Tax Report Form Muscle Shoals printable

Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web to enter the 2439 in the individual module: And you are filing a form. Go to screen 17.1 dispositions (schedule d, 4797, etc.). Web tax on certain net.

Form 990T Exempt Organization Business Tax Return (and proxy…

Send all information returns filed on paper to the following. Go to screen 17.1 dispositions (schedule d, 4797, etc.). Web if you live in missouri. Web the information on form 2439 is reported on schedule d. Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Cp60 tax year 2016 january 30, 2017 social security. Web what is form 2439? Web a form a mutual fund or other investment company files with the irs to report any capital gains that were not distributed to shareholders over the course of the year. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

And you are filing a form. It will flow to your schedule d when it is entered into turbotax. Web what is form 2439? And you are not enclosing a payment, then use this address. Send all information returns filed on paper to the following.

Web The Information On Form 2439 Is Reported On Schedule D.

And you are enclosing a payment, then use this. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Go to screen 17.1 dispositions (schedule d, 4797, etc.). And you are not enclosing a payment, then use this address.

To Enter Form 2439 Go To Investment.

As a shareholder, you are required to report your share of this gain on your tax return. From the dispositions section select form 2439. Web what is form 2439? And you are filing a form.

Web Tax On Certain Net Capital Gain Income It Received During Its Tax Year.

Cp60 tax year 2016 january 30, 2017 social security. Send all information returns filed on paper to the following. Web to enter the 2439 in the individual module: Web if you live in missouri.

Web A Form A Mutual Fund Or Other Investment Company Files With The Irs To Report Any Capital Gains That Were Not Distributed To Shareholders Over The Course Of The Year.

It will flow to your schedule d when it is entered into turbotax.