1099 Form 2016

1099 Form 2016 - For privacy act and paperwork reduction act notice, see the. Copy a for internal revenue service center. For internal revenue service center. 2016 general instructions for certain information returns. 2016 general instructions for certain information returns. Proceeds from real estate transactions. 2016 general instructions for certain information returns. Web filing requirements each payer must complete a form 1099 for each covered transaction. Web instructions for recipient recipient's identification number. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website.due dates.

Department of the treasury internal revenue service For privacy act and paperwork reduction act notice, see the. Web instructions for recipient recipient's identification number. 2016 general instructions for certain information returns. For internal revenue service center. Proceeds from real estate transactions. For internal revenue service center. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website.due dates. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. This is important tax information and is being furnished to the internal revenue service.

Copy a for internal revenue service center. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Three or four copies are made: Web taxes federal tax forms federal tax forms learn how to get tax forms. 2016 general instructions for certain information returns. For internal revenue service center. Web filing requirements each payer must complete a form 1099 for each covered transaction. For privacy act and paperwork reduction act notice, see the. 2016 general instructions for certain information returns. For internal revenue service center.

Free Printable 1099 Form 2016 Free Printable

2016 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Web taxes federal tax forms federal tax forms learn how to get tax forms. For privacy act and paperwork reduction act notice, see the. This is important tax information and is being furnished to the internal revenue service.

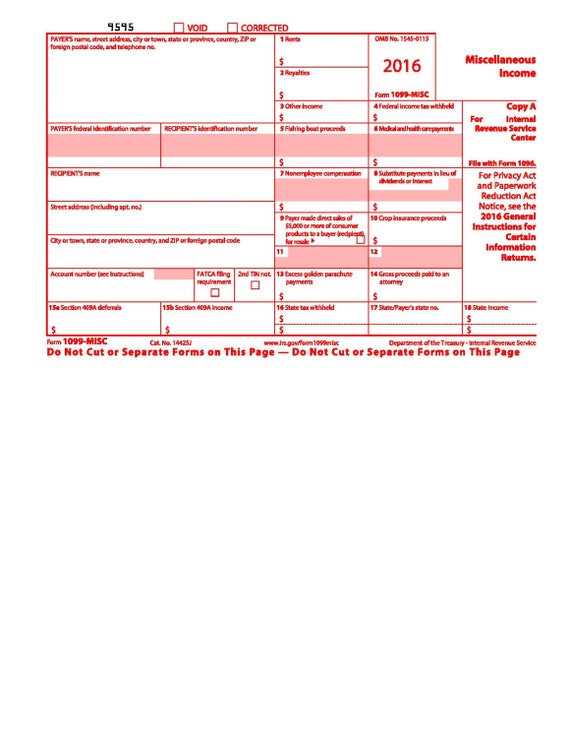

The Tax Times 2016 Form 1099's are FATCA Compliant

This is important tax information and is being furnished to the internal revenue service. 2016 general instructions for certain information returns. 2016 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required.

Form Fillable PDF for 2016 1099MISC Form.

One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For privacy act and paperwork reduction.

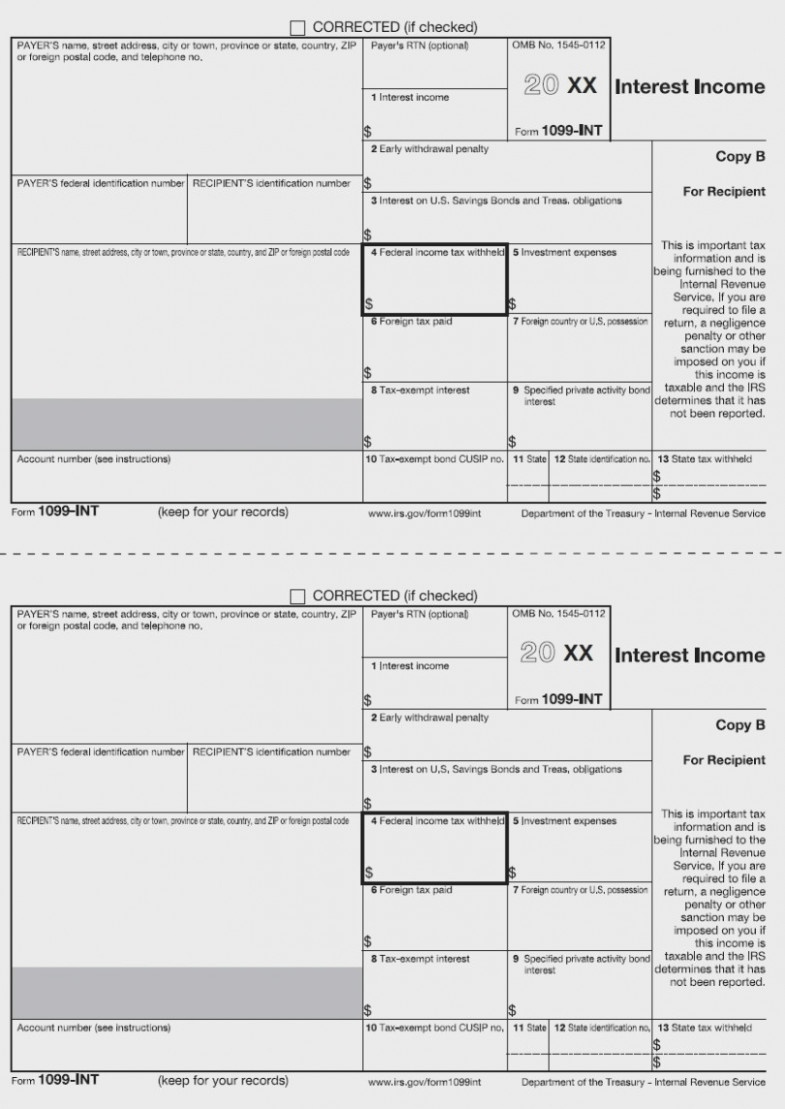

1099 Int Fill out in PDF Online

2016 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Copy a for internal revenue service center. Department of the treasury internal revenue service One for the payer, one for the payee, one for the irs, and one for the state tax department, if required.

14 Ingenious Ways You Can Realty Executives Mi Invoice And Free

This is important tax information and is being furnished to the internal revenue service. Three or four copies are made: For privacy act and paperwork reduction act notice, see the. For privacy act and paperwork reduction act notice, see the. For internal revenue service center.

1099 Form Template 2016 Templates2 Resume Examples

For privacy act and paperwork reduction act notice, see the. 2016 general instructions for certain information returns. 2016 general instructions for certain information returns. Department of the treasury internal revenue service For internal revenue service center.

NJ Tax Preparer Admits Conspiring To Commit Tax Fraud Thru False Filing

For privacy act and paperwork reduction act notice, see the. Web filing requirements each payer must complete a form 1099 for each covered transaction. For internal revenue service center. For privacy act and paperwork reduction act notice, see the. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification.

What is a 1099Misc Form? Financial Strategy Center

Proceeds from real estate transactions. Three or four copies are made: For internal revenue service center. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. For internal revenue service center.

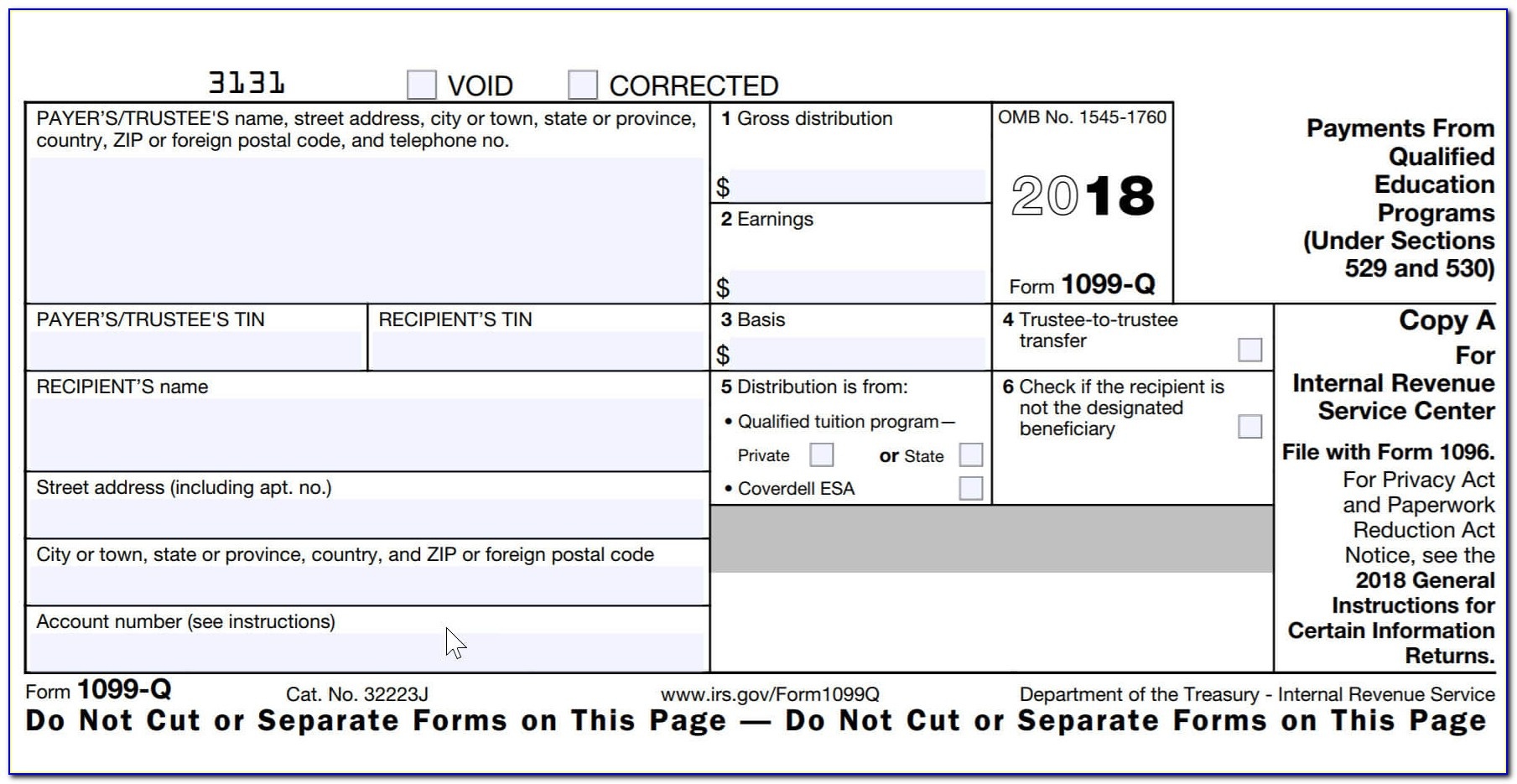

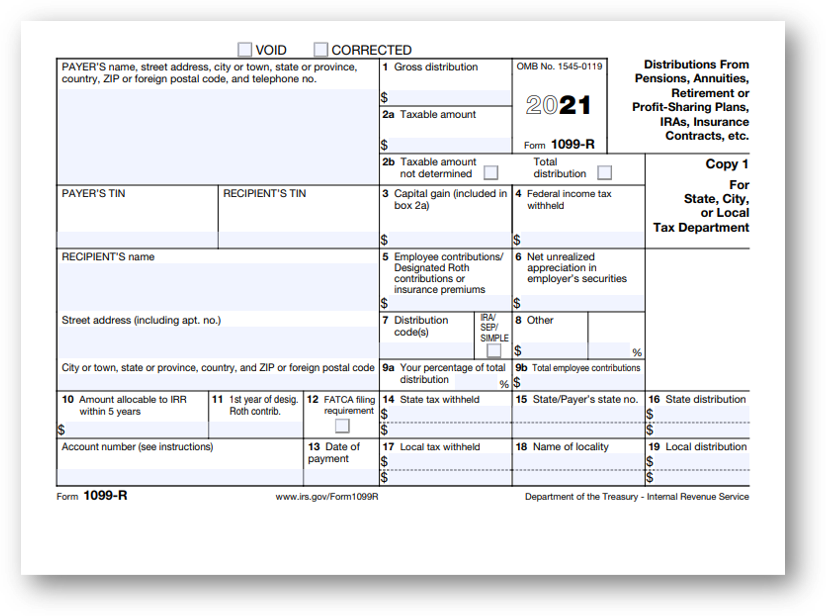

Tax Form Focus IRS Form 1099R » STRATA Trust Company

For internal revenue service center. Three or four copies are made: 2016 general instructions for certain information returns. Copy a for internal revenue service center. For privacy act and paperwork reduction act notice, see the.

Form 1099INT Interest (2016) Free Download

Three or four copies are made: Copy a for internal revenue service center. This is important tax information and is being furnished to the internal revenue service. For internal revenue service center. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required.

[4] Payers Who File 250 Or More Form 1099 Reports Must File All Of Them Electronically With The Irs.

Web instructions for recipient recipient's identification number. One for the payer, one for the payee, one for the irs, and one for the state tax department, if required. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this. Department of the treasury internal revenue service

For Privacy Act And Paperwork Reduction Act Notice, See The.

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For internal revenue service center. For privacy act and paperwork reduction act notice, see the. For privacy act and paperwork reduction act notice, see the.

Because Paper Forms Are Scanned During Processing, You Cannot File Forms 1096, 1097, 1098, 1099, 3921, 3922, Or 5498 That You Print From The Irs Website.due Dates.

Proceeds from real estate transactions. 2016 general instructions for certain information returns. Copy a for internal revenue service center. 2016 general instructions for certain information returns.

Web Taxes Federal Tax Forms Federal Tax Forms Learn How To Get Tax Forms.

2016 general instructions for certain information returns. Three or four copies are made: This is important tax information and is being furnished to the internal revenue service. Web filing requirements each payer must complete a form 1099 for each covered transaction.