You Expect To Generate 10 Million In The First Year

You Expect To Generate 10 Million In The First Year - A firm has three different investment options, each costing $10 million. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. In this case, the movie costs $10 million. It is a simple tool that tells you how long it will take to recoup your investment. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year.

It is a simple tool that tells you how long it will take to recoup your investment. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. A firm has three different investment options, each costing $10 million. Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. In this case, the movie costs $10 million.

Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment b will generate $1.70 million at the. It is a simple tool that tells you how long it will take to recoup your investment. A firm has three different investment options, each costing $10 million. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. In this case, the movie costs $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Option a will generate $12 million in revenue at the end of one year.

The Devil, 10 million, the Detail and how you use it.

Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1.

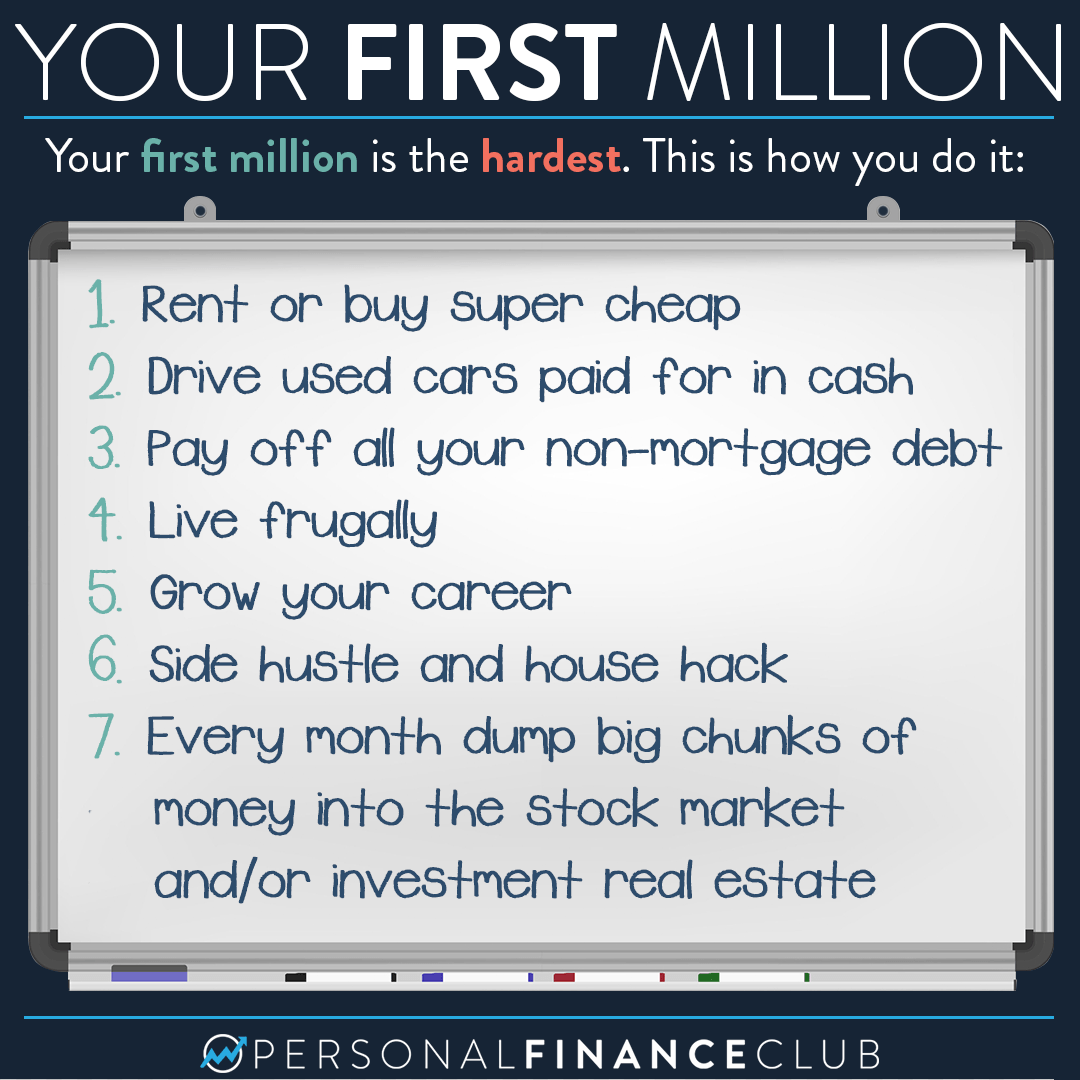

How to make your first million dollars Personal Finance Club

Investment b will generate $1.70 million at the. It is a simple tool that tells you how long it will take to recoup your investment. A firm has three different investment options, each costing $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that.

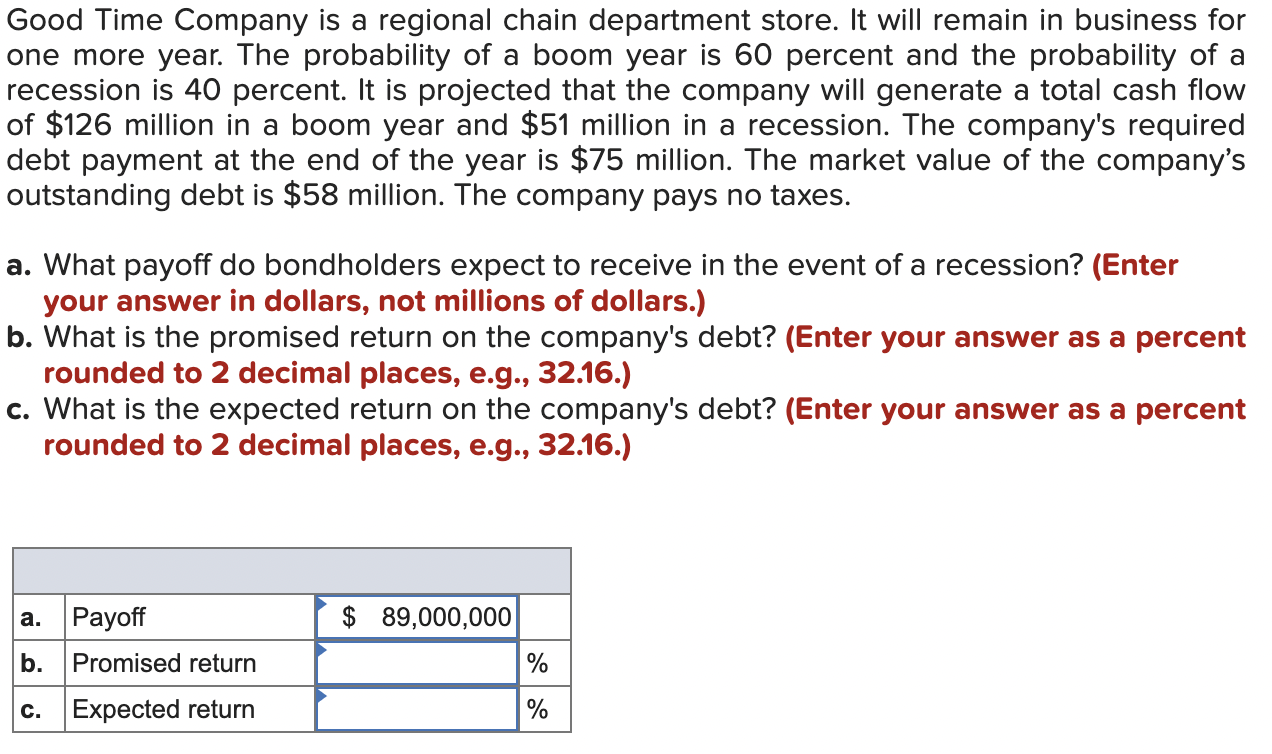

Solved Good Time Company is a regional chain department

A firm has three different investment options, each costing $10 million. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. In this case, the movie costs $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each.

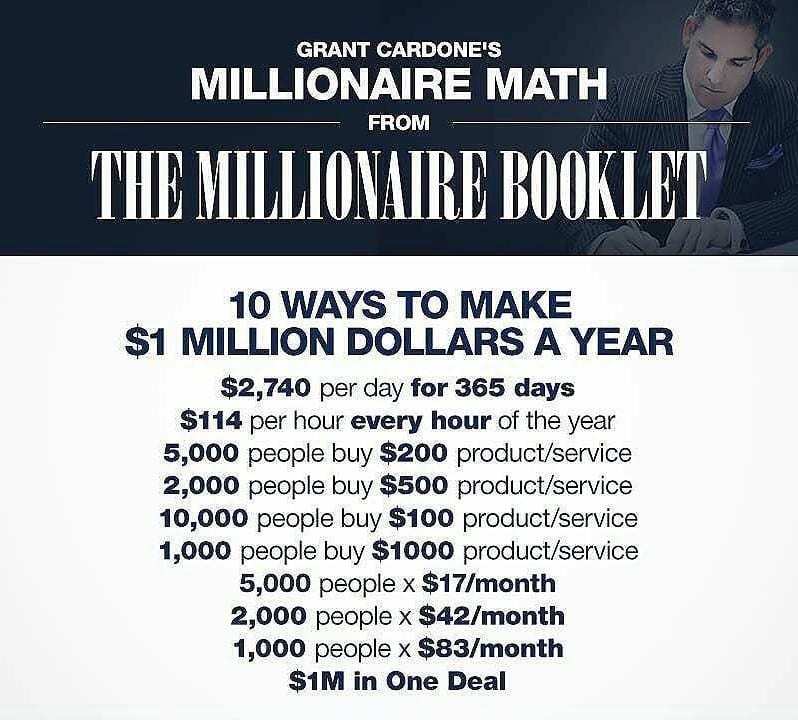

Millionaire Match, How You can Earn Your 1st Million Dollars Online

Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year. In this case, the movie costs $10 million. You expect it to generate $10 million in the first.

The Tools to 10 Million PCA Overdrive

You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. It is a simple tool that tells you how long it will take to recoup your investment. Option a will generate $12 million in revenue at the end of one year. Investment.

How to make 1 million dollars in one year, make your first million

Option a will generate $12 million in revenue at the end of one year. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. A firm has three different investment options, each costing $10 million. You expect it to generate $10 million in the first year, $5 million in the.

What To Do With 10 Million Dollars in Cash MoneyRyde 2024

Option a will generate $12 million in revenue at the end of one year. A firm has three different investment options, each costing $10 million. In this case, the movie costs $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the.

Solved Quad Enterprises is considering a new threeyear

In this case, the movie costs $10 million. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. Investment b will generate $1.70 million at the. A firm has three different investment.

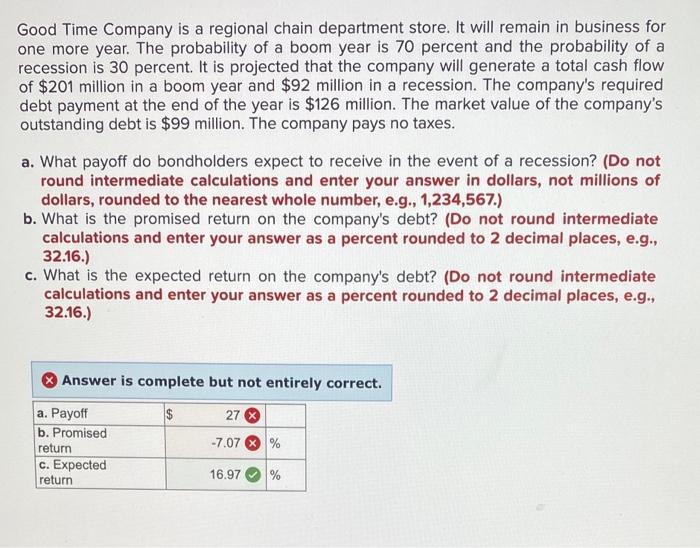

Solved Good Time Company is a regional chain department

Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Option a will generate $12 million in revenue at the end of one year. You expect it to generate $10 million in.

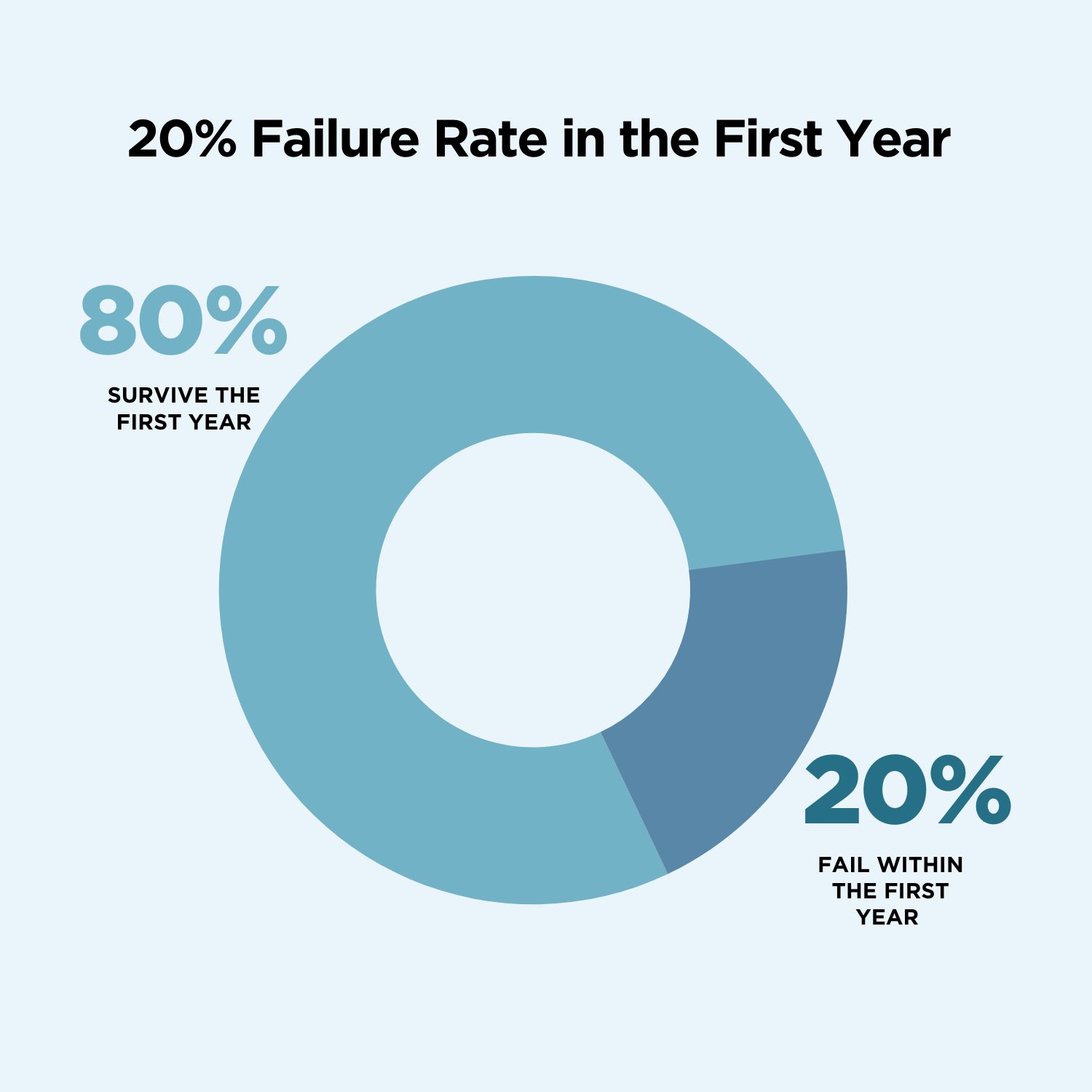

The Percentage of Businesses That Fail (Statistics & Failure Rates)

Option a will generate $12 million in revenue at the end of one year. Investment b will generate $1.70 million at the. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Has earnings before interest and taxes (ebit) of $10 million,.

In This Case, The Movie Costs $10 Million.

Investment b will generate $1.70 million at the. A firm has three different investment options, each costing $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Option a will generate $12 million in revenue at the end of one year.

It Is A Simple Tool That Tells You How Long It Will Take To Recoup Your Investment.

Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity.