Wisconsin Irrevocable Trust Form

Wisconsin Irrevocable Trust Form - Trustees are bound by strict rules under wisconsin. Ad instant download and complete your irrevocable trust forms, start now! This trust may become irrevocable and. Web the new wisconsin trust code is transformative and makes wisconsin a better place to administer trusts. The trust purchases a life insurance policy. Date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust. Web attorney sample documents bank these sample documents are provided by wispact as a service to the wisconsin legal community. Fill in your firm’s or practice’s identifying information. Web trusts & wills wills are a common way for people to state their preferences about how their estates should be handled after their deaths. Web file a federal form 5227 for a charitable remainder trust, you are not required to file a wisconsin tax return.

Web a trust is irrevocable if the power to revest title does not exist. Select your trust account option. Web wisconsin general form of irrevocable trust agreement category: Web 701.0410 modification or termination of trust; Ad instant download and complete your irrevocable trust forms, start now! The trust purchases a life insurance policy. Web you need no one's permission to do so unless you have created a joint trust with your spouse. Web what is a revocable trust? Mail, fax or email it back to the. We advise you that any sample form must.

Ad instant download and complete your irrevocable trust forms, start now! Sign and date the certificate. Select your trust account option. We advise you that any sample form must. The trust purchases a life insurance policy. However, if the charitable remainder trust has at least $1,000 of. A trust that can be amended and revoked, usually by the person who established the trust. Fill in your firm’s or practice’s identifying information. Web under wisconsin's current trust law, if you create an irrevocable trust and later decide that a change needs to be made, you are (with very limited exceptions) required to go to. Web 701.0410 modification or termination of trust;

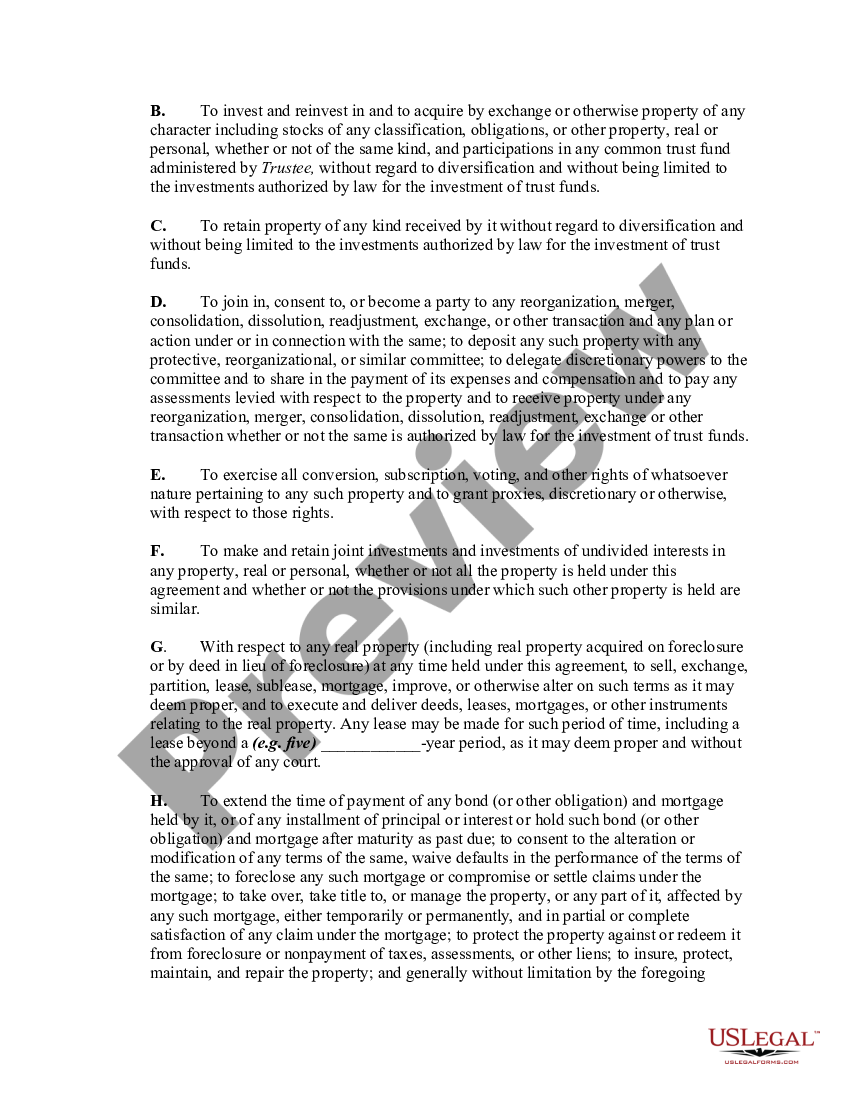

Texas General Form of Irrevocable Trust Agreement Medicaid Asset

However, if the charitable remainder trust has at least $1,000 of. Web a trust is irrevocable if the power to revest title does not exist. Web download and print the form. Date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust. The trust purchases a life insurance policy.

Irrevocable Trust Form New York Universal Network

However, if the charitable remainder trust has at least $1,000 of. Web wisconsin general form of irrevocable trust agreement category: Web a person (the “settlor”) creates an irrevocable trust with someone other than the settlor as the trustee. Web for medicaid purposes, wisconsin law stipulates that such trusts may be made irrevocable as to the first $4,500 of the funds.

Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trustor with

The following inter vivos trusts that become irrevocable on or. Date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust. Fiduciary income tax for estates or trusts. In wisconsin, a trust is revocable unless it specifically states it is irrevocable. We advise you that any sample form must.

What Is an Irrevocable Trust? What You Should Know CentSai

Proceedings for approval or disapproval. Web for medicaid purposes, wisconsin law stipulates that such trusts may be made irrevocable as to the first $4,500 of the funds paid under the agreement. Mail, fax or email it back to the. We advise you that any sample form must. Law prior to october 29, 1999:

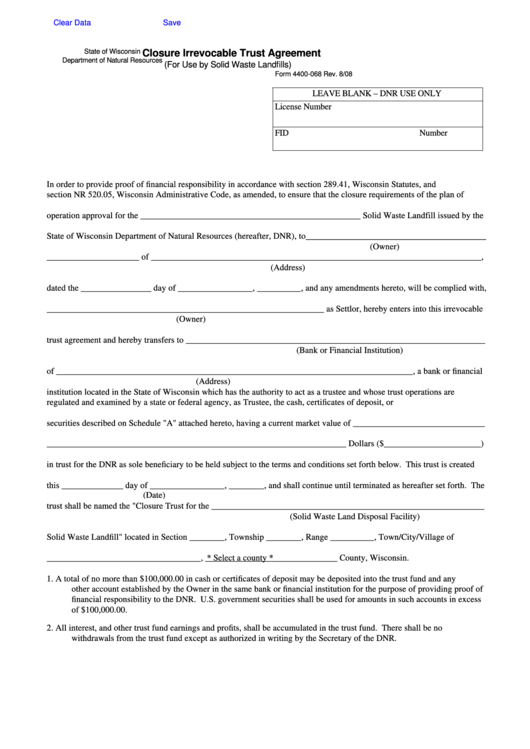

Fillable Form 4400068 Closure Irrevocable Trust Agreement (For Use

A trust that can be amended and revoked, usually by the person who established the trust. Web wisconsin general form of irrevocable trust agreement category: John doe, a resident of wisconsin, set up an irrevocable trust on. Web file a federal form 5227 for a charitable remainder trust, you are not required to file a wisconsin tax return. Ad instant.

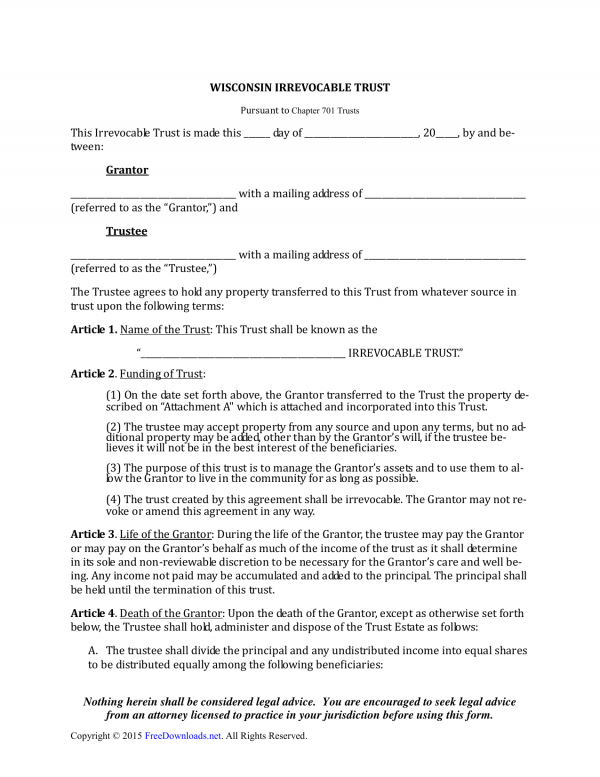

Download Wisconsin Irrevocable Living Trust Form PDF RTF Word

Date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust. Web a person (the “settlor”) creates an irrevocable trust with someone other than the settlor as the trustee. John doe, a resident of wisconsin, set up an irrevocable trust on. Ad answer simple questions to make your legal forms..

Irrevocable Trust Forms California Form Resume Examples o7Y3115M2B

We advise you that any sample form must. Mail, fax or email it back to the. Web you need no one's permission to do so unless you have created a joint trust with your spouse. Web what is a revocable trust? Fill in your firm’s or practice’s identifying information.

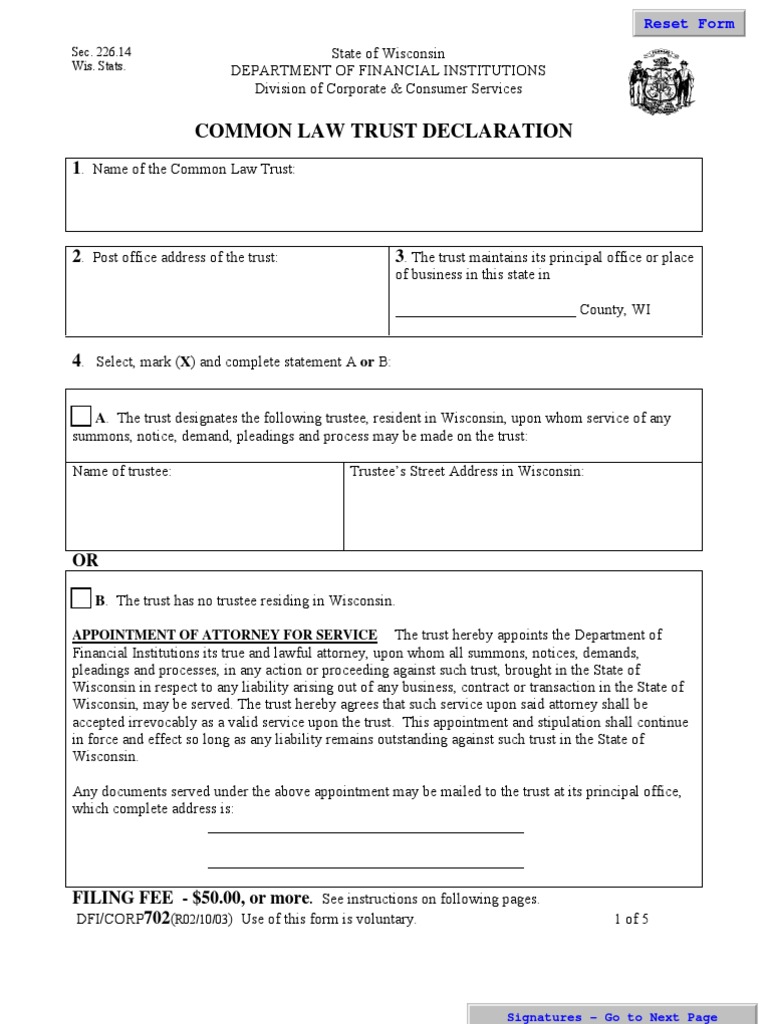

Common Law Trust Declaration Form 702 Copy Service Of Process Trust Law

Web you need no one's permission to do so unless you have created a joint trust with your spouse. Web wisconsin fiduciary income tax for estates or trusts form2 date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust revocable or. John doe, a resident of wisconsin, set up.

New Hampshire Declaration of Trust Form Free Printable Legal Forms

Proceedings for approval or disapproval. 701.0411 modification or termination of noncharitable irrevocable trust by consent. However, if the charitable remainder trust has at least $1,000 of. Mail, fax or email it back to the. Lawyer shall maintain and preserve complete records of trust account funds, all deposits and disbursements, and other trust property and shall.

Irrevocable Trust Form Arizona Universal Network

Web wisconsin general form of irrevocable trust agreement category: A trust that can be amended and revoked, usually by the person who established the trust. John doe, a resident of wisconsin, set up an irrevocable trust on. Web wisconsin fiduciary income tax for estates or trusts form2 date trust or bankruptcy estate was created or date of decedent’s death if.

Web File A Federal Form 5227 For A Charitable Remainder Trust, You Are Not Required To File A Wisconsin Tax Return.

Trustees are bound by strict rules under wisconsin. Web trusts & wills wills are a common way for people to state their preferences about how their estates should be handled after their deaths. Web a person (the “settlor”) creates an irrevocable trust with someone other than the settlor as the trustee. However, if the charitable remainder trust has at least $1,000 of.

The Trust Purchases A Life Insurance Policy.

Web the new wisconsin trust code is transformative and makes wisconsin a better place to administer trusts. Web under wisconsin's current trust law, if you create an irrevocable trust and later decide that a change needs to be made, you are (with very limited exceptions) required to go to. Web for medicaid purposes, wisconsin law stipulates that such trusts may be made irrevocable as to the first $4,500 of the funds paid under the agreement. Web download and print the form.

It Answers Basic Questions Not Covered In The Previous Trust Code And.

Web a trust is irrevocable if the power to revest title does not exist. Fiduciary income tax for estates or trusts. Sign and date the certificate. Mail, fax or email it back to the.

Web Irrevocable Trusts In Wisconsin Are Based On The Idea Of Entrusting Properties To The Care And Control Of Independent Trustees.

Proceedings for approval or disapproval. Date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust. Web wisconsin fiduciary income tax for estates or trusts form2 date trust or bankruptcy estate was created or date of decedent’s death if this is a trust return, is the trust revocable or. This trust may become irrevocable and.