Consensual Lien Form

Consensual Lien Form - The most common consensual lien is a residential mortgage, where the home buyer consents to a bank taking a security interest in the home when a mortgage is obtained. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or an order of a judge and do not require a debtor’s agreement. Web sep 27, 2019 great question and we assist roofing contractors with this issue all of the time. As the name suggests, a statutory lien arises automatically by statute. Contractual liens are used to designate a borrower’s property as collateral for a loan. Because both parties voluntarily agree to the arrangement, such liens are often referred to as “voluntary” or “consensual” liens. Web types of consensual liens. Web a consensual lien is typically a result of a loan or other advance of credit. Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: Under this type of lien, a creditor lends money to the debtor for the specific purchase of buying the property which will secure the debt.

Web consensual liens are those you consent to voluntarily, such as taking out a loan or line of credit. In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to pay for such asset. Mechanic's liens / tax liens. Contractual liens are used to designate a borrower’s property as collateral for a loan. Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: There are two types of consensual liens: There are two main types of consensual liens. One common example is the residential mortgage or deed of trust. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or. Web types of consensual liens.

Because both parties voluntarily agree to the arrangement, such liens are often referred to as “voluntary” or “consensual” liens. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or. Mechanic's liens / tax liens. Web consensual liens are those you consent to voluntarily, such as taking out a loan or line of credit. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or an order of a judge and do not require a debtor’s agreement. As the name suggests, a statutory lien arises automatically by statute. In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to pay for such asset. Web a consensual lien is typically a result of a loan or other advance of credit. A consensual lien is one created voluntarily by the owner of the property encumbered by the lien. First, as a direct contractor (someone hired by the property owner), you already have a self executed texas constitutional lien without even having to file a lien affidavit against the property.

Hospital MedFin

A consensual lien is one created voluntarily by the owner of the property encumbered by the lien. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or an order of a judge and do not require a debtor’s.

NONCONSENSUAL? ALWAYS CONSENSUAL Misc quickmeme

As the name suggests, a statutory lien arises automatically by statute. Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: One common example is the residential mortgage or deed of trust. Web types of consensual liens..

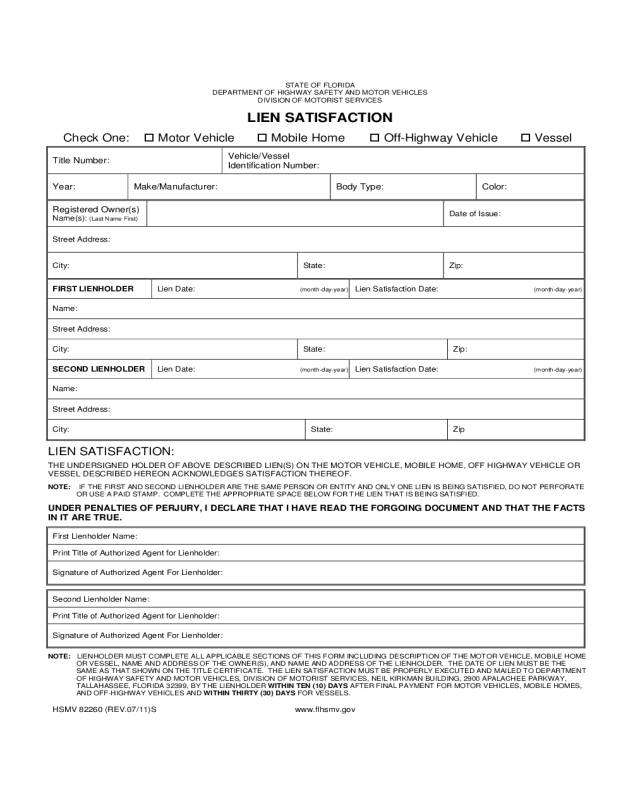

2022 Car Lien Form Fillable, Printable PDF & Forms Handypdf

In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to pay for such asset. Mechanic's liens / tax liens. Contractual liens are used to designate a borrower’s property as collateral for a loan. There are two types of consensual liens: Web consensual liens are those you consent to voluntarily, such as taking out a.

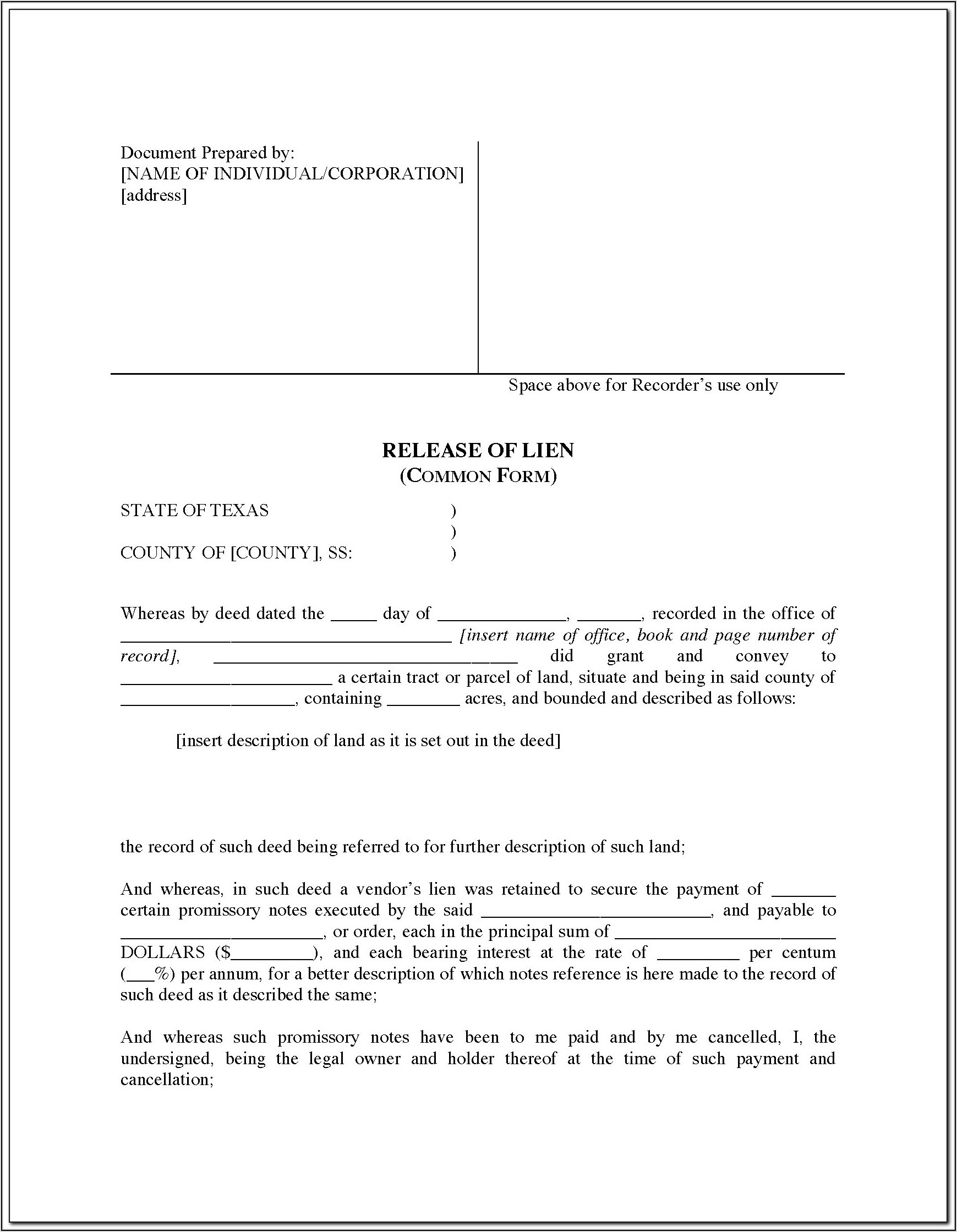

Lien Release Form Texas Contractor Form Resume Examples emVKelL9rX

First, as a direct contractor (someone hired by the property owner), you already have a self executed texas constitutional lien without even having to file a lien affidavit against the property. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation.

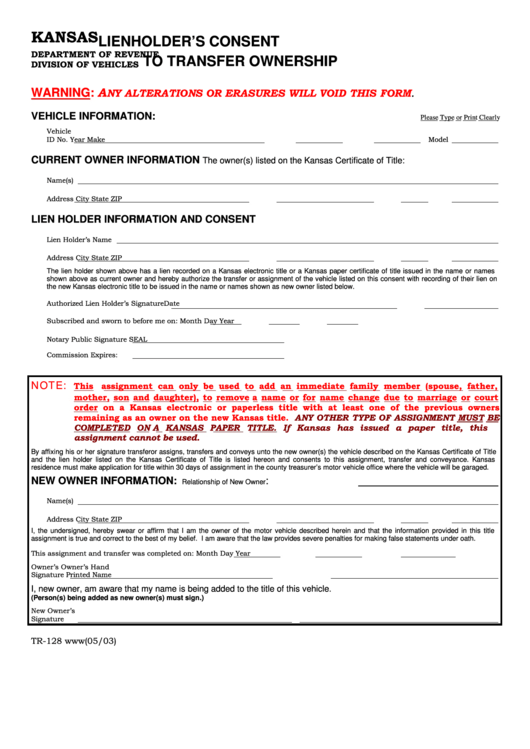

Fillable Form Tr128 Lienholder'S Consent To Transfer Ownership

In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to pay for such asset. Contractual liens are used to designate a borrower’s property as collateral for a loan. Web a consensual lien is typically a result of a loan or other advance of credit. There are two types of consensual liens: Web contractual lien.

Louisville Kentucky Consensual Lien US Legal Forms

There are two types of consensual liens: Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: Web a consensual lien is typically a result of a loan or other advance of credit. Residential mortgages, vehicles, and.

Aia Partial Release Of Lien Form Form Resume Examples gzOe8Zl5Wq

A consensual lien is one created voluntarily by the owner of the property encumbered by the lien. First, as a direct contractor (someone hired by the property owner), you already have a self executed texas constitutional lien without even having to file a lien affidavit against the property. Web the primary distinction is that consensual liens are created by a.

Oregon Medical Services Lien Legal Forms and Business Templates

Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or an order of a judge and do not require a debtor’s agreement. A consensual lien is one created voluntarily by the owner of the property encumbered by the.

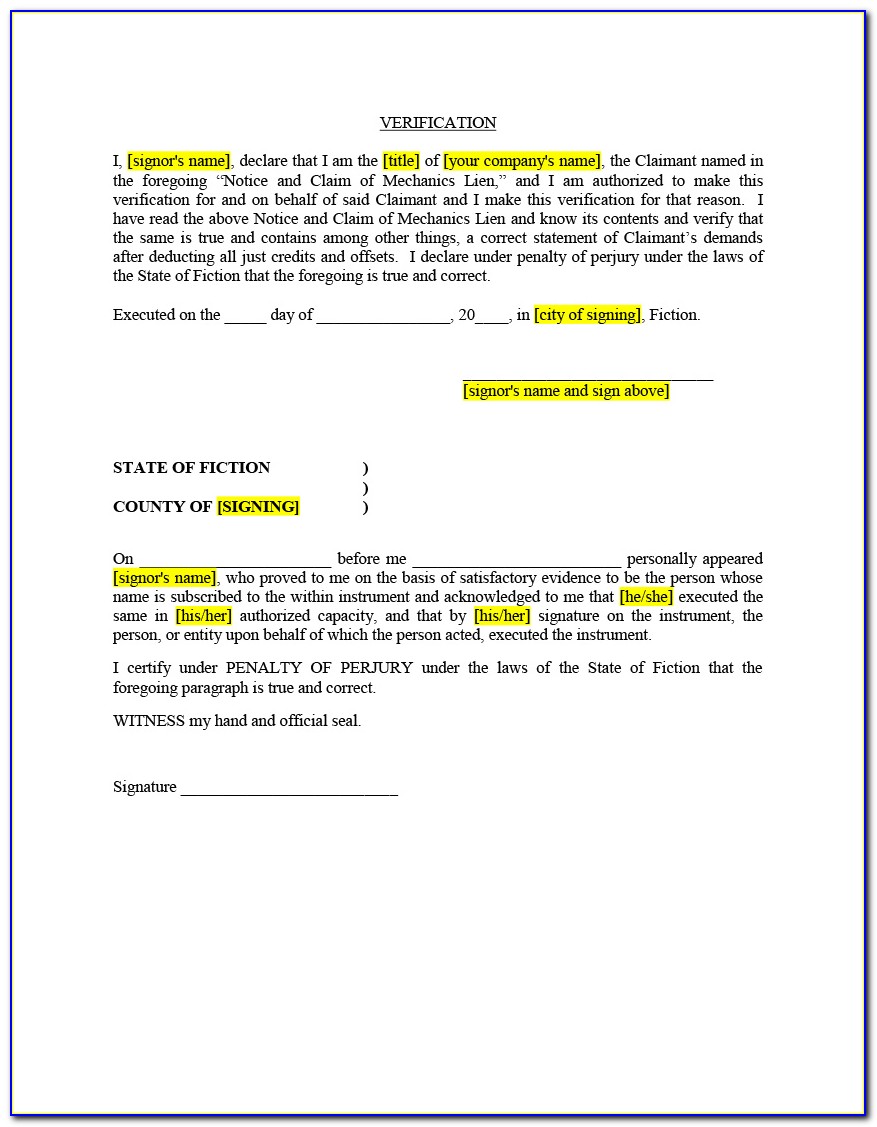

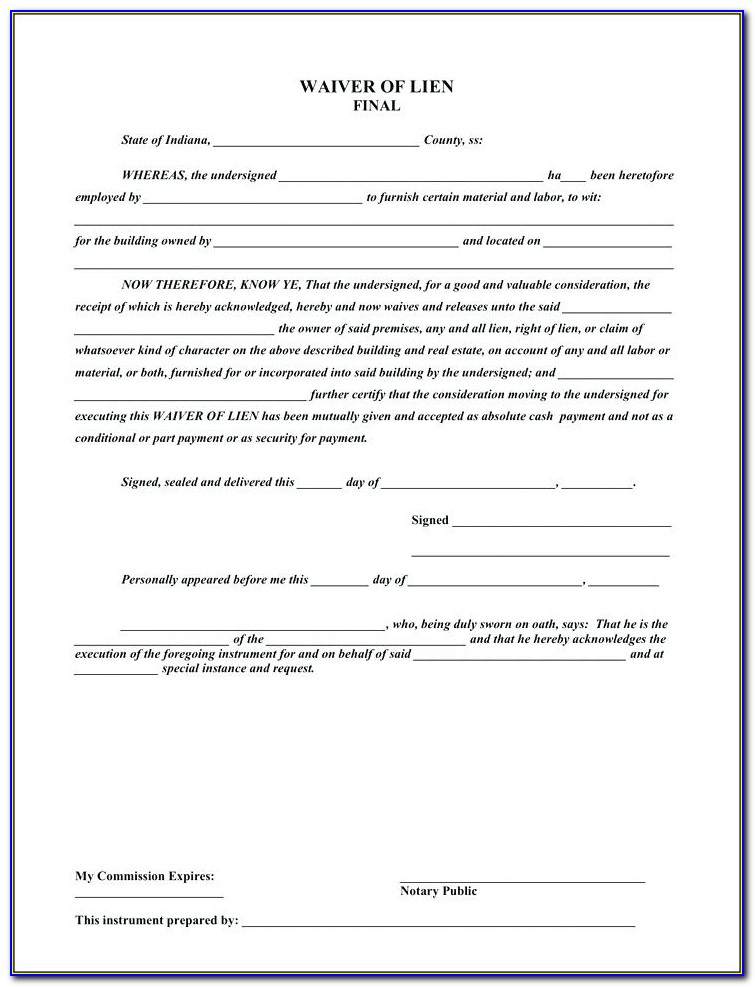

Release Of Lien Form Florida Pdf

As the name suggests, a statutory lien arises automatically by statute. Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to.

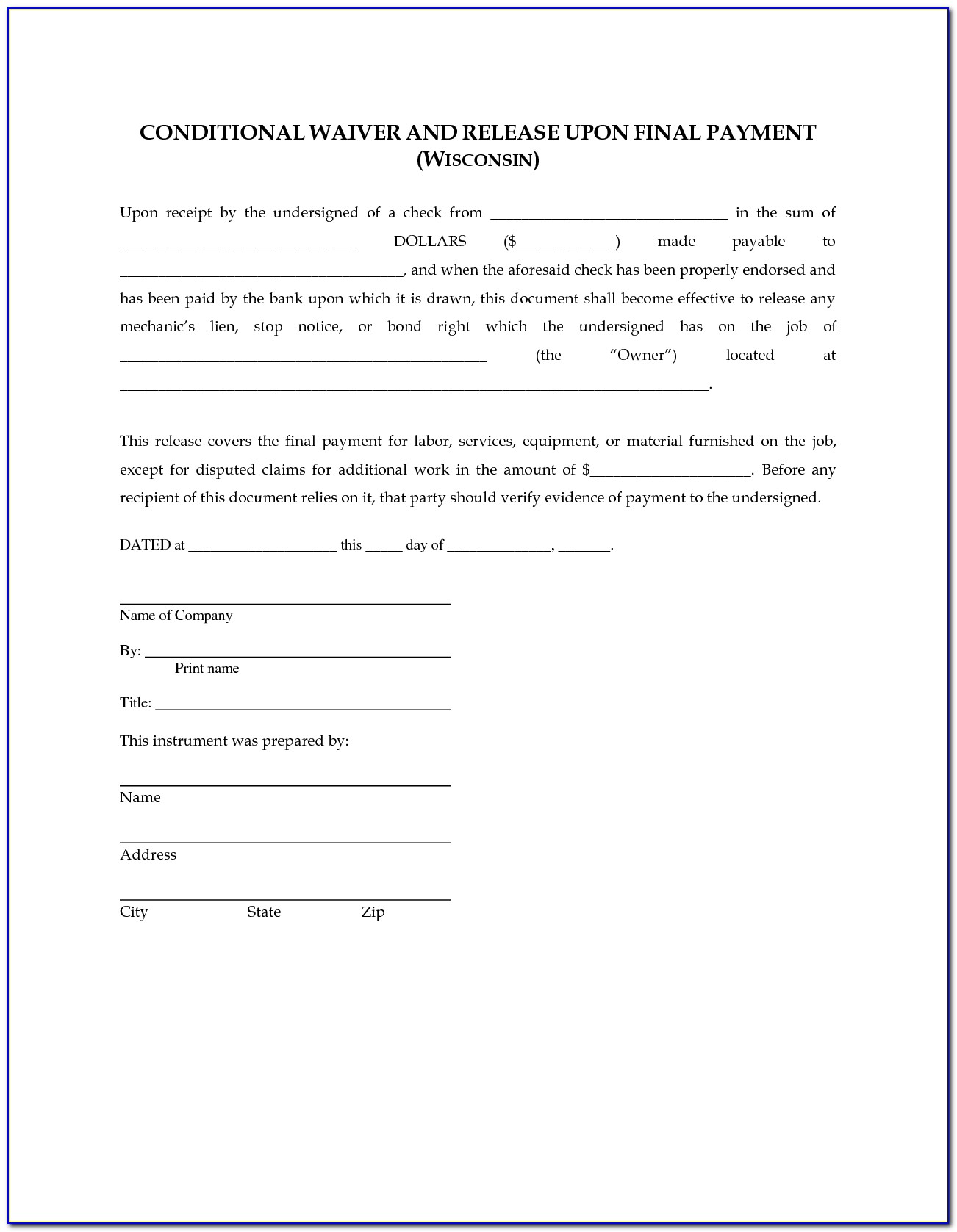

Unconditional Lien Waiver Form Michigan Form Resume Examples

Contractual liens are used to designate a borrower’s property as collateral for a loan. The most common consensual lien is a residential mortgage, where the home buyer consents to a bank taking a security interest in the home when a mortgage is obtained. Web consensual liens are those you consent to voluntarily, such as taking out a loan or line.

Web Types Of Consensual Liens.

Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or. Contractual liens are used to designate a borrower’s property as collateral for a loan. In many cases, the asset that is acquired by the borrower secures the borrower’s obligation to pay for such asset. Web the primary distinction is that consensual liens are created by a security agreement between a debtor and a creditor, while judicial and statutory liens are created by operation of law and/or an order of a judge and do not require a debtor’s agreement.

Web Sep 27, 2019 Great Question And We Assist Roofing Contractors With This Issue All Of The Time.

The most common consensual lien is a residential mortgage, where the home buyer consents to a bank taking a security interest in the home when a mortgage is obtained. Residential mortgages, vehicles, and business assets fall under the category of. As the name suggests, a statutory lien arises automatically by statute. Because both parties voluntarily agree to the arrangement, such liens are often referred to as “voluntary” or “consensual” liens.

A Consensual Lien Is One Created Voluntarily By The Owner Of The Property Encumbered By The Lien.

Web consensual liens are those you consent to voluntarily, such as taking out a loan or line of credit. There are two main types of consensual liens. One common example is the residential mortgage or deed of trust. Mechanic's liens / tax liens.

Web Contractual Lien Is One That Is Set Up In A Contract Between The Creditor And The Debtor.

There are two types of consensual liens: Web in order to know if your assets are at risk, it is imperative that you have an understanding of the different types of liens you may encounter as a small business owner: Web a consensual lien is typically a result of a loan or other advance of credit. First, as a direct contractor (someone hired by the property owner), you already have a self executed texas constitutional lien without even having to file a lien affidavit against the property.