Wv Form It-140 Instructions

Wv Form It-140 Instructions - Active military separation (see instructions on page 22) must enclose. Web west virginia — west virginia personal income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web show sources > form it140 is a west virginia individual income tax form. Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Please use the link below. 14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries. For security reasons, the tax division suggests you download the fillable. Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. With us legal forms the whole process of completing legal. Web follow the simple instructions below:

The days of frightening complicated tax and legal documents have ended. Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. Web west virginia — west virginia personal income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Active military separation (see instructions on page 22) must enclose. With us legal forms the whole process of completing legal. Fiduciary fi lers use line 6. Amended return instructions have been updated and should reduce the processing time of returns. Web show sources > form it140 is a west virginia individual income tax form. Please use the link below. 14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries.

14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries. Amended return instructions have been updated and should reduce the processing time of returns. Like the federal form 1040, states each provide a core tax return form on which most high. With us legal forms the whole process of completing legal. The days of frightening complicated tax and legal documents have ended. Web show sources > form it140 is a west virginia individual income tax form. For security reasons, the tax division suggests you download the fillable. Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Web follow the simple instructions below: Please use the link below.

2011 Form WV DoR IT140 Fill Online, Printable, Fillable, Blank pdfFiller

The days of frightening complicated tax and legal documents have ended. Web tax information and assistance: Amended return instructions have been updated and should reduce the processing time of returns. Active military separation (see instructions on page 22) must enclose. With us legal forms the whole process of completing legal.

Wv state tax form 2015 Fill out & sign online DocHub

The days of frightening complicated tax and legal documents have ended. Web tax information and assistance: Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Please use the link below. Web follow the simple instructions below:

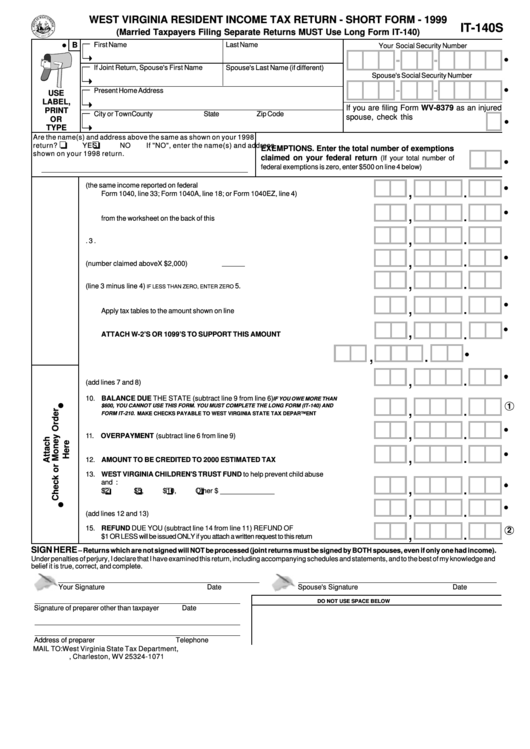

Form It140s West Virginia Resident Tax Return Short Form

Fiduciary fi lers use line 6. Web follow the simple instructions below: For security reasons, the tax division suggests you download the fillable. Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. Amended return instructions have been updated and should reduce the processing time of returns.

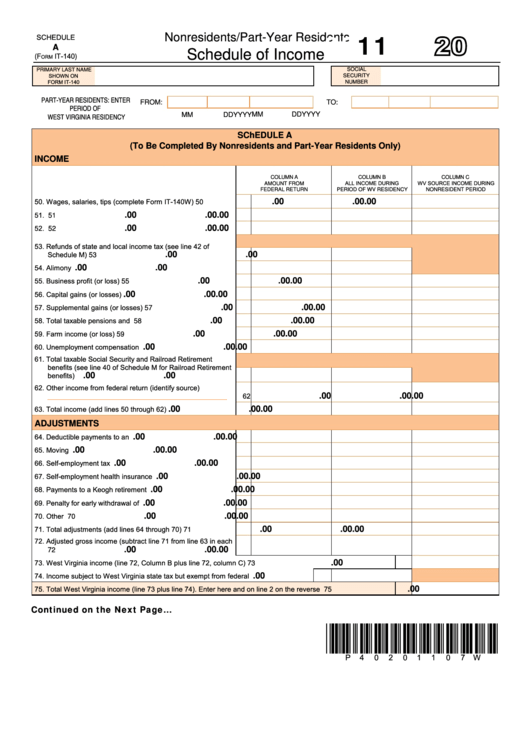

Schedule A (Form It140) West Virginia Nonresidents/partYear

Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. For security reasons, the tax division suggests you download the fillable. Web follow the simple instructions below: Web show sources > form it140 is a west virginia individual income tax form. With us legal forms the whole process of completing legal.

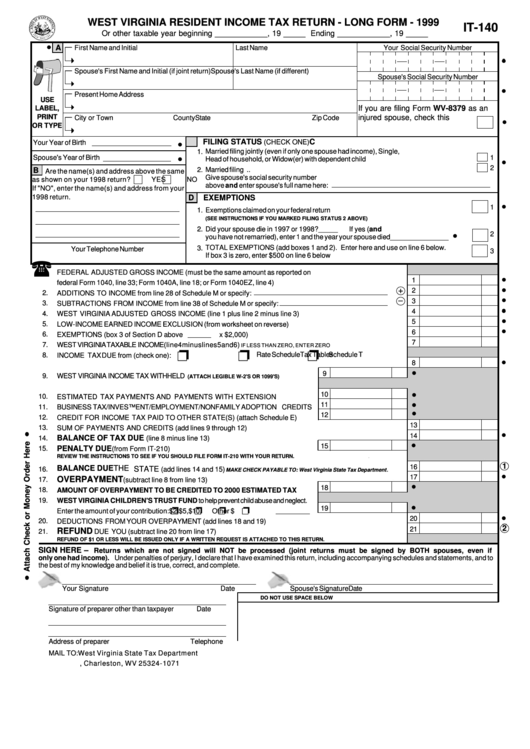

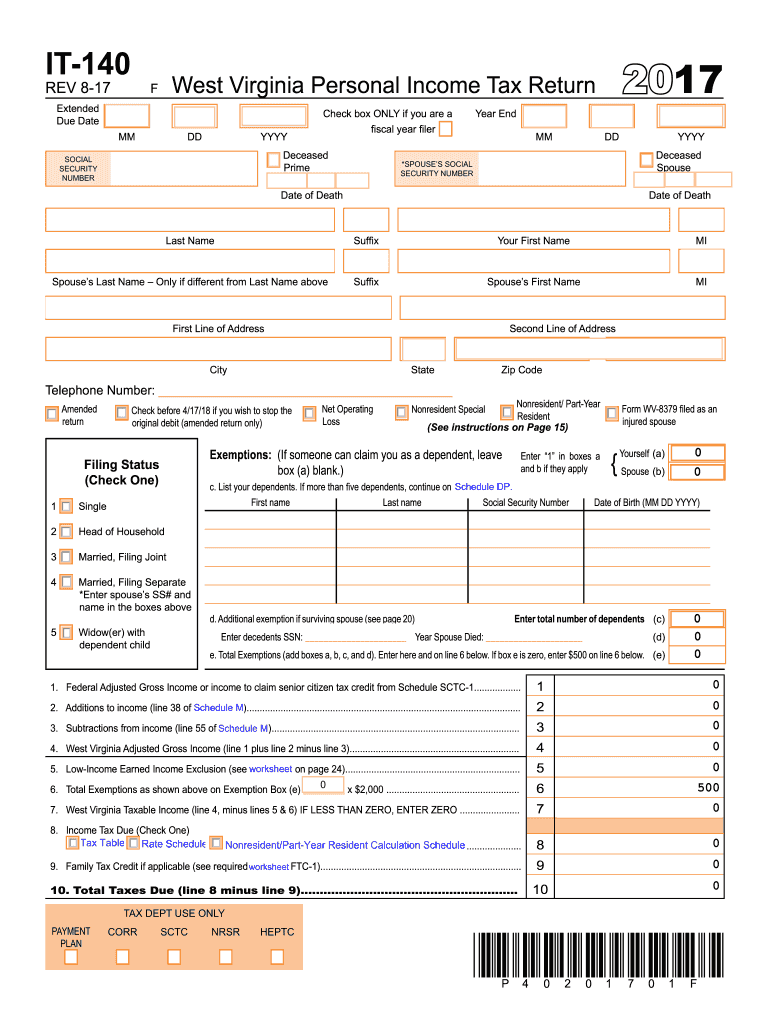

Form It140 West Virginia Resident Tax Return Long Form

Active military separation (see instructions on page 22) must enclose. Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). 14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries. Please use the link below. Web form it140 schedule.

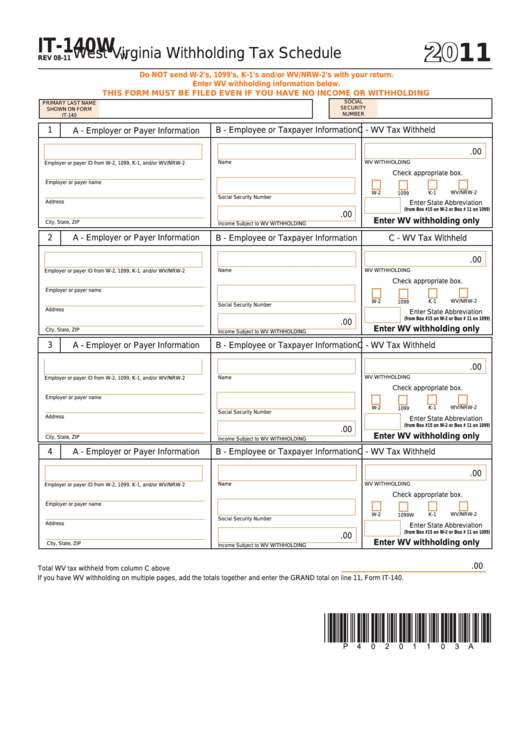

Form It140w West Virginia Withholding Tax Schedule 2011 printable

Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Fiduciary fi lers use line 6. For security reasons, the tax division suggests you download the fillable. Like the federal form 1040, states each provide a core tax return form on which most high. Active military separation (see instructions on page 22) must enclose.

Form IT140 Schedule HEPTC1 Download Printable PDF 2017, Homestead

14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries. Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony..

WV DoR IT140 2017 Fill out Tax Template Online US Legal Forms

Web follow the simple instructions below: Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. Web show sources > form it140 is a west virginia individual income tax form. Web active duty military pay for personnel with west virginia domicile (see instructions on page 22). Fiduciary fi lers use line.

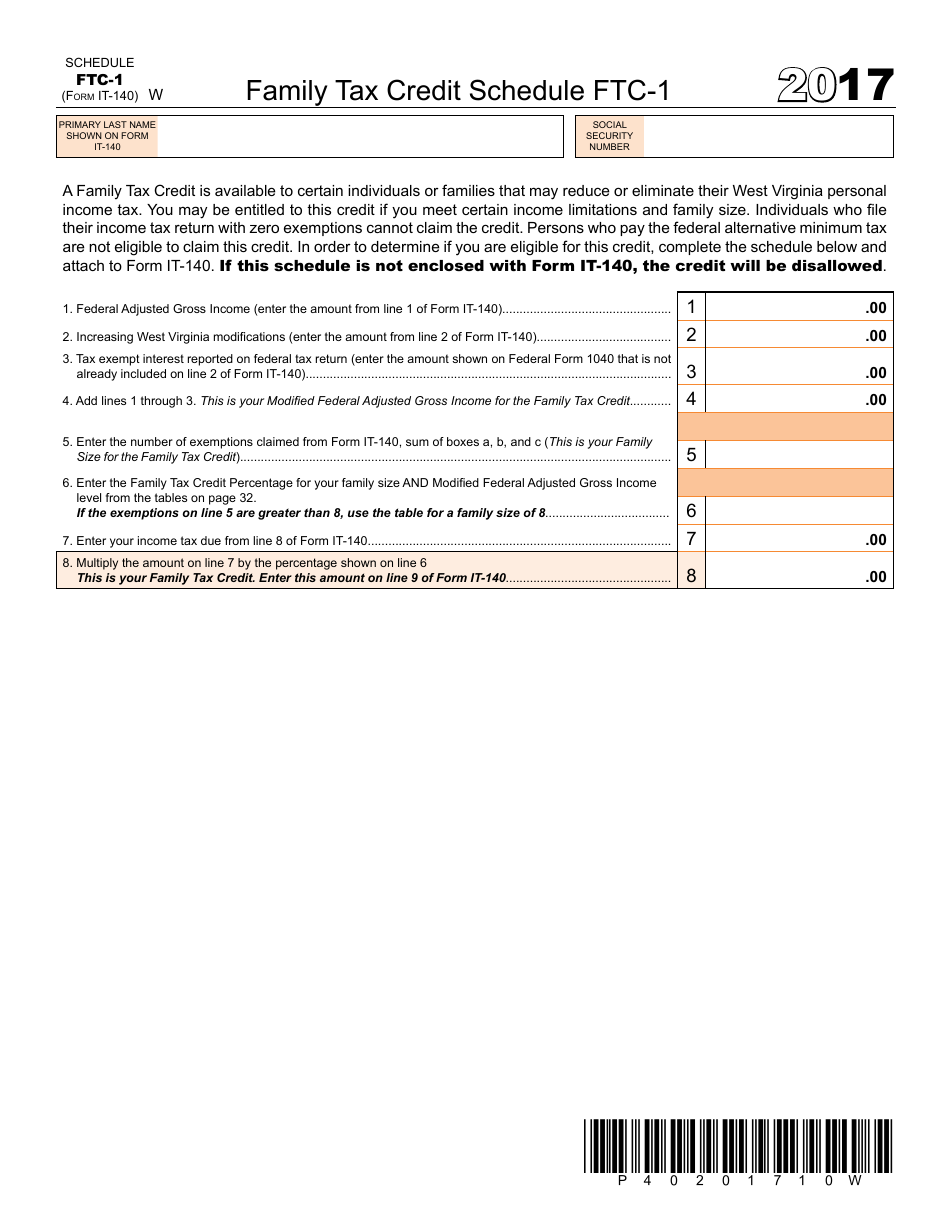

Form IT140 Schedule FTC1 Download Printable PDF or Fill Online Family

Web follow the simple instructions below: The days of frightening complicated tax and legal documents have ended. Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. 14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or.

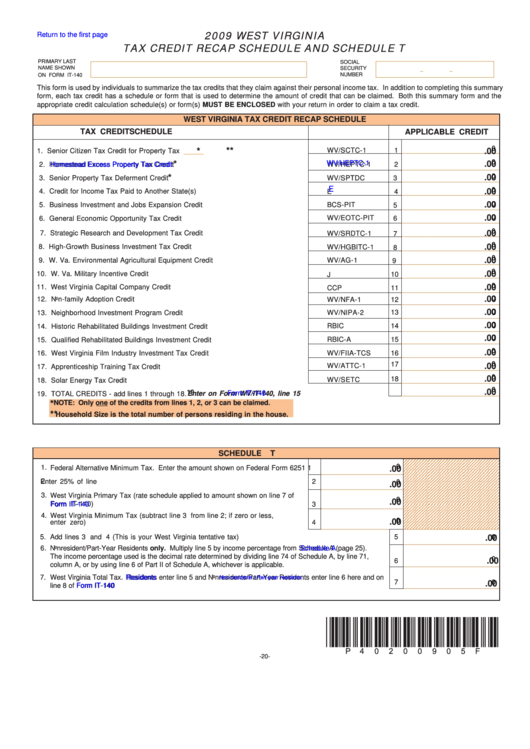

Fillable Form It140 2009 West Virginia Tax Credit Recap Schedule And

For security reasons, the tax division suggests you download the fillable. With us legal forms the whole process of completing legal. Active military separation (see instructions on page 22) must enclose. Web follow the simple instructions below: The days of frightening complicated tax and legal documents have ended.

Web Show Sources > Form It140 Is A West Virginia Individual Income Tax Form.

Web form it140 schedule a requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax information and assistance: With us legal forms the whole process of completing legal. For security reasons, the tax division suggests you download the fillable.

Like The Federal Form 1040, States Each Provide A Core Tax Return Form On Which Most High.

Web west virginia — west virginia personal income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Please use the link below. Web follow the simple instructions below: Web active duty military pay for personnel with west virginia domicile (see instructions on page 22).

Amended Return Instructions Have Been Updated And Should Reduce The Processing Time Of Returns.

Active military separation (see instructions on page 22) must enclose. The days of frightening complicated tax and legal documents have ended. 14.00 **you cannot claim credit for taxes paid to ky, md, pa, oh, or va unless your source income is other than wages and/or salaries. Fiduciary fi lers use line 6.