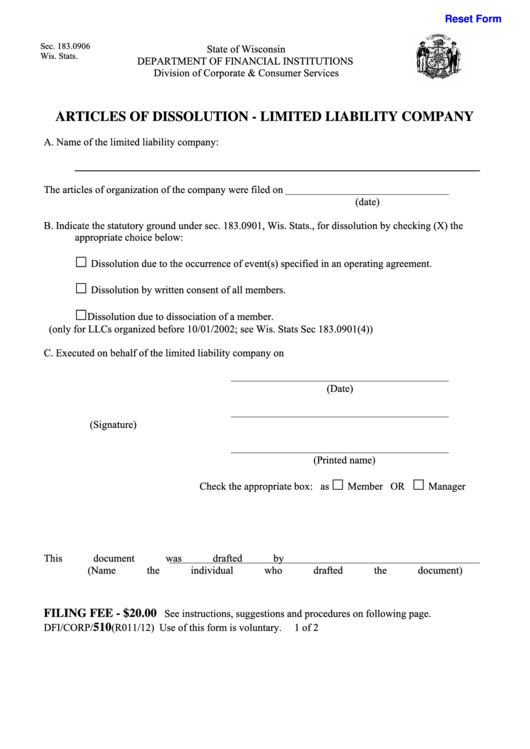

Wisconsin Form 510 Articles Of Dissolution

Wisconsin Form 510 Articles Of Dissolution - Ad when it's time to move on from your business, we're here to help through the process. Edit your form 510 online. You can also download it, export it or print it out. 180.1401, 180.1402, or 180.1403, wis. Name of limited liability company: Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing fee, to. Web send wisconsin form 510 articles of dissolution via email, link, or fax. Web articles of dissolution business corporation sec. Form 10 for a business corporation; Web 180.1406 known claims against dissolved corporation.

Web a corporation is not required to use this form to file its articles of dissolution; Ad when it's time to move on from your business, we're here to help through the process. Once these articles are filed, the legal existence. (mm/dd/yyyy) identify the statutory grounds for dissolution under s. Web wisconsin form 510 articles of dissolution. Name of limited liability company: (1) except as provided in sub. Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing fee, to. Web 180.1406 known claims against dissolved corporation. Web file final returns for any other tax account registered with the department (e.g., excise tax, premier resort area tax, local exposition tax) close your business tax.

Web filing articles of dissolution does not satisfy a company’s obligation to file a final return with tax authorities, if a return is due. There is a list of dissolution documents that you, as an llc owner, have to file. Web please check box for (optional) expedited service + $25.00 form 110 articles of dissolution nonstock corporation sec. However, if a corporation doesn’t want to use this form, it will need to ensure that it provides the. Easy with a few clicks. (mm/dd/yyyy) identify the statutory grounds for dissolution under s. Trusted by over 5,000+ businesses. Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing fee, to. Articles of organization were filed with the department on: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

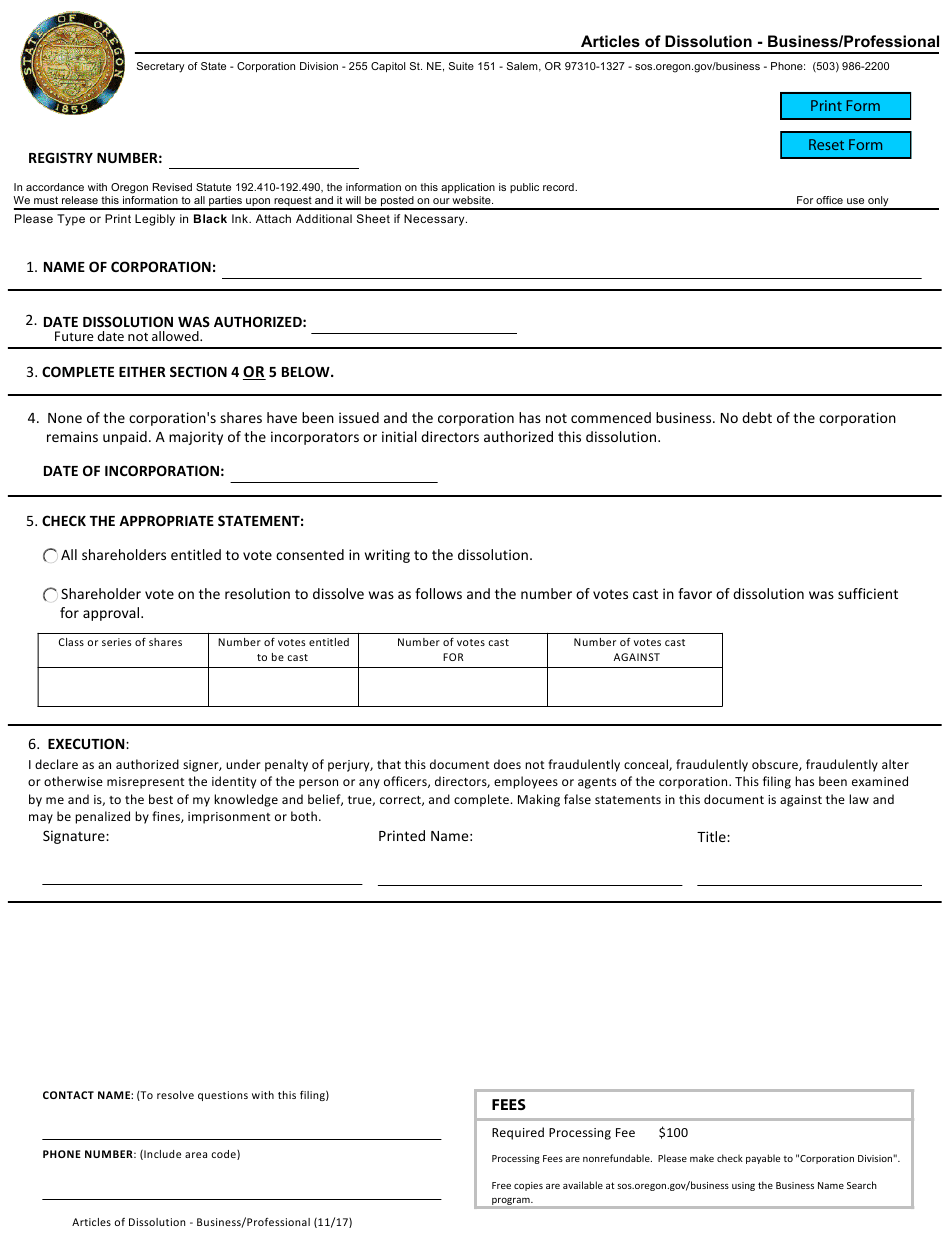

Oregon Articles of Dissolution Business/Professional Download

We'll create & file the articles of dissolution for you. You can also download it, export it or print it out. Articles of organization were filed with the department on: There is a list of dissolution documents that you, as an llc owner, have to file. Web please check box for (optional) expedited service + $25.00 form 110 articles of.

Articles Of Dissolution Template Collection

Trusted by over 5,000+ businesses. For particulars, contact wi dept of revenue at. Web filing articles of dissolution does not satisfy a company’s obligation to file a final return with tax authorities, if a return is due. Division of corporate and consumer services. Articles of organization were filed with the department on:

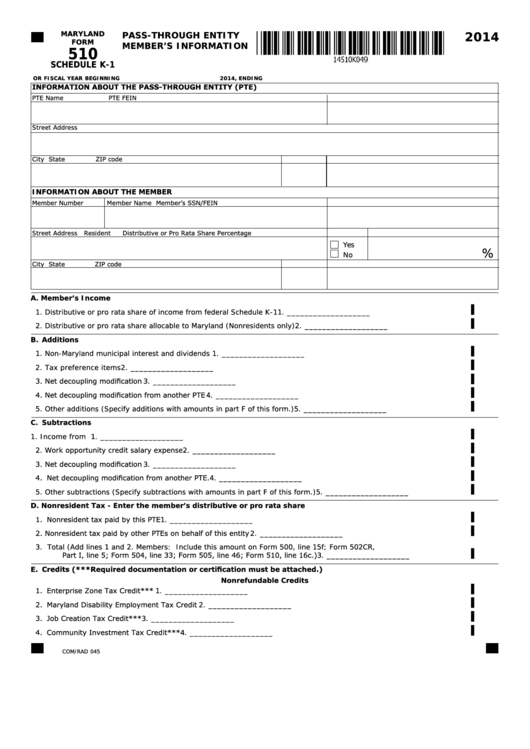

Fillable Form 510 Schedule K1 PassThrough Entity Member'S

Web please check box for (optional) expedited service + $25.00 form 110 articles of dissolution nonstock corporation sec. Web for a list of the events causing dissolution and other legal provisions relating to the dissolution and winding up of limited liability companies, review subchapter vii (entitled. Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing.

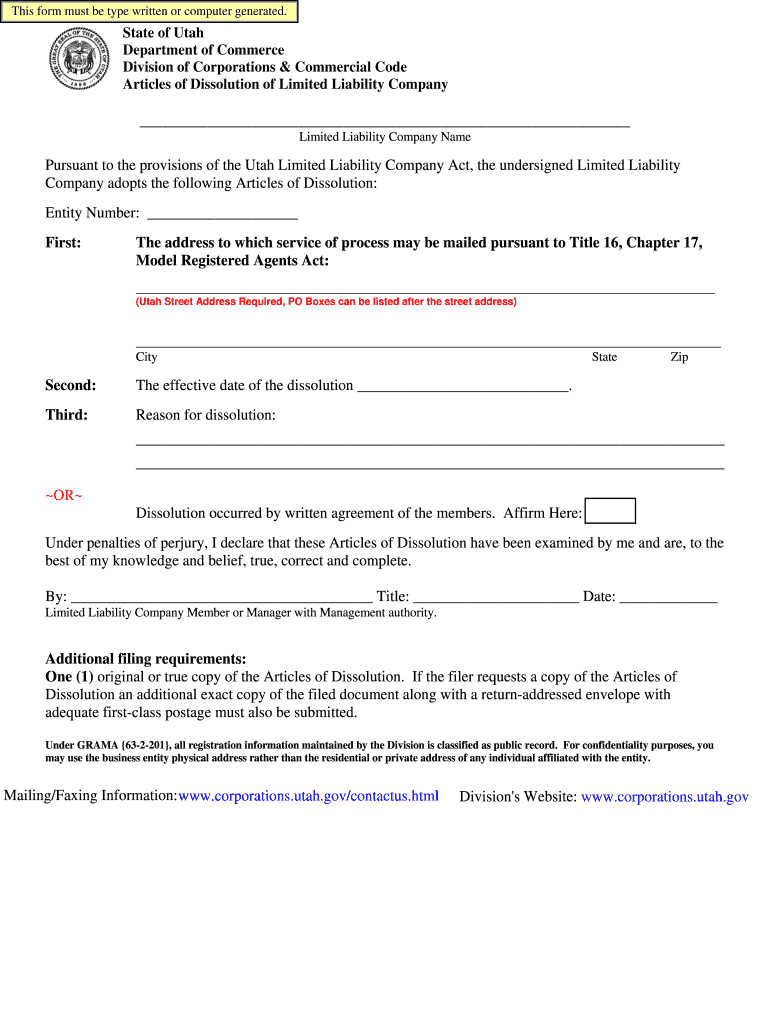

Fillable Form 510 Articles Of Dissolution For A Limited Liability

180.1401, 180.1402, or 180.1403, wis. Easy with a few clicks. There is a list of dissolution documents that you, as an llc owner, have to file. You can also download it, export it or print it out. Web 180.1406 known claims against dissolved corporation.

Wisconsin form 510 Fill out & sign online DocHub

Easy with a few clicks. Web filing articles of dissolution does not satisfy a company’s obligation to file a final return with tax authorities, if a return is due. Web state of wisconsin department of financial institutions division of corporate & consumer services form corp10i (revised february 2023) page 1 of 2 business. Web file final returns for any other.

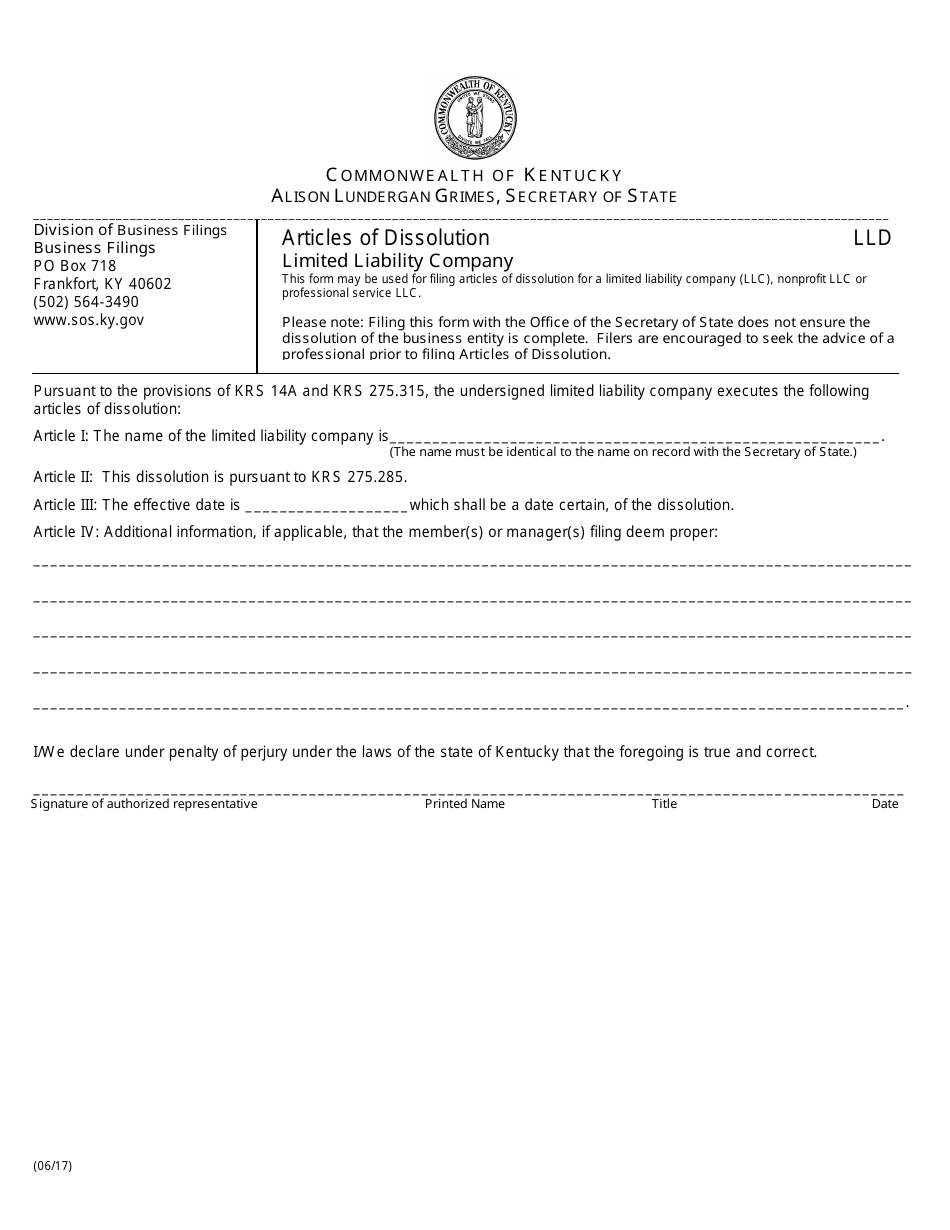

Form LLD Download Fillable PDF or Fill Online Articles of Dissolution

Form 510 for an llc Easy with a few clicks. Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing fee, to. (4), a dissolved corporation may dispose of the known claims against it by following the. (1) except as provided in sub.

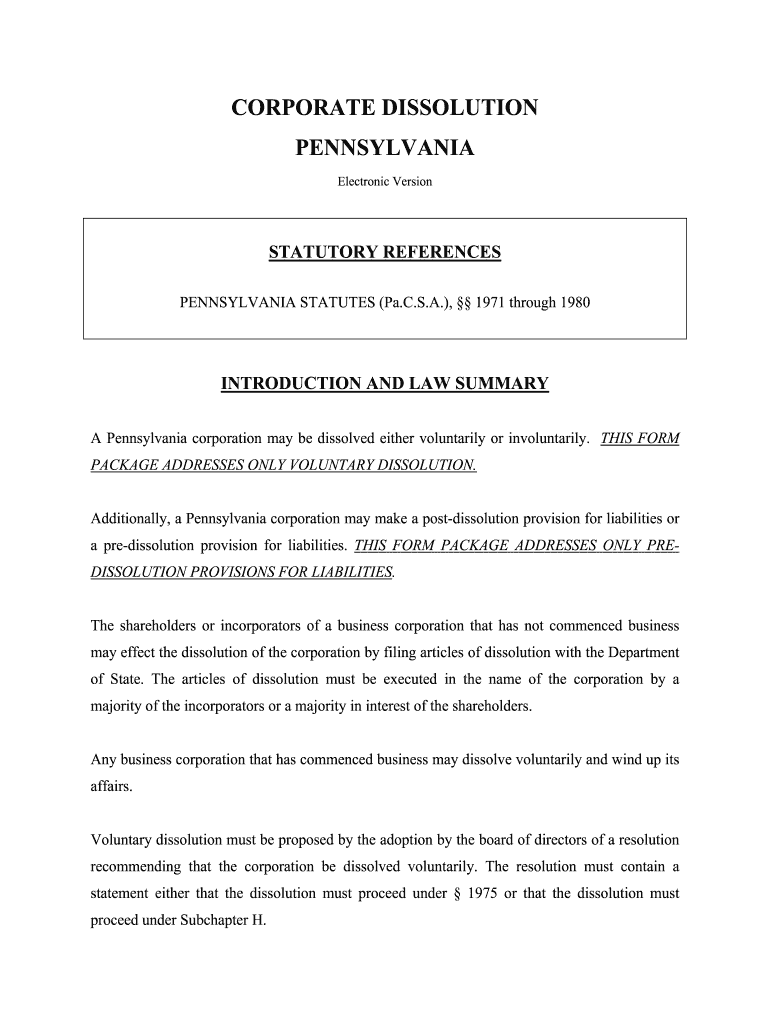

Dissolve Llc Pennsylvania Form Fill Out and Sign Printable PDF

Web state of wisconsin department of financial institutions division of corporate & consumer services form corp10i (revised february 2023) page 1 of 2 business. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. (4), a dissolved corporation may dispose of the known claims against it by following the. For particulars,.

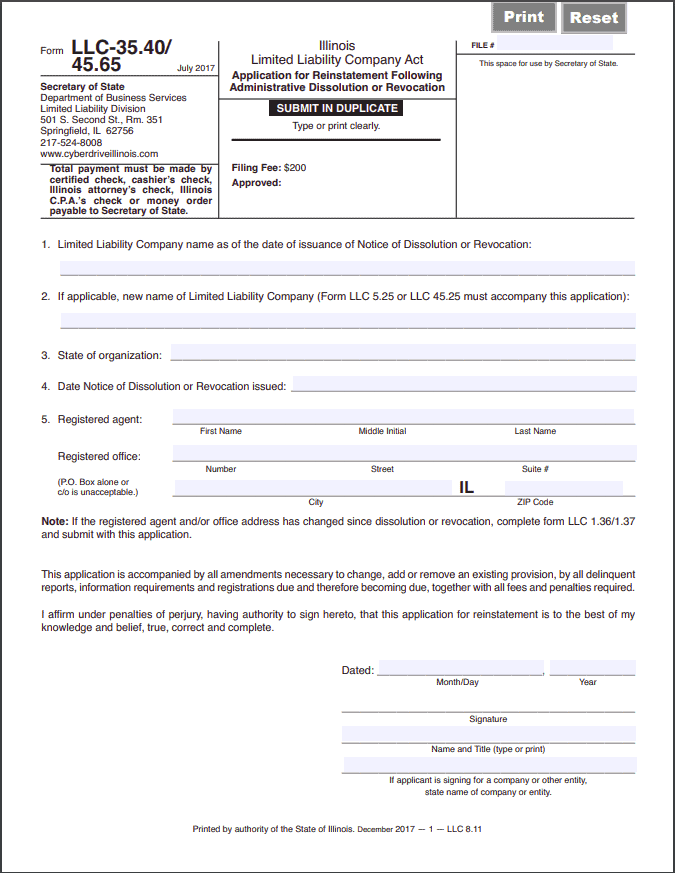

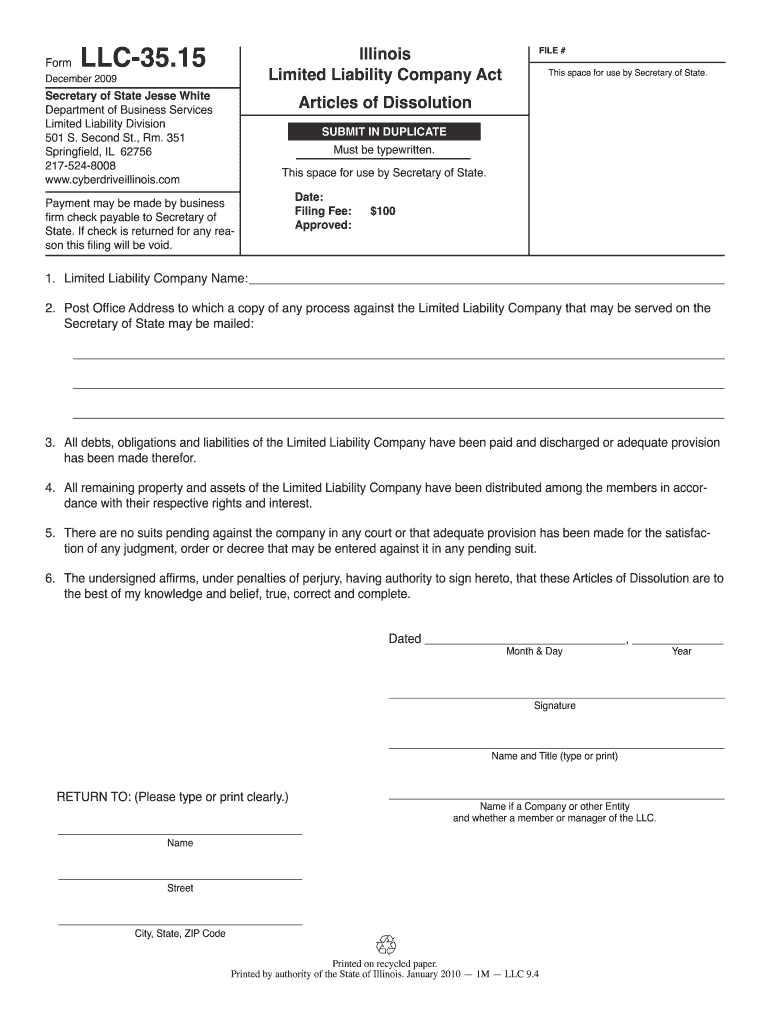

Free guide to reinstate or revive an Illinois Limited Liability Company

180.1401, 180.1402, or 180.1403, wis. Easy with a few clicks. Articles of organization were filed with the department on: Ad when it's time to move on from your business, we're here to help through the process. Web file final returns for any other tax account registered with the department (e.g., excise tax, premier resort area tax, local exposition tax) close.

Statement Of Dissolution Fill Out and Sign Printable PDF Template

Web file final returns for any other tax account registered with the department (e.g., excise tax, premier resort area tax, local exposition tax) close your business tax. For particulars, contact wi dept of revenue at. Web 180.1406 known claims against dissolved corporation. Division of corporate and consumer services. Complete and submit wisconsin form 510, articles of dissolution, along with a.

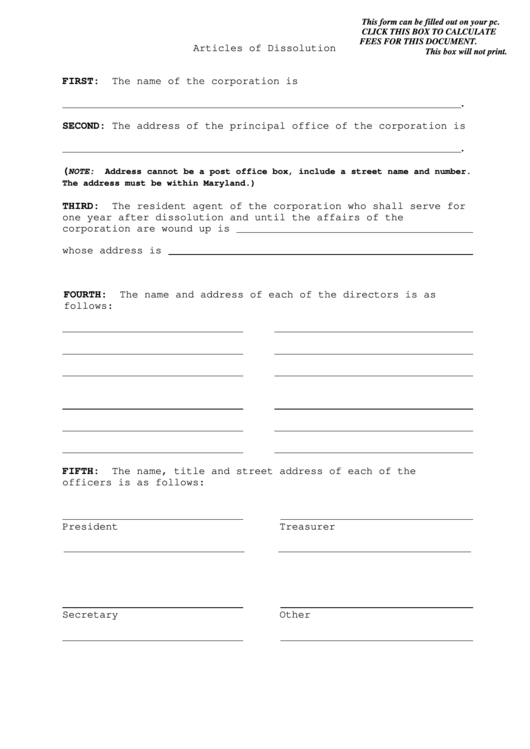

Fillable Articles Of Dissolution Form Maryland printable pdf download

Trusted by over 5,000+ businesses. Web to dissolve your llc in wisconsin, submit wisconsin form 510, articles of dissolution to the department of financial institutions: Web up to $48 cash back how do you dissolve an llc in wisconsin? Division of corporate and consumer services. You can also download it, export it or print it out.

Once These Articles Are Filed, The Legal Existence.

(1) except as provided in sub. Web state of wisconsin department of financial institutions division of corporate & consumer services form corp10i (revised february 2023) page 1 of 2 business. Trusted by over 5,000+ businesses. Web for a list of the events causing dissolution and other legal provisions relating to the dissolution and winding up of limited liability companies, review subchapter vii (entitled.

(Mm/Dd/Yyyy) Identify The Statutory Grounds For Dissolution Under S.

Edit your form 510 online. For particulars, contact wi dept of revenue at. Web up to $48 cash back how do you dissolve an llc in wisconsin? Articles of organization were filed with the department on:

180.1401, 180.1402, Or 180.1403, Wis.

Web articles of dissolution business corporation sec. Web please select your entity type and locate the appropriate articles of dissolution form. Ad when it's time to move on from your business, we're here to help through the process. Web wisconsin form 510 articles of dissolution.

Form 510 For An Llc

Web 180.1406 known claims against dissolved corporation. Division of corporate and consumer services. Complete and submit wisconsin form 510, articles of dissolution, along with a $20 filing fee, to. However, if a corporation doesn’t want to use this form, it will need to ensure that it provides the.