Form 8974 Pdf

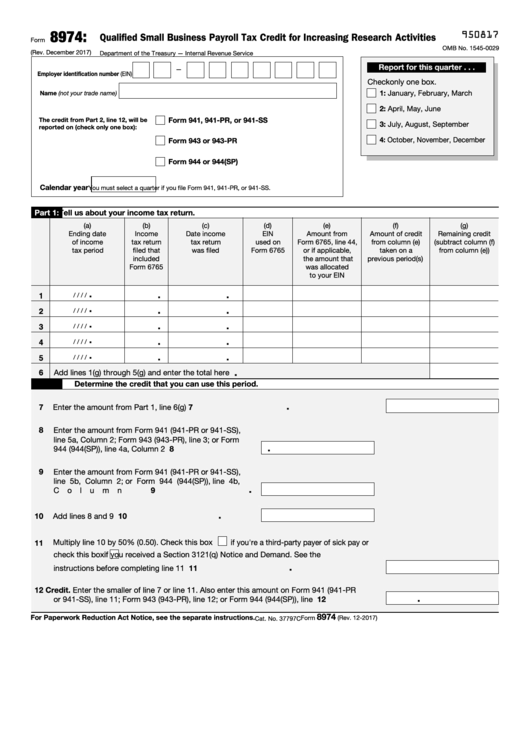

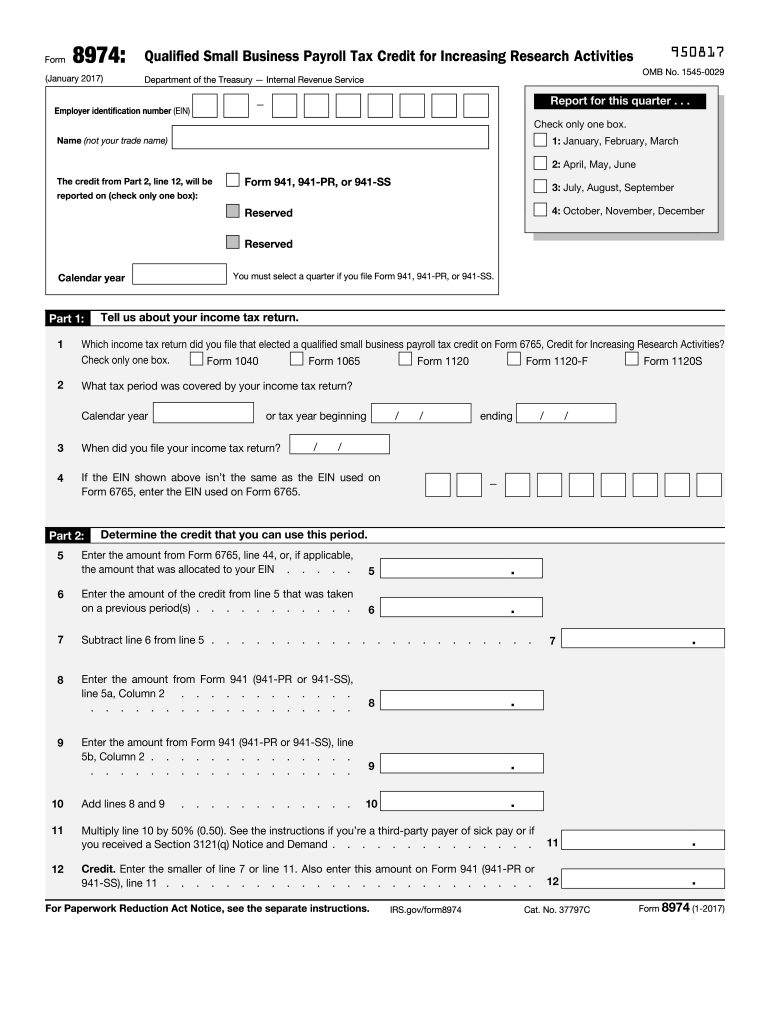

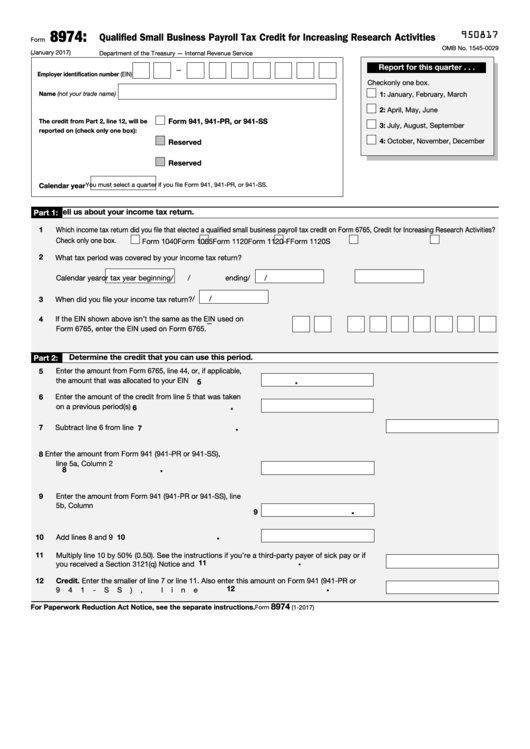

Form 8974 Pdf - Web form 8974, part 1, redesigned. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Web employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their. Edit about form 8974, qualified. Easily fill out pdf blank, edit, and sign them. Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds, other securities, or commodities. Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years.

Ad complete irs tax forms online or print government tax documents. Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more. Web form 8974 is used to determine the amount of qualified small business r&d payroll tax credits generated, used, and remaining for increased research and. Ad complete irs tax forms online or print government tax documents. Save or instantly send your ready documents. Part 1 also tracks the amount of credit.

Draw your signature, type it,. Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. Web you must file form 8974 and attach it to form 941, 943, or 944 if you made an election on your income tax return to claim the qualified small business payroll tax credit for. Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds, other securities, or commodities. Web what is form 8974? Web employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their. Claim the payroll tax credit by completing form 8974 pdf. The form is called the 8974 form and it will be used by all departments that receive. Type text, add images, blackout confidential details, add comments, highlights and more. Get the form 5674 you need.

Form 8974 Complete Guide & FAQs TaxRobot

Easily fill out pdf blank, edit, and sign them. Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years. Web form 8974 is a document that most business owners utilize to determine the qualified small business r&d payroll tax credit amount produced, the amount used. Web use form 8974.

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years. Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. A qualified small business claiming a portion of the research credit as a payroll tax credit..

Form 8974 (Qualified Small Business Payroll Tax Credit for Increasing

Save or instantly send your ready documents. Web what is form 8974? Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. Web form 8974, part 1, redesigned. Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds,.

Internal Revenue Bulletin 202213 Internal Revenue Service

You must attach this form to your payroll tax return, for example, your form 941, employer's quarterly. Ad complete irs tax forms online or print government tax documents. Draw your signature, type it,. If you are required to complete this form. Easily fill out pdf blank, edit, and sign them.

Form 8974 (January 2017). Quarterly Small Business Payroll Tax Credit

A qualified small business claiming a portion of the research credit as a payroll tax credit. You must attach this form to your payroll tax return, for example, your form 941, employer's quarterly. Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. December 2017) qualified small.

Financial Concept about Form 8974 Qualified Small Business Payroll Tax

Ad complete irs tax forms online or print government tax documents. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Web what is form 8974? Get the form 5674 you need. Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing.

Fill Free fillable IRS PDF forms

Get the form 5674 you need. Web what is form 8974? Save or instantly send your ready documents. Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. Ad complete irs tax forms online or print government tax documents.

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

Save or instantly send your ready documents. Web form 8974, part 1, redesigned. Draw your signature, type it,. Part 1 also tracks the amount of credit. Claim the payroll tax credit by completing form 8974 pdf.

Fill Free fillable F8974 Form 8974 (Rev. December 2017) PDF form

Web a new form has been created for the city of chicago to use in order to process requests. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Ad complete irs tax forms online or print government tax documents. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury.

Form 8974 Payroll Tax Credit

Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds, other securities, or commodities. Easily fill out pdf blank, edit, and sign them. Get the form 5674 you need. Draw your signature, type it,. Web employers use this form to determine the amount of qualified small business payroll tax credit for.

You Must Attach This Form To Your Payroll Tax Return, For Example, Your Form 941, Employer's Quarterly.

Web what is form 8974? Claim the payroll tax credit by completing form 8974 pdf. Ad complete irs tax forms online or print government tax documents. Web use form 8974 to figure the amount to be applied to your payroll taxes.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. If you are required to complete this form. Web employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service.

A Qualified Small Business Claiming A Portion Of The Research Credit As A Payroll Tax Credit.

The form is called the 8974 form and it will be used by all departments that receive. Draw your signature, type it,. Complete, edit or print tax forms instantly. Save or instantly send your ready documents.

Part 1 Of Form 8974 Has Been Redesigned To Allow Reporting Of Income Tax Return Information For Up To 5 Years.

Part 1 also tracks the amount of credit. Get the form 5674 you need. Edit about form 8974, qualified. Web a new form has been created for the city of chicago to use in order to process requests.