1099 Form For Landlords

1099 Form For Landlords - In a few easy steps, you can create your own 1099 forms and have them sent to your email. Gardeners, landscapers, contractors, property managers and repair services. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: There are many types of 1099 forms, but for landlords, there are two main forms typically used for rental properties. Form 1099 is issued by the property managers to all the independnet contractors they have hired to. Web types of 1099 forms. Starting in 2021, there are two. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. The current tax law defines. Reporting payments to the irs, over $600 in a year, that we’ve made to.

Reporting payments to the irs, over $600 in a year, that we’ve made to. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. Web types of 1099 forms. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: Are you engaged in a trade or business of renting a. Gardeners, landscapers, contractors, property managers and repair services. File form 1099 for tenants, landlords, and property managers. Form 1099 is issued by the property managers to all the independnet contractors they have hired to. You may only use one or. Web 1099 rules for a tenants, landlords, and property managers what information do you need to file a 1099?

Gardeners, landscapers, contractors, property managers and repair services. The current tax law defines. Web types of 1099 forms. Starting in 2021, there are two. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. Are you engaged in a trade or business of renting a. File form 1099 for tenants, landlords, and property managers. Form 1099 is issued by the property managers to all the independnet contractors they have hired to. Reporting payments to the irs, over $600 in a year, that we’ve made to. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms:

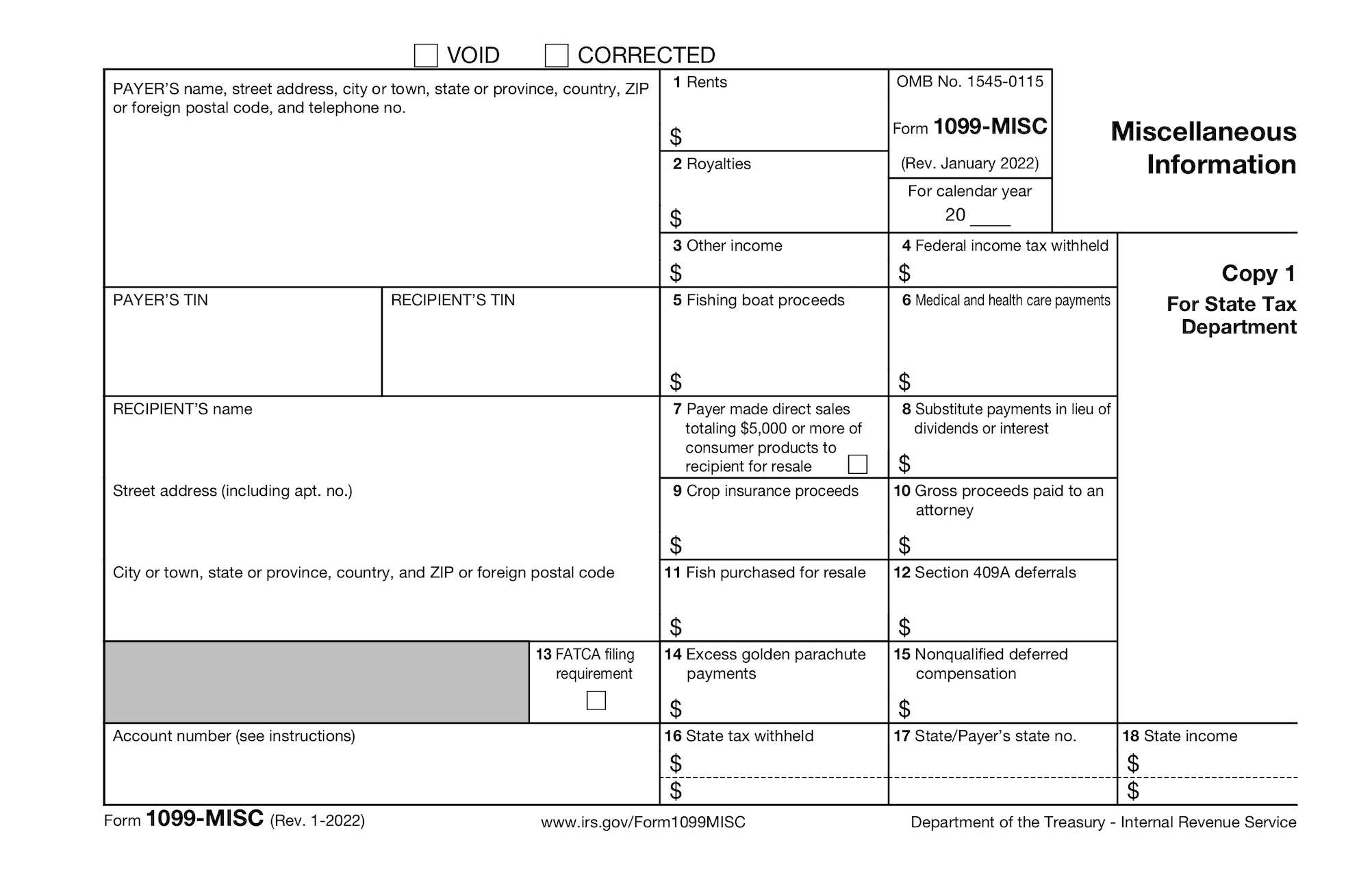

Who Should Receive Form 1099MISC?

Complete, edit or print tax forms instantly. There are many types of 1099 forms, but for landlords, there are two main forms typically used for rental properties. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Web 1099 rules for a tenants, landlords, and property managers what information do you.

11 Common Misconceptions About Irs Form 11 Form Information Free

Ad accurate & dependable 1099 right to your email quickly and easily. Web 1099 rules for a tenants, landlords, and property managers what information do you need to file a 1099? You may only use one or. Ad get ready for tax season deadlines by completing any required tax forms today. Reporting payments to the irs, over $600 in a.

How To File Form 1099NEC For Contractors You Employ VacationLord

Form 1099 is issued by the property managers to all the independnet contractors they have hired to. Complete, edit or print tax forms instantly. Starting in 2021, there are two. The current tax law defines. You may only use one or.

All landlords should file Form 1099MISC to qualify for important tax

Form 1099 is issued by the property managers to all the independnet contractors they have hired to. Reporting payments to the irs, over $600 in a year, that we’ve made to. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: You may only use one or. File form 1099 for tenants,.

Form 1099 Overview and FAQ Buildium Help Center

Ad get ready for tax season deadlines by completing any required tax forms today. Web who files a form 1099 for tenants, landlords, and property managers? Starting in 2021, there are two. Ad accurate & dependable 1099 right to your email quickly and easily. You may only use one or.

Form 1099 Misc Fillable Universal Network

Reporting payments to the irs, over $600 in a year, that we’ve made to. Gardeners, landscapers, contractors, property managers and repair services. Web 1099 rules for a tenants, landlords, and property managers what information do you need to file a 1099? Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: You.

How To Fill Out A 1099 Form For Contractors Universal Network

The current tax law defines. In a few easy steps, you can create your own 1099 forms and have them sent to your email. Are you engaged in a trade or business of renting a. Web 1099 rules for a tenants, landlords, and property managers what information do you need to file a 1099? File form 1099 for tenants, landlords,.

Form1099NEC

The current tax law defines. Are you engaged in a trade or business of renting a. Ad get ready for tax season deadlines by completing any required tax forms today. File form 1099 for tenants, landlords, and property managers. Web types of 1099 forms.

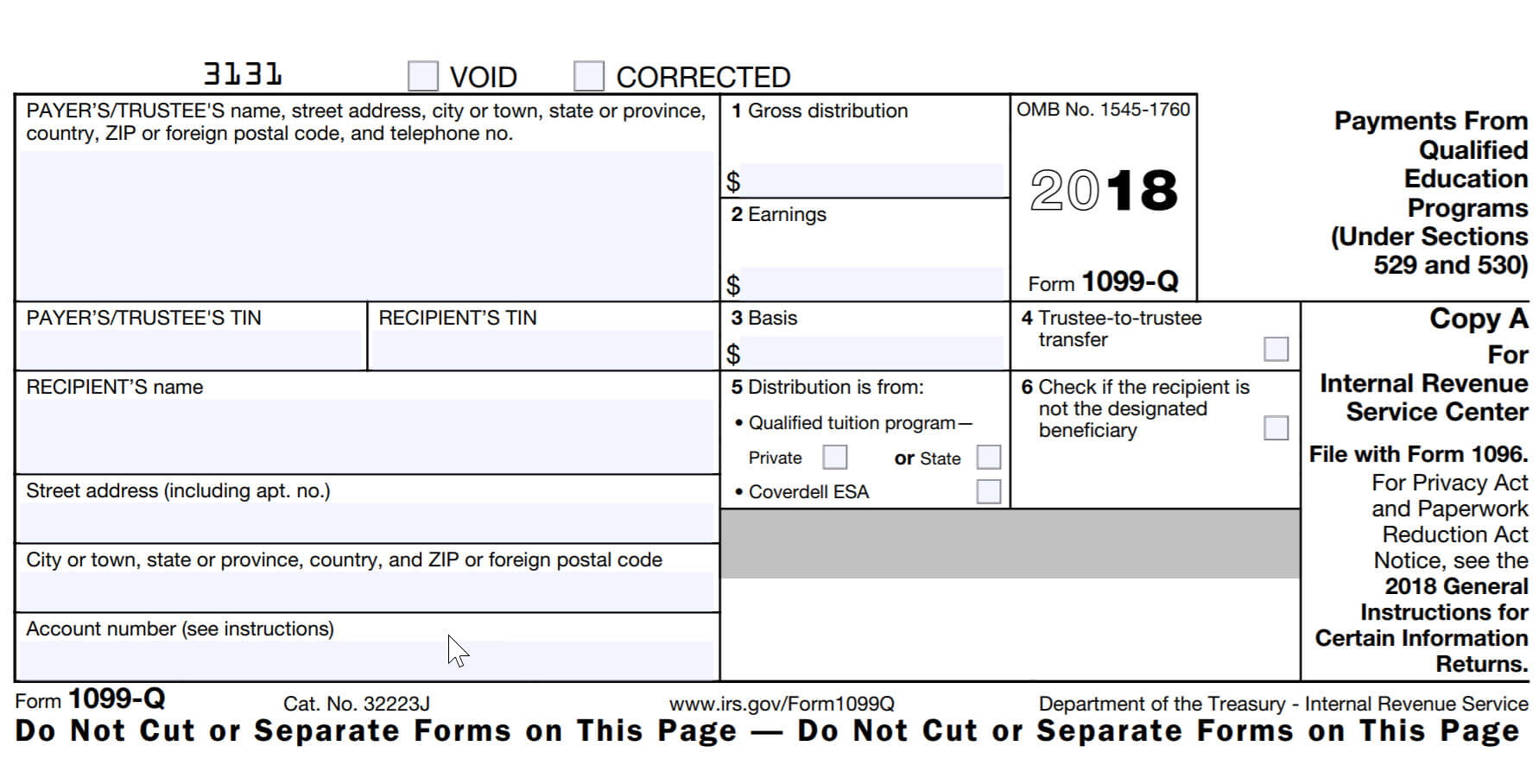

Irs Form 1099 Int 2018 Universal Network

Gardeners, landscapers, contractors, property managers and repair services. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: File form 1099 for tenants, landlords, and property managers. In a few easy steps, you can create your own 1099 forms and have them sent to your email. You may only use one or.

What is a 1099Misc Form? Financial Strategy Center

There are many types of 1099 forms, but for landlords, there are two main forms typically used for rental properties. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: Starting in 2021, there are two. File form 1099 for tenants, landlords, and property managers. Complete, edit or print tax forms instantly.

Reporting Payments To The Irs, Over $600 In A Year, That We’ve Made To.

In a few easy steps, you can create your own 1099 forms and have them sent to your email. Web in short, for our purposes as landlords, here are the two common uses for 1099 tax forms: Ad get ready for tax season deadlines by completing any required tax forms today. Web types of 1099 forms.

Complete, Edit Or Print Tax Forms Instantly.

The current tax law defines. Are you engaged in a trade or business of renting a. If a business deducts rent as a business expense, they may need to issue a 1099 form to the landlord. Starting in 2021, there are two.

Gardeners, Landscapers, Contractors, Property Managers And Repair Services.

File form 1099 for tenants, landlords, and property managers. Web who files a form 1099 for tenants, landlords, and property managers? There are many types of 1099 forms, but for landlords, there are two main forms typically used for rental properties. You may only use one or.

Web 1099 Rules For A Tenants, Landlords, And Property Managers What Information Do You Need To File A 1099?

Ad accurate & dependable 1099 right to your email quickly and easily. Form 1099 is issued by the property managers to all the independnet contractors they have hired to.