Form 1065 B

Form 1065 B - To which payments does section 267a apply? Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Return of income for electing large partnerships. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Web where to file your taxes for form 1065. Return of partnership income, including recent updates, related forms and instructions on how to file. Form 1065 is used to report the income of. Upload, modify or create forms. According to the irs, the number of 1065 forms being filed has. Try it for free now!

Complete, edit or print tax forms instantly. 1066 (schedule q) 2022 † quarterly notice to residual. If the partnership's principal business, office, or agency is located in: Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Try it for free now! Return of income for electing large partnerships. To which payments does section 267a apply? Web form 1065 2021 u.s. Form 1065 is used to report the income of. Return of partnership income, including recent updates, related forms and instructions on how to file.

Return of partnership income, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. To what extent is a. When completing your minnesota schedule. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Try it for free now! Web where to file your taxes for form 1065. Web what should a partnership report? Web irs form 1065 is the us tax return for specific types of businesses such as partnerships and llcs. To which partners does section 267a apply?

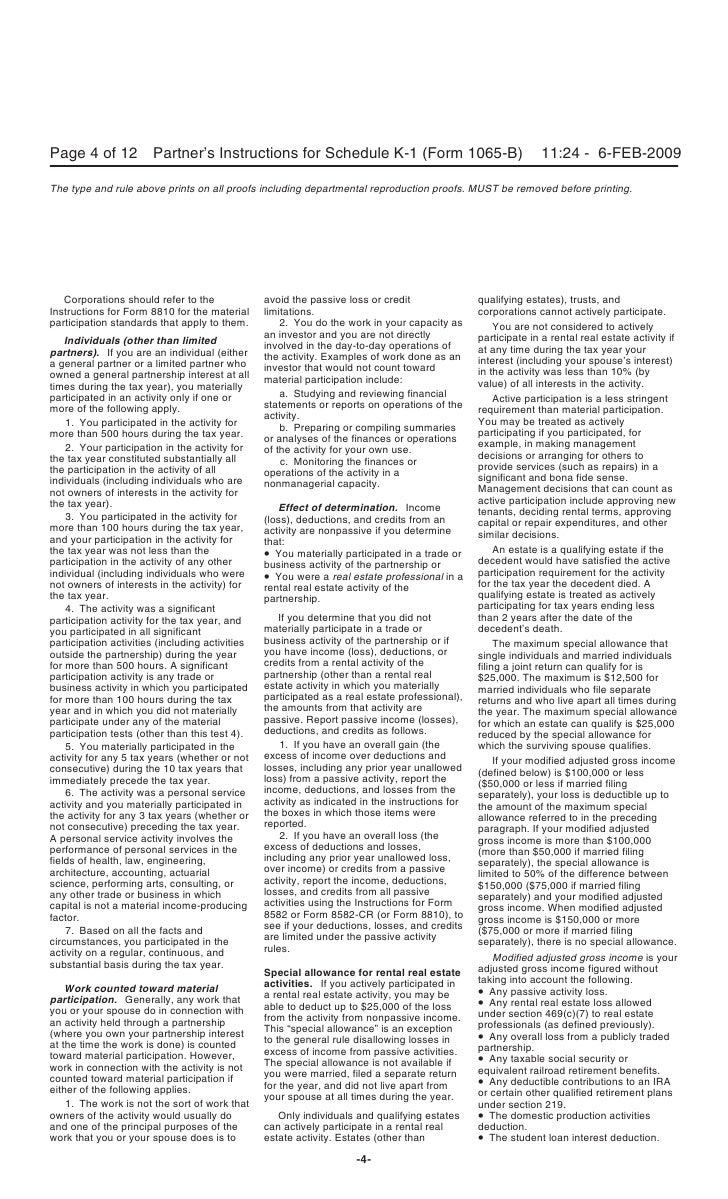

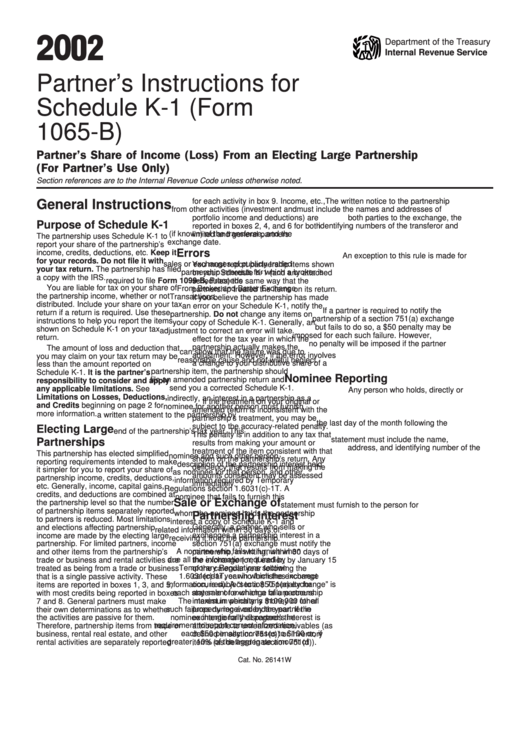

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Form 1065 is used to report the income of. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. And the total assets at the end of the tax year. Web what should a partnership report?

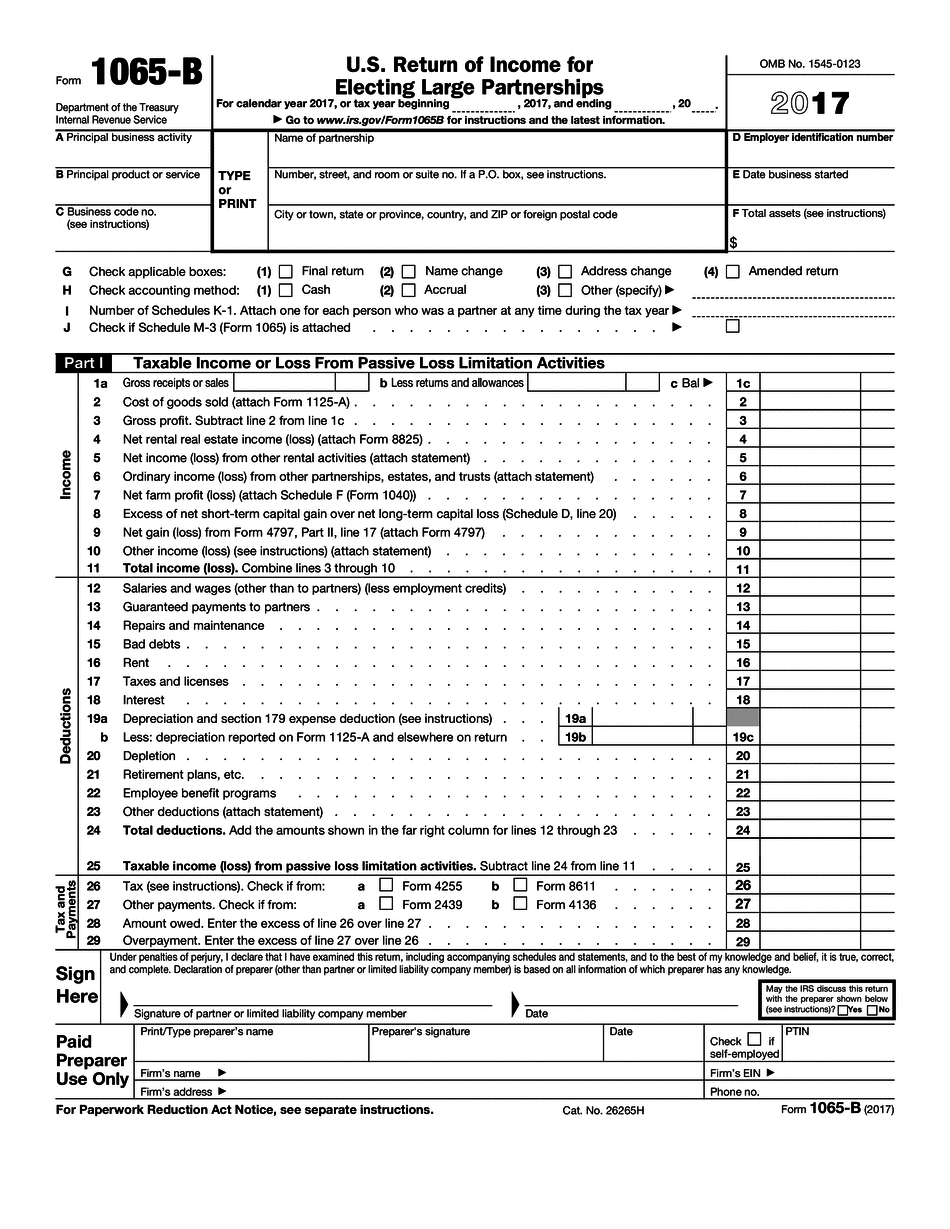

Form 1065B U.S. Return of for Electing Large Partnerships

If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year. Complete, edit or print tax forms instantly. 1066 (schedule q) 2022 † quarterly notice to residual. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

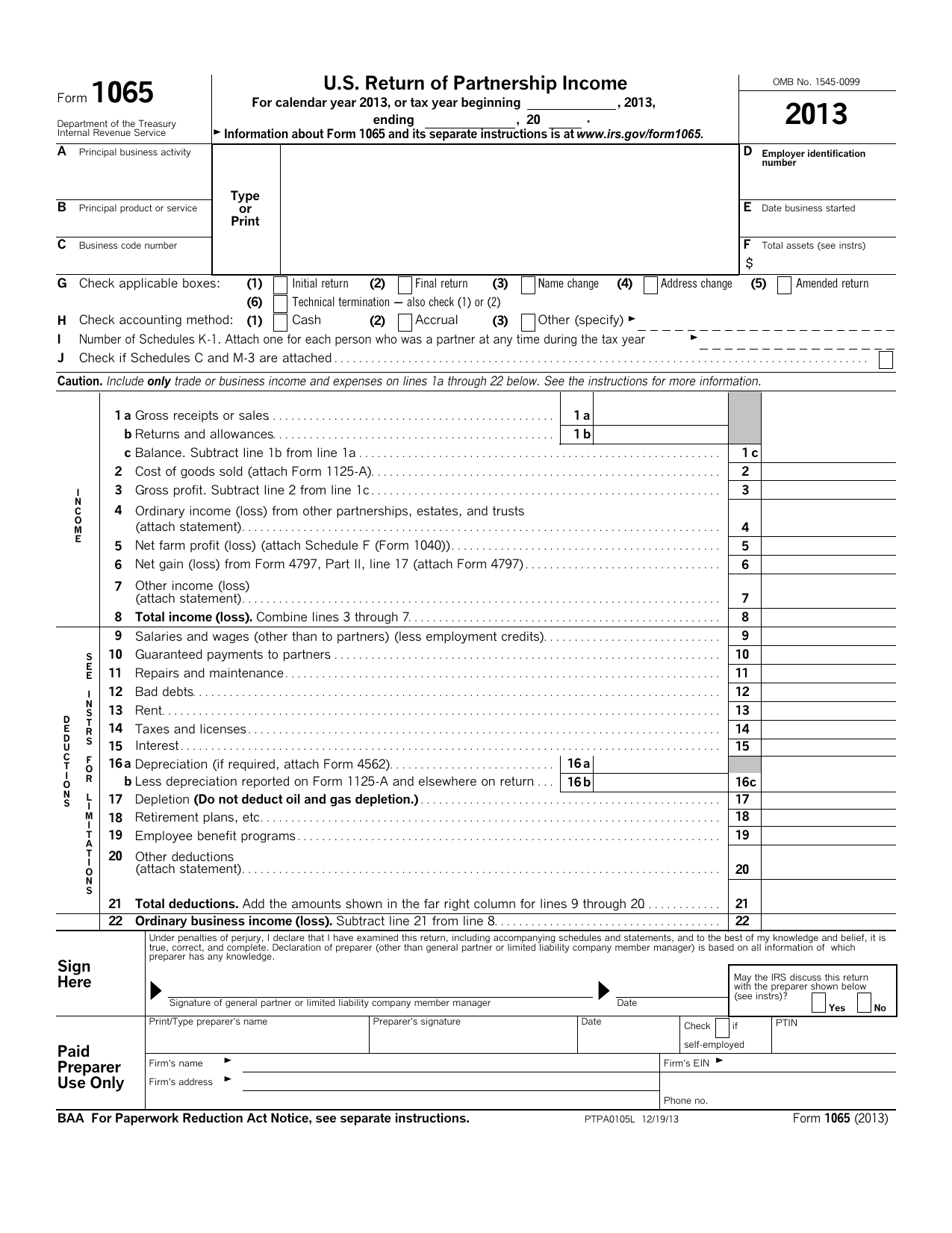

Form 1065 (2013)

Web where to file your taxes for form 1065. Web we last updated the u.s. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Web a foreign partnership filing form 1065 solely to make an election (such as an election to amortize organization expenses) need only provide its name, address,.

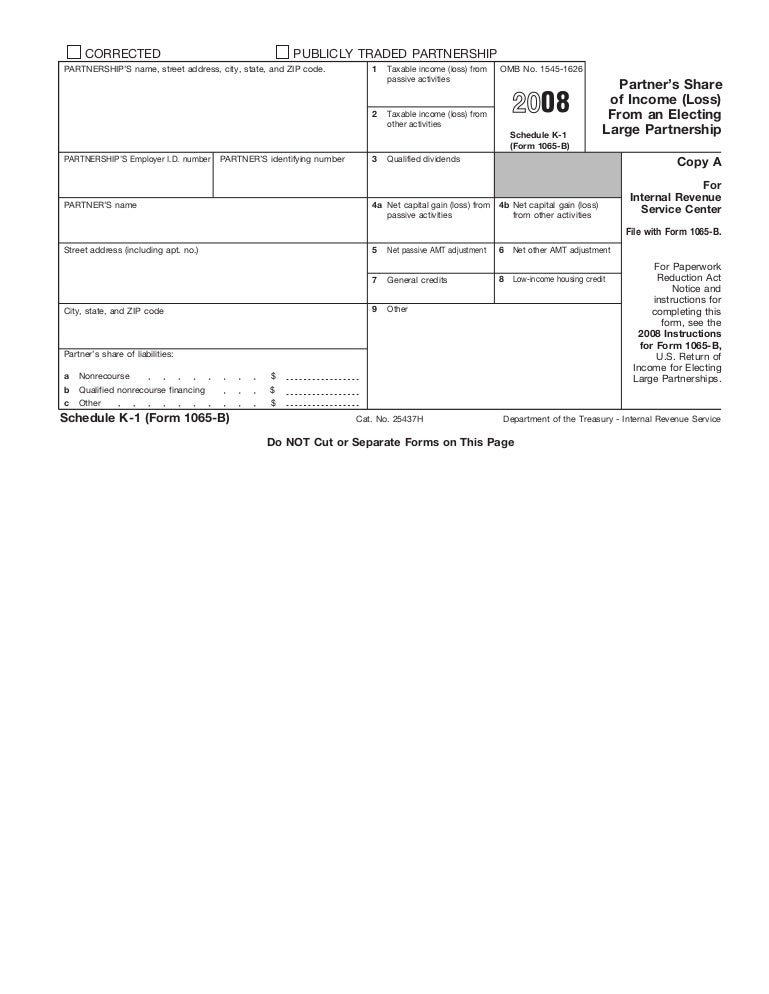

Form 1065B (Schedule K1) Partner's Share of (Loss) from an

Return of partnership income, including recent updates, related forms and instructions on how to file. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. If the partnership's principal business, office, or agency is located in: Web information about form 1065, u.s. And the total assets at the end of the.

Form 1065B U.S. Return of for Electing Large Partnerships

Return of partnership income, including recent updates, related forms and instructions on how to file. Web certain partnerships with 100 or fewer partners can elect out of the centralized partnership audit regime if each partner is an individual, a c corporation, a foreign entity that would. Web where to file your taxes for form 1065. Web a foreign partnership filing.

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Upload, modify or create forms. Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. Web a foreign partnership filing form 1065 solely to make an election (such.

Form 1065B (Schedule K1)Partner's Share of (Loss) From an E…

Return of income for electing large partnerships. Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. Web we last updated the u.s. Web what should a partnership report? If the partnership's principal business, office, or agency is located in:

2022 Irs Form 1065 Fillable Fillable and Editable PDF Template

Web we last updated the u.s. 1066 (schedule q) 2022 † quarterly notice to residual. Return of income for electing large partnerships. Web what should a partnership report? To what extent is a.

Form 1065B U.S. Return of for Electing Large Partnerships

Web information about form 1065, u.s. And the total assets at the end of the tax year. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. When completing your minnesota schedule. To what extent is a.

Partner'S Instructions For Schedule K1 (Form 1065B) Partner'S Share

Return of partnership income is a tax document issued by the internal revenue service (irs) used to declare the profits, losses, deductions, and. Form 1065 is used to report the income of. Upload, modify or create forms. Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next.

Try It For Free Now!

To which payments does section 267a apply? Web what should a partnership report? Line 21 replaces line 16p for foreign taxes paid or accrued with respect to basis adjustments and income reconciliation. 1066 (schedule q) 2022 † quarterly notice to residual.

Web Certain Partnerships With 100 Or Fewer Partners Can Elect Out Of The Centralized Partnership Audit Regime If Each Partner Is An Individual, A C Corporation, A Foreign Entity That Would.

Web copyrit 2021 omson reuters quickfinder® handbooks | form 1065 principal business activity codes—2020 returns 1 quick nder® table continued on the next page form. To which partners does section 267a apply? Return of income for electing large partnerships. Upload, modify or create forms.

Web Information About Form 1065, U.s.

Web form 1065 2021 u.s. Web irs form 1065 is the us tax return for specific types of businesses such as partnerships and llcs. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. According to the irs, the number of 1065 forms being filed has.

Web A Foreign Partnership Filing Form 1065 Solely To Make An Election (Such As An Election To Amortize Organization Expenses) Need Only Provide Its Name, Address, And Employer.

Form 1065 is used to report the income of. If the partnership's principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Web where to file your taxes for form 1065.