Irs Form 4835

Irs Form 4835 - Where can i find a copy of form 4835? • tenant—instead use schedule f (form 1040) to report farm income and expenses; Web employer's quarterly federal tax return. Web farm rental income and expenses form 4835; Do not use form 4835 if you were a/an: Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web about form 4835, farm rental income and expenses. Instructions for form 941 pdf As with all businesses, the irs requires you to report the income and expenses involved with running that business, including a farm rental.

As with all businesses, the irs requires you to report the income and expenses involved with running that business, including a farm rental. • tenant—instead use schedule f (form 1040) to report farm income and expenses; Who must file form 4835? Web 20224, or by email to pra.comments@irs.gov. What is irs form 4835? Where can i find a copy of form 4835? Web the irs provides instructions for form 4835 as to whether you should be categorized as a farmer or a landowner. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). Web farm rental income and expenses form 4835; Web employer's quarterly federal tax return.

Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. Web employer's quarterly federal tax return. Where can i find a copy of form 4835? Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Who must file form 4835? Do not use form 4835 if you were a/an: What is irs form 4835? Web the irs provides instructions for form 4835 as to whether you should be categorized as a farmer or a landowner. As with all businesses, the irs requires you to report the income and expenses involved with running that business, including a farm rental. Instructions for form 941 pdf

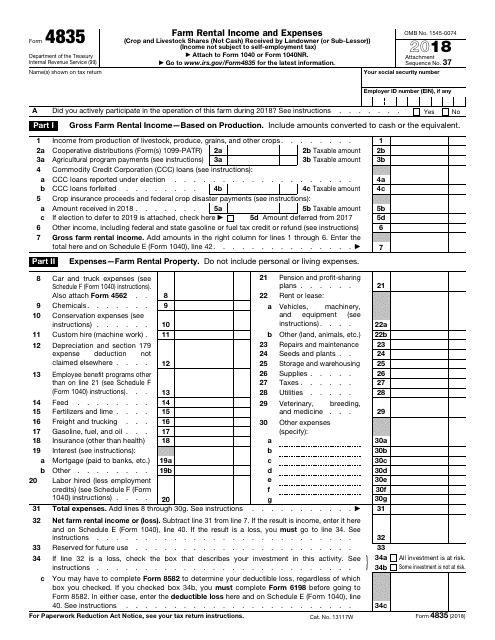

IRS Form 4835 Download Fillable PDF or Fill Online Farm Rental

Do not use form 4835 if you were a/an: Web how do i complete irs form 4835? Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. If you were a tenant, use schedule f (form 1040) to report farm income. Web instructions for form 8582, passive activity loss limitations, for the definition.

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). Web 20224, or by email to pra.comments@irs.gov. Instructions for form 941 pdf Where can i find a copy of form 4835? As with.

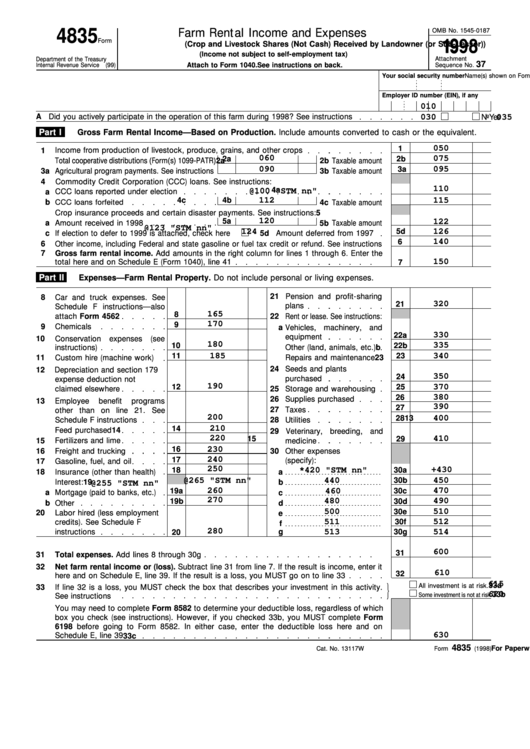

Fillable Form 4835 Farm Rental And Expenses 1998 printable

Web the irs provides instructions for form 4835 as to whether you should be categorized as a farmer or a landowner. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Where can i find a copy of form 4835? Web 20224, or.

Form 4835 Farm Rental and Expenses (2015) Free Download

Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). • tenant—instead use schedule f (form.

Instructions for Form 8995 (2021) Internal Revenue Service

Web the irs provides instructions for form 4835 as to whether you should be categorized as a farmer or a landowner. Do not use form 4835 if you were a/an: Web how do i complete irs form 4835? Where can i find a copy of form 4835? • tenant—instead use schedule f (form 1040) to report farm income and expenses;

Fill Free fillable IRS PDF forms

• tenant—instead use schedule f (form 1040) to report farm income and expenses; Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. If you were a tenant, use schedule f (form 1040) to report farm income. Instructions for form 941 pdf As with all businesses, the irs requires you to report the.

Fill Free fillable F4835 Accessible 2019 Form 4835 PDF form

Do not use form 4835 if you were a/an: Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. Instructions for form 941 pdf If you were a tenant, use schedule f (form 1040) to report farm income. What is irs form 4835?

Fill Free fillable Farm Rental and Expenses Form 4835 PDF form

Web farm rental income and expenses form 4835; Web about form 4835, farm rental income and expenses. Do not use form 4835 if you were a/an: Where can i find a copy of form 4835? Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax.

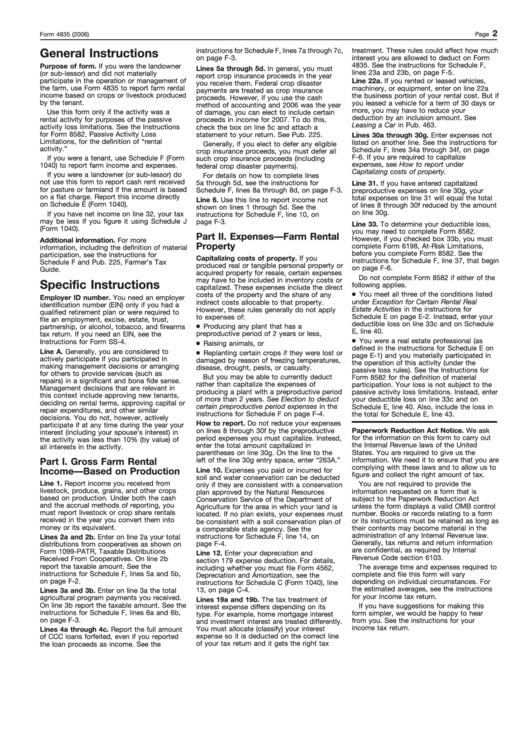

Instructions For Form 4835 2006 printable pdf download

Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). What is irs form 4835? Web.

Web How Do I Complete Irs Form 4835?

Where can i find a copy of form 4835? Bottom line, you need to see a tax preparer who understands the subtleties of farm income reporting. • tenant—instead use schedule f (form 1040) to report farm income and expenses; Web employer's quarterly federal tax return.

As With All Businesses, The Irs Requires You To Report The Income And Expenses Involved With Running That Business, Including A Farm Rental.

Web about form 4835, farm rental income and expenses. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Who must file form 4835? Instructions for form 941 pdf

Web Farm Rental Income And Expenses Form 4835;

If you were a tenant, use schedule f (form 1040) to report farm income. Web instructions for form 8582, passive activity loss limitations, for the definition of “rental activity.” if you have net income on line 32, your tax may be less if you figure it using schedule j (form 1040). Web 20224, or by email to pra.comments@irs.gov. What is irs form 4835?

Web The Irs Provides Instructions For Form 4835 As To Whether You Should Be Categorized As A Farmer Or A Landowner.

Do not use form 4835 if you were a/an: