1099 Form Florida

1099 Form Florida - If you no longer have access to the Web instructions for recipient recipient’s taxpayer identification number (tin). Web a 1099 issuance will be sent to all independent contractors or individuals who receive total payments that exceed $600.00 from the university within a calendar year. Select “inbox” from the claimant homepage. Medical and health care payments. Dfs sends these forms to vendors by january 31 of each year. This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. We can help with your fl taxes, including federal deductions for paying state taxes. The sum of all payments made to the person or. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in florida.

If you no longer have access to the We can help with your fl taxes, including federal deductions for paying state taxes. Web a 1099 issuance will be sent to all independent contractors or individuals who receive total payments that exceed $600.00 from the university within a calendar year. The payment was made to another business that is incorporated, but was not for medical or legal services or. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in florida during calendar year 2023. Uf functions independently of the state treasury and is solely responsible for processing payments and submitting 1099 information to the irs on their behalf. Select “1099” from the list of correspondence in the claimant inbox. Web this form is for informational purposes only. Web march 29, 2023, at 9:49 a.m. Select “inbox” from the claimant homepage.

Web instructions for recipient recipient’s taxpayer identification number (tin). There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Web understanding taxes in florida can be tricky. With this service, we’ll match you with a tax pro with florida tax expertise. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in florida. Visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Web you are not required to file information return (s) if any of the following situations apply: The sum of all payments made to the person or. This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. If you no longer have access to the

The Green CPA 1099s

Web understanding taxes in florida can be tricky. Web you are not required to file information return (s) if any of the following situations apply: With this service, we’ll match you with a tax pro with florida tax expertise. Visit the florida department of commerce's tax information webpage to view options for requesting tax documents. Luckily, we’re here to save.

Florida 1099 Form Online Universal Network

Web a 1099 issuance will be sent to all independent contractors or individuals who receive total payments that exceed $600.00 from the university within a calendar year. Select “inbox” from the claimant homepage. This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. These where to.

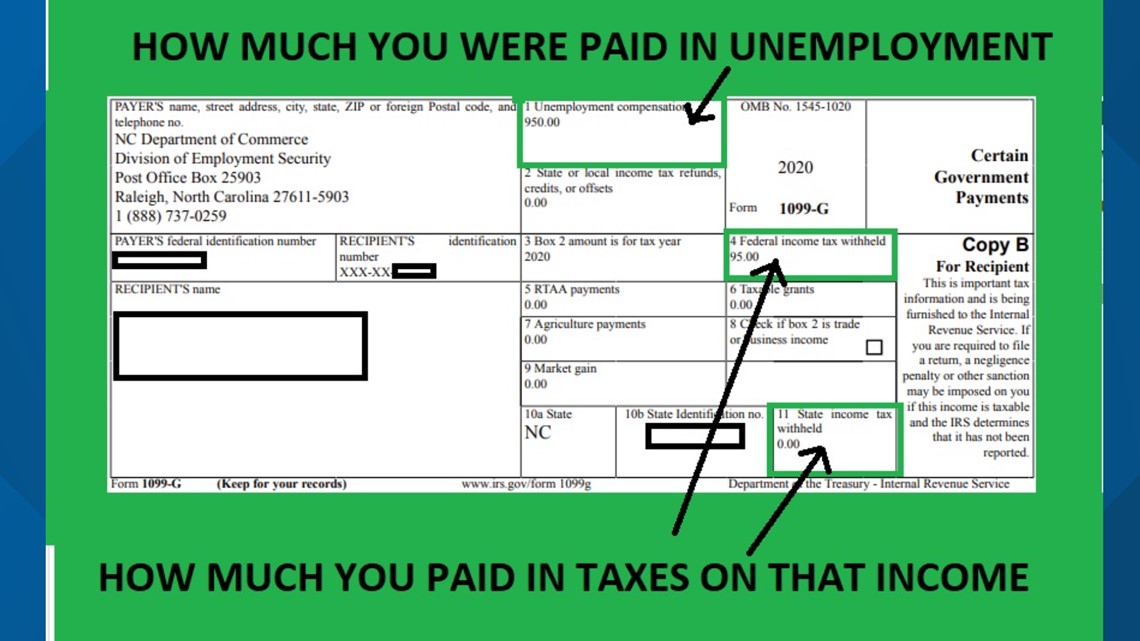

Try This If You Can’t See Your 1099G in CONNECT NBC 6 South Florida

Then, you will upload your tax documents, and our tax pros will do the rest! If you no longer have access to the You are not engaged in a trade or business. This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. These where to file.

Irs Printable 1099 Form Printable Form 2022

Web this form is for informational purposes only. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Dfs sends these forms to vendors by january 31 of each year. Uf functions independently of the state treasury.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

We can help with your fl taxes, including federal deductions for paying state taxes. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web florida 1099 filing requirements 2022. Luckily, we’re here to save the day.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in florida. Then, you will upload your tax documents, and our tax pros will do the rest! The payment was made to another business that is incorporated, but was not for medical or legal services or. The tax credit application must be.

How To Get 1099 G Form Online Florida Leah Beachum's Template

This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. Medical and health care payments. The tax credit application must be filed online on the dates specified on the form. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for.

Illinois Unemployment W2 Form Universal Network

Select “1099” from the list of correspondence in the claimant inbox. This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in florida during calendar year.

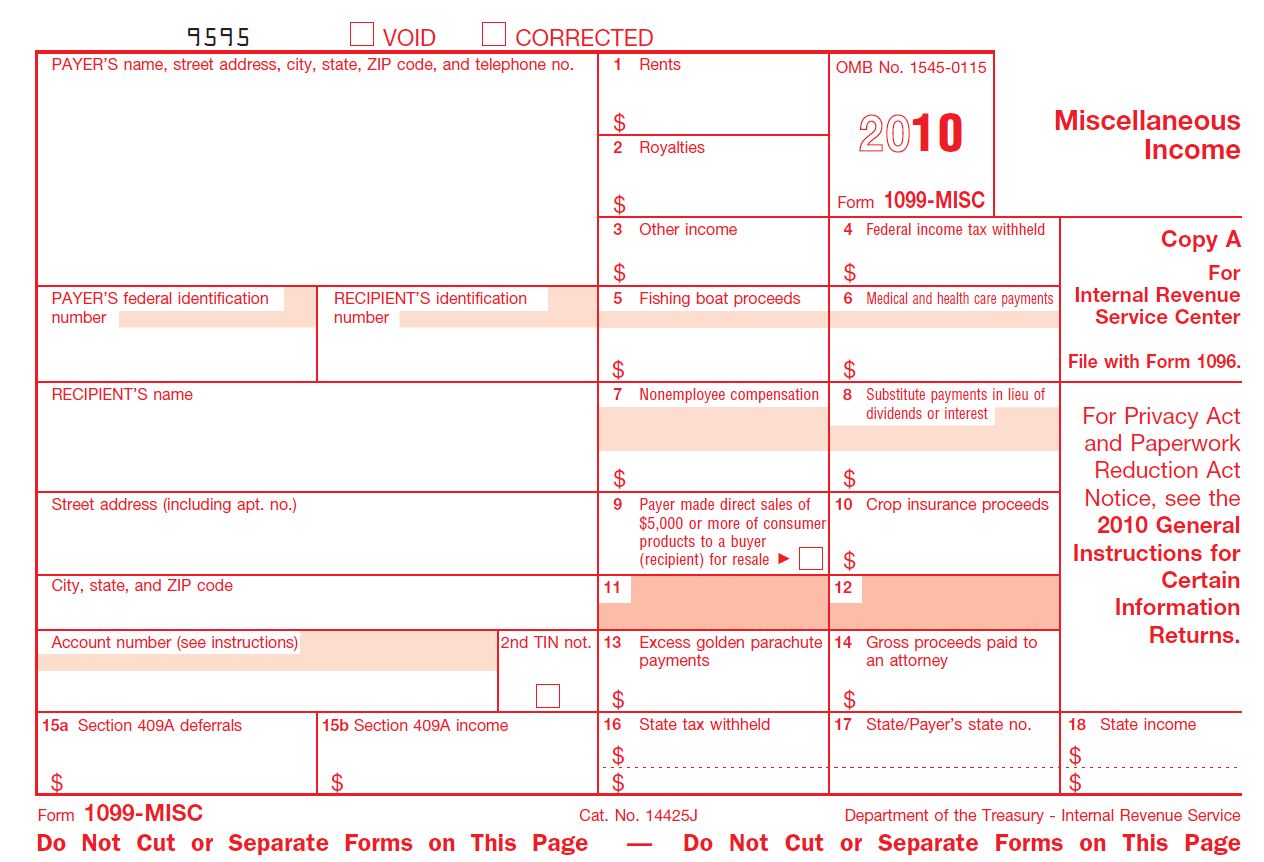

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web even though the state of florida does not require 1099 form, the irs still requires you to file form 1099 to report payments and the taxes withheld for each of your recipients for the year. Web a 1099 issuance will be sent to all independent contractors or individuals who receive total payments that exceed $600.00 from the university within.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

What is a 1099 form? We can help with your fl taxes, including federal deductions for paying state taxes. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). The sum of all payments made to the.

Web March 29, 2023, At 9:49 A.m.

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Dfs sends these forms to vendors by january 31 of each year. The payment was made to another business that is incorporated, but was not for medical or legal services or. The tax credit application must be filed online on the dates specified on the form.

What Is A 1099 Form?

Uf functions independently of the state treasury and is solely responsible for processing payments and submitting 1099 information to the irs on their behalf. If you no longer have access to the Select “inbox” from the claimant homepage. You are not engaged in a trade or business.

Web Florida 1099 Filing Requirements 2022.

Web a 1099 issuance will be sent to all independent contractors or individuals who receive total payments that exceed $600.00 from the university within a calendar year. Web you are not required to file information return (s) if any of the following situations apply: The sum of all payments made to the person or. Web new 1099 independent contractor reporting requirements for florida businesses.

Web Find Irs Mailing Addresses For Taxpayers And Tax Professionals Filing Individual Federal Tax Returns For Their Clients In Florida.

This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2022. Web even though the state of florida does not require 1099 form, the irs still requires you to file form 1099 to report payments and the taxes withheld for each of your recipients for the year. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Visit the florida department of commerce's tax information webpage to view options for requesting tax documents.